Latest Global Coal Markets Research

See more >

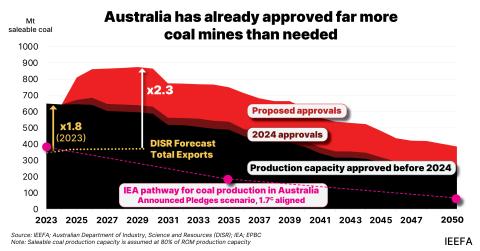

Australia’s coal production limits far exceed actual output, so why approve new mine developments?

February 11, 2025

Anne-Louise Knight

Insights

Anglo sale puts Queensland coal mine emissions in the spotlight – and in Wall Street’s hands

November 26, 2024

Andrew Gorringe

Insights

Petrochemicals: Rising signs of a secular decline?

September 30, 2024

Tom Sanzillo, Suzanne Mattei, Abhishek Sinha...

Briefing Note

NSW coalmine approvals out of step

September 27, 2024

Andrew Gorringe

Insights

Australia’s coal export market: Shifting trade dynamics with Asia

July 30, 2024

Andrew Gorringe

Insights

Coalmine M&A, financing and unintended consequences

July 15, 2024

Andrew Gorringe

Insights

Glencore’s coal spin-off plan: Responsible investors are right to be concerned

May 15, 2024

Simon Nicholas

Briefing Note

Shifting sands: The evolution of coal mining costs in Australia

May 07, 2024

Andrew Gorringe

Insights

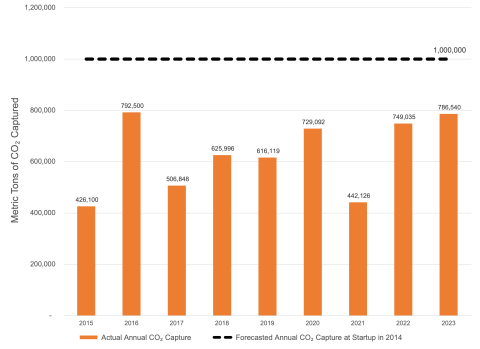

Carbon Capture at Boundary Dam 3 still an underperforming failure

April 30, 2024

David Schlissel, Mark Kalegha

Insights

New coalmines could deliver zero royalties and a methane headache for Queensland

April 05, 2024

Andrew Gorringe

Insights

Australian thermal coal exports decline further and faster than expected, and demand from South East Asian markets is unlikely to help

April 03, 2024

Anne-Louise Knight

Insights

Rising costs to impact Australian coal miners’ margins sooner than expected

December 13, 2023

Andrew Gorringe

Insights

Latest Global Coal Markets Reports

See more >

The coal cost of aluminum

October 11, 2023

Ghee Peh

Report

Whitehaven Coal: Assessing its claims about its long-term outlook

October 06, 2023

Simon Nicholas

Report

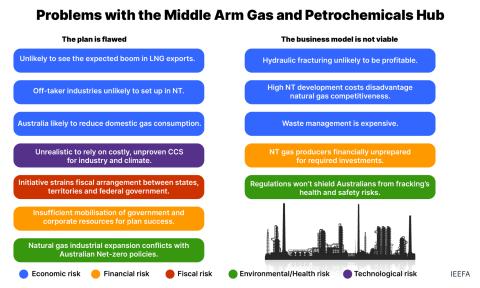

Middle Arm Gas and Petrochemicals Hub: Combination of problems makes it unprofitable for business and a red flag to the public

June 14, 2023

Tom Sanzillo, Abhishek Sinha, Suzanne Mattei...

Report

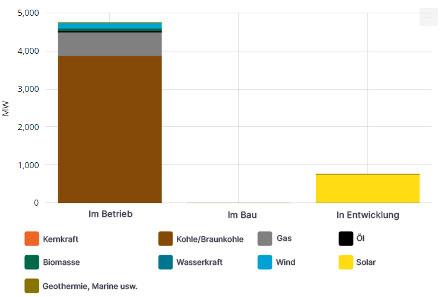

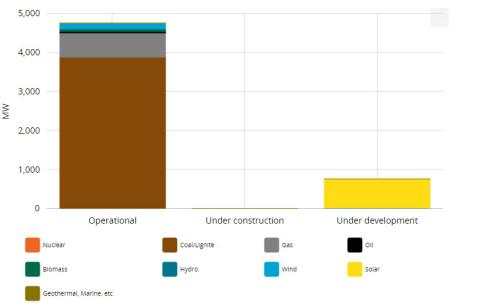

Ungewisse und zögerliche Dekarbonisierungsstrategie der STEAG

June 01, 2023

Jonathan Bruegel

Report

STEAG’s uncertain and slow decarbonisation strategy

June 01, 2023

Jonathan Bruegel

Report

A strategic fossil fuel divestment policy would strengthen the British Columbia Teachers' Pension Plan

March 17, 2023

Mark Kalegha, Tom Sanzillo

Report

No economic case for new lignite plant in Bosnia and Herzegovina

March 07, 2023

Paolo Coghe, Arjun Flora

Report

Blue Hydrogen: Technology Challenges, Weak Commercial Prospects and Not Green

February 08, 2022

Suzanne Mattei, Tom Sanzillo, David Schlissel...

Report

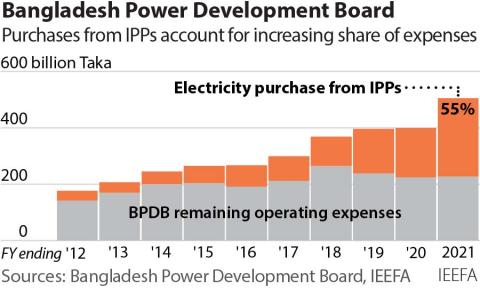

Bangladesh Power Development Board Financial Results FY2020-21

February 01, 2022

Simon Nicholas

Report

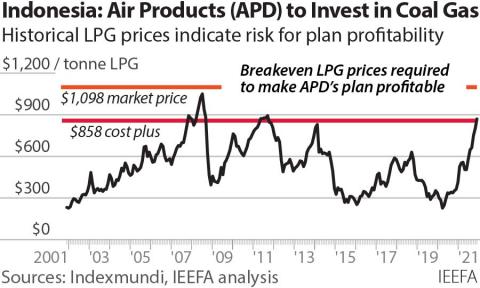

Indonesia's Downstream Coal Plans Add up to a Black Hole

January 27, 2022

Ghee Peh

Report

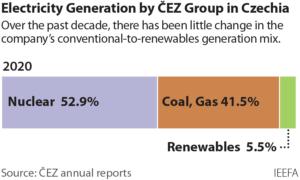

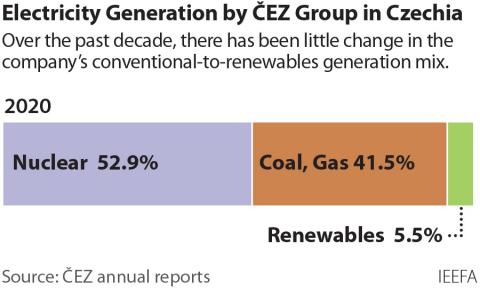

Is ČEZ Ready for Decarbonization?

January 01, 2022

Arjun Flora

Report

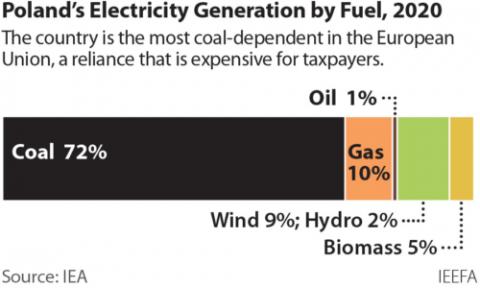

Poland's Energy Transition - Caught Between Lobbying and Common (Economic) Sense

January 01, 2022

Arjun Flora

Report

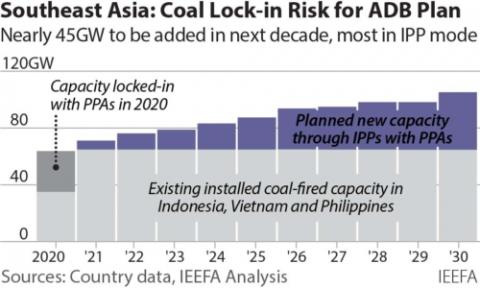

Coal Lock-In in Southeast Asia

December 01, 2021

Haneea Isaad

Report

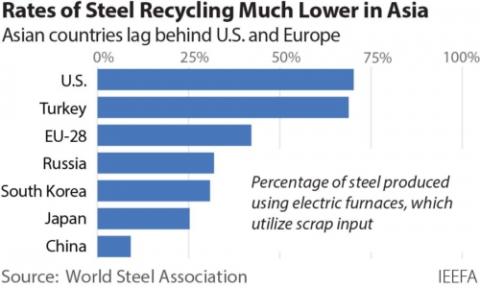

New from Old: The Global Potential for More Scrap Steel Recycling

December 01, 2021

Simon Nicholas

Report

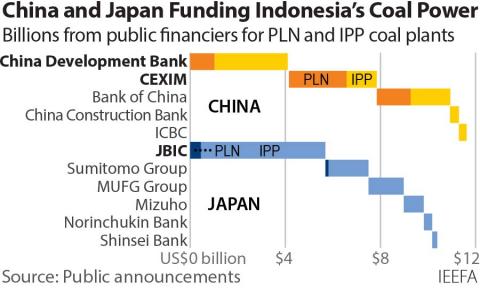

Indonesia Wants to go Greener but PLN is Stuck with Excess Capacity from Coal-Fired Power Plants

November 01, 2021

Elrika Hamdi, Putra Adhiguna

Report

Latest Global Coal Markets Press Releases

See more >

Adaro aluminum smelter plans in Indonesia face financial risks

October 11, 2023

Press Release

Australian taxpayers face big bills for flawed Northern Territory industrial development plan

June 14, 2023

Press Release

Verkaufspläne des staatlichen Energieversorgers STEAG drohen Kohleausstieg bis 2030 zu verzögern

June 01, 2023

Press Release

Plans to sell state-owned utility STEAG risk delaying Germany’s coal exit goals in 2030

June 01, 2023

Press Release

Divesting is the correct path for the British Columbia Teachers’ Pension Plan

March 20, 2023

Press Release

Proposed Gacko II lignite-fired power plant is a non-starter

March 07, 2023

Press Release

IEEFA U.S.: Experts offer testimony on Maine fossil fuel divestment planning

February 28, 2022

Press Release

IEEFA Bangladesh: Rising cost of IPPs and further dependence on imported fossil fuels threatens the need for increasing power tariffs

February 11, 2022

Press Release

Federal blue hydrogen incentives: No reliable past, present or future

February 08, 2022

Press Release

IEEFA: Air Products’ coal gasification proposal triggers looming policy disputes in Indonesia

January 27, 2022

Press Release

IEEFA Europe: ČEZ Group lays out decarbonisation plan, but is it ready?

January 20, 2022

Press Release

IEEFA Europe: Skupina ČEZ předkládá plán dekarbonizace, je ale připravena k jeho realizaci?

January 20, 2022

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.