Rising costs to impact Australian coal miners’ margins sooner than expected

This Analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Less than 12 months ago, coal producers were reporting record profits. During 2022 and the first part of 2023, record metallurgical and thermal coal prices translated directly into profits, which miners used to pay down debts and return cash to shareholders.

However, with international supply shocks now stabilising, coal prices have retreated. Meanwhile cost inflation has become embedded in Australian coal mining operations through increased labour costs; extreme weather events impacting production; elevated energy and consumable input costs; rising port costs; increasing strip ratios; higher financing costs; and government royalty hikes. Industry-wide unit cost inflation has until now done little to dampen the profit reporting of Australian coal miners.

This trend has now been demonstrated, with Coronado Global Resources Australian Operations recording a loss in its financial reporting in September 2023.

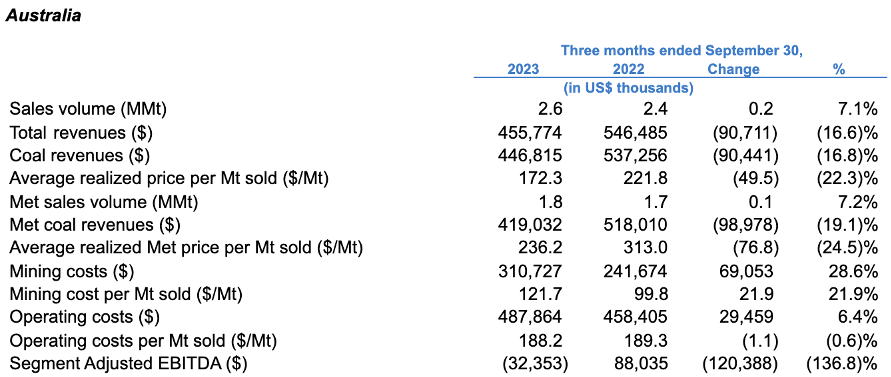

In March 2023, IEEFA analysed miners’ record profits from the 2022 calendar year; then in August we reported that profits were fragile in the sector. This trend has now been demonstrated, with Coronado Global Resources Australian Operations recording a loss in its financial reporting in September 2023. Coronado reported an EBITDA [earnings before interest, taxes, depreciation, and amortisation] loss of US$32.4 million for its Curragh coal mine for the September 2023 quarter, which represents a turnaround of US$120 million from the September 2022 quarter.

Figure 1 – Extract from Coronado quarterly report

Source: Coronado Global Resources Inc. Form 10-Q September 30, 2023, p34

Apart from lower realised prices (by 22.3%) and higher Queensland coal royalties, the fundamental reason for the loss was higher unit mining costs. These rose by US$22 per tonne. Removing the effect of favourable FX variance, the AUD-based mining costs rose by A$38 to A$184 per tonne, or 25.6% in a year. Reasons given included “additional fleets mobilised in 2023 to advance pre-strip overburden removal, continued inflationary pressures on contractor and supply costs, higher freight expense and increased third-party coal purchases”. Coronado also referred to mechanical equipment reliability on a dragline, and coal preparation plant maintenance.

The industry-wide inflationary cost pressures can no longer be described merely as “pressures” – instead they represent a new reality for miners, grappling with labour availability as well as the costs of energy and consumable inputs such as diesel, electricity and explosives. Labour shortages and the increased cost of attracting employees and contractors was highlighted by IEEFA in 2022.

Coronado is not alone in stating a need to focus on more overburden removal. This is an industry norm, as reported by IEEFA in November 2023, with an increase in open-cut mine strip ratios observed across the industry. During the record prices of 2022, miners prioritised coal extraction over pre-strip and overburden removal activities.

There is also a geological necessity that depleted open-cut mines will be replaced by either open-cut mines with higher strip ratios, or costly underground mines. This is the issue facing Whitehaven as it looks towards the closure of its lower-strip ratio Werris Creek mine in early 2024. It is replacing production with higher-strip ratio volumes from its Tarrawonga and Early Vickery mines, impacting unit costs going forward.

As margins get squeezed, some miners may struggle to find new investment for increased stripping fleets. As a result they will suffer a two-fold blow of increased strip ratios and lower volumes – inflating unit costs even further.

Coronado claimed lower first-quarter production/sales due to wet weather and rail interruptions. IEEFA has drawn attention to the impact of extreme weather events and their effects on mine costs as well as lost production/outages. These are at risk of becoming more severe and more frequent.

Production was disrupted by a train derailment on the Blackwater line that ensured no railing of coal for nearly a month – an impact outside Coronado’s control. IEEFA has also highlighted the potential for rail and port interruptions such as experienced by Coronado. The interrelationships along the coal supply chain mean that disruptions to port and rail operations can adversely affect miners’ coal sales and their unit costs.

It is not yet clear how the Australian government’s revised Safeguard Mechanism will impact unit costs, though these are expected to mostly affect underground mines, coming into play from 2024 onward. Curragh’s results have already been impacted by the Queensland royalty hike, but the recent coal royalty rate increase in New South Wales will impact mine unit cost results in that state from 2024 onward.

As other Australian coal miners release their 31 December 2023 reporting over the next two months, they may join Coronado in reporting squeezed margins. Trends to higher unit costs are being experienced across the industry, but most other miners have not yet reported financial results for the second half of 2023. These reports will include the new higher unit cost levels and will also incorporate coal sale prices that are down from the record highs.

Meanwhile in the US, according to S&P Global Market Intelligence, coal miners reported mixed earnings for the third quarter and were evenly split in beating and missing analyst projections – the met coal producers exceeded expectations, while the thermal producers underperformed.

If earnings here are squeezed and coal prices stay low, there will be wider impacts. With many new coal mines announced for 2024 and beyond, how the investment cases stack up now is not known. Greenfield coal projects face a risk of a blow-out in the payback period of the investment. Brownfield projects, meanwhile, will need to stress-test margins in the event of a continued depressed price environment. What might have looked favourable in the past may come under increased scrutiny in 2024.

Coronado announced in its 2023 half-year results that in June the Board approved the Curragh North Underground mine, commencing in 2024. The proposed mining method is via bord and pillar mining. Capital costs of a bord and pillar operation are expected to be lower than that of a longwall mine, and the technical risks may be lower. However, the operating costs may be higher. The project would need to be viewed carefully in a tight margin environment with skilled labour shortages.

In a tighter margin environment, there is a higher risk of early mine closure – on economic grounds. Miners need to ensure that rehabilitation provisions are adequately funded and are appropriately updated to reflect cost inflation. BHP is currently assessing its rehabilitation plan for its Mount Arthur coal mine and has estimated a A$1 billion price tag. In its 2022 Annual Report, BHP disclosed that a review of its coking coal mine lives resulted in it recognising that the end of its operations “may be earlier than previously anticipated”. This led to an increase in its rehabilitation provision by approximately US$750 million.

For Australian coal miners, 2024 is expected to be a busy reporting year. In addition to financial reporting and management discussion of lower margins, they will need to contend with communicating revised investment cases and asset impairment tests. In addition, Australia’s new climate-related reporting obligations will take effect from July 2024 and will require large miners to report their Scope 1, 2 and 3 emissions.