Cost inflation underlines thermal coal miners’ fragile profits and financing risks

Key Findings

Although Australia’s coal producers have reported strong profit results in the period to 30 June, elevated cost inflation is at risk of placing persistent downward pressure on future profits.

Despite producers' growing appetite for coal mine expansion, downside risks remain, with shareholder support waning, cash flows evaporating as coal prices return to normal, and traditional financing sources drying up.

The July 2023 coal market update from the International Energy Agency (IEA) describes strong international demand for coal use for thermal energy, concentrated in major regions of China and India, and to a lesser extent in Indonesia – but not the high-energy coal markets that Australian producers target.

As the world’s second largest thermal coal exporter, Australia’s producers have now recovered from flood-constrained production over the past year and are poised to increase output. Across New South Wales (NSW) and Queensland there are at least 23 coal mine projects under consideration that involve expansion or extension of thermal coal production.

However, trends revealed in the latest reporting results indicate that profits are fragile and opportunities to bankroll expansions are declining.

The IEA highlighted that thermal coal prices have returned to more normal levels after 18 months of high prices and volatility. Indeed, the high premiums for Australian coal achieved in 2022 have now receded.

- NSW Minerals Council’s CEO Stephen Galilee has said that, “Coal prices have fallen dramatically since the record highs of last year, and are expected to fall further over time. Since 2020, coal production costs have significantly increased.”

- KPMG’s latest consensus coal price forecasts indicate that the outlook remains on a downward trend.

- Australia’s Office of the Chief Economist expects the price to be US$120 per tonne by 2025.

Production costs remain elevated

Meanwhile, record high costs of production have been reported for producers in their most recent financial reports.

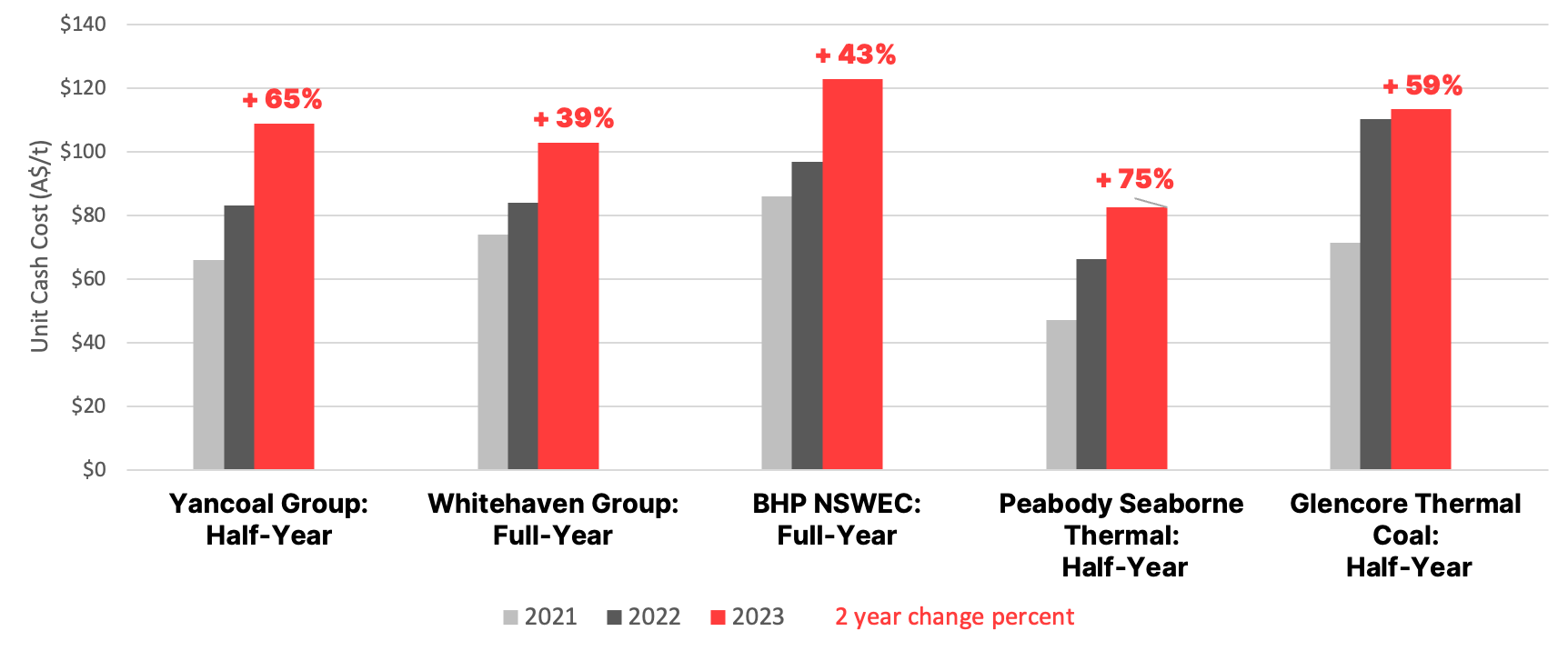

The trend to increasing production costs is clear (Figure 1).

Figure 1. Coal Producers’ Reported Unit Costs – June 2023

Source: 30 June 2023 company reported results. Normalised to AUD/tonne. Peabody and Glencore unit costs include royalties. IEEFA

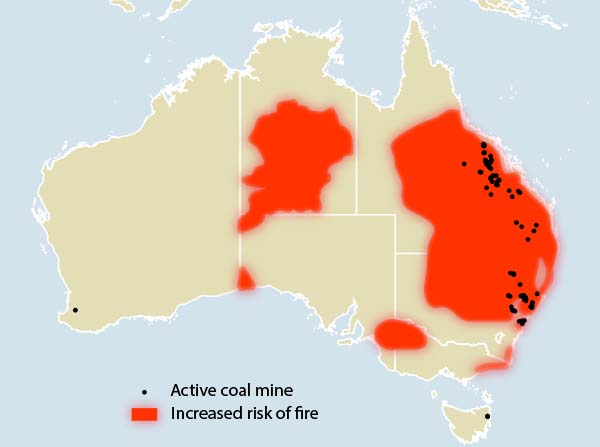

There may be some relief in unit costs as flooding risks recede now the La Niña weather pattern has passed. However, Australia looks like it may flip straight into an El Niño phase, with the Bureau of Meteorology recently issuing an alert. A seasonal outlook for bushfires for Spring 2023 is expected, with above average heat and dryness. This has direct implications for the coal mines (Figure 2). These conditions can impact production, as happened with major wildfires in Canada this year.

Figure 2. Coal Mines in the Line of Increased Risk of Fire (Spring 2023) – Eastern Australia

Image source: Increased risk of fire extent derived from the National Council for Fire and Emergency Services (AFAC). Coal mines data: Climate Trace (http://www.climatetrace.org)

All of the major miners are beginning to acknowledge a persistent higher unit cost base, and have flagged high labour costs as a continuing trend. Geraldine Slattery, President Australia at BHP, recently reflected on the shortage of miners attracted to the industry. Slattery has estimated the cost of pay rises given “could increase the operating costs of our existing operations by nearly US$200 million (A$297.7 million) per year, and maybe up to US$500 million (A$744.4 million) in a worst case scenario”.

Whitehaven has offered a $20k pa pay rise in addition to bonuses to attract workers to its Maules Creek coal mine under its new enterprise agreement, and has signalled increased unit costs guidance for FY 2024.

South32 is facing production outages amid worker pay negotiations at Appin and is reportedly considering exiting its remaining coal mines instead of recapitalising them, amid increasing unit cost guidance.

Yancoal commented in its 1H 2023 financial result presentation: “External cost inflation factors including diesel, explosives and electricity remain, and may prove persistent… Unit cost reduction takes longer to deliver than the production uplift, as the recovery plans incur additional costs and cost inflation from recent years is now embedded in cost structures.”

Going forward there are new costs to the industry in Australia with the government’s introduction of the Safeguard Mechanism on 1 July 2023. Miners will need to figure out how to reduce emissions or else purchase emissions offsets.

Funding sources dry up

Coming down from the record profits of the past year, excess cash generation in the future will be challenging. Coal miners are reducing their focus on returning funds to shareholders in favour of reserving some capital for expansion opportunities.

Nonetheless, miners will need to ensure that their rehabilitation expenses are adequately funded, including updating for persistent cost inflation factors. This follows reports that BHP’s Mount Arthur mine has been refused funding from the federal government’s A$1.9 billion Powering the Regions Fund (PRF) to support mine closure.

Meanwhile, for those looking to expand, traditional forms of finance risk drying up.

Whitehaven signalled in its most recent earnings call that “it is increasingly difficult in a thermal coal producer to attract external funding”, following revelations that it failed to secure term loan refinancing.

Australian banks are beginning to adopt fossil fuel policies that limit exposure to coal mining. Notably, Macquarie and CBA have adopted more comprehensive targets to phase out financing thermal and metallurgical coal expansions.

Macquarie Group has committed “not to enter into new business activity [with a coal company who derives more than 50% of its revenue from thermal and metallurgical coal], where the underlying purpose is to fund the purchase, development or expansion of a coal mine”. Its policy, however, is restricted to on-balance-sheet activities.

CBA has a target to phase out lending by 2030 to “include all coal mining customers with more than 5% of their revenues coming directly from the sale of thermal coal”, and from 2025 will require clients to publish independently verified Transition Plans to cut emissions – encompassing their Scope 1, 2 and 3 emissions. CBA’s updated commitments include curbs on alternative forms of lending, such as limiting corporate or trade finance, or bond facilitation to new clients who derive 25% or more of revenue from thermal coal sales.

Producers will increasingly need to turn to offshore banks or off-balance sheet financing with lower environmental, social and governance (ESG) requirements.

A recent action by a hedge fund opposing Whitehaven’s move to acquire BHP metallurgical coal assets reflects the sentiment that coal mining companies seeking expansion will increasingly need to provide justification to shareholders. In particular, they will need to explain why committing capital to these ventures is better than returning funds to shareholders – through payment of dividends – and why they should increase borrowing to pay for new mines.