Solar growth, reliability undercut opposition

Key Findings

Wind and solar have produced 40.2% of ERCOT’s electricity through June.

Despite political obstacles, utility-scale solar generation has more than doubled in two years.

There’s a good chance that wind and solar will both generate more than coal this year in Texas, which uses more electricity than any other state in the U.S.

Solar accounted for 27.7% of peak generation in ERCOT during June, even as total ERCOT demand hit a new record high.

The ongoing electric power transition in the Electric Reliability Council of Texas (ERCOT) belies the anti-renewable rhetoric flowing from Washington. Through June, wind and solar have produced 40.2% of the electricity generated in ERCOT, the grid operator serving about 90% of the demand in Texas, the largest single state electricity consumer in the U.S. by far.

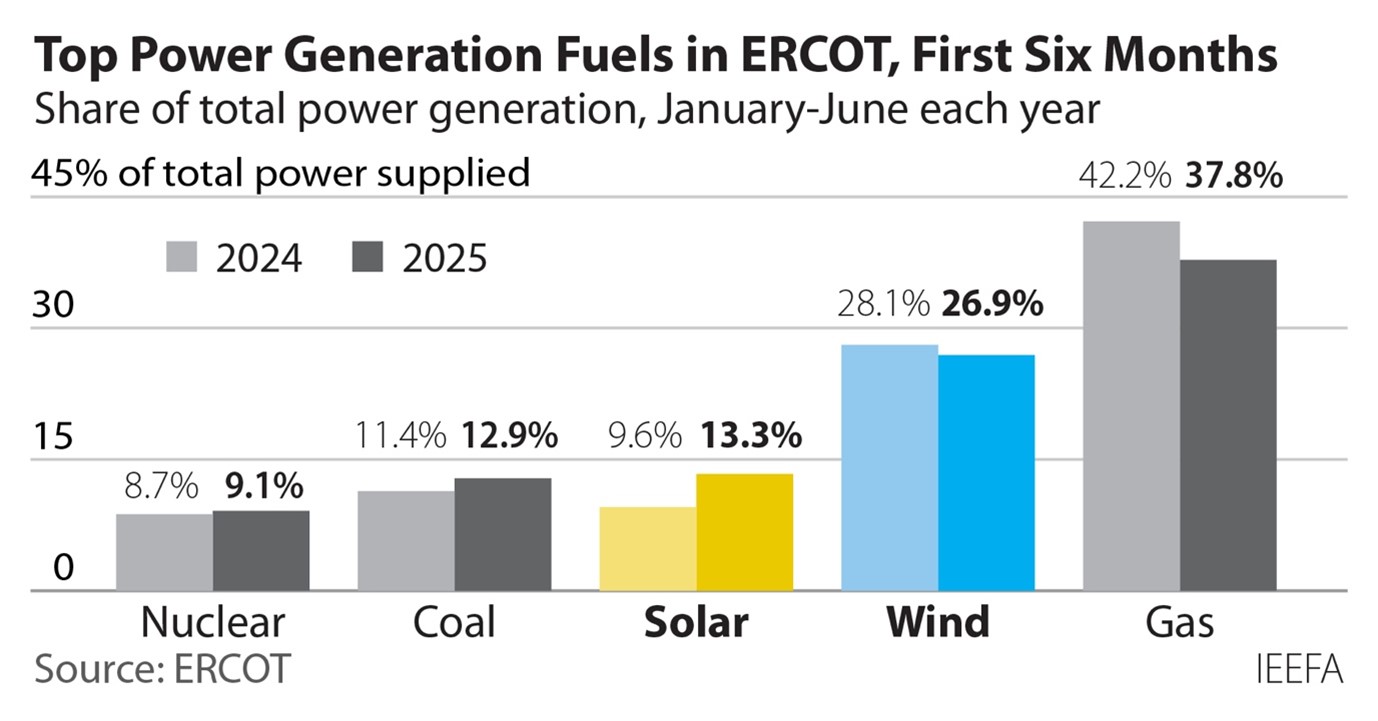

Wind power is still the largest component of renewable generation in ERCOT, but much of the recent growth in the state that consumes the most electricity in the U.S., is due to the rapid buildout of utility-scale solar across the system. This year through June, solar generation amounted to slightly more than 31 million megawatt-hours (MWh), more than double the amount produced during the same period just two years ago, and almost equal to solar’s entire output of 32.4 million MWh in 2023.

The speed of solar’s generation growth is also clear compared to the output of ERCOT’s coal generators, long a mainstay of system output. Solar generation topped coal in three months in 2024, a first for ERCOT. But for the entire year, coal still generated 10 million MWh more than solar. This year, there is a good chance solar generation will top coal for the entire year, even though coal output is up due to higher gas prices.

Through June, coal generation has totaled 29.9 million MWh, up sharply from the 24.8 million MWh produced in the comparable period a year ago, yet still below solar’s output. As a result, solar is now the third-largest power source on the ERCOT system, trailing gas and wind. Year-to-date, solar’s share of total generation in ERCOT stands at 13.3%, more than double its share from just three years ago.

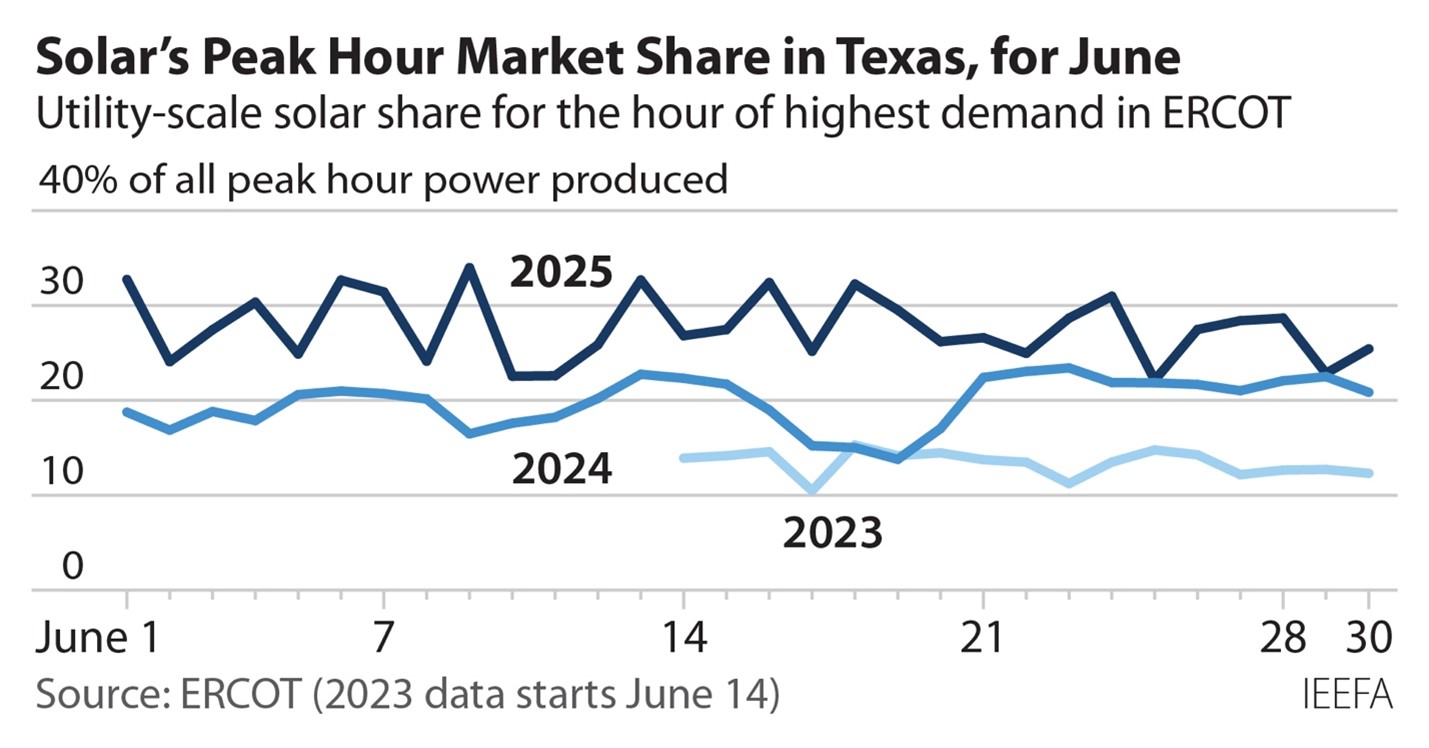

Another key gauge of solar’s growing importance as a reliable generation resource within ERCOT is its rising contribution to peak demand. IEEFA began tracking solar’s generation performance at the peak demand hour in 2023; the results have been impressive.

In June 2023, there were just over 17,000 megawatts (MW) of installed solar capacity in ERCOT. From June 14 (when our data series began) through the end of the month, solar generation averaged 9,773 MW during the peak hour, supplying 13.3% of demand. The reliability of the generation is also noteworthy, since solar supplied between 10.4% and 15.2% of ERCOT’s peak demand during that period.

In June of 2024, solar generation at the peak hour jumped to 16,614 MW, a 70% increase, accounting for an average of 19.9% of demand. And this June, solar generation at the peak hour in ERCOT averaged 20,745 MW, more than double the 2023 level, and accounted for 27.7% of peak demand. Again, the reliability of this solar generation is worth underscoring: during June 2025, solar’s share of peak demand was never less than 22%, even as total systemwide demand hit a new June record of 45.1 million MWh and posted an average peak demand of 74,766 MW. In other words, solar is a resource whose output can be counted on.

Adding wind makes renewables’ performance even more impressive. In June 2024, solar and wind supplied almost 36% of ERCOT’s peak demand needs; in June 2025 the total jumped to 45%.

ERCOT CEO Pablo Vegas recently cited the growth in ERCOT’s solar resources, coupled with its existing wind, and the recent rapid buildout of battery storage capacity as a significant contributor to the grid’s growing reliability, even as overall demand continues to rise.

“The state of the grid is strong, it is reliable—it is as reliable as it has ever been and it is as ready for the challenges of extreme weather,” Vegas said.

What has changed since last summer, when ERCOT was warning that grid shortages could occur? Developers built 5,395MW of solar capacity, 3,821MW of dispatchable battery storage and 253MW of new wind projects.

The reliability provided by these new renewable and battery storage resources stands in sharp contrast to the unexpected reliability problems that have hit ERCOT’s coal plants so far this summer. On July 11-12, 5,019 MW of coal-fired generation was offline across ERCOT—totaling 36.9% of the system’s accredited coal capacity of 13,596 MW. The reasons for the outages vary, but almost two-thirds of the total capacity offline was due to unexpected, short-term maintenance issues that ERCOT would not have planned for, forcing the system operator to turn to other resources for needed power supplies.

In addition to these short-term outages, ERCOT says two large coal units will be offline for the entire high-demand summer period: the 932 MW Sandy Creek facility, which is majority-owned by LS Power, and Martin Lake Unit 1, an 800 MW generator that is owned by Vistra. A fire forced the Martin Lake generator offline in late 2024, and Vistra had initially said it would be back in operation in June, but ERCOT’s latest reliability assessment said it would not return to service until November. The Sandy Creek facility, which only entered commercial service in 2013 and is the youngest coal plant in Texas, was offline in March and most of April; ERCOT now says it will not return to service until June 2026. No reason has been given for the outage, but it is highly unusual for a plant just 12 years old to be offline that for that length of time. The Martin Lake unit, in contrast, is 48 years old, having come online in 1977.

Meanwhile, renewables and dispatchable battery storage continue to demonstrate their dependability in the ERCOT system. New peak records were set earlier this month for both solar generation, which hit 28,071 MW on July 10, and battery storage, which discharged 6,309 MW into the ERCOT system on the evening of July 11, accounting for 9.2% of system demand at that point and reducing the need for that amount of coal or gas-fired generation. Further, during the day on July 11 when those 5,019 MW of coal capacity were offline, wind and solar provided more than 50% of total system demand for more than six hours. At the peak hour of 5 p.m., solar and wind were meeting 49.6% of total demand.

The divergence on reliability is clear. Fossil fuel plants, particularly coal, can and do fail unexpectedly, taking unplanned chunks of capacity offline without notice, and can be offline for extended periods. Renewables, particularly solar, shine during the peak summer months, providing reliable power for the grid when it is most needed.