North America

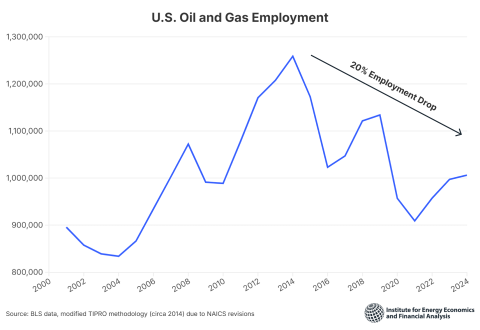

In North America, IEEFA’s research analyzes the ways that the fossil fuel industry is losing its financial rationale as a sound investment. For investors seeking a steady, stable investment, fossil fuels are increasingly an unreliable option, and sustainability tools like divestment can protect against climate risk. A more sustainable economy is steadily growing—the U.S. Energy Information Administration has projected that renewables will displace fossil fuels in the electric power sector over the long term.

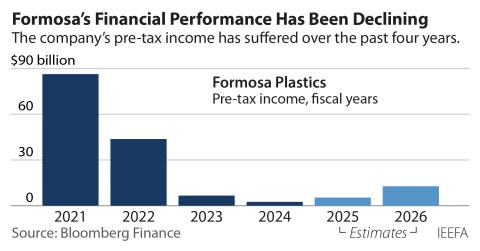

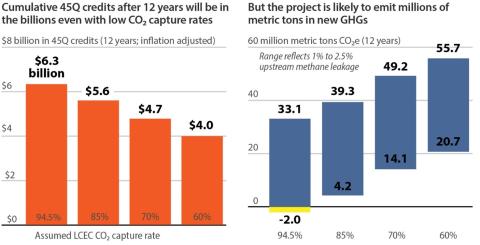

In response to poor market performance, the fossil fuel industry has looked toward the petrochemical industry and proposed new technologies, such as carbon capture, as lifelines. Currently, a weak economic outlook indicates that the petrochemical industry is in secular decline, while carbon capture and storage is an expensive and unproven technology that distracts from global decarbonization efforts while allowing the oil and gas industry to conduct business as usual.

Stay up to date with our work in North America by signing up for our quarterly newsletter.

North American LNG Export Tracker

The tracker visually tells the story of the LNG boom across the continent, export destinations, and the impact on consumers.

The transition to renewables is unstoppable

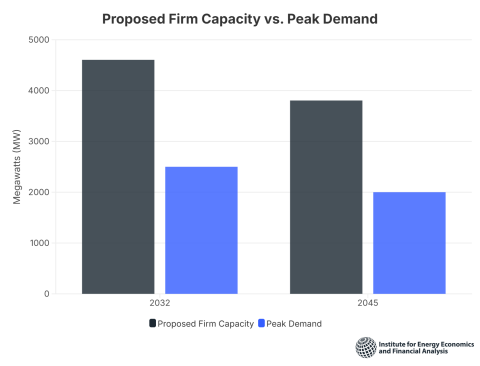

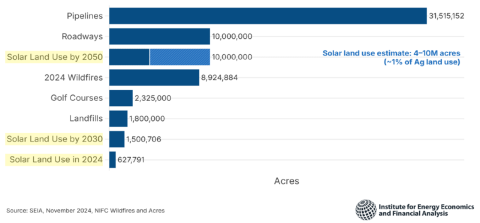

Renewable energy and dispatchable battery storage are economically transitioning the power sector away from fossil fuels.

The fossil fuel sector has lost its investment rationale

Fossil fuels have underperformed the broad market for a decade and have a negative long-term financial outlook.

Petrochemicals: A Sector in Secular Decline

Anyone betting on the future of the petrochemical industry should take a careful look at recent trends. The pace of project delays and cancellations across the U.S. make it clear: trouble lies ahead for new petrochemical facilities.