Mexico Pacific Limited: Delays, turmoil, and permitting errors have stymied Mexico's largest LNG project

Key Findings

The proposed $15 billion Saguaro Energía liquefied natural gas export terminal on Mexico’s Pacific coast faces major obstacles to completion, many of its own making.

Supplying Saguaro Energía LNG with gas would require a 500-mile pipeline through territory that is controlled or heavily influenced by drug cartels.

U.S. tariffs on Mexican imports have raised the prospect of counter-tariffs that could render MPL’s gas feedstock unaffordable or unavailable at any price.

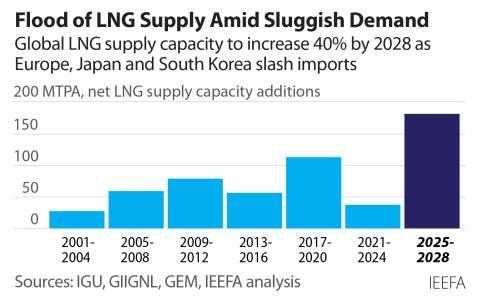

An extended glut in global LNG markets is forecast, due to weak global demand growth and massive new LNG capacity being built around the world.

For almost eight years, Mexico Pacific Limited (MPL) has worked to secure financing for its proposed Saguaro Energía liquefied natural gas (LNG) export terminal on Mexico’s Pacific coast. The project, reported to cost at least $15 billion, would export as much as 15 million tons per year (Mtpa) of LNG from a facility near the small town of Puerto Libertad in Sonora, Mexico. A potential second phase would double that capacity. Natural gas would be transported from Texas to the Pacific coast via a 500-mile (800-kilometer) pipeline that would be built specifically to supply gas to the liquefaction facility.

Saguaro Energía’s Pacific location offers comparatively direct access to the Asian markets that are expected to drive LNG demand growth in the coming decades. MPL estimates that its terminal would shave $1 in shipping costs per million British thermal units (MMBtu) of LNG produced, when compared with Atlantic and Gulf Coast export facilities that must route Asian shipments through the increasingly unreliable Panama Canal, the security-challenged Suez Canal, or around Africa or South America.

MPL was launched in 2017 but didn’t attract its first customer until 2022, when global natural gas prices spiked due to Russia’s invasion of Ukraine and the curtailment of gas shipments to Europe. From 2022-24, MPL was able to leverage those price spikes and its shipping cost advantages to lock in 14 Mtpa of LNG sales agreements with ExxonMobil, Shell, ConocoPhillips, Woodside Energy, and two Chinese buyers.

But despite this commercial progress, internal turmoil—including frequent changes in investors and executives, evolving project designs, and critical permitting errors—has slowed the project’s momentum. Even if the project could solve its internal challenges, it would still face a tangled web of external obstacles, including rising construction costs, contracting difficulties, shifting trade politics, legal challenges, regulatory barriers, safety concerns, and growing local opposition.

MPL’s rotating cast of investors and managers

Saguaro Energía’s history began in 2004, when U.S.-based energy investment firm DKRW Energy acquired the Puerto Libertad site with the intent to develop an LNG import terminal. But with the North American shale gas boom rendering gas imports unnecessary, DKRW eventually pivoted, partnering with U.S.-based real estate investment firm AECOM Capital to pursue an LNG export project that would rely on U.S.-sourced gas. In August 2017, Mexico Pacific Limited was established as a Delaware limited liability corporation, with DKRW as majority owner and an AECOM subsidiary holding a minority stake. MPL filed its initial LNG export request with the U.S. Department of Energy (DOE) in June 2018.

In 2019, an group of investors led by private equity firm AVAIO Capital acquired almost three-quarters of the firm, with AECOM and DKRW retaining minority ownership. Less than two years later, PE firm Quantum Capital acquired a 38% stake in MPL. Quantum steadily increased its capital contributions over the subsequent years, and by early 2025 had acquired 90% of the company.

But with MPL struggling to get its project across the finish line, Quantum began looking for an exit. On Feb. 3, 2025, Quantum and MPL’s other investors offloaded their stakes to Kronos Polo, LP—a newly formed, little-known entity with listed addresses at a Fort Worth, Texas, strip mall and a nearby residence. (See Figure 1.) Just a month later, Kronos Polo sold MPL to another newly formed firm, Mexico Pacific Holdings, LLC, registered to a strip mall outside Wilmington, Del., marking MPL’s fifth turnover in corporate control in less than five-and-a-half years.

Figure 1. The registered address for Kronos Polo, L.P. is “Suite 218” in a mailing shop in a Fort Worth strip mall.

MPL’s executive leadership has changed even more frequently than its investors. The company’s original president, Robert Kelly (a founder of DKRW Energy), was replaced in 2018 by GE Oil & Gas veteran Josh Loftus. Former Cheniere Energy executive Doug Shanda took the reins in 2020. He was followed in 2022 by NextDecade alumnus Ivan Van der Walt. In April 2024, MPL hired seasoned LNG executive Sarah Bairstow as CEO, but she left the firm barely a year later. MPL hired its latest chief executive, Manuela Molina, in May 2025—the company’s sixth top executive in seven years.

To add to the disarray, the firm reportedly has laid off staff in Houston and Singapore while relocating its corporate headquarters from Houston to Mexico City. One analyst group described the turmoil bluntly: “Mexico Pacific project falls apart as originally envisioned.”

Shifting strategies, permitting errors, and costly delays

MPL’s internal churn has coincided with strategic drift, permitting oversights, rising costs, and critical delays that have dissipated the company’s momentum.

In June 2018, MPL applied to DOE to export 12 Mtpa of LNG. The request was approved that December, giving the company until December 2025 to complete construction and begin exports.

In December 2022, MPL filed a second DOE application for enough additional gas to export as much as 15 Mpta of LNG. The company explained that it had decided on a higher-capacity design, while acknowledging that its initial request had failed to ask for enough fuel to power liquefaction equipment and pipeline compressors—critical omissions that had gone uncorrected for more than four-and-a-half years. Almost two-and-a-half years have passed since MPL’s second application, and DOE has yet to approve the firm’s request for additional gas. Investors are unlikely to fully fund the project until authorization is granted.

Meanwhile, inflation has pushed up construction costs. MPL settled on a revised project design in 2024, and its engineering and construction contractor, Bechtel, has reportedly demanded higher fees to reflect the rising cost of steel, aluminum, labor, and equipment. Cost escalations have forced MPL to ask buyers to accept higher liquefaction tolls to cover higher construction expenses.

The timing of the contract renegotiations could hardly have been worse, since they coincided with rising tensions between the U.S. and its trading partners. In early 2025, China ceased all imports of U.S. LNG, and the central government reportedly has directed Chinese firms not to sign new U.S. contracts—potentially stymying talks between MPL and its two Chinese buyers, Zhejiang Energy and Guangzhou Development Group.,

While it is unclear whether China’s contracting restrictions extend to a U.S.-sourced LNG project on Mexican soil, it may not matter: Chinese firms may be reluctant to lock in higher prices given the growing volumes of uncontracted LNG in the global market and rising uncertainty about China’s future LNG demand. Through mid-June, Kpler LNG Analytics data showed Chinese LNG imports had fallen 22% year over year due to a slowdown in economic growth, growth in domestic gas output, and rising supplies of pipeline gas from Russia. Meanwhile, China’s power sector has not been replacing coal with LNG, limiting China’s thirst for the fuel.

An array of obstacles

Even if MPL manages to obtain its export permits and negotiate new sales contracts, it will still face logistical, legal, and practical obstacles that could stymie the firm’s efforts to obtain the debt and equity financing it needs to proceed.

Security risks. Supplying Saguaro Energía LNG with gas would require the construction of a 500-mile (800-kilometer) pipeline through territory that is controlled or heavily influenced by drug cartels. The Sonora region has seen a recent spike in violence that a local anthropologist has described as “the worst that it has been since … the last 20 years.” Gas pipeline contractors might be forced to hire private security forces, potentially boosting construction and insurance costs while exposing the pipeline’s financial backers to reputational and political risks.

Trade conflicts. Attempts by the U.S. to impose sweeping tariffs on Mexican imports have raised the prospect of counter-tariffs that could render MPL’s gas feedstock unaffordable, or trade restrictions that would make U.S. gas unavailable at any price. Rising political tensions between the two nations could make gas trade between the two nations a political flashpoint or a point of leverage in bilateral trade negotiations.

Global LNG oversupply. Many independent LNG analysts forecast an extended glut in global LNG markets, due to weak global demand growth and the massive amount of new LNG capacity being built around the world. The global LNG industry is currently constructing enough new liquefaction projects to boost global LNG output by 40% over the next five years, even though Kpler LNG Analytics data show LNG consumption grew only 15% over the preceding five years. Analysts from ICIS (the Independent Commodity Intelligence Services, a Lexis-Nexis subsidiary) now predict 11 consecutive years of oversupply in LNG markets, peaking between 2028 and 2032—roughly when MPL would open if construction were to begin in the next few years. A glut would likely mean plummeting LNG prices, declining profits for exporters, and potential shutdowns at liquefaction facilities, as occurred during the glut conditions in 2020.

North American gas market risks. The growth of North American LNG exports is expected to boost long-term natural gas prices, while contributing to volatility in gas prices in both the U.S. and Mexico. Increases in gas feedstock prices could erode the cost advantages that North American LNG projects have held over some international competitors. In addition, the potential for spikes in U.S. gas prices could create political pressure to curb gas exports. Similar political pressures are already vexing Australia’s LNG industry, where rising LNG exports have shortchanged domestic markets and contributed to a tripling of domestic gas and power prices.

Local opposition. LNG projects in the Gulf of California, particularly Saguaro Energía, are facing rising opposition from Mexican fishing and tourism industries, as well as non-governmental and civil society organizations. Saguaro Energia would be located on the Sea of Cortez (also known as the Gulf of California), nicknamed “The World’s Aquarium” by famed explorer Jacques Cousteau for its abundance and variety of sea life, including whale sharks, humpback whales, dolphins, sea lions, manta rays, and sailfish, and for its commercially important fisheries. Local businesses are increasingly concerned that traffic from LNG vessels will strain the region’s fishing and ecotourism industries, which are already under pressure from climate change, pollution, and over-exploitation. Environmental concerns also raise reputational risks for potential investors in MPL.

Legal risks. MPL faces five separate lawsuits in Mexican courts challenging permitting for the Saguaro project. Four of those lawsuits were filed by property rights claimants, alleging violations of constitutionally or internationally protected human rights. A fifth lawsuit was filed by a coalition of environmental organizations alleging improper modification of a 2006 environmental impact authorization for a re-gasification project into a liquefaction plant. A preliminary injunction against construction of the plant has been issued and remains in effect pending resolution of the litigation.

Litigation has also been filed against the pipelines that would supply gas to the terminal. In the U.S., Public Citizen and the Sierra Club filed a lawsuit over the Federal Energy Regulatory Commission’s approval of the Saguaro Connector Pipeline proposed to bring gas from the Permian Basin to the Mexican border, alleging inadequacy of the environmental review that covers only 1,000 feet of the pipeline, rather than the pipeline’s full 157-mile length. And in March 2025, environmental organizations filed a lawsuit against the approval of the proposed 500-mile Sierra Madre Pipeline from the U.S.-Mexico border to Puerto Libertad, alleging violations of human rights based on deficiencies in the environmental review process.

Labor and workforce challenges. The city of Puerto Libertad has fewer than 3,000 residents, and the surrounding desert landscape is largely devoid of inhabitants. MPL would need to attract most of its workforce from outside the region, particularly the skilled laborers needed for complex, specialized construction projects. This would boost the project’s costs, both for the incentive payments needed to attract skilled employees to the remote locale and for the provision of housing and other infrastructure to support thousands of new residents during the project’s construction phase. Mexico Pacific Limited has claimed that construction of Saguaro Energía would temporarily employ 13,000 workers during construction (though only a fraction of that total would be needed for the project’s operations).

Cost overruns and project delays. Like many LNG projects around the world, Mexico’s two existing LNG projects have faced significant cost and schedule challenges. The Energía Costa Azul (ECA) LNG Project south of Tijuana is only one-fifth the size of Saguaro Energía but has already been delayed by roughly a year and gone more than $300 million over budget. Similarly, New Fortress Energy’s Altamira LNG terminal off the Gulf Coast of Mexico faced multiple delays and construction mishaps that exacerbated its parent company’s financial challenges. These projects highlight the construction risks that could affect the much larger and more complex Saguaro Energía project.

CONCLUSION

After eight years and more than $300 million dollars of development capital, Mexico Pacific Limited still faces substantial obstacles in securing financing for its Saguaro Energia LNG project. Many of those obstacles are of the company’s own making: Management churn and shifting strategies likely contributed to the permitting missteps that have slowed the project’s progress. Those internal difficulties have been compounded by a web of external obstacles, including rising costs, deteriorating market conditions, spiking violence stemming from drug cartel activity, rising political and trade tensions between the U.S. and Mexico, and stiffening local opposition. Investors would be wise to pay close attention to the many warning signs flaring around this troubled project.