LNG is not displacing coal in China’s transition to renewable power

Imported LNG is not a “bridge fuel” in the world’s largest coal-consuming country

June 25, 2024 (IEEFA Asia): Liquefied natural gas (LNG) is often pitched as a transition fuel that can help countries reduce coal usage amid the switch to renewable energy. However, evidence from China, the world’s largest coal consumer, shows that LNG is unlikely to materially displace coal-fired power generation, according to the latest report from the Institute for Energy Economics and Financial Analysis (IEEFA).

“Policymakers in both LNG exporting and importing countries should approach claims about the necessity of LNG as a ‘bridge fuel’ with a high degree of skepticism,” says Sam Reynolds, the report’s co-author and LNG/Gas Research Lead for IEEFA Asia. “The case of China clearly shows that LNG has played a minimal role in displacing coal in the country’s largest coal-consuming sectors.”

The big picture

Arguments that LNG has supported China’s clean energy transition ignore fundamental trends in the country’s energy sector development. China has prioritized domestic energy resources over imported LNG due to energy security and cost incentives.

China’s growing LNG imports have not reduced or slowed the growth of its coal consumption. Since 2017, coal demand has increased more than LNG imports every year.

In the power sector, which accounts for 60% of China’s total coal usage, the share of natural gas generation has remained at just 3% since 2015. Meanwhile, the share of wind and solar generation has quadrupled to 16%. Although coal-fired power generation has increased during this time, its relative market share in the power mix has fallen from 70% to 61%.

“While coal has not been displaced in absolute terms, wind and solar have contributed more than gas to reducing coal’s share in the generation mix,” says Christopher Doleman, report co-author and an LNG/Gas Specialist for IEEFA. “Looking ahead, annual capacity additions of coal, wind, and solar will continue to exceed new gas-fired power capacity.”

A matter of energy security and cost

Chinese government policies strongly favor domestic energy sources, including coal, renewables, and indigenous natural gas, over imported fuels such as LNG. Recent policies aim to “strictly control” coal-to-gas switching and position coal, rather than gas, as the cornerstone of electrical reliability.

For example, recent Chinese energy plans aim to retrofit 200 gigawatts of existing coal capacity to support the integration of variable solar and wind generation. Meanwhile, the country’s natural gas strategy ensures that imports do not rise above 50% of total gas consumption.

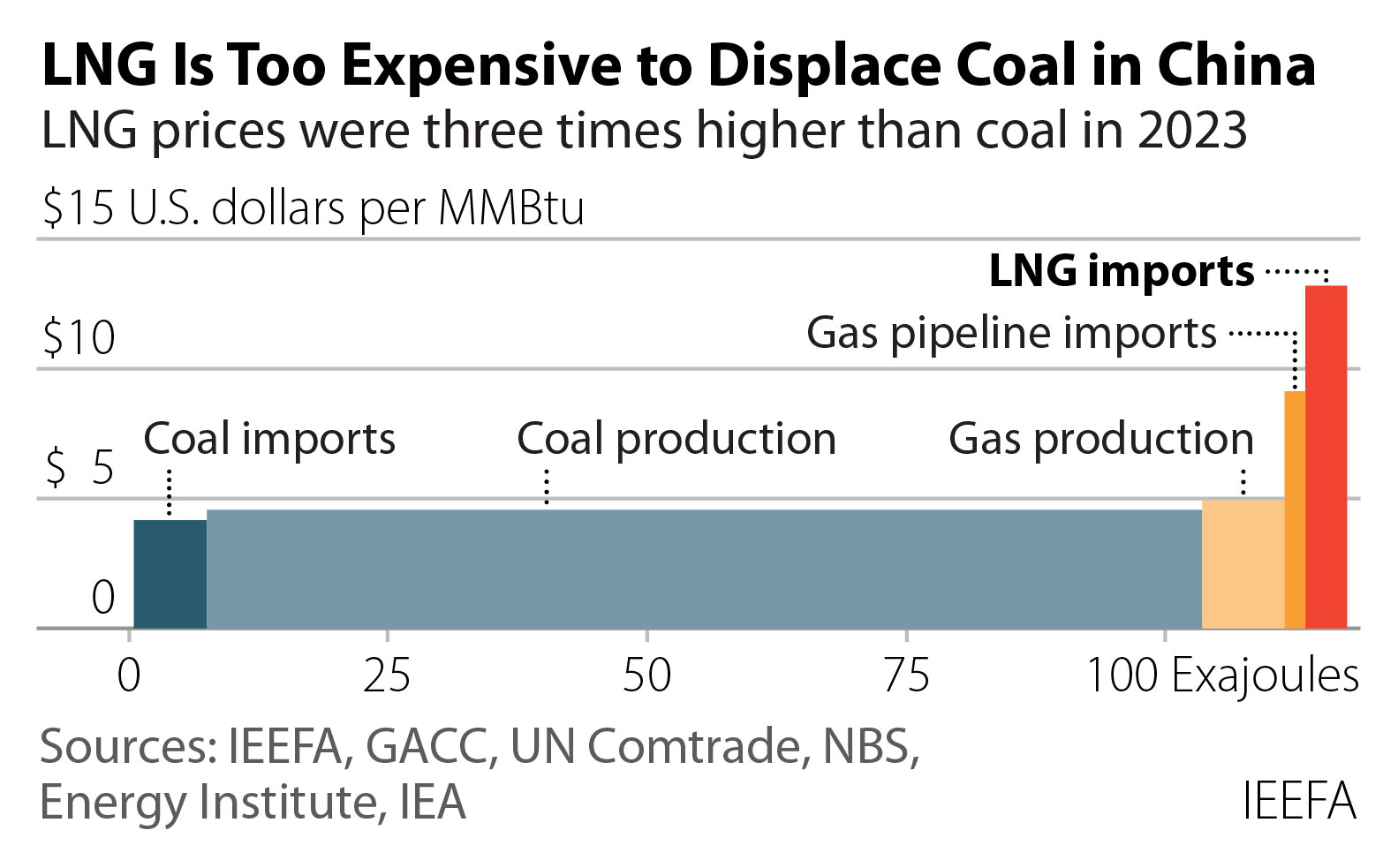

LNG is also too expensive to materially displace coal. Chinese customs data shows that the average cost of imported LNG is nearly three times that of domestically produced coal and gas. It is also between 37% and 61% more expensive than pipeline gas imports from Russia and other Asian countries.

As a result, coal generation is typically US$30-40 per megawatt-hour cheaper than natural gas-fired power generation. Meanwhile, onshore wind and utility-scale solar are the cheapest power sources, costing roughly half as much as gas-fired power generation.

Although LNG prices are expected to fall in the coming years, IEEFA’s report finds they are unlikely to drop to levels that are competitive with coal or renewables.

Non-power sectors

China’s industrial sectors, primarily iron, steelmaking, and cement, account for 33% of the country’s coal consumption.

“However, Chinese investments in coal-based iron and steelmaking capacity still far exceed those in natural gas-based processes, and full decarbonization will require non-fossil fuel alternatives rather than a shift from coal to gas,” according to Ghee Peh, report co-author and an Energy Finance Specialist for IEEFA.

Efforts to replace coal-fired stoves with gas heaters in urban areas have run their course and extending them into rural areas will prove challenging. Other factors, including energy security and cost incentives, also weigh heavily against coal-to-gas switching.

In the long term, China’s non-fossil infrastructure investments will dwarf fossil energy investments. Replacing coal with clean renewable energy, rather than imported LNG, will likely enable China to peak its carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060.

Read the report: LNG is not displacing coal in China’s power mix

Read the factsheet: LNG is not a "bridge fuel" in China’s transition from coal to renewables

Author contact: Sam Reynolds ([email protected]), Christopher Doleman ([email protected]), and Ghee Peh ([email protected])

Media contact: Alex Yu ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)