First year of European Green Bond Standard sets stage for growth

Key Takeaways:

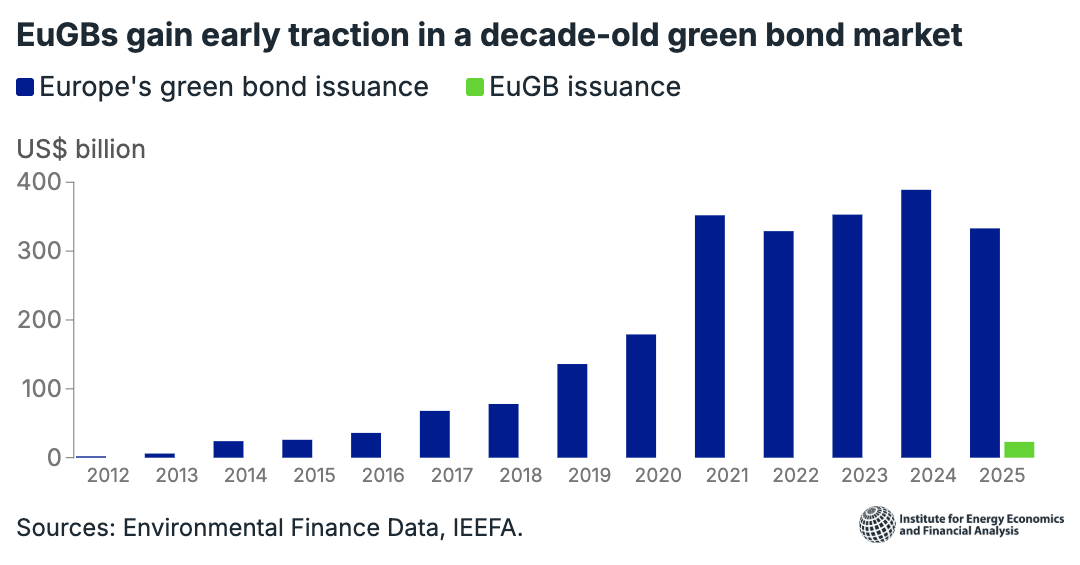

The European Green Bond Standard (EUGBS) has helped drive credibility and transparency in the green bond market, with more than €22 billion in issuances carrying the label just over one year after its introduction.

Issuance under the EUGBS reflects strong market reception and a broad diversity of issuer types spanning sovereigns, municipal entities, development institutions, banks and corporates.

But the standard captures only a small fraction of reported EU taxonomy-aligned investment thus far.

The EUGBS could help issuers credibly showcase to investors their sustainability credentials across four pillars: commitments, capital expenditure pipelines, green asset delivery and governance.

9 February 2026 (IEEFA) | Although more than €22 billion in issuances carry the European Green Bond Standard (EUGBS) label just over one year after it took effect, research from the Institute for Energy Economics and Financial Analysis (IEEFA) finds room for improvement.

Since entering into force in late 2024, the landmark standard has helped drive credibility and transparency in the green bond market. The bonds meet requirements including EU taxonomy-aligned use of proceeds, mandatory external review and standardised reporting.

“Early momentum is encouraging, with every transaction achieving robust oversubscription. But the standard only captures a small fraction of taxonomy-aligned investment so far,” said Kevin Leung, an IEEFA sustainable finance analyst for European debt markets and author of the report.

The analysis found a trio of factors that have worked well:

- Issuance under EUGBS reflects strong market reception and a broad diversity of issuer types spanning sovereigns, municipal entities, development institutions, banks and corporates. This breadth matters for investors seeking to build diversified sustainable fixed-income portfolios.

- The EUGBS supports corporate financing aligned with EU energy security objectives. The relatively high concentration of European Green Bond issuance in the energy and utility sector reflects the standard’s role as a direct capital market funding channel for activities aligned with EU environmental objectives, which in turn support EU energy security and competitiveness.

- Early-adopting public issuers provide an example for others. For example, the government of Denmark’s DKK7 billion (€940 million) transaction in September 2025 provides a blueprint for other sovereigns considering the standard.

However, the analysis identified three factors that should be considered for improvement:

- The European Commission is missing as an issuer.

- European Green Bonds finance a limited share of taxonomy-aligned capex.

- Financial institutions have yet to use European Green Bond funding to scale green finance.

The EUGBS could help issuers credibly showcase to investors their sustainability credentials across four pillars: commitments, capital expenditure pipelines, green asset delivery and governance.

The analysis identifies several opportunities to broaden the effectiveness of the standard, including the conversion of existing bonds, the creation of innovative products and the development of taxonomy-aligned financial products that incentivise broader issuer participation.

It also calls on policymakers to attract international issuers to adopt the standard. This would expand the investable universe, diversify the portfolio and create cross-border capital flows toward green investments.

“Impact reporting remains a critical — and still underdeveloped — pillar of the EUGBS,” said Leung. “As green bond impacts differ substantially by project, monitoring impact reporting quality and issuer alignment trajectories will be critical to assessing whether EUGBS delivers on its gold standard promise.”

Press contact

Jules Scully | [email protected] | +447594 920255

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org