EU Green Bond Standard: A strong first year, but more to be done

Download Briefing Note

View Press Release

Key Findings

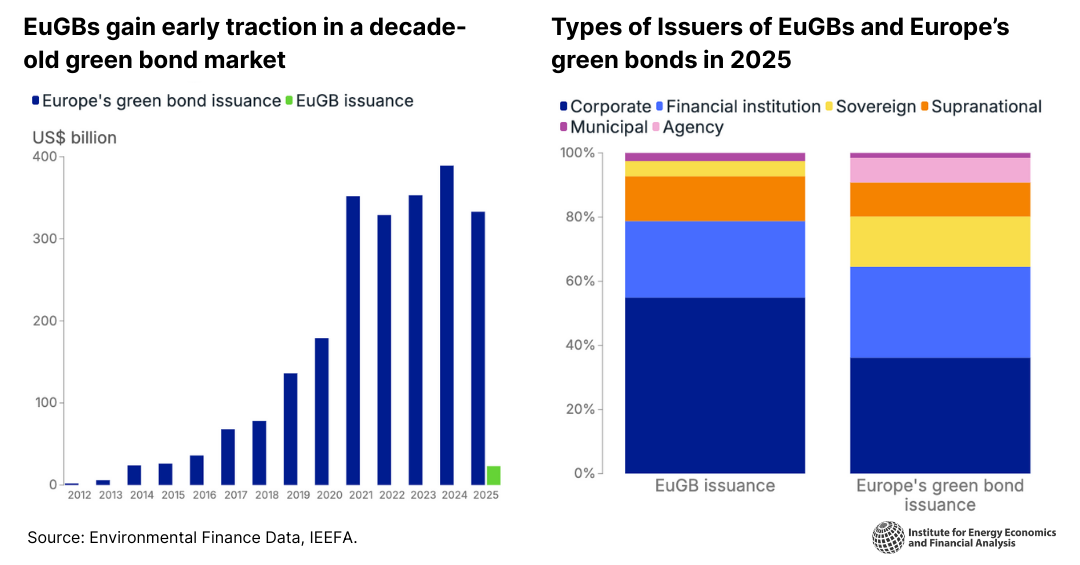

Just over one year after the European Green Bond Standard (EUGBS) went into effect, the more than €22 billion in bonds issued have met with strong market reception, including consistent oversubscription and diverse issuer participation

Grid and renewable energy utilities lead early adoption, demonstrating the EUGBS's role in financing EU energy security and competitiveness objectives.

Denmark's sovereign issuance sets an important example for the broader public issuer participation necessary to accelerate adoption and address the climate investment gap

Monitoring impact reporting quality and issuer alignment trajectories will be critical to assessing whether EUGBS delivers on its gold standard promise.

Just over one year after the European Green Bond Standard (EUGBS) — a landmark regulatory framework for sustainable bonds — took effect in late 2024, more than €22 billion in issuances carry the “European Green Bond” or “EuGB” label. That means these bonds meet requirements including EU taxonomy-aligned use of proceeds, mandatory external review and standardised reporting. Early momentum is encouraging, setting the scene for enhanced credibility and transparency in the green bond market. Yet as investments required to drive the energy transition accelerate, the standard captures only a small fraction of reported taxonomy-aligned investment thus far, signalling significant room for growth.