EU risks new energy dependence as US could supply 80% of its LNG imports by 2030

Key Findings

The EU’s rising reliance on US liquefied natural gas (LNG) has created a potentially high-risk geopolitical dependency and could cause it to miss its gas demand reduction commitments.

If the EU fulfils all its supply deals for US LNG and its gas demand reduction efforts falter, the bloc could source as much as 75–80% of its LNG imports from the US in 2030, up from 57% in 2025.

By 2030, 40% of the EU’s total gas and LNG imports could be from the US, up from 27% in 2025.

An overreliance on US LNG, the most expensive LNG for EU buyers, contradicts the REPowerEU plan of enhancing EU energy security through diversification, demand reduction and making energy more affordable.

The EU has strengthened its energy security by cutting gas demand by over 20% between 2021 and 2024 and curbing gas imports from Russia. However, this progress masks a new vulnerability for the EU: Incentivising imports of US liquefied natural gas (LNG) has created a potentially high-risk new geopolitical dependency.

Following Moscow’s full-scale invasion of Ukraine in 2022, the EU has gradually reduced its reliance on Russian gas. The bloc’s imports of Russian gas (including pipeline gas and LNG) fell by 75% between 2021 and 2025. Despite this shift, Russia remains one of the EU’s largest gas suppliers.

The EU has agreed to a legally binding, stepwise prohibition on both LNG and pipeline gas imports from Russia, with a full ban from the end of 2026 and autumn 2027, respectively.

Recent EU imports of gas from Norway have been consistent, averaging around 90 billion cubic metres (bcm) annually in the last four years.

The pivot away from Russian gas has increased the EU’s strategic dependency on US LNG, the most expensive LNG for EU buyers. EU imports of US LNG rose from 21bcm in 2021 to an estimated 81bcm in 2025, an almost fourfold increase. This means that EU countries sourced 57% of their LNG imports from the US in 2025.

Thirteen EU countries imported US LNG in 2025. The Netherlands, France, Spain, Italy and Germany accounted for 75% of the bloc’s imports of US LNG last year.

As part of the trade deal announced between the EU and US in July 2025, the EU intends to buy USD750 billion of US energy by 2028. The deal effectively ties the EU’s energy supply to one seller, risking energy security and jeopardising gas reduction plans.

IEEFA calculates that if EU countries were to spend USD750 billion on renewables instead, the EU could install about 546 gigawatts of combined solar and wind capacity. This would boost energy security and could bring down electricity prices.

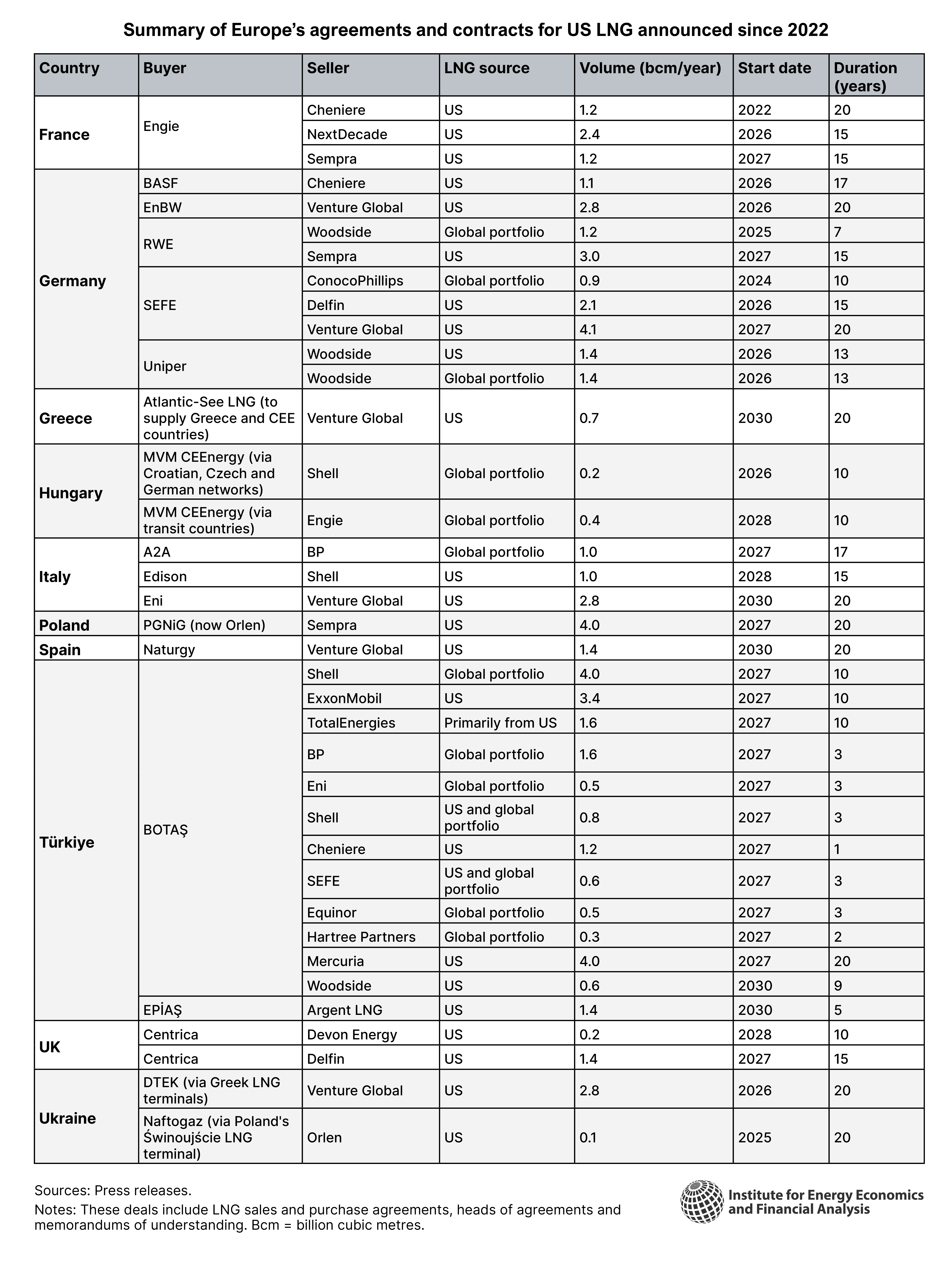

EU countries’ dependency on US LNG is set to deepen following LNG supply deals announced at the Gastech conference in Milan in September 2025 and the Partnership for Transatlantic Energy Cooperation (P-TEC) meeting in Athens in November. But by locking in long-term gas contracts, the EU risks undermining its Green Deal and energy autonomy.

IEEFA has calculated a 2030 scenario where all these deals materialise and EU gas demand reduction efforts falter. The deals could increase EU imports of US LNG to around 115bcm annually by 2030, meaning 75–80% of the bloc’s LNG imports would be from the US.

The EU sourced 27% of its total gas and LNG imports from the US in 2025. New LNG contracts mean this figure could rise to 40% by 2030 under the 2030 scenario.

The EU's REPowerEU plan to end its reliance on Russian fossil fuels aims to enhance energy security through diversification, demand reduction and making energy more affordable. An overreliance on US gas contradicts this strategy.