Oil/Gas & LNG

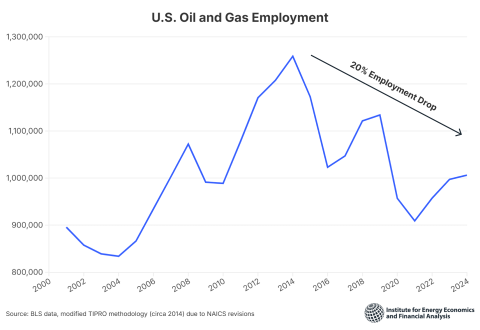

Diminished expected returns accompanied by expanding risk, cost inflation, and growing liabilities (associated with carbon reduction, remediation, and climate impact initiatives) have irreversibly changed the oil and gas industry. In this mature capital-intensive sector that is facing long-term demand decline and an increased likelihood of stranded assets, investors are pressing for financial discipline and not production growth. As renewable energy gains ground and creditors, consumers and insurers are leveling calls for carbon reduction and climate impact mitigation, energy lobbyists are applying pressure to secure greater subsidies and government policies that enhance the economic advantages these companies count on. IEEFA closely monitors the industry and brings to light the domestic and global incentives that the oil and gas industry relies on to enhance its financial standing at the expense of consumers, public health, and the environment.

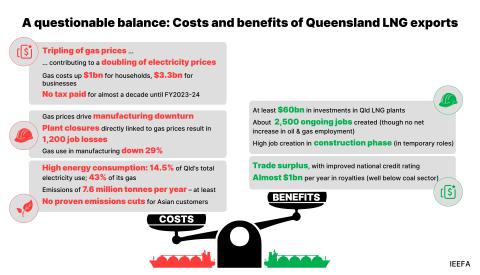

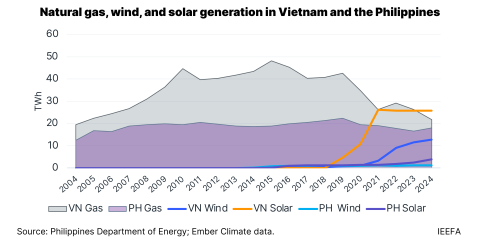

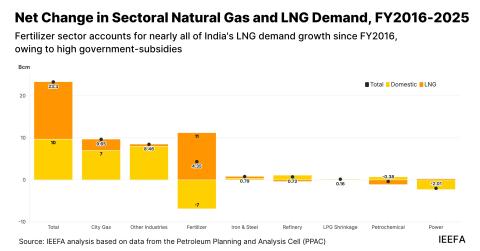

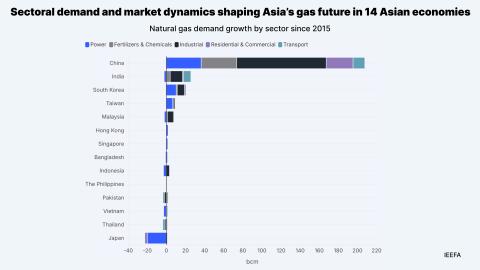

Natural gas represents nearly one-quarter of global energy consumption, but growing concerns over CO2 emissions, methane leaks, and high and unstable costs are clouding the outlook for the fuel. Spiking global gas prices have created new headwinds for demand growth, while the falling cost of renewables is boosting competitive pressures on the fuel. IEEFA examines the finances of the global gas industry, from upstream gas producers, to midstream pipeline and LNG facilities, to the ultimate sources of demand, including power plants and the petrochemical industry.