Big Four banks exposed over methane emissions

Key Takeaways:

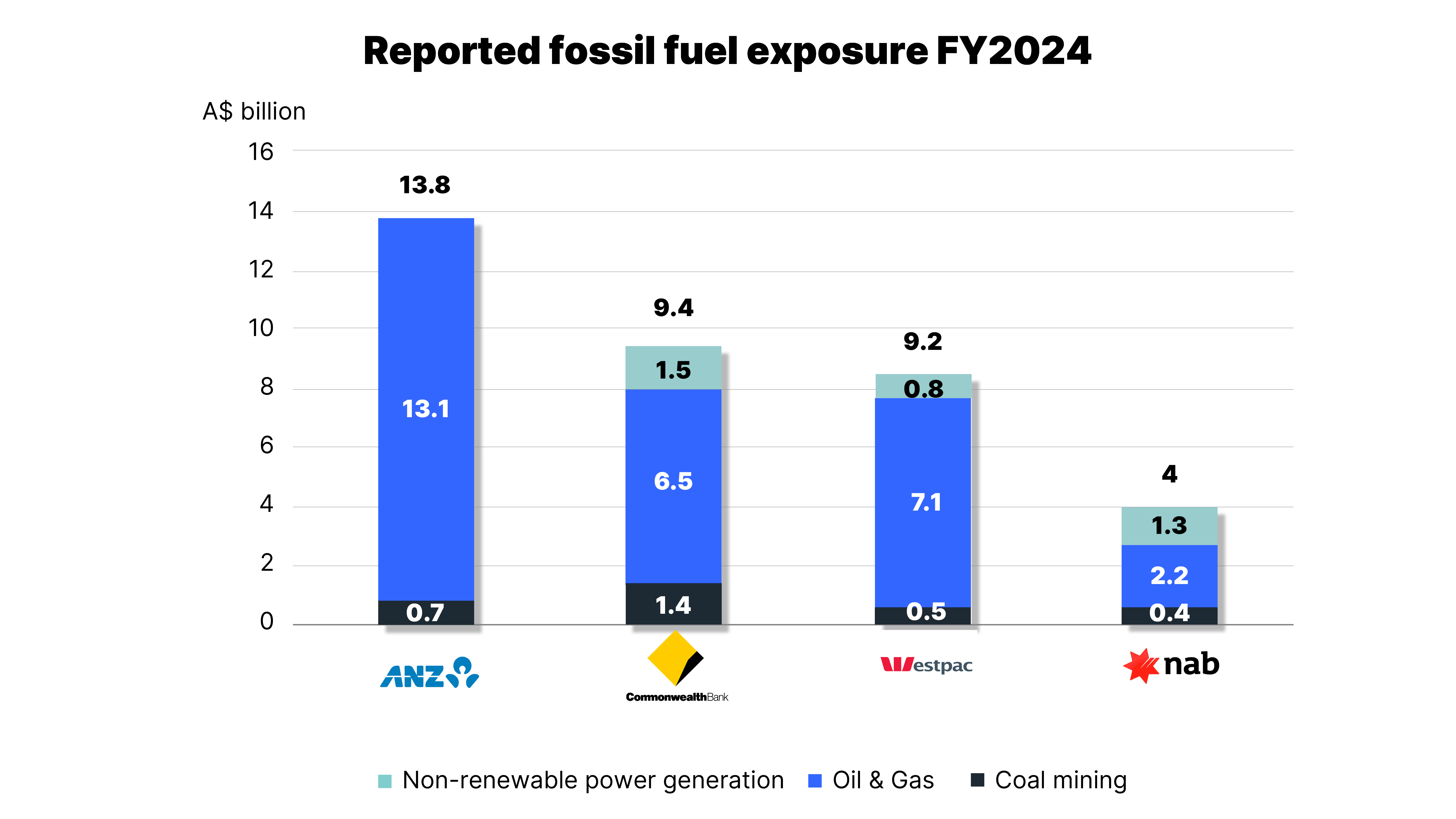

Australia’s Big Four banks have reduced their project finance to fossil fuel companies in recent years, but their overall financial exposure remains in the billions.

Methane has been overlooked in banks’ emissions accounting and reduction targets, despite its potent warming effect and its prevalence in coal mining and oil & gas operations.

None of the Big Four banks has set a phase-out date for metallurgical coal financing, leaving a potentially more methane-intensive emissions source unaddressed.

Banks continue to provide corporate lending and capital markets services to fossil fuel clients without including these services in their emissions reduction targets, despite updated international guidelines.

3 July 2025 (IEEFA Australia): Australia’s “Big Four” banks retain billions of dollars of exposure to fossil fuel assets, and are at significant risk due to flawed measurement of the sector’s methane emissions.

The Institute for Energy Economics and Financial Analysis (IEEFA) has found that Australia’s major banks – Commonwealth Bank (CBA), ANZ, Westpac and NAB – are largely overlooking the risks associated with the release of methane emissions during fossil fuel production. The findings are presented in a new briefing note, Ignoring methane emissions leaves Australia’s Big Four banks exposed, by Anne-Louise Knight, IEEFA’s Lead Coal Analyst for Australia.

“Although banks recognise the methane risks in other sectors, they tend to ignore the methane emissions from their coal or oil & gas clients,” says Knight. “So far, none of the major banks in Australia report methane emission estimates separately from the carbon dioxide emissions for these companies.”

All of the Big Four banks have set targets to reduce their exposure to emissions-intensive sectors and clients, but IEEFA’s examination of their climate plans suggests a range of potential flaws. For example, some of the banks are basing their plans on outdated versions of the International Energy Agency (IEA)’s Net Zero Emissions (NZE) scenarios, meaning their decarbonisation strategies could be insufficiently ambitious.

The frequent omission of methane from the banks’ estimates quantifying the total greenhouse gas emissions of their fossil fuel industry clients leaves those banks significantly exposed. Moreover those that do include methane may nonetheless be at risk of facing higher climate-related exposures than they currently assume, due to potential methane underreporting in the coal mining and oil & gas sectors.

In addition, none of the Big Four banks has set a date for phasing out financing for metallurgical coal mining. This poses climate exposure risks, as met coal is more methane-intensive to mine than thermal coal on average. The problem is compounded by problems in the way banks classify whether a client is a thermal or met coal miner.

“Methane is a potent greenhouse gas, responsible for about 30% of the post-industrial increase in global temperatures,” says Knight. “It’s also the main component of liquefied natural gas (LNG) and naturally occurs in coal seams. Therefore, methane goes hand in hand with coal production and oil & gas drilling, storage and transportation.”

IEEFA argues that the banks could reduce their risk exposure by targeting methane reduction more directly. This could be accomplished by:

- Making the submission of climate transition plans for all fossil fuel clients mandatory and integrate methane into emissions accounting and customer transition plans

- Requiring clients in methane-intensive sectors to provide independent verification of self-reported methane emissions.

- Considering setting Phase-Out Targets for Metallurgical Coal financing

“Australia’s major banks have taken significant strides in addressing their climate-related financial risks and setting decarbonisation targets,” says Knight. “However, the credibility and effectiveness of these efforts are undermined by various critical shortcomings – most notably the inconsistent, often inadequate treatment of methane emissions.

“As greenhouse gases go, methane burns bright and dies young; it traps far more heat in the atmosphere than carbon dioxide over the short term. This means reducing methane emissions now could have more immediate results at slowing down global warming. And banks could be doing more to help achieve this.”

Read the analysis: Ignoring methane emissions leaves Australia’s Big Four banks exposed

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Anne-Louise Knight, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)