Key Findings

Investors have an opportunity to incentivise more rapid action on methane – a potent greenhouse gas and a major contributor to fossil fuel companies’ Scope 1 emissions – by incorporating methane reporting and abatement into their engagement with companies.

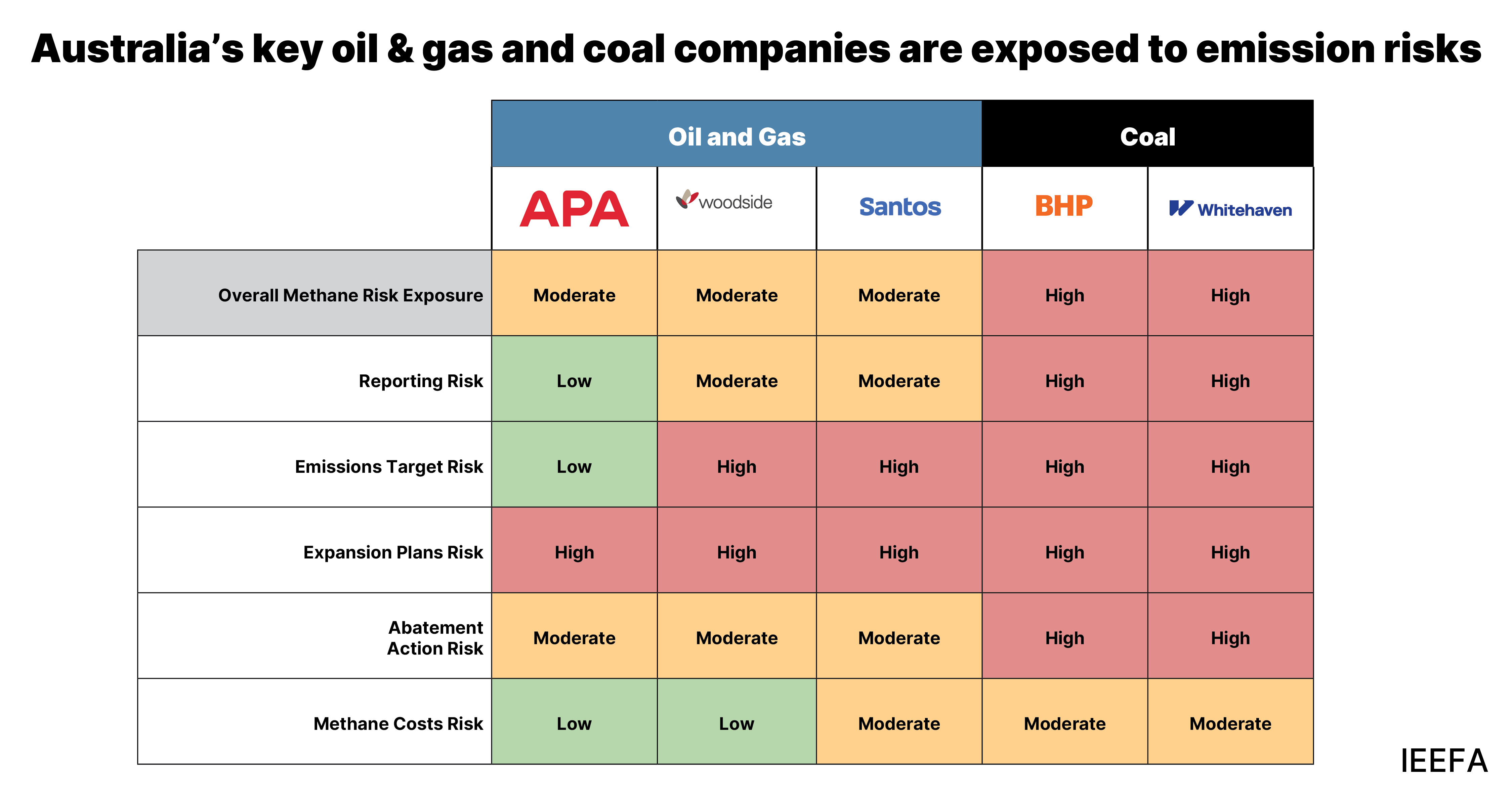

Leading companies in Australia’s oil & gas and coal mining sectors are not taking sufficient action to reduce methane emissions, while planning substantial expansions of production that would outweigh any existing abatement action, relying instead on buying carbon credits to meet their climate-related targets.

By not implementing structural methane abatement measures, companies will rely on purchasing carbon offsets, increasing risk exposure in the event of a rising Australian carbon price.

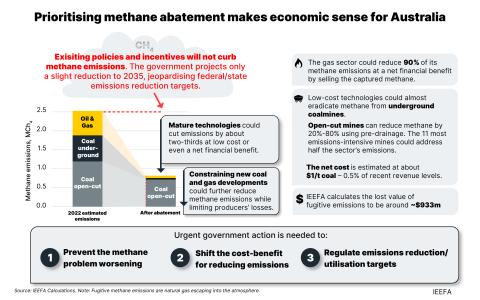

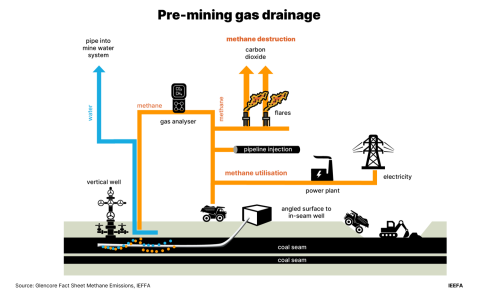

Methane abatement can be undertaken with mature technologies at relatively low cost, and offers potential financial benefits for companies through the use and sale of captured gas.

Greater methane abatement action is required by oil & gas and coal mining companies in Australia to decrease their climate-related risk exposure and reduce greenhouse gas emissions.

Methane is a potent greenhouse gas that increases the climate-related risks facing companies in these sectors. Methane’s significant contribution to fossil fuel companies’ Scope 1 emissions means without strong mitigation action companies risk missing their own emissions reduction targets or breaching regulatory emissions requirements. Methane abatement could also offer financial opportunities through the use or sale of captured methane.

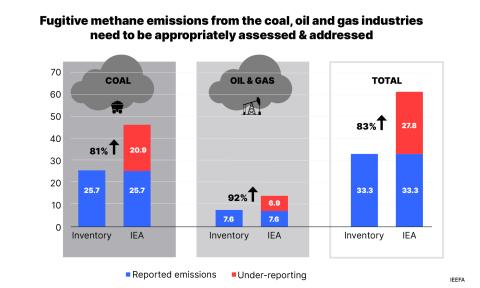

There is a significant risk that companies’ self-reported methane emissions are underestimated in Australia. Emissions could be two times higher than reported for oil & gas companies and three times higher for open-cut coal miners. This is largely due to current estimation methods relying only on production-based emissions factors, which may not incorporate comprehensive empirical data, and do not require third-party verification. Additionally, companies are not fully utilising ‘top-down’ methods such as satellite monitoring, remote sensing and flyovers to verify reported emissions and monitor for leaks or plume events.

Meanwhile, companies are not taking strong action specifically aimed at cutting methane emissions and generally report carbon dioxide-equivalent rather than individual greenhouse gases.

This report examines the actions of five companies in these sectors: Woodside, Santos, APA Group, BHP and Whitehaven. All five have significant plans to extend or increase production. This will lead to increased methane emissions unless structural abatement activities or net decreases in production are undertaken concurrently. All five companies have taken no or limited abatement action to date. For those that have, the scale of methane abatement is outweighed by the scale of planned production growth and expansions.

However, abatement action is possible and, could even be financially beneficial for companies. Methane abatement technology is technologically mature, and could be undertaken at relatively low costs. IEEFA’s analysis found that abatement in coal mining could be rolled out at an average cost of AU$1 per tonne of coal. For oil & gas companies, methane abatement could be done at an overall net financial benefit due to the options to use or sell the methane gas captured.

Investors have an opportunity to incentivise more rapid action on methane emissions by incorporating methane reporting and abatement into their engagement with fossil fuel companies. Doing so would promote accurate, transparent methane emissions disclosures, verifiable methane measurements and reductions, and stricter performance standards.

This report provides a methane exposure risk assessment of each of the five companies assessed, based on reporting risks; stated targets; expansion plans; abatement actions taken; and methane costs incurred by companies. These indicators all affect companies’ exposure to risks regarding their climate targets.