Growth in Australian open-cut coalmining raises urgency of methane abatement

Key Findings

Open-cut mines in Australia are responsible for more than half of the total methane emissions from Australian coalmining. However, methane abatement is rarely performed in open-cut coalmines.

Underground coalmines represent the “low hanging fruit” for methane abatement in the industry, as methane is readily captured and is also a safety hazard in underground mining.

More needs to be done to incentivise methane abatement projects for open-cuts, to ensure that the runaway growth of large open-pit mines in Australia does not put emissions reduction targets beyond reach.

Methane (CH4) is best known as a fuel – as natural gas or ‘fossil gas’ – but when it leaks into the atmosphere it is a potent greenhouse gas, with a higher warming effect than carbon dioxide (CO2). Controlling it is seen as one of the quickest ways to reduce global warming, and Australia has joined more than 120 other countries in signing the Global Methane Pledge to collectively reduce methane emissions by at least 30% from 2020 levels by 2030.

Methane emissions occur in coalmining operations because coal seams are also reservoirs for methane gas – which leaks out before, during and after mining.

According to Ember’s 2022 report Tackling Australia’s Coal Mine Methane Problem, “independent satellite measurements have uncovered underreporting of methane emissions from Australian coal mines – twice as high as official estimates”. The report also prioritised actions to capture emissions from underground coalmines as the largest immediate opportunity.

However, data published in late 2023 by Global Energy Monitor (GEM) in the Global Methane Emitters Tracker (GMET) indicated that there is more to consider for Australia. Australia is the world’s fourth largest coalmine methane emitter, yet it operates 75% of its coalmining by purely open-cut, or surface, methods; only 16% comes from purely underground mines. Therefore, while underground mines may be the most emissions-intensive, achieving meaningful change will require action on open-cut mines as well.

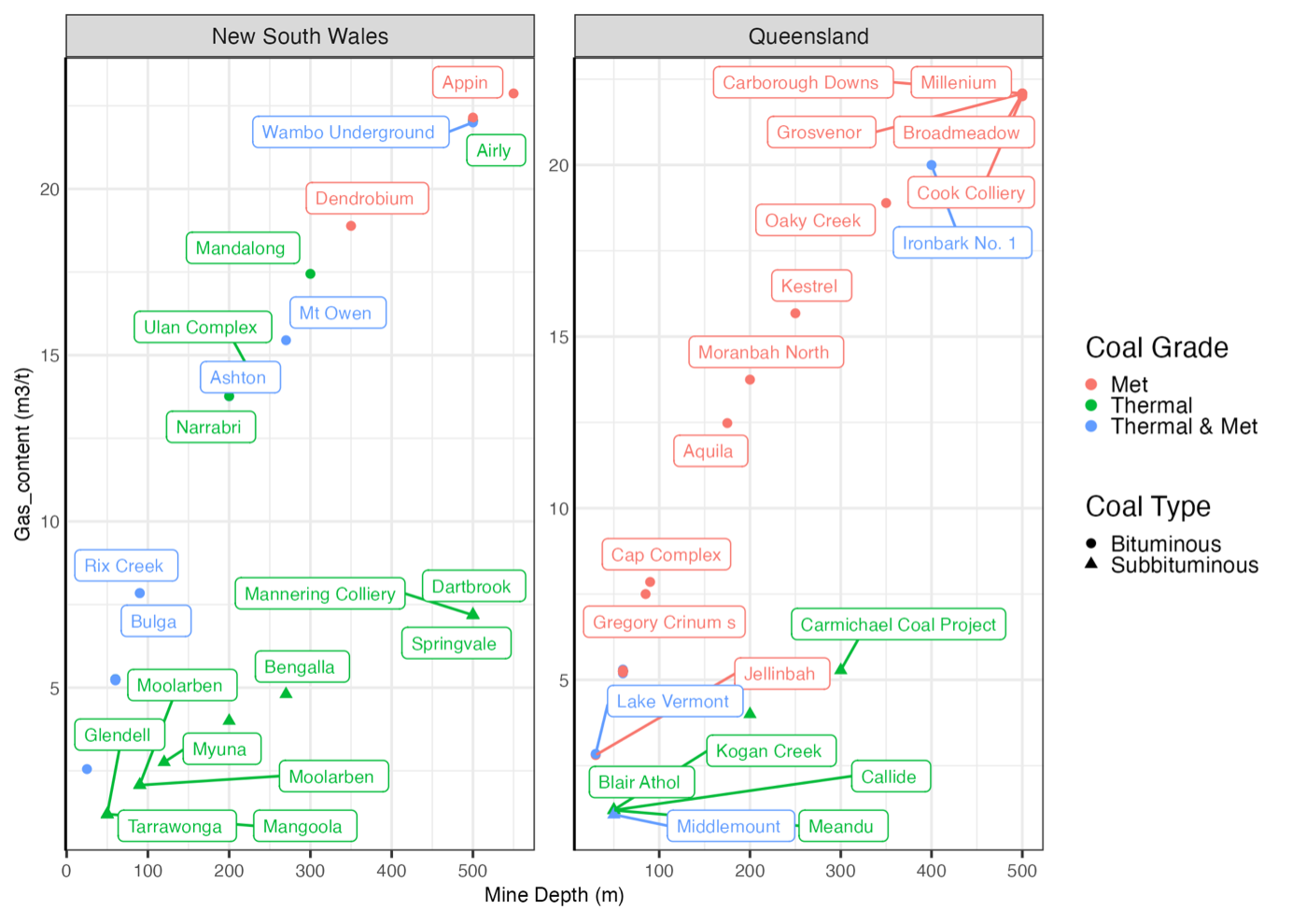

Varying methane emissions intensity of New South Wales (NSW) and Queensland (QLD) mines

Source: GEM Global Coal Mine Tracker Oct 2023. IEEFA Analysis.

Gas Content is Coalmine Methane Emissions Estimate (cubic metres per coal tonne).

Open-cut coalmining dominates Australia’s methane emissions

Open-cut mines in Australia are responsible for 52% of the methane emissions in Australian coalmining, and up to 60% when including the operations that combine open-cut and underground mining, according to the GEM data. A breakdown by state illustrates the key sources of emissions.

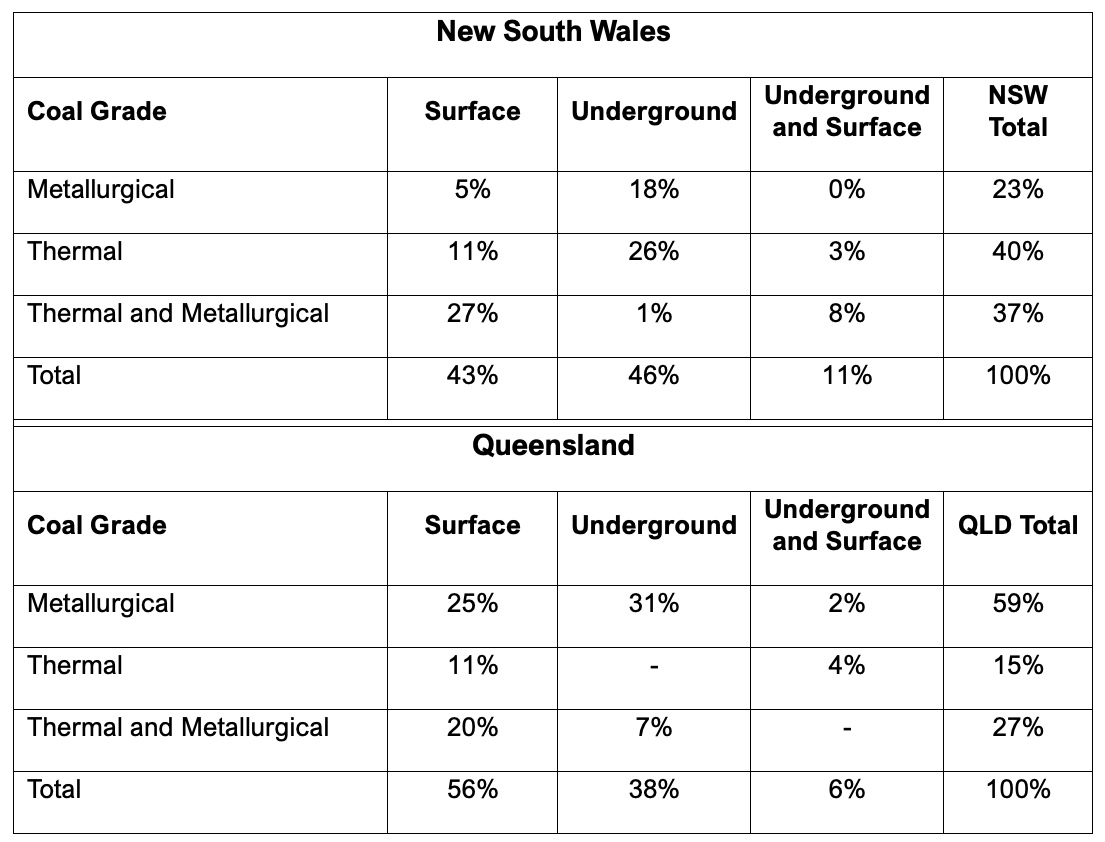

Table: Methane emissions are dominated by thermal coal in NSW and metallurgical coal in QLD

Source: GEM Global Coal Mine Tracker Oct 2023.

Metallurgical (bituminous type) coal generally has higher methane emissions intensity than thermal. While some coal companies are pushing to ‘diversify’ into metallurgical coal because this is seen as having a longer demand outlook, the increase in metallurgical coal production has implications for Australia’s coalmine methane emissions.

Environmental groups have warned that coalmine expansions set for NSW and QLD are expected to significantly increase Australia’s methane emissions inventory, with limited methane reduction activities planned. The Hunter Valley Operations (HVO) Continuation Project, for example, would enable a further extraction of 684 million tonnes (Mt) of coal from the open-cut operation and extend its life to 2050. This includes the extraction of 400mt of bituminous coal from deeper coal seams in the HVO North, with an anticipated release of more than 1Mt of CO2-equivalent Scope 1 emissions per year for 25 years.

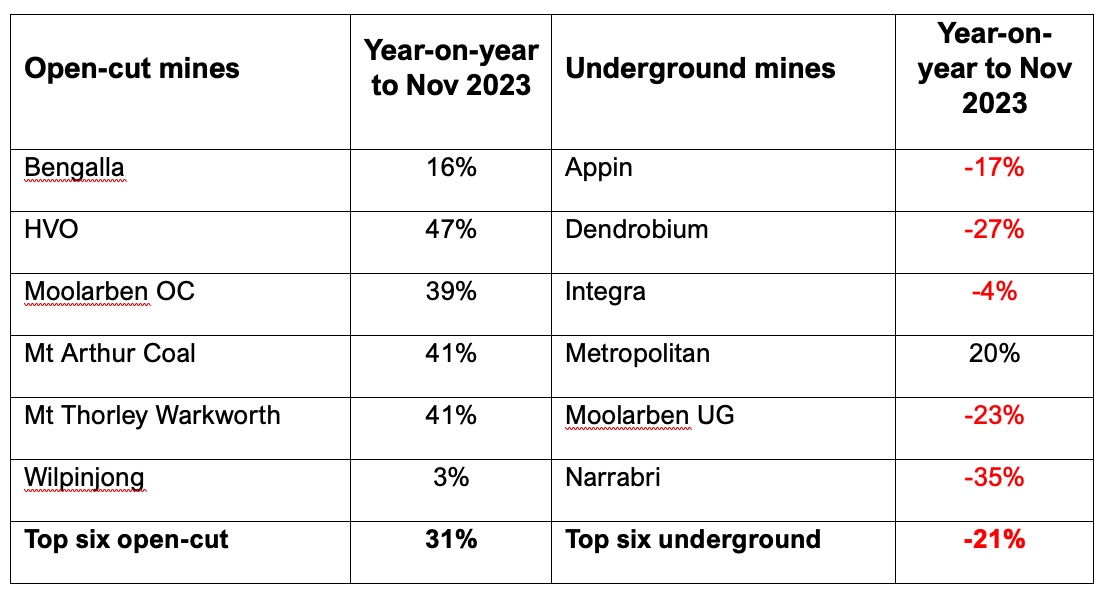

There is a widening divide in Australia between the growth of open-cut coalmines and reduced production at underground mines. The largest six mines in NSW are open-cut mines and are expanding at a rapid rate. They now make up more than 40% of production and the top six underground share of production has fallen to just 10%.

Table: NSW top six mines, production by type

Source: NSW Coal Services, IEEFA. Saleable Production Year-on-Year (YoY) Calendar Year 2023 vs Calendar Year 2022.

Methane abatement in coalmining

Methane released from coalmining is classified as Scope 1 fugitive emissions. While it is worth noting that greenhouse gas emissions from the combustion of coal (Scope 3 emissions) are many times higher than these Scope 1 emissions, they consist of CO2 and other combustion gases. According to the International Energy Agency (IEA), “Addressing methane from coal will require a two-pronged strategy: transitioning away from coal use, particularly in the power sector, while simultaneously encouraging mitigation strategies where economically feasible.”

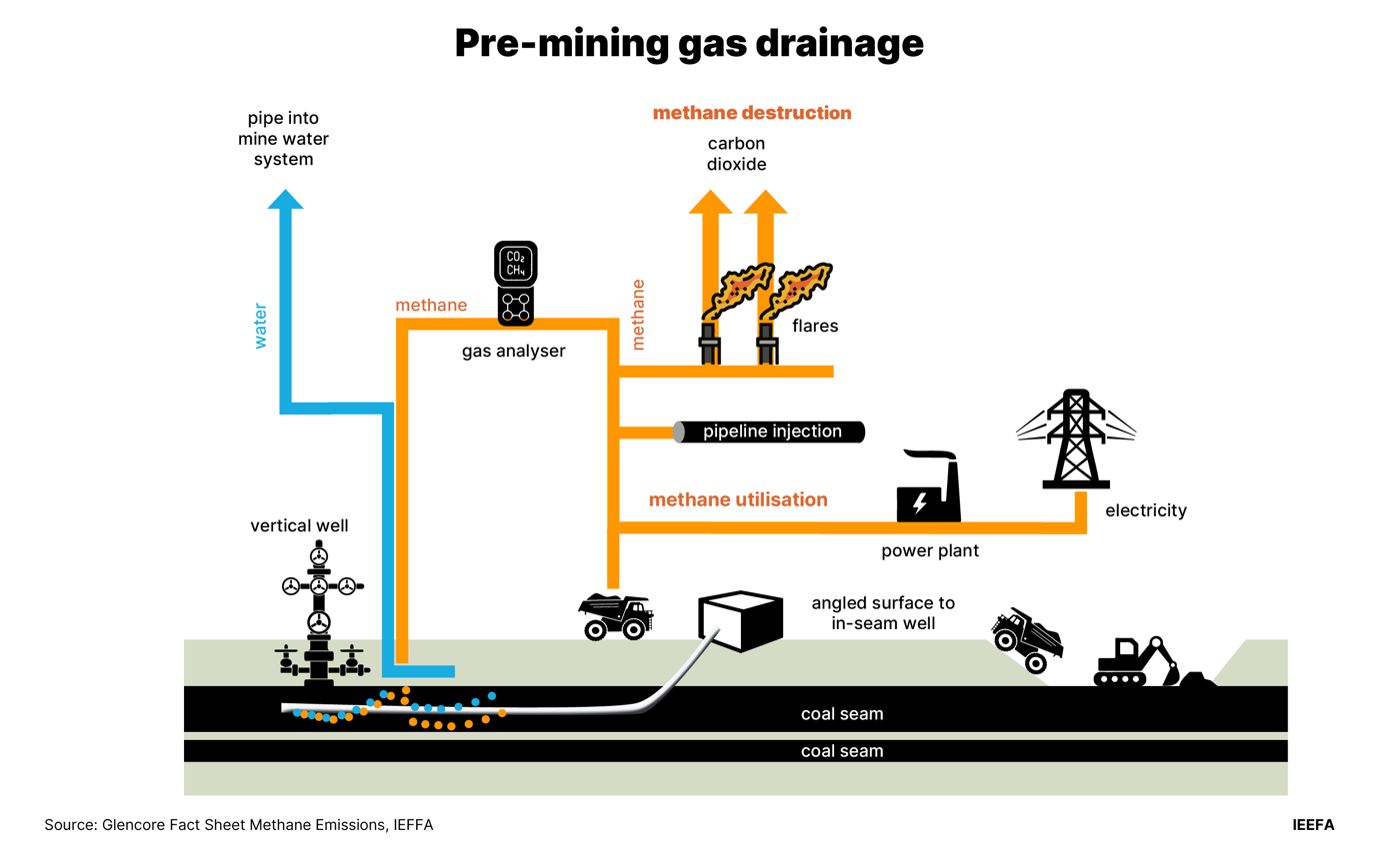

The ability for coalmines to capture and utilise or destroy the methane emissions is a function of the methane concentration and the gas permeability in the coal seams, as well as the mining method used. Gas drainage prior to mining is suitable for both open-cut and underground mines.

When the methane exists in low concentrations, various technologies exist and are being developed to oxidise the methane and convert it to less-potent carbon dioxide. In higher concentrations it can be used as an energy source, such as to power mining equipment, on-site electricity generation or in gas pipelines.

The industry currently lacks meaningful incentives to develop methane abatement projects beyond enhancing its green credentials. In the case of underground mining it is necessary for mine safety reasons – as recently as January 2024, Russell Vale Colliery was closed by the regulator due to safety breaches associated with mine methane. However, in open-cut mines, methane abatement is rarely performed. Nonetheless, in coal fields with high methane content and good gas permeability, there is an opportunity in open-cut mining to pre-drain the gas from the coal seam prior to the drill and blast activity releasing the gas.

For example, Coronado has a Gas Pilot Project at its Curragh open-cut mine aiming to capture and use waste gas from its open-cut mine for power generation and as a diesel substitute in mining fleets.

Meanwhile, HVO’s Continuation Project has offered to consider pre-drainage. Its environmental impact statement (EIS) stated that, “pre-drainage is not currently economically viable for a multi-seam open-cut mining operation such as HVO”. Late last year in response to submissions it revised its position- to commit to undertake a gas pre-drainage trial – and that only the scope of the trial would be developed within two years of mining approval, and consider pre-drainage later in the mine life. IEEFA estimates that the potential CO2-e reduction in HVO’s gas pre-drainage project could equate to shutting down a 300MW coal-fired power station for 10 years. This calculation uses details from the HVO project’s pre-drainage feasibility report and the conservative figure for methane’s global warming potential of 28 over a 100-year time horizon.

A framework for addressing methane emissions

The Federal Government’s approach to managing methane emissions is via the Safeguard Mechanism. In 2023, Wood Mackenzie highlighted the issue: “A significant portion of Australia’s open-cut mines will be receiving credits from the scheme every year over 2023 to 2030. Meanwhile, underground mines will be subject to significant costs and need to purchase safeguard mechanism credits.”

Open-cut miners will need to consider the implications of the Safeguard Mechanism, yet no miners have suggested that it will provide the required incentive to pre-drain their open-cut mines.

In October 2022, Minister for Climate Change and Energy Chris Bowen, when joining the Global Methane Pledge committed, “to partner with industry to decarbonise the economy and pursue emissions reduction initiatives across energy and waste sectors including capturing waste methane to generate electricity.”

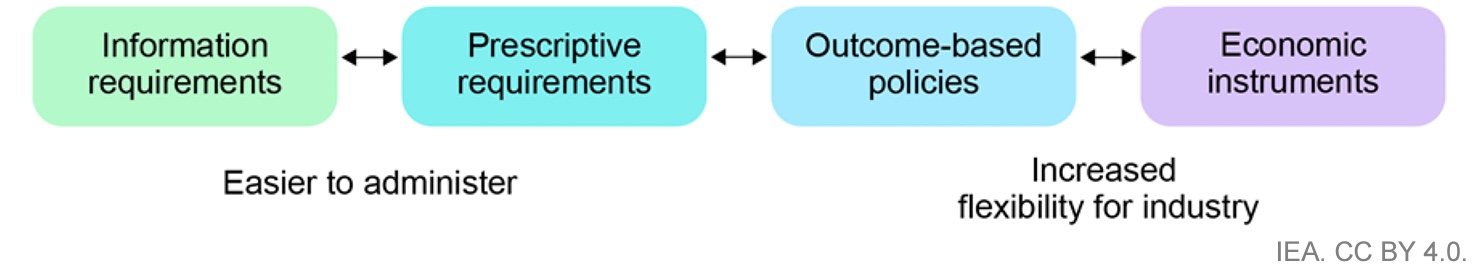

A broader perspective on the problem is offered in the IEA’s roadmap Driving Down Coal Mine Methane Emissions, which contains a four-point plan for policy interventions.

IEA regulatory intervention approaches

- Information requirements: According to the IEA roadmap, “Information-based regulations are designed to improve the state of information about emissions.” In December 2023 the Climate Change Authority (CCA) reviewed aspects of the National Greenhouse and Energy Reporting (NGER) scheme. It recommended an urgent review of the provisions relating to open-cut coalmines, because mines can choose the most favourable outcome based on a Method 1 (sector-wide ‘factor’ applied to run-of-mine coal production) or Method 2 (limited gas sampling). This is widely believed to result in underreporting. Currently actions to reduce emissions would have no impact at all on their safeguard mechanism liability because it only varies with their coal production volume.

- Prescriptive requirements: Direct mines to undertake specific actions or procedures.

- Outcome-based policies: This “establishes a mandatory performance standard for regulated entities, but does not dictate how the target must be achieved”.

- Economic instruments: This would “induce action by applying financial penalties or incentives”. Australia’s Safeguard Mechanism would be an example of applying financial penalties.

Consideration should also be given to creating stronger incentives. A recent Climate Policy Initiative report, Landscape of Methane Abatement Finance 2023, recommends that governments have a pivotal role in stimulating private capital for this task. It states, “Scaling up finance for the fossil sector is essential as it has the largest mitigation potential [of any sector] and is often cost effective.”

In the USA, as part of the US Inflation Reduction Act (IRA), the Methane Emissions Reduction Program proposes to tax excess methane emissions from the oil and gas sector at US$900 per tonne for 2024 emissions and increasing thereafter.

According to the IEA, “There are many different policy approaches, but they all have one thing in common: they change the cost-benefit analysis for companies and drive them to internalise the societal cost of methane pollution.”

Australian policies need to measure up against the IEA’s framework. More needs to be done to incentivise methane abatement projects not only at underground mines, but also for open-cuts, to ensure that the runaway growth of the large open-pit mines in Australia do not put emissions reductions targets beyond reach.

The risk for Australian coalminers is that greater action will be required on methane reduction. Producers have incurred elevated costs due to a range of factors such as labour shortages, wet-weather impacts and higher royalty rates. Now they need to contend with a new cost pressure – increasing expenditure on methane reduction strategies.