Clean energy is driving coal’s decline in the Philippines, not LNG

Key Findings

Coal-fired power generation in the Philippines fell in the first half of 2025, putting the country on track for its first annual decline in coal generation in decades. Commentators are quick to attribute this decline to the rise of liquefied natural gas (LNG) while downplaying the role of clean energy.

However, in the first half of 2025, the Philippines saw greater increases in generation and capacity from renewables than from liquefied natural gas (LNG). Moreover, eight coal plants in the Philippines faced extended outages in the first quarter of 2025, which provides a better explanation for the drop in coal than the rise of LNG.

Price trends indicate clearly that renewables are likely to limit the long-term role of LNG in the Philippines.

Over the past two decades, coal usage in the Philippines has grown to record highs, but recent data suggests this may be changing. Annual coal-fired electricity generation is on track to fall for the first time since 2008, after declining 5.2% in the first half of 2025 (1H2025).

While this is a positive signal for the country’s energy transition, understanding why is also critical. Recent media coverage has asserted that growing liquefied natural gas (LNG) imports are responsible for coal’s decline, reciting oil and gas industry logic that Asia’s energy transition hinges on replacing one fossil fuel (coal) with another (LNG).

However, these conclusions overlook basic trends in the Philippines’ energy market. Renewables have rapidly outpaced the growth of LNG, while gas-fired power generation remains below historical levels. Outages at existing coal facilities provide a better explanation for declining coal generation than the growth of LNG, which is significantly more expensive than renewables and other energy resources.

Many of these issues have been conspicuously ignored and point to a different explanation for coal’s dip: renewable energy, not LNG, is driving the Philippines’ energy transition.

Renewables are growing more quickly than LNG

Recent media coverage has primarily attributed falling coal generation in the Philippines to the rise of LNG. For example, a Reuters report states that coal’s decline was “driven by rising liquefied natural gas-fired power generation.” The report also states that while many Asian countries have bet on renewables, “the Philippines has instead bet on LNG…”

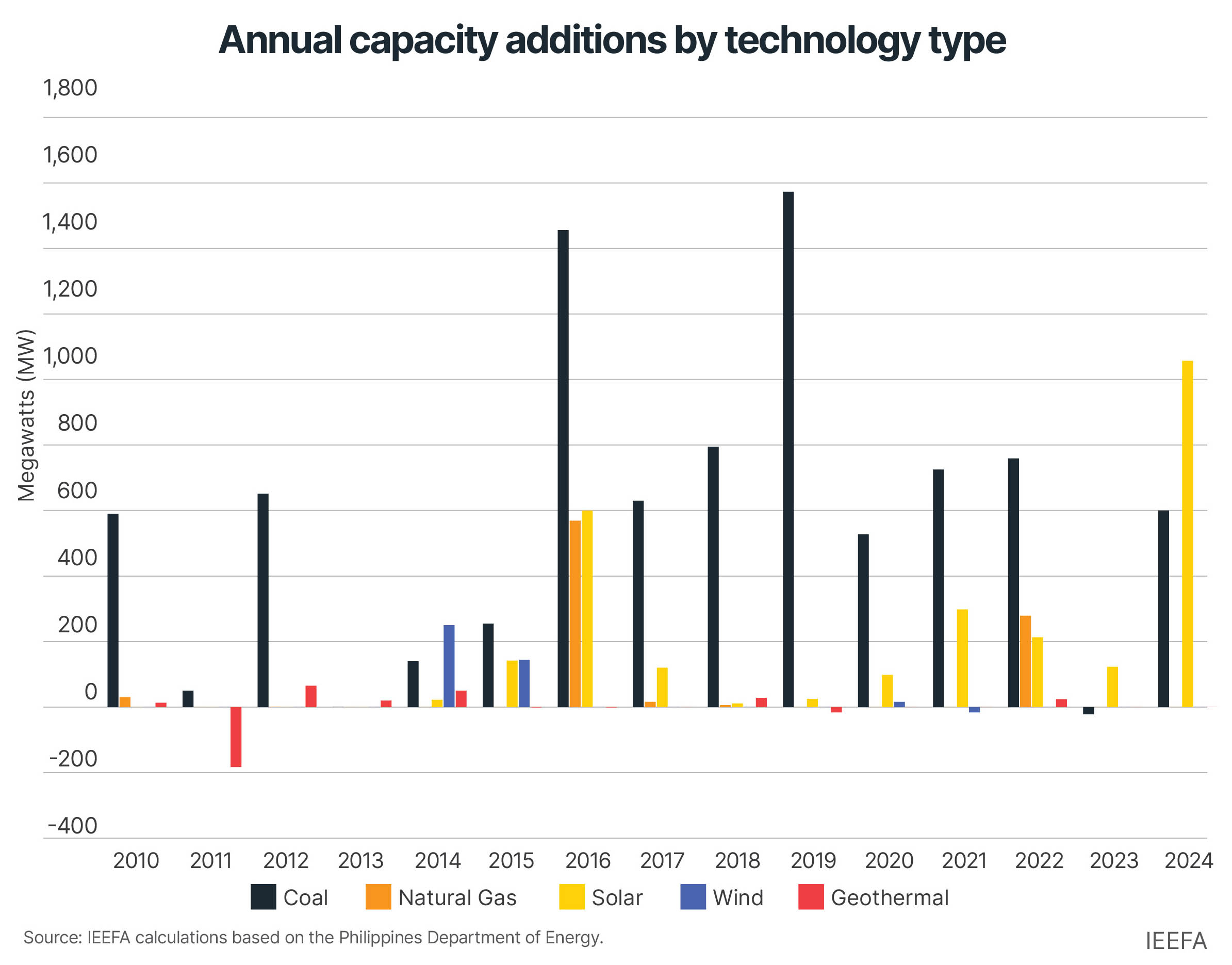

However, the numbers tell a different story. For example, government data shows that the country did not add any new greenfield gas or LNG-fired power capacity between 2017 and 2024. The most recent increase in the country’s gas capacity was in 2022, when several existing facilities were uprated, according to Department of Energy (DOE) figures.

Meanwhile, the Philippines added more than 1 gigawatt (GW) of solar in 2024 alone. This growth outpaced all other asset classes last year and previous projections for solar deployment. Centralized government auctions, among other government policies, are driving project developments. The government is holding a fourth auction round this year for up to 10.5GW of new renewables capacity, including 1,100MW of solar-plus-storage projects.

In the Philippines’ liberalized electricity market, power projects win supply contracts with distribution utilities through auctions, called competitive selection processes (CSP). Utilities are legally required to supply power in the “least cost manner,” meaning power generators must compete on price. To date, only one greenfield LNG-fired power project has managed to win a CSP. Although that project is beginning operations this year, auctions present a key challenge for the rapid growth of future LNG projects.

At the same time, coal capacity has continued to grow despite a moratorium on greenfield plants issued in 2020, due to exclusions for brownfield expansions and projects already underway.

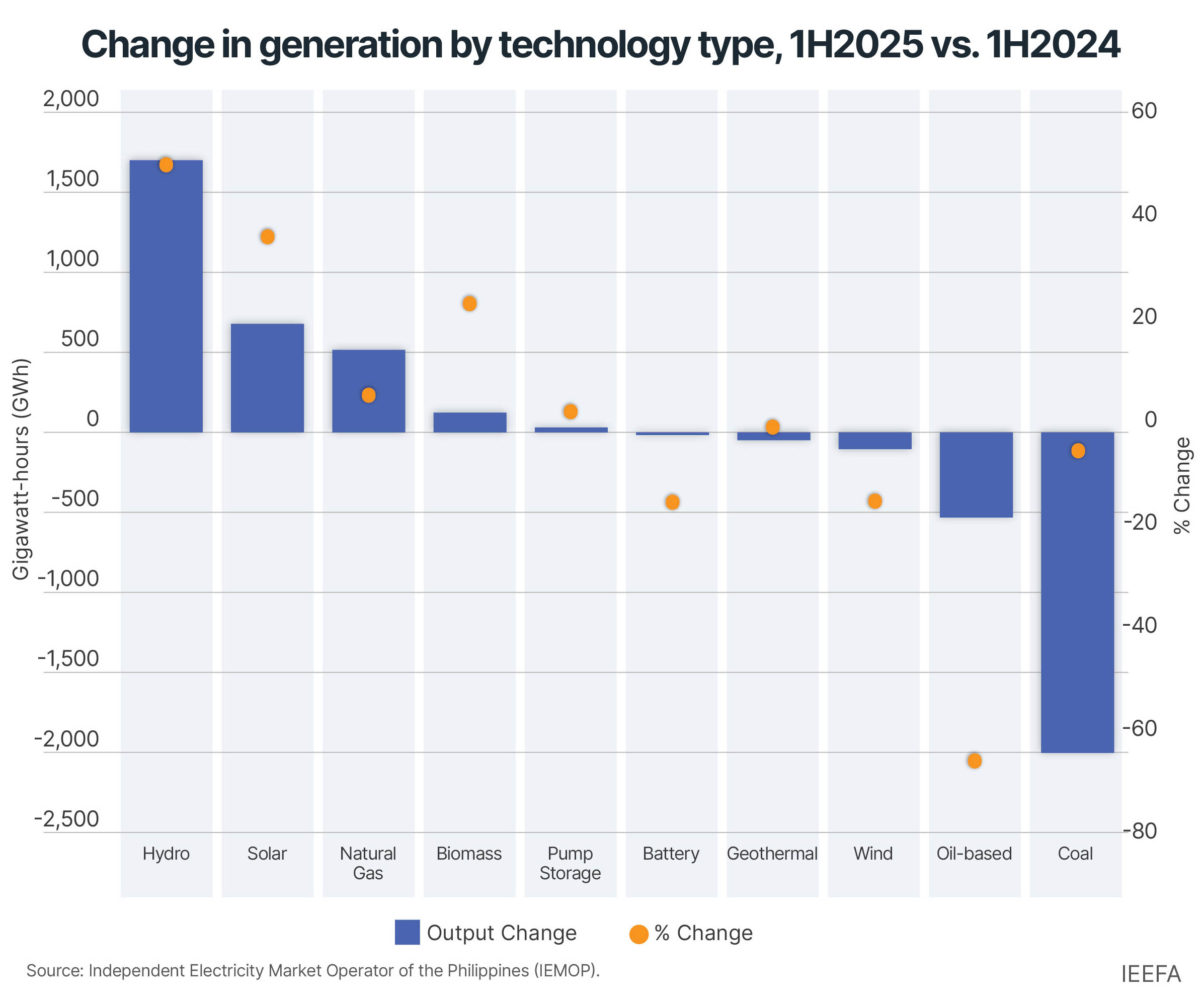

Moreover, claims that LNG was responsible for the drop in coal overlook that hydropower and solar generation increased more than gas generation in 1H2025 compared to the same period last year. While several technologies have helped compensate for the decline in coal generation, it is misleading to position LNG as the main driver.

Natural gas generation is still below historical levels

Another important oversight is that natural gas generation in the Philippines remains below historical levels. Despite an 8.3% rebound in 2024, natural gas generation remained less than in every year between 2007 and 2021. Although natural gas rallied in 2024, coal also increased by nearly 8%.

So, while LNG proponents often focus on inverse relationships between coal and LNG consumption, evidence from the Philippines is more nuanced.

Natural gas for power declined rapidly in the Philippines between 2019 and 2023, due primarily to falling output from Malampaya, the country’s only gas-producing field. This drop occurred before LNG import terminals were online to augment supplies.

Since two terminals started operating and LNG imports began in 2023, gas generation has started to recover, but not in a way that would effectively explain coal’s decline.

Why has coal generation fallen in the first half of 2025? Along with the rise of hydropower and solar, coal plant outages provide another explanation. During the first quarter of 2025 (1Q2025), eight coal plants with a combined capacity of 1.4GW were offline for more than 30 days.

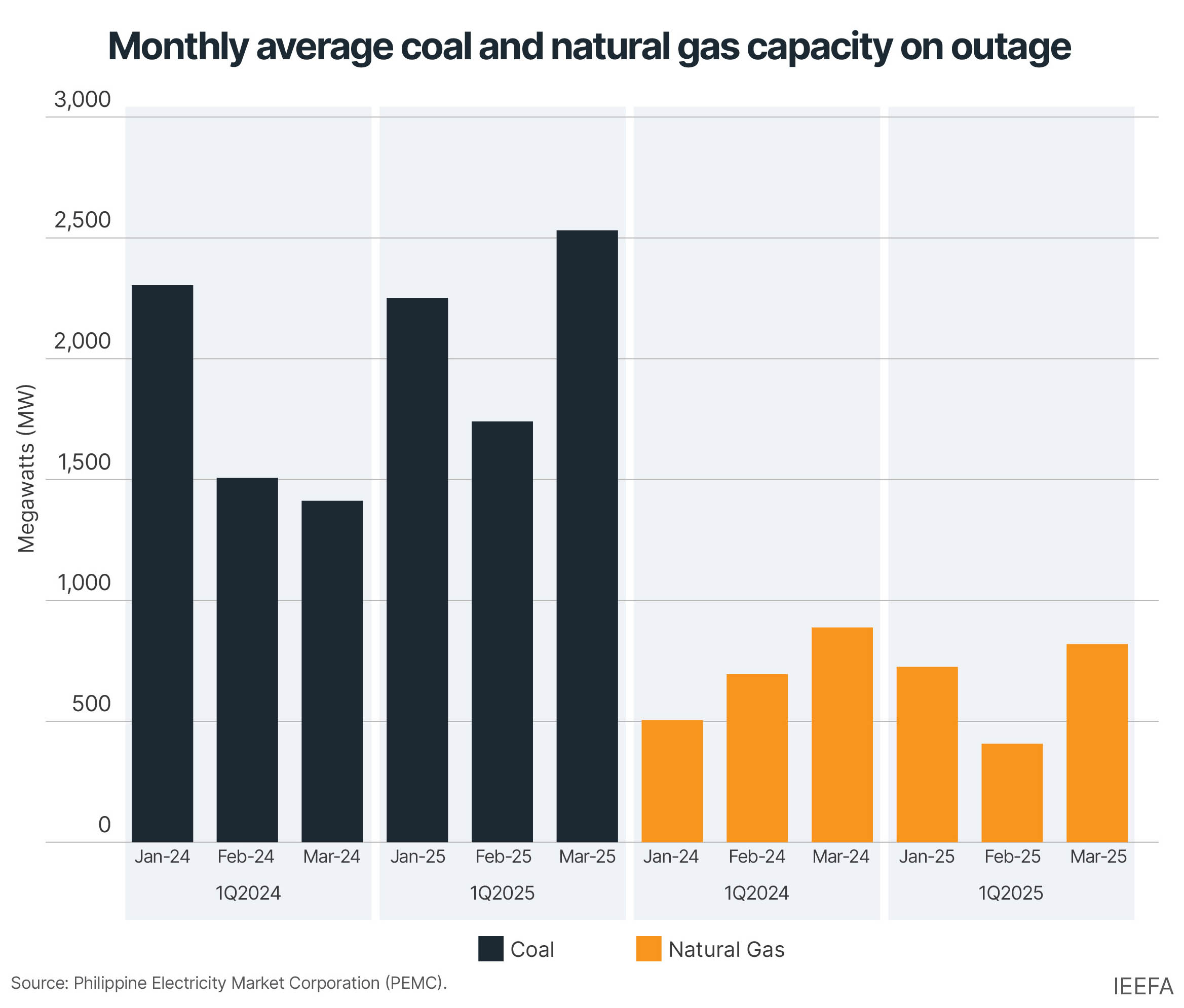

Outages at fossil fuel generators in the Philippines occur every year — mainly during hot, dry months — but the average coal plant capacity on outage in 1Q2025 was markedly higher than the same period last year. By contrast, natural gas capacity on outage was slightly lower in the first quarter.

Cost is key to the Philippines’ energy future

Some commentators attribute the drop in coal to falling LNG prices this year, arguing that LNG has become more cost-competitive. However, LNG prices in Asia remain above historical averages. Recent coal prices are nearly four times cheaper than LNG on an energy equivalent basis.

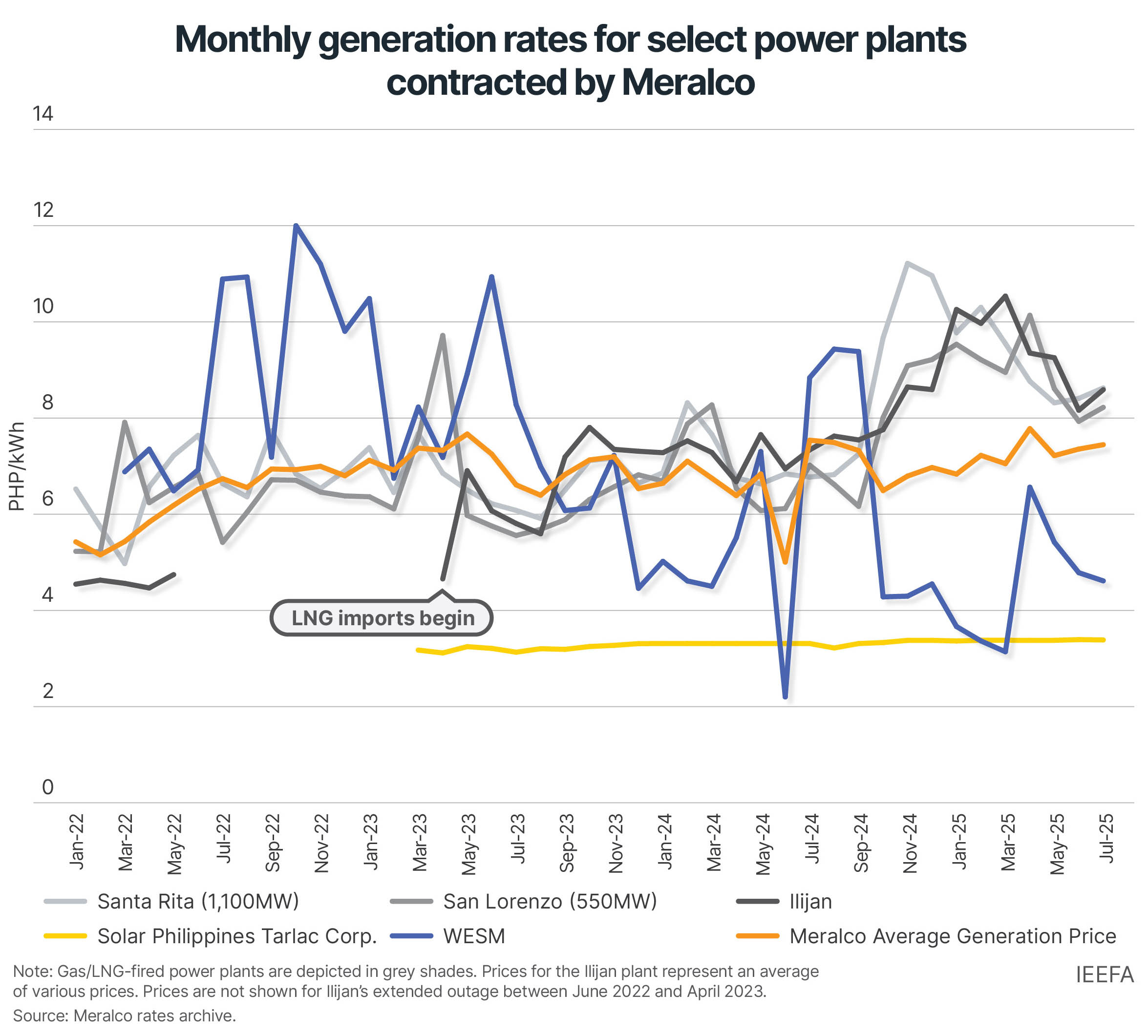

Higher LNG fuel costs are reflected in the generation rates of various power plants in the Philippines. Based on data from Meralco, the country’s largest distribution utility, LNG imports have put upward pressure on generation prices from gas-fired power plants, which have recently risen to between PHP8-11 per kilowatt-hour (kWh).

These prices are significantly higher than solar and coal generation rates, as well as purchases from the Wholesale Electricity Spot Market (WESM). They are also above Meralco’s overall average purchase price, meaning that LNG is keeping electricity prices high for Filipino consumers.

Notably, the Independent Electricity Market Operator of the Philippines (IEMOP) recently attributed falling WESM prices to the country’s rapid renewables growth and transmission infrastructure investments. A recent analysis by Bloomberg New Energy Finance (BNEF) also shows that solar is now the cheapest source of electricity in the Philippines, with levelized costs from USD35-72 per megawatt-hour (MWh), while solar-plus-storage systems are quickly becoming cost-competitive with new thermal plants.

In conclusion, it should be no surprise that the global oil and gas industry will continue to promote LNG in Asia while downplaying the role of clean energy. However, arguments that LNG is replacing coal fail to stand up to scrutiny when considering the growth of renewables, coal plant outages, and long-term cost trends in the Philippines’ energy market.