Australian investors urged to tackle fossil fuel companies’ methane time bomb

Key Takeaways:

Investors have an opportunity to incentivise more rapid action on methane – a potent greenhouse gas and a major contributor to fossil fuel companies' Scope 1 emissions – by incorporating methane reporting and abatement into their engagement with companies.

Leading companies in Australia's oil & gas and coal mining sectors are not taking sufficient action to reduce methane emissions, while planning substantial expansions of production that would outweigh any existing abatement action, and relying instead on buying carbon credits to meet their climate-related targets.

By not implementing structural methane abatement measures, companies will rely on purchasing carbon offsets, increasing their risk exposure in the event of a rising Australian carbon price.

Methane abatement can be undertaken with mature technologies at relatively low cost, and offers potential financial benefits for companies through the use and sale of captured gas.

28 March 2025 (IEEFA Australia): Investors in Australia have the opportunity to encourage faster reductions in greenhouse gas emissions by pushing for improved methane reporting and abatement efforts from fossil fuel companies.

Methane is a potent greenhouse gas that increases the climate-related risks facing companies in these sectors. A major new report from the Institute for Energy Economics and Financial Analysis (IEEFA) reveals that leading companies in Australia’s oil & gas and coal mining sectors are lagging on taking action to reduce the amounts of methane emitted as part of their operations. Meanwhile, the same companies are planning substantial expansions of production that will increase their methane emissions.

Anne-Louise Knight, Lead Analyst, Australian Coal at IEEFA and co-author of the report, says: “By not implementing methane abatement measures, companies risk missing their own emissions reduction targets or breaching regulatory requirements. Companies will also be forced to rely on purchasing carbon offsets, increasing their risk exposure in the event of a rising Australian carbon price.

“In the coal sector, strategies to increase metallurgical coal mine production could carry additional risks given that Australian metallurgical coal is 40% more methane-intensive on average than thermal coal.”

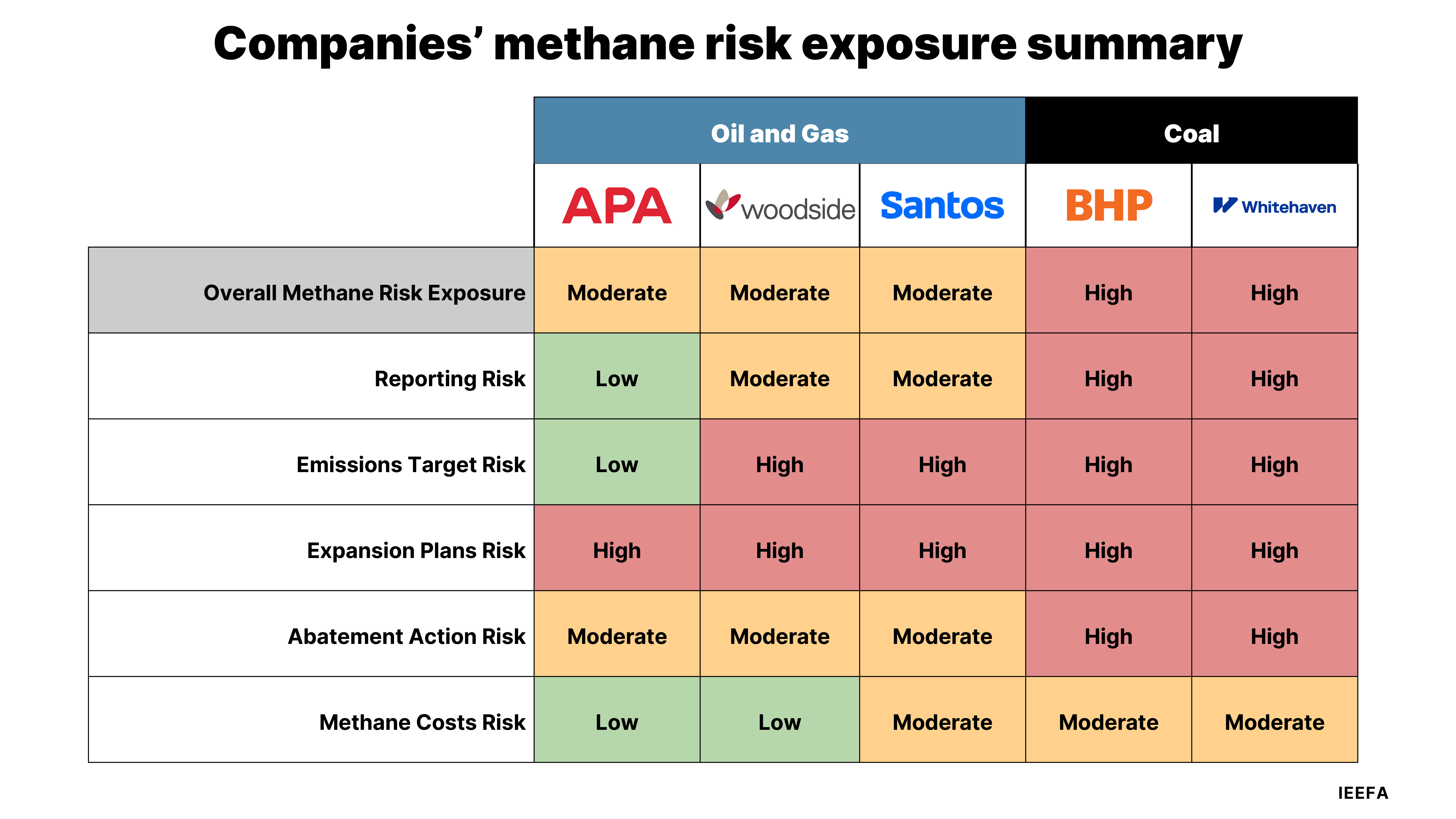

IEEFA’s report, Methane – A ticking time bomb for Australian investors, examined the records of five companies: Woodside, Santos and APA Group in oil & gas; and BHP and Whitehaven, two of Australia’s largest coal mining companies. It identified a significant risk that their self-reported methane emissions are underestimated due to their reliance on flawed estimation methods.

Moreover, all five of the companies assessed have taken minimal action on methane abatement to date. IEEFA found that they had committed zero or limited capital allocation or targets specifically to address methane emissions.

To compound these problems, all five companies have significant plans to extend or increase production. Even among those companies that have taken limited abatement actions, their scale is outweighed by the scale of planned production growth and expansions.

Joshua Runciman, Lead Analyst, Australian Gas and report co-author of the report, says: “Australia’s fossil fuel industries face the risk of dwindling social licence due to their continued methane emissions and their prioritisation of growth over abatement. This could have a material impact on future operations.

“For the oil & gas industry in particular, methane emissions and the increasing awareness of potential underreporting undercut the industry’s narrative that gas is cleaner than coal, and is therefore a crucial transition fuel.”

However, the report notes that abatement action is possible and could even be financially beneficial for companies. Methane abatement technology is technologically mature, and could be undertaken at relatively low costs. IEEFA found that abatement in coal mining could be rolled out at an average cost of AU$1 per tonne of coal. For oil & gas companies, methane abatement could be done at an overall net financial benefit due to the options to use or sell the methane gas captured. This would also help to increase gas supply in Australia, putting downward pressure on prices and ensuring gas is available for Australian industry that does not currently have financially viable alternatives.

Overall, the simplest strategy for these companies to decrease methane emissions would be to decrease coal and gas production in line with their climate- and sustainability-related targets. This would have the additional benefit of minimising their exposure to the long-term decline in global demand for Australian coal and liquefied natural gas (LNG).

Knight adds: “Methane’s short atmospheric life and stronger global warming potential than carbon dioxide mean methane abatement can provide benefits relatively quickly. There is a real opportunity for investors to incentivise more rapid action on methane emissions by incorporating methane reporting and abatement into their engagement with fossil fuel companies.”

Read the analysis: Methane – A ticking time bomb for Australian investors

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Anne-Louise Knight, [email protected]; Joshua Runciman, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)