Glut – The four-letter word that has producers doubting their futures

Key Findings

There is a mismatch between abundant oil and gas supplies and weak demand.

The gap between supply and demand has soared from 60,000 barrels per day to almost 1.3 million barrels.

Surveys find that oil prices are expected to fall at least 10% over the next year, dropping into the low $60 range.

Given the current environment, the energy sector will continue to produce underwhelming returns through 2026.

The global oil industry has a serious problem: there’s simply too much oil and not enough demand. Today’s prices are too low for the oil and gas industry to thrive and are projected to fall even further. A fundamental mismatch between abundant supply and weak demand has created a weak outlook that has dampened the private sector’s enthusiasm for oil and gas companies.

Background

The downward trend in oil prices for both Brent and West Texas Intermediate (WTI) Crude began in 2022, after peaking at more than $100 per barrel due to speculative concerns that the world would be undersupplied because of Russia’s invasion of Ukraine. But that “war impact” has evaporated, and global crude supplies have continued to grow. So, despite posturing by the executive branch and a record-setting year for hydrocarbon production, industry executives and observers are dour about a future in which weaker oil prices could be the norm.

Oil prices have made a round trip back to 2021 levels, with year-to-date prices now averaging $72 per barrel for Brent and $68 per barrel for WTI—mirroring 2021 prices. More importantly, the prognosis of weaker oil prices over the remainder of this year and next appears to have domestic oil producers pumping the brakes on drilling new wells, signaling a potential slump in U.S. oil output next year.

Supply and Demand Fundamentals

Oil prices tend to reflect the balance of supply and demand. If there’s more supply than demand, prices fall; if demand outpaces supply, prices rise. Currently, swelling supplies and weak demand have sent prices downward, forcing producers to cut back on drilling. U.S. crude oil production reached record levels in 2025, with April’s daily production approaching almost 13.5 million barrels per day (Mbpd). More broadly, the gap between global supply and demand has expanded from 60,000 barrels per day in the second quarter of 2024 to almost 1.3 Mbpd in 2Q 2025, according to the U.S. Energy Information Administration (EIA) Short-Term Energy Outlook (STEO). Against this backdrop of oversupply, OPEC+ has pledged to boost oil output by another 1.0 Mbpd over the coming months, which comes on top of 1.2 Mbpd earlier in the year.

Observations by Industry Participants

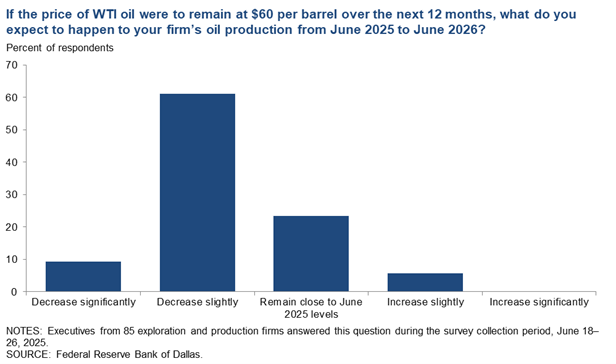

The Dallas Federal Reserve Bank’s Quarterly Energy Survey (July 2025) revealed an industry beset by multiple challenges: abundant global oil supplies, falling oil prices, rising costs for equipment and services, economic and geopolitical uncertainty, tariffs and supply chain concerns, and market volatility. The overall negative tone conveyed in the survey’s Business Activity Index, which turned negative in 2Q 2025, suggests a contraction in oil & gas activity; 70 percent of oil producing respondents anticipated their oil production would wane over the next year if oil prices remained at $60 per barrel levels (Figure 1).

Figure 1: Federal Reserve Bank of Dallas - Special Survey Question

Of the many comments provided by E&P firms responding to the Dallas Fed’s Energy Survey, one statement was particularly blunt:

“The Liberation Day chaos and tariff antics have harmed the domestic energy industry. Drill, baby, drill will not happen with this level of volatility. Companies will continue to lay down rigs and frack spreads.” (Emphasis added)

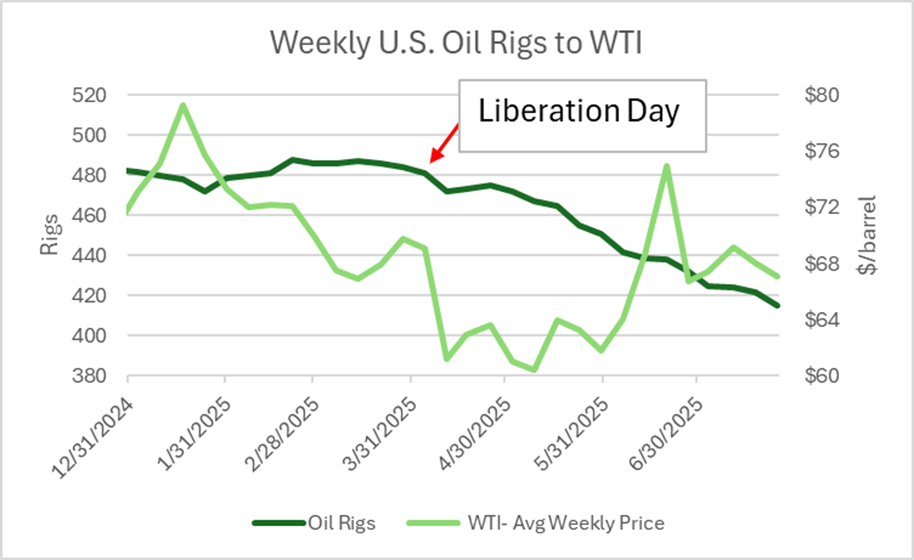

This provocative assessment of current conditions coincides with recent declines in the domestic oil rig count, as shown in Figure 2.

Figure 2: U.S. Oil Rig Activity

Source: Baker Hughes, U.S. Energy Information Administration

The fall in the oil rig count from April to July represents a loss of 66 rigs, or a decline of 13.7% to 415 rigs. Half the rigs that dropped out of the count were previously operating in the Permian Basin. Over the same four-month period, weekly oil prices dropped 2.8% to $67 barrel. But from a weekly high in January to a weekly low in May, year-to-date weekly oil prices fell 23.8%, suggesting a lagged response to price deterioration. Regardless, both large and small oil producers are responding to lowered prices.

In a letter to shareholders near the beginning of summer, Travis Stice, chairman and previous CEO of Diamondback Energy, a large Permian Basin producer, noted that fracking crews in the basin were down roughly 20% since peaking in January 2025, and the U.S. oil rig count was anticipated to continue its decline in the third quarter of this year. He also said, “ … it is likely that U.S. onshore oil production has peaked and will begin to decline this quarter [2Q 2025].”

Outlook for Oil Prices

As of Aug. 5, 2025, the next-12-month strip (the average price of the next 12 monthly contracts for crude futures), settled at $62.86. Given that oil prices have averaged $69.66 over the last 12 months, market conditions are currently holding a downside bias with a 10% drop in prices anticipated.

Consensus among Wall Street investment banks, as recently reported by the Wall Street Journal, holds a view that is more pessimistic than futures prices. WTI is forecasted by the Journal’s survey to fall to $61.11 per barrel in the fourth quarter, about $2.50 per barrel or 4% below the average of October, November and December futures contracts that were $63.58 per barrel settlement (Aug. 5, 2025). In the upcoming first quarter of 2026, the Journal’s survey pegged prices at $60.60 per barrel, or 3% below the $62.56 per barrel average for January, February, and March futures contracts.

Interestingly, the EIA’s most recent STEO (July 2025) raised its annual Brent crude oil price outlook by $3 to $69 per barrel for 2025, while lowering its 2026 projection by $1 to $58 per barrel. Their projections were influenced more by risk premium expectation in 2025 due to geopolitical tensions. In 2026, their revisions were lower in response to anticipated higher available oil supplies globally.

Circling back to the Dallas Fed’s Energy Survey, those executives were anticipating WTI oil price at year-end of $68 per barrel.

Both the Energy Survey and the STEO were conducted before OPEC+ signaled its members would raise production levels sooner than previously indicated. The responses to the Wall Street Journal survey therefore are more recent projections than the EIA or Dallas Fed’s survey.

Implications for future investments

Previous Energy Surveys conducted by the Dallas Federal Reserve Bank found that oil and gas executives planned their 2025 capital budgets using $68 per barrel oil assumptions. Considering oil prices ended calendar 2024 at around $70 per barrel, the operators appeared to plan activity with a mindset that oil prices would remain steady. But over much of the year, oil prices have weakened—and since April have averaged $65 per barrel. We also note that at the beginning of the year, the average price for drilling a new well profitably was $65 per barrel, according to the first quarter Energy Survey.

Market conditions deteriorating further would compel oil and gas operators to reconsider their investments in future drilling activities. Publicly traded stocks in the energy sector have severely underperformed the broader markets, with an absolute return of 8% compared to 185% growth in the S&P 500 over the last decade.

The recent trends in oil prices and rig counts send a distinct message that all is not well within the oil patch. If Wall Street’s view on declining prices is remotely accurate, the energy sector will continue to produce underwhelming returns through 2026, and beyond.