Key Findings

In India’s power sector, which accounts for 70% of coal consumption, natural gas has fallen to less than 2% of the generation mix due to high LNG costs and limited supplies of cheaper domestic gas.

Rather than adopting LNG as a “bridge fuel” in the power sector, India does not plan to build new gas-fired power capacity through 2032 and is instead leapfrogging to cheaper forms of renewable energy.

Despite efforts to expand the gas network, demand growth barriers may exacerbate the ongoing underutilization of gas-fired power plants, pipelines and LNG import terminals. Any upcoming gas infrastructure risks becoming a stranded asset.

Natural gas demand in India is more likely to grow in sectors that do not consume significant amounts of coal, such as city gas, transportation, fertilizers, and others. But the suitability of LNG to meet this demand will depend on pricing, infrastructure, and the competitiveness of alternative fuels.

Executive Summary

Liquefied natural gas (LNG) producers and policymakers in gas exporting countries often claim that LNG can replace coal use in India, the world’s second-largest coal-consuming country. They argue that more LNG exports are necessary to help the country reduce coal demand and meet national emissions reduction targets. In a recent example, Australia’s Woodside Energy Group stated that exports from its newly approved Louisiana LNG liquefaction facility in the United States would contribute to coal-to-gas switching in India.

Although the government has set ambitious targets to increase gas consumption and expand the gas infrastructure network, this report finds that claims about the role of LNG in displacing coal in India are largely unsubstantiated for several reasons:

- India’s LNG import growth pales compared to its coal demand. Despite government targets to increase the share of natural gas in the national energy mix to 15% by 2030, its share has fallen from 10% in FY2013 to 7% in FY2024.

Roughly 70% of India’s overall coal demand is in the power sector. However, rather than displacing coal-fired electricity, natural gas generation has been effectively squeezed out of India’s power mix over the past decade due to high LNG costs and limited supplies of cheaper domestically produced gas. The generation share of natural gas has fallen from nearly 13% in FY2010 to less than 2% in FY2025. In FY2025, 31 gas-fired power plants — with a combined capacity of nearly 8 gigawatts (GW) and representing 32% of the country’s total gas power capacity — did not generate any electricity at all, rendering them stranded assets. In April 2025, 5.3GW of this 8GW was retired due to inoperability, leaving 20.1GW of remaining gas-fired power capacity. Moreover, India does not plan to build any through at least 2032. Since FY2016, gas demand in India’s power sector has fallen substantially.

While the share of natural gas in electricity generation has declined consistently over the last decade, the share of wind and solar in the mix has quadrupled from 3% in FY2016 to 12% in FY2025, with plans to reach 596GW of installed capacity by 2032. Meanwhile, the utilization of India’s gas-fired power fleet has dropped since 2019 and was 14.47% in FY2025, falling below 10% in the winter months from November 2024 to March 2025. While gas generators are used to meet peak demand in the short term, the country is rapidly turning to other sources for grid flexibility, including coal flexibilization, energy storage, and demand-side management.

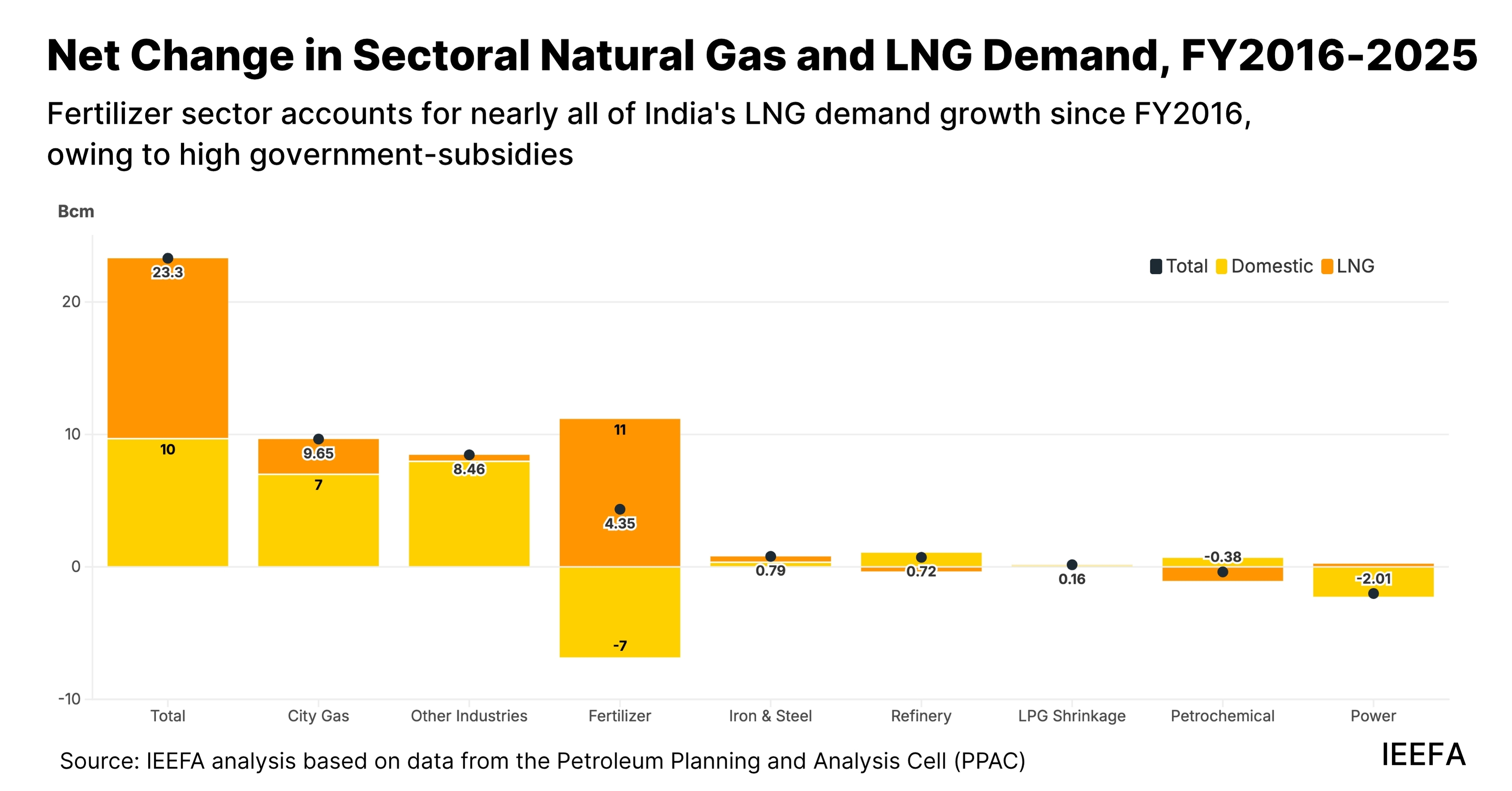

Since FY2016, India’s LNG demand growth has come almost entirely from the fertilizer sector due to high government subsidies that shield fertilizer end-users from volatile fuel and production costs. However, the fertilizer sector historically does not consume large amounts of coal, so there is limited potential for coal displacement. Meanwhile, gas demand for fertilizer production is not expected to grow significantly by 2030 due to the small pipeline of proposed gas-based urea capacity and government efforts to contain chemical fertilizer demand growth.

- After power generation, iron and steelmaking is India’s second largest individual coal-consuming sector. Since FY2016, however, natural gas demand in this sector has increased by just 0.63 billion cubic meters (bcm), 0.55bcm of which has come from domestically produced gas, not LNG. Although India is the largest producer of direct reduced iron (DRI) in the world — a process which typically uses natural gas — 80% of the country’s DRI fleet uses coal-based rotary kilns due to relatively cheaper fuel. Looking ahead, proposed iron and steel capacity is dominated by coal-based processes rather than natural gas or LNG.

Besides power and steel production, Indian government data identifies a broad “miscellaneous” category as a major coal consumer. This category includes the ceramic, glass, metal, and pharmaceutical sectors, as well as other small industries. This sector accounts for a large share of coal and natural gas demand. While there may be room for coal-to-gas switching among smaller industries, especially as the country expands its national gas grid, the suitability of LNG will depend on pricing, infrastructure, and the competitiveness of alternative fuels. Over the past decade, LNG demand in these sectors has remained marginal compared to demand growth for cheaper domestic gas.

While the evidence demonstrates that LNG is not displacing coal use in India’s largest coal-consuming sectors, most forecasts expect natural gas demand to grow rapidly in sectors that do not consume significant amounts of coal, such as city gas, transportation, fertilizers, and others.

This report also examines gas demand growth in these sectors. To date, nearly all gas demand growth (excluding fertilizer production) has come from domestically produced gas rather than LNG. In fact, LNG demand has fallen over the last decade in several energy-intensive sectors, including power, petrochemicals, and refineries. Based on historical trends, the Institute for Energy Economics and Financial Analysis (IEEFA) expects that LNG demand growth will continue to face challenges related to the price sensitivities of end-users, competition with other energy alternatives, and efforts to contain high public subsidy burdens.

Bullish forecasts about India’s LNG demand often imply that (a) LNG will compensate for any shortfalls in domestic gas production, and (b) infrastructure expansion necessarily means demand will grow. While these may be true to some extent, end-users in India have repeatedly demonstrated a tendency to reduce gas demand altogether and switch to more affordable alternatives when prices rise, leading to an underutilization of existing infrastructure. India’s gas-fired power plants, LNG import terminals, and natural gas transmission networks struggle with low utilization rates.

For example, out of the country’s seven LNG import terminals operating in FY2025, six operated at utilization rates below 50% due partly to price sensitivities, lack of demand, and site-specific operational challenges. This has led to financial losses for public sector oil and gas companies. Meanwhile, the country’s existing natural gas pipeline network operates at very low rates. Based on available data, IEEFA estimates that the capacity-weighted average utilization rate of India’s major gas pipelines is 41%, with some major pipelines operating at less than 10%, leading to losses for pipeline operators. In other words, consumers opt for cheaper alternatives even when LNG is available.

In short, IEEFA’s analysis indicates that LNG is not serving as a “bridge fuel” from coal to clean energy in India. In June 2024, a similar study of China, the world’s largest coal-consuming country, found that global oil and gas industry claims about the potential of LNG to displace coal usage were overstated. These analyses demonstrate that LNG has yet to play a significant role in supporting the transition to clean energy in the world’s two largest coal-consuming economies.