LNG unlikely to displace coal in India’s largest coal-consuming sectors

LNG demand growth continues to face challenges related to end-user price sensitivities, competition from cheaper alternatives and a high public subsidy burden.

Key Takeaways:

In India’s power sector, which accounts for 70% of coal consumption, natural gas has fallen to less than 2% of the generation mix due to high LNG costs and limited supplies of cheaper domestic gas.

Rather than adopting LNG as a “bridge fuel” in the power sector, India does not plan to build new gas-fired power capacity through 2032 and is instead leapfrogging to cheaper forms of renewable energy.

Despite efforts to expand the gas network, demand growth barriers may exacerbate the ongoing underutilization of gas-fired power plants, pipelines and LNG import terminals. Any upcoming gas infrastructure risks becoming a stranded asset.

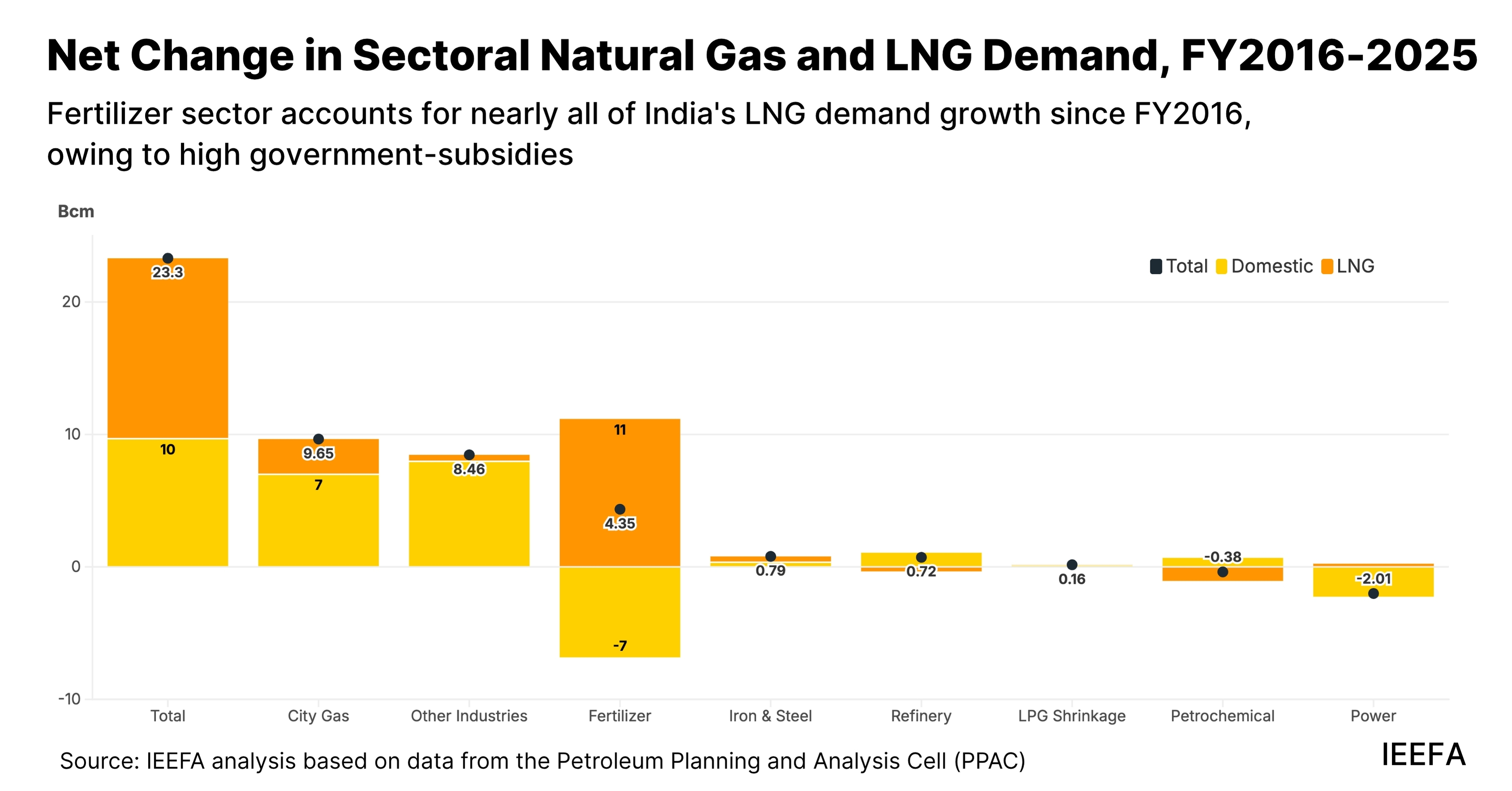

Natural gas demand in India is more likely to grow in sectors that do not consume significant amounts of coal, such as city gas, transportation, fertilizers, and others. But the suitability of LNG to meet this demand will depend on pricing, infrastructure, and the competitiveness of alternative fuels.

10 June (IEEFA South Asia): A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) finds little evidence that liquefied natural gas (LNG) is displacing coal in India’s largest coal-consuming sectors. This is despite frequent claims from the global oil and gas industry that LNG serves as a transition fuel from coal to clean energy.

In the power sector, which accounts for 70% of India’s coal demand, gas and LNG have been squeezed out of the generation mix due to high costs and their inability to compete with cheaper resources like renewables and coal. The share of gas-fired power in India’s electricity mix has fallen to less than 2% in FY2025, from 13% in FY2010.

This is due to limited supplies of domestic gas, along with uncompetitive prices for imported LNG. For instance, average LNG prices in FY2024 were roughly nine times the cost of domestically produced coal and more than twice that of coal imported from Indonesia, India’s largest coal supplier.

“As gas-fired power generation has floundered, renewables now account for 12% of the country’s generation mix, four times more than a decade earlier,” says Sam Reynolds, co-author of the report and IEEFA Asia’s LNG/Gas Research Lead.

“While gas plants currently provide peaking power during periods of high demand, that role may be usurped by rapid growth in battery storage deployments through 2030,” says report co-author Purva Jain, Energy Specialist, Gas and International Advocacy.

The report highlights that in FY2025, 31 gas-fired power plants — with a combined capacity of nearly 8 gigawatts (GW) and representing 32% of the country’s total gas power capacity — did not generate any electricity, rendering them stranded assets. In April 2025, 5.3GW of this 8GW was retired due to inoperability.

Iron and steelmaking is India’s second-largest individual coal-consuming sector. Since FY2016, natural gas demand in this sector has increased only marginally by 0.63 billion cubic meters (bcm), 0.55bcm of which has come from domestically produced gas rather than LNG.

Although the country is the largest producer of direct reduced iron (DRI) in the world — a process which typically uses natural gas — 80% of the country’s DRI fleet uses coal-based rotary kilns due to relatively cheaper fuel.

There may be room for coal-to-gas switching among smaller industries, especially as the country expands its national gas grid. The suitability of LNG will depend on pricing, infrastructure, and the competitiveness of alternative fuels.

Rather than displacing coal, natural gas demand in India is more likely to grow in sectors that do not consume significant amounts of coal, such as city gas, transportation, fertilizers, and others. “However, demand growth in these sectors is also likely to face barriers related to the high costs and volatility of imported LNG, end-user price sensitivities, and the emergence of cheaper, cleaner alternatives” Reynolds notes.

For example, the fertilizer sector has accounted for almost all of India’s LNG demand growth since FY2016, due to high government subsidies that shield end-users from volatile fuel and production costs. “In sectors that do not receive large public subsidies or government support, LNG demand growth remains to be seen,” says Jain.

“In many energy-intensive sectors, like petrochemical production and refineries, demand for gas and LNG have not increased over the past decade,” Jain highlights. Similarly, increasing gas consumption in the transport sector faces several barriers, including stiff competition from electric vehicles.

IEEFA’s analysis indicates that India’s gas-fired power plants, LNG import terminals and natural gas transmission networks struggle with low utilization rates. Rising dependence on expensive LNG could mean that end-users switch to more affordable alternatives.

Bullish forecasts for India’s LNG demand growth will require a substantial change from trends observed over the past decade. Rather than using LNG when cheaper domestic gas is unavailable, consumers may opt for cheaper alternatives, leading to low utilization of additional gas infrastructure and exacerbating stranded asset risk.

Read the report:Can LNG displace coal demand in India?

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Sam Reynolds ([email protected]), Purva Jain ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)