Actions to unlock adaptation financing can shield Southeast Asia from climate shocks

Strengthening national plans and taxonomies, enhancing project preparation and implementation, leveraging financial instruments, and incorporating forward-looking benefits can help address chronic underinvestment in adaptation

February 9, 2026 (IEEFA Asia): Asia remains disproportionately vulnerable to climate shocks, but adaptation finance remains a challenging and underfunded area. A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) highlights challenges in adaptation projects, identifies key barriers in Southeast Asia, and recommends opportunities to address the gap.

Direct economic losses from climate-related events in Asia averaged USD75.7 billion annually between 2000 and 2023, accounting for about 40% of global losses over the same period. However, in 2023, global adaptation finance amounted to just USD65 billion (4% of total climate finance flows of USD1.9 trillion) and was even lower in Asia. Between 2018 and 2019, Southeast Asia received USD27.8 billion in total climate finance, with adaptation accounting for only 12%.

“Closing the adaptation financing gap requires treating it as a core national development and economic priority, integrated into long-term planning, budgeting, and policy frameworks. Investors should move beyond seeing it solely as a cost and incorporate forward-looking resilience risks and benefits into financial appraisal, investment strategies, and project evaluations,” says report co-author Ramnath N. Iyer, IEEFA's Sustainable Finance Lead, Asia.

“Apart from robust, detailed national adaptation plans and dedicated budgets, strong institutional capacity is also needed that understands adaptation policies and accelerates the identification and implementation of credible projects,” says co-author Shu Xuan Tan, IEEFA's Sustainable Finance Analyst, Asia.

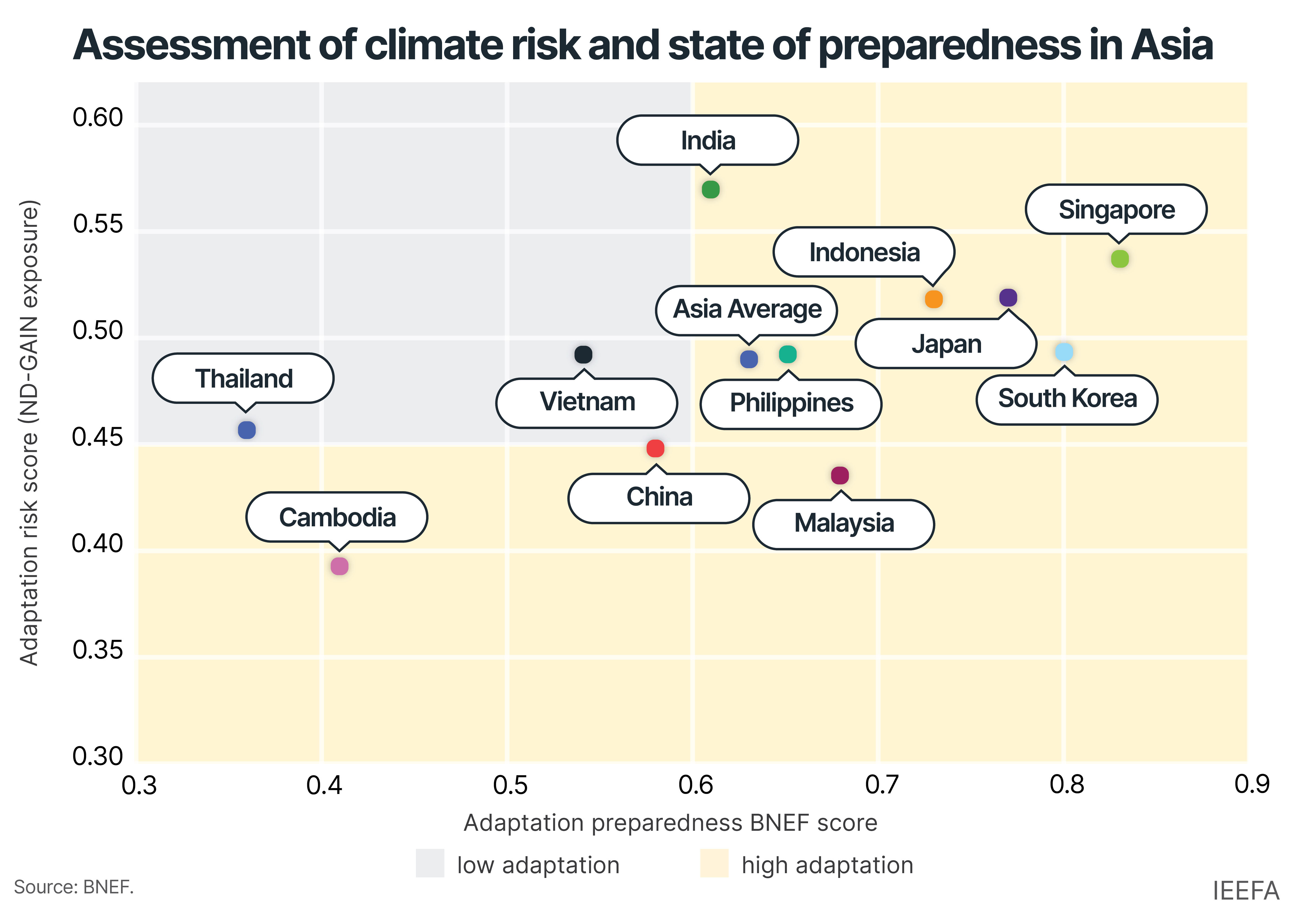

“Currently, adaptation risks and adaptation preparedness vary widely across Asia. Adaptation projects struggle with a low disbursement ratio of 66%, compared with 98% for overall development finance, and project approvals are often low due to insufficient data, unclear baselines, or poorly articulated change theories.”

Think globally, act locally

According to the report, adaptation projects typically rely on grants and concessional financing, which fall far short of needs. Efforts should focus on mobilizing private investors to unlock greater financing flows.

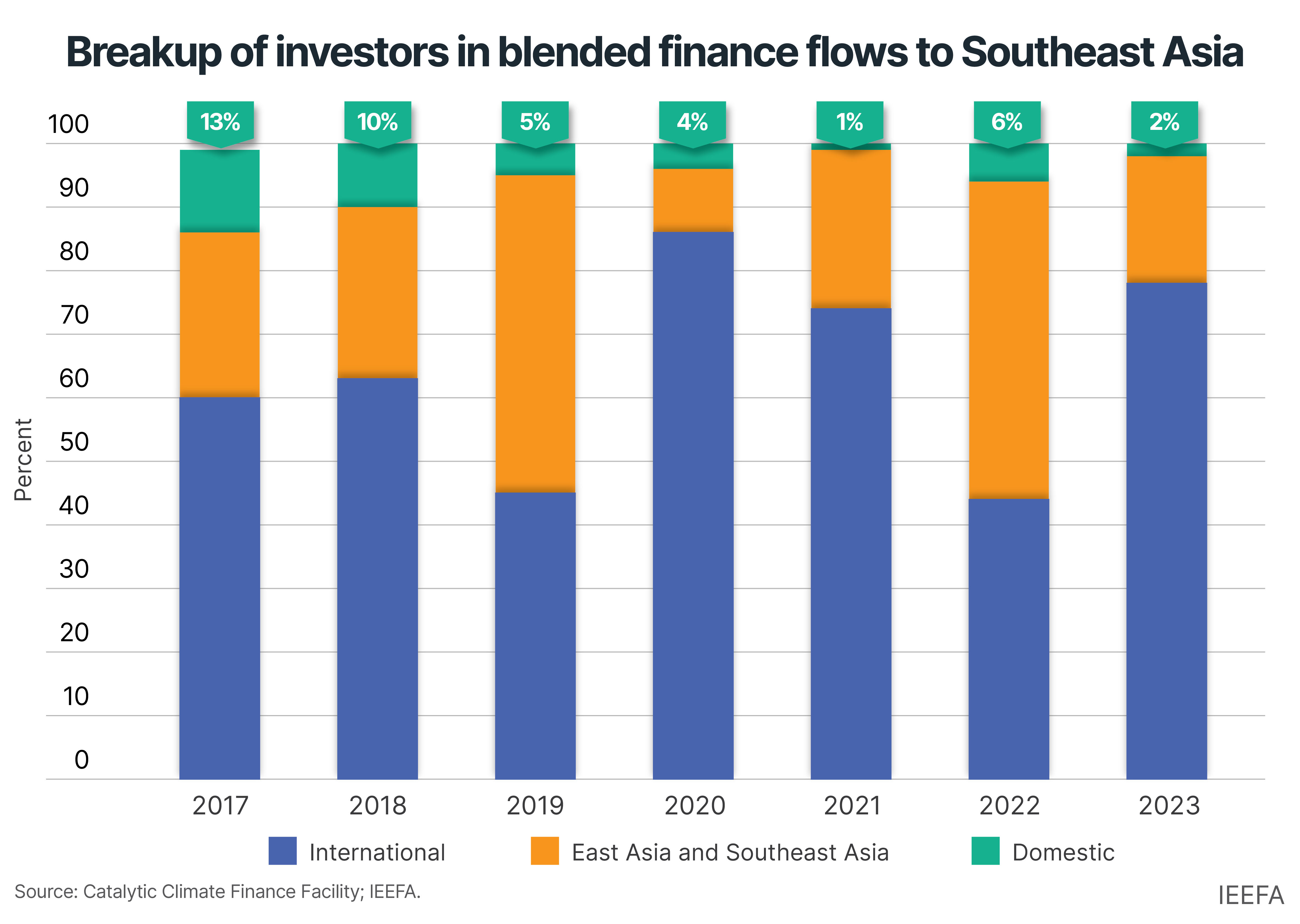

Developed nations have pledged to increase adaptation finance for developing countries to USD40 billion by 2025 and to triple it to USD120 billion by 2035. However, given shifting global priorities and the decline in international development aid, domestic sources will need to play a bigger role.

Between 2018 and 2023, international and regional investors accounted for 66% and 28% of blended climate finance commitments in Southeast Asia, respectively, while domestic sources contributed just 6%.

There is a dominant perception that adaptation benefits are “hard to measure”, despite growing evidence that adaptation investments deliver substantial economic and social returns by avoiding losses, enhancing economic activity, and generating broader environmental and social advantages. This lack of understanding highlights the urgent need to accelerate the development of practical, interoperable adaptation criteria and outcome indicators.

“Sustainable finance taxonomies that account for and credit measures related to adaptation can play a crucial role,” says Tan.

Adaptation is recognized as an environmental objective in most Asian taxonomies, except in China and Vietnam. However, the classification criteria for adaptation are either not fully defined or are presented mainly through qualitative descriptions, lacking the detailed technical screening criteria and thresholds typically applied to mitigation activities.

“The Association of Southeast Asian Nations (ASEAN) taxonomy is currently being updated to reflect these gaps and, if designed comprehensively, it can reduce fragmentation, clarify and ease the flow of finance into adaptation projects in the region, while serving as an example for other regional taxonomies.”

Reorienting financial instruments for adaptation

The report authors highlight a strong case for reorienting financial instruments to directly target adaptation and resilience outcomes, rather than treating them as secondary components within climate portfolios.

“Concessional windows, guarantees, and first-loss tranches should be calibrated to the risk and revenue characteristics of adaptation projects, with dedicated provision for grant-funded technical assistance, safeguards, and monitoring,” suggests Iyer.

“Even modest allocations can substantially improve climate impact and financial performance. Development banks and finance institutions can play a pivotal role by structuring facilities that bundle smaller, localized adaptation measures into larger portfolios aligned with national priorities and crowd in commercial lenders,” adds Tan.

Emerging instruments such as adaptation and resilience bonds also demonstrate the strategic use of capital markets to scale up adaptation needs.

From 2015 to 2024, climate change adaptation received only around 6–10% of total proceeds across both corporate and sovereign issuances, indicating significant untapped potential. A notable example is the Tokyo Resilience Bond, the first bond to be certified under the Climate Bonds Standard. With a size of EUR300 million, it was oversubscribed seven times, signaling strong investor demand and offering a replicable model for scaling adaptation finance in the region.

“Sovereigns can leverage internationally recognized standards to enhance credibility and attract a broader pool of global investors,” explains Iyer. “When combined with development bank credit enhancements or guarantees — particularly for countries with weaker sovereign ratings — such instruments can provide a practical pathway to attract private capital and finance priority climate resilience projects.”

For financially vulnerable countries, debt restructuring or debt exchange mechanisms linked to climate resilience commitments warrant deeper consideration.

“Debt-for-resilience swaps can help ease fiscal pressures, while creating dedicated funding streams for priority adaptation programs aligned with national plans,” says Tan.

Read the report: Scaling adaptation finance in Southeast Asia

Author contacts:

Shu Xuan Tan ([email protected])

Ramnath N. Iyer ([email protected])

Media contact: Josielyn Manuel ([email protected])