Mining’s diesel addiction a burning issue

Rising consumption undermines government’s emissions outlook

Key Takeaways:

Diesel use is emerging as one of the largest emissions sources in Australia’s resources sector, with fuel use growing faster than mining production as strip ratios increase.

Government projections of a rapid fall in mining energy emissions ignore recent trends and the long timelines required for fleet and fuel decarbonisation.

Limited progress is likely before 2035 due to companies deferring decarbonisation plans, weak policy drivers, the diesel fuel rebate and lengthy implementation timelines.

30 January 2026 (IEEFA Australia): Government forecasts that diesel emissions from Australian mining have peaked and will fall over the next decade ignore the reality on the ground, where fuel consumption is rising as miners chase diminishing returns, according to new research from the Institute for Energy Economics and Financial Analysis (IEEFA).

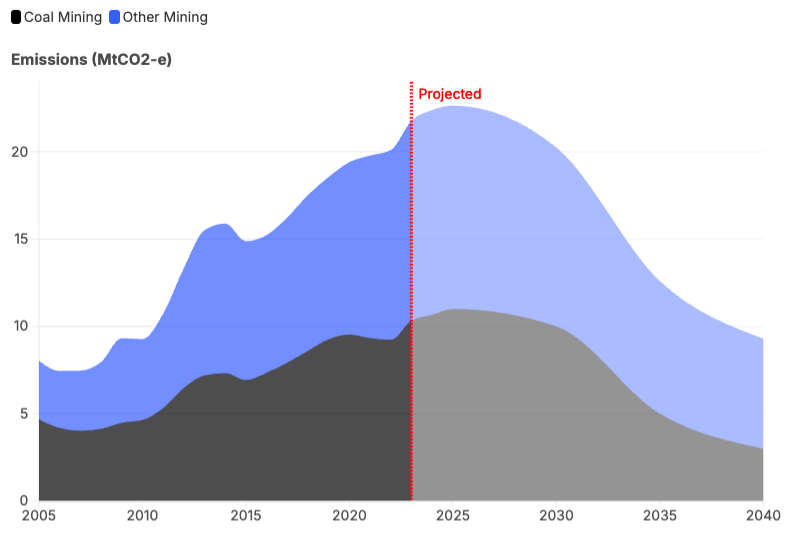

The federal government’s latest forecast projects diesel emissions from mining will fall a rate of 4.5% a year from a baseline of 21.7 million tonnes (Mt) in 2023 to 12.6Mt in 2035. However, in its new briefing note Cutting Australian mining’s diesel emissions, IEEFA finds that the industry’s actual diesel emissions are rising 6% a year.

The largest reductions are expected to come from coalmining due to decreased production and the impacts of the federal Safeguard Mechanism. However, a shift to more fuel-intensive open-cut coalmining and higher strip ratios are driving up diesel consumption, and in turn leading to increased emissions, says the author Andrew Gorringe, Energy Finance Analyst, Australian Coal, at IEEFA.

“Australia’s climate targets require deep emissions cuts across all sectors of the economy,” Mr Gorringe says. “For the resources sector to contribute, this means capturing more of the fugitive methane emissions from coal & gas production but also importantly achieving meaningful reductions in miners’ diesel fuel use – across all forms of mining.”

Mining consumes 9.6 billion litres of diesel a year, producing 22Mt of carbon dioxide equivalent (CO2e) emissions. Together, coal (48%) and iron ore mining (26%) account for three-quarters of the industry’s diesel emissions in Australia.

IEEFA has identified several factors that undermine the government’s emissions projections, especially for coal, such as:

- The shift towards more diesel-intensive open-cut coalmines, where higher strip ratios have increased diesel intensity by 50% since FY2010-11, a trend expected to continue. (Strip ratio is the amount of material mined per tonne of coal.)

- Regulations offer limited incentive for action, such as the Safeguard Mechanism’s emissions baselines for open-cut coalmines and the low cost of compliance.

- Decarbonisation projects have long implementation timelines – for example, due to lengthy approvals and construction delays.

- The diesel fuel tax rebate scheme, which provides an estimated A$5 billion to mining each year, including A$1.5 billion to coalmining, is a disincentive to invest in diesel alternatives.

- Major miners slashing spending and deferring decarbonisation plans to the 2030s.

- Other disincentives include: declining mine profitability; lengthy approvals; construction delays; and short/uncertain mine lifespans that could make fleet decarbonisation uneconomic.

Mining diesel emissions trend and projections

Sources: National Greenhouse Accounts; DCCEEW Australia’s Emissions Projections 2025; IEEFA. Note: Actuals to FY2023.

The government expects declining coal production to make a significant contribution to diesel emissions reduction.

“Historical data trends don’t bear this out,” Mr Gorringe says. “Diesel emissions in mining have doubled since 2011, while coal production grew by only 18%. Furthermore, the proportion of coal produced from open-cut mines operating heavy surface equipment grew by 30% in that period. Emissions per tonne increased by 50%.

“Considering the energy transition, diesel intensity in mining is increasingly moving in the opposite direction.”

IEEFA’s analysis shows that the diesel fuel tax rebate (52.6 cents per litre) effectively covers the purchase cost of mining companies’ off-road diesel vehicles and equipment over their lifespan. For example, one large mining haul truck costs almost $10 million, and BHP and Rio Tinto operate 1,500 such vehicles in Australia.

“If historical trends persist, diesel emissions could increase by 30% to 40% (8-10MtCO2e) by 2035, making sector emissions targets challenging to achieve,” Mr Gorringe says.

“Armed with strong policies, governments could position themselves as agents of change. Instead, inconsistent policies and incentives to retain diesel prevail.”

Read the note: Cutting Australian mining’s diesel emissions

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contacts: Andrew Gorringe, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute's mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)