Economic reality continues pushing coal offline

Key Takeaways:

The decision by three different owners to stop burning coal at a four-unit Arizona plant highlights the uncompetitive environment for the fuel.

The decision about the Springerville plant occurs as six units at four plants across the Mountain West stopped burning coal in 2025.

Continuing to burn coal faces long-term risks including rising fuel costs and higher maintenance costs as plants age.

Coal is no longer economically competitive—in Arizona or elsewhere.

The decision to stop burning coal at the four-unit Springerville, Ariz., coal plant—home to one of the newest units in the country—highlights the rising costs of coal-fired generation that has made it increasingly uncompetitive compared to renewables and gas. The latest briefing note from the Institute for Energy Economics and Financial Analysis (IEEFA) highlights the fact that coal is no longer economically competitive.

The Springerville coal plant has three different utility owners. All have reached the same conclusion: Continuing to burn coal at the plant is no longer an economic option. Tucson Electric Power, which owns two of the four units, underscored coal’s long-term problems in announcing its decision to convert its capacity to gas, noting that the current political environment does not erase coal’s supply and delivery risks, and that cleaner and cheaper alternatives are available.

“The high and uncompetitive cost of coal is not limited to Springerville,” said Dennis Wamsted, IEEFA energy analyst, and co-author of the briefing note. “Six units at four plants across the Mountain West stopped burning coal in 2025. Continuing to burn coal faces long-term risks including rising fuel costs and higher maintenance costs as plants age. Springerville and other coal plant operators should look at solar and battery storage to meet their power needs. Solar is already cheaper, has no fuel cost risks and, when paired with battery storage, is a dispatchable resource.”

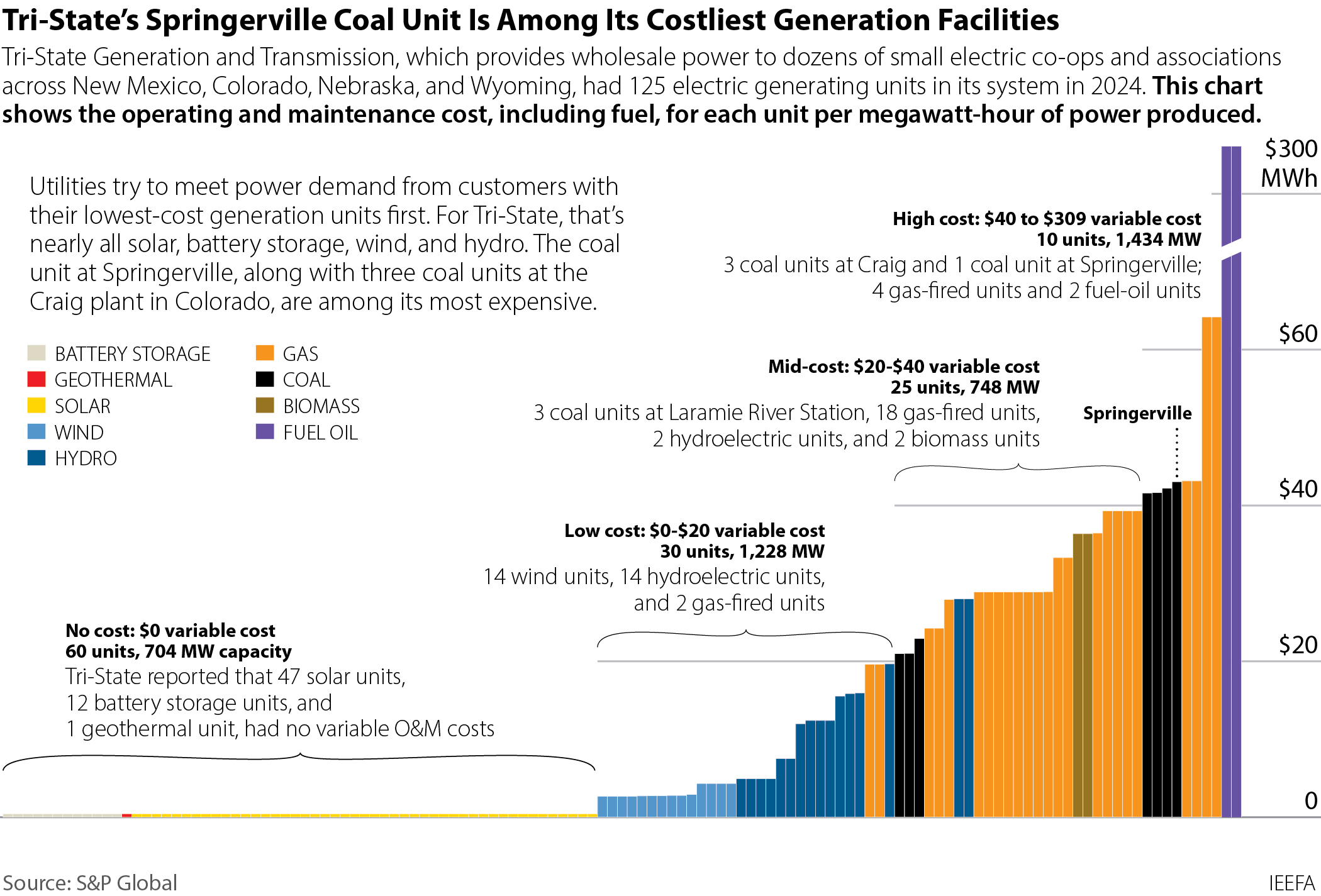

The problems facing all three owners are illustrated below in IEEFA’s calculation of the generation supply curve of the Tri-State Generation & Transmission Cooperative. Tri-State owns Unit 3 of the Springerville plant; the unit was its highest-cost coal resource in 2024. The curve moves from Tri-State’s least-cost resources on the left (hydro, solar and wind, which are always dispatched when available) to higher cost gas and coal resources toward the right.

The highest cost resources on the far right, the co-op’s peaker units, are only dispatched during the highest demand periods. Springerville Unit 3 is well to the right, meaning it is only economic to run when demand is relatively high. If the owners run their units less often, the fixed costs must be spread over fewer units of output, putting further upward pressure on the price of power.

The economic reality at Springerville is clear. Coal is no longer economically competitive—in Arizona or elsewhere.