IEEFA launches LNG export tracker focused on North America

Web page shows how the rapid growth of gas exports has strained North America’s gas system and created higher and more volatile gas prices

Key Takeaways:

The United States exports more liquefied natural gas (LNG) than any other country.

North American LNG export capacity will roughly double by 2030.

The rapid growth of gas exports has strained North America's gas system, creating higher and more volatile gas prices for homes and businesses.

LNG projects in both Canada and Mexico have experienced lengthy construction delays and rising costs.

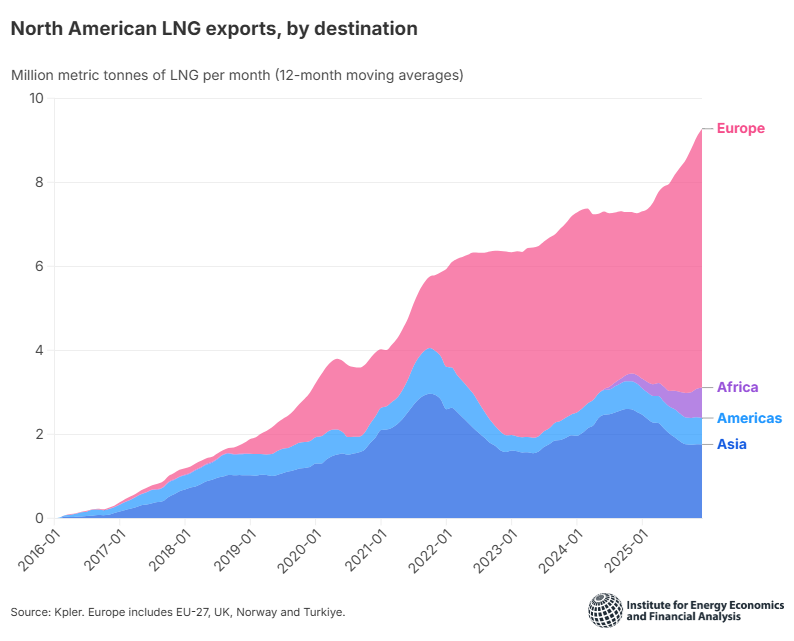

North America is now the leading global exporter of liquefied natural gas. As the continent exports more gas, it imports increasing price volatility as prices become more enmeshed in global market fluctuations. While this is good news for oil and gas companies and energy traders, it’s bad news for consumers who will face higher and less predictable energy bills. The just launched North American LNG Export Tracker from the Institute for Energy Economics and Financial Analysis (IEEFA) visually tells the story of the LNG boom across the continent, export destinations, and the impact on consumers.

The United States currently exports more LNG than any other country, and North American LNG export capacity is expected to roughly double by 2030. As the globe faces an already saturated LNG market, projects in Canada and Mexico have struggled to come online even as proponents taught their benefits.

“The United States’ prolific exporting of LNG has led to higher and more volatile gas prices for consumers,” said Clark Williams-Derry, IEEFA energy finance expert and main author of the page. “This is a global story, and the North America LNG Export Tracker tells one part of the story in a new way. Taken with our previous work in Europe, Asia, and Australia, the North America tracker visually brings a new piece of the globe into focus.”

The tracker shows the bulk of the continent’s LNG output last year was shipped to Europe. Since Russia’s invasion of Ukraine in 2022, European nations have turned to U.S. LNG to offset the loss of Russian gas shipments. Even though Asia is widely expected to be the source of most new global LNG demand, shipping LNG from the U.S. Gulf Coast to Asia faces rising challenges due to a lack of demand in the Asian market.

While the United States has increased exports, Canada and Mexico’s LNG industries have floundered. As displayed on the tracker’s maps, many proposed projects have been canceled, stalled, or delayed due to rising prices and a lack of buyers. By the time these projects get online, the global LNG markets could be saturated as the global mark gets closer to a glut.

To received updates on LNG, including the next version of the North America LNG tracker, sign up at the bottom of the page.