Puerto Rico government plans to contract for significantly more centralized generation than the island needs

Key Findings

On October 17, the P3 Authority and LUMA announced conflicting plans for the future of Puerto Rico’s energy grid.

The conflicts highlight the continued failure of sound energy planning in Puerto Rico—and the challenges that the island faces in meeting its 100% by 2050 renewable energy target.

The replacement of a comprehensive planning process by ad-hoc contracting is likely to facilitate a costly overbuild and is also likely to favor the natural gas industry in Puerto Rico.

Current plans to overbuild the generation system would all but guarantee that system costs will be higher for consumers and that Puerto Rico will not reach its 100% by 2050 renewable energy goal.

Contracting process undermines sound energy planning, likely resulting in higher costs and over-dependence on fossil fuels

On Oct. 17, the Puerto Rico Public-Private Partnerships Authority (P3 Authority) issued a Request for Qualifications (RFQ) for the construction and operation of 3,000 megawatts (MW) of new power generation on the island. On the same day, Puerto Rico’s grid operator LUMA Energy filed with its regulator, the Puerto Rico Energy Bureau (PREB), its 20-year plan for the buildout of the island’s generation system—a plan made largely irrelevant by the P3 Authority’s process announced that same day.

This timing coincidence illustrates the continued failure of sound energy planning in Puerto Rico—and the challenges that the island faces in meeting its legislatively mandated 100% by 2050 renewable energy target.

The RFQ for 3,000 MW of new firm power generation capacity is the latest, and largest, in a pattern of the PREB ordering new generation system investments outside of the integrated resource plan (IRP) process. Other recent examples include the procurement process that resulted in a contract for a new 560MW natural gas plant, and plans for 800 MW of temporary generation to be installed that will operate for the next decade. While the PREB has attempted to justify some of these decisions in the context of the currently approved IRP, that plan had only called for the evaluation of a possible 300MW natural gas plant.

If these plans come to fruition, Puerto Rico will have far more capacity than it needs—and this problem will only worsen in the future as residents and businesses continue to move to rooftop solar and storage.

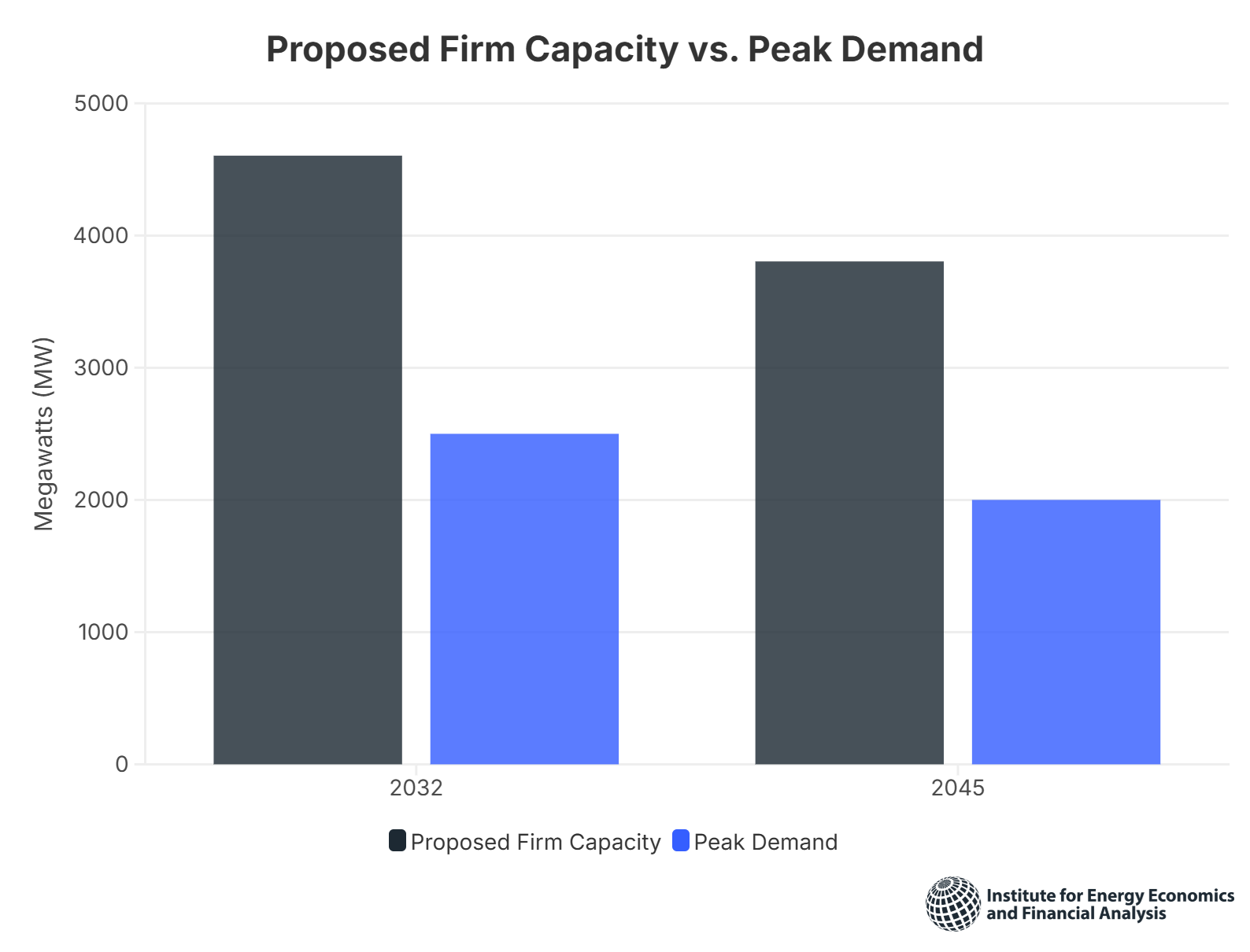

The following graph shows IEEFA’s estimate of new firm power plant capacity versus LUMA’s projected peak system demand in 2032 (assuming that new natural gas plants will not be constructed until the early 2030s) and 2045. These figures take into consideration the new resources mentioned above, as well as 244 MW of new natural gas peakers. They assume that all of Puerto Rico’s existing generation is retired, and they do not take into consideration the significant amount of utility-scale battery storage that is currently planned, even though those battery resources will provide some capacity value to the system during peak demand hours. Even with those very conservative assumptions, these figures show that Puerto Rico’s generation system will be substantially overbuilt. While it is reasonable to have a reserve margin of power plant capacity, if these projects are realized, Puerto Rico’s reserve margin will be greater than 85% for the foreseeable future. Indeed, the amount of new capacity being planned is significantly in excess of what LUMA found to be necessary to meet the U.S. electrical industry’s standard for generation system reliability, according to LUMA’s October 2024 resource adequacy study.

What is the purpose of a planning process if the decision has already been made to overbuild the system for the next twenty years?

A rigorous IRP process should evaluate multiple scenarios to arrive at the plan that meets energy needs at the lowest cost, incorporating energy efficiency, demand response and distributed resources, as well as centralized resources.

The replacement of a comprehensive planning process by ad-hoc contracting is likely to facilitate a costly overbuild and is also likely to favor the natural gas industry in Puerto Rico. Rather than an open regulatory process in which modeling assumptions can be questioned and alternatives proposed, under Puerto Rico law, the procurement process is a closed-door process in which politically driven outcomes have been common. Puerto Rico governor Gonzalez-Colon has been a strong supporter of natural gas during her political career.

Any gas plant that is constructed in the next few years will have a useful life that extends well beyond 2050, the year in which Puerto Rico is supposed to achieve 100% renewable energy. While both green hydrogen and biodiesel have been mentioned as fuel conversion possibilities to enable natural gas units to continue operating past 2050 in Puerto Rico, neither option appears likely to materialize as a cost-effective, renewable alternative. For the last twenty years, retail biodiesel prices in the U.S. have averaged about 29% higher than conventional diesel prices; conventional diesel is already the most expensive fuel in Puerto Rico’s generation mix. At the same time, studies have called into question the climate benefits of switching to biodiesel because converting land for biodiesel may result in deforestation and loss of carbon sinks.

Green hydrogen is also unlikely to be a cost-effective solution. A 2023 study commissioned by the Energy Bureau did not even consider using green hydrogen for power generation in Puerto Rico, instead arguing that it is more appropriate for applications that do not have other readily available low-carbon alternatives, such as aviation and shipping fuel, fertilizer production, steel production, or long-duration energy storage. While the contract for the 560MW new natural gas plant states that the plant should be initially capable of blending up to 30% hydrogen, it does not contain any timeline for hydrogen conversion or penalties if hydrogen is never used.

In short, making major generation resource decisions outside the framework of a rigorous planning process repeats past errors, facilitating the politically-driven contracting practices that contributed to PREPA’s physical and financial crisis. Current plans to overbuild the generation system would all but guarantee that system costs will be higher for consumers and that Puerto Rico will not reach its 100% by 2050 renewable energy goal.