Despite harm to ratepayers, Puerto Rico oversight board opens door to increases

Key Findings

A debt restructuring plan opens the door to electricity rate increases for Puerto Rico households that already suffer frequent outages.

The rate increases would be used to pay off legacy debt of the bankrupt utility.

New bonds would be issued with principal and interest payments over the next 35 years, coming to as much as $5.3 billion.

The proposed plan would exacerbate the electrical system’s financial woes for decades.

The Financial Oversight and Management Board (FOMB) recognized earlier this year what IEEFA has long been stating: There is no room to raise rates in Puerto Rico to pay off the electrical system’s legacy debt, and priority must be given to restoring the island’s grid to a functional level of service.

In its 2025 Fiscal Plan for the Puerto Rico Electric Power Authority (PREPA), the FOMB concluded in February that “PREPA has no projected excess cash flow after addressing the system needs and … no ability to raise rates further to sustain any debt.”

Even so, the FOMB proposed a plan in March to restructure PREPA’s legacy debts. The Plan of Adjustment presented to a federal bankruptcy court would open the door for rate increases to pay the debt.

PREPA has approximately $8.5 billion in legacy bond debt and has been in federal bankruptcy court since 2017. It also has a pension system that currently is only kept afloat by periodic injections of cash from the commonwealth government; that money is expected to run out this month. Under the FOMB plan, the total pension liability is estimated at $3.5 billion.

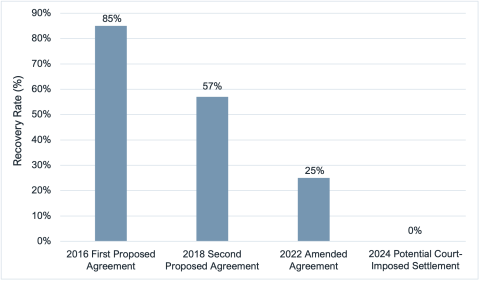

The FOMB’s proposed plan includes the issuance of as many as three series of new bonds, totaling as much as $2.54 billion (a reduction in principal of approximately 70%), to pay off the legacy bond debt. The final principal amount of the new bonds will depend on the outcome of the litigation over the value of bondholders’ collateral, among other issues before the bankruptcy court. Principal and interest payments on these new bonds over the next 35 years would amount to as much as $5.3 billion.

Via an agreement with a group of bondholders led by BlackRock, PREPA would be able to sell as much as $1.9 billion of new bonds and receive cash to distribute to other creditors. The commonwealth would put in $2.6 billion to establish a fund to be used to pay the pensions, and that PREPA could also borrow from to pay principal and interest on the new bonds (at 4.5% interest).

These numbers don’t add up without rate increases. It’s true that the proposed FOMB plan differs from previous versions by not including a specific surcharge on electric rates to pay the debt. But the plan would require PREPA to adjust its rates so that revenues are sufficient to pay operating expenses and debt service on the new bonds—however much they turn out to be. And as IEEFA as noted previously, a group of PREPA bondholders are litigating to insist that PREPA pay even more to bondholders.

Eight years into the bankruptcy process and under the oversight of the FOMB, PREPA still struggles to set rates that cover costs. If it continues to fail to set rates that cover costs—including the new debt service costs imposed by the plan—the balance of the $2.6 billion supplied by the commonwealth would be used to pay shortfalls in principal and interest payments while undermining the financing of the pension system.

The plan also would require that unpaid interest accrue for two of the three new series of bonds, even past the final maturity date of the bonds, which means that if the bonds are not paid off by maturity, the liability would be on PREPA’s books indefinitely instead of simply defaulting.

Although FOMB has recognized the inability of PREPA’s electrical system to sustain rate increases to pay the legacy debt, its proposed solution still falls short and will continue to exacerbate the electrical system’s fiscal and operational problems, possibly for decades to come.