FOMB warns Puerto Rico bonds could be worthless

Key Findings

A new court filing by Puerto Rico’s Financial Oversight and Management Board (FOMB) warns Puerto Rico utility bonds could be worthless

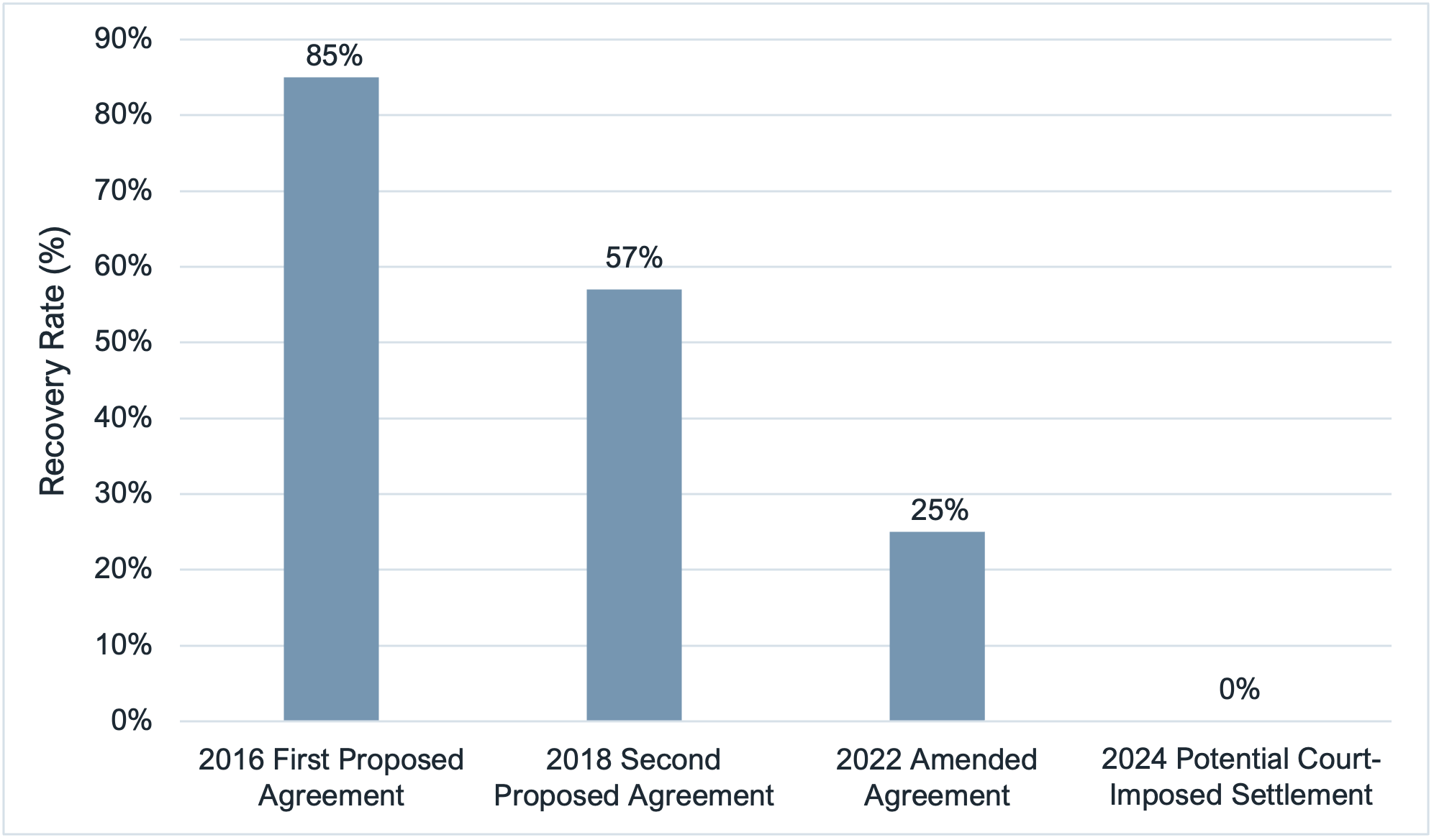

Estimates of proposed recovery rates by creditors have fallen steadily since 2017

Creditors and underwriters should work together to ensure they recover some money while not destroying the island’s economy

Creditors who loaned money to the bankrupt Puerto Rico Electric Power Authority (PREPA) are at risk of recovering none of it, a federal panel warned in a recent filing. For the first time since the Federal Oversight and Management Board (FOMB) was established in 2016 it has officially acknowledged that using reasonable budget assumptions, there is no money to pay back more than $11 billion in outstanding electrical system debt.

Here is the back story.

In July 2017, FOMB rejected a debt agreement for PREPA, explaining that the deal was not in the best interests of Puerto Rico. The FOMB said the agreement failed to meet the twin goals of an affordable and reliable system and would fail to ensure economic growth.

The rejected FOMB plan offered a recovery rate of 85% for the bondholders. It also called for an increase in the use of natural gas and renewable energy. In the wake of the rejection, the utility’s chief financial advisor was replaced. Various post-mortems on the process and orders from the utility regulators raised concerns about conflicts of interest, and about high fees for the law firms and financial advisors who had negotiated and would implement the deal.

In August 2019, Moody’s Investors Service estimated potential recovery rates would be less than 35%. A slightly more optimistic second FOMB proposal was floated in 2022 that would have increased customer rates to cover $5.68 billion in debt, but still estimated a recovery rate of approximately 57% for the creditors.

A June 2023 amended plan, however, cut the payout to $2.5 billion—about a 25% recovery rate for bondholders—and offered a new rate structure to support the legacy debt, as well as maximizing renewable energy.

During the deliberations on the new 25% recovery rate, the FOMB, McKinsey & Company, and legal advisors produced an analysis that reviewed the range of recoveries available to PREPA bondholders if the bankruptcy proceeding failed to produce a result. The FOMB analysis applied various debt stacking, expense payment and revenue assumptions as if a court were adjudicating how PREPA should be managed. The analysis showed that debt recoveries ranged from zero to approximately $2.6 billion, with the variation reflecting different assumptions about future PREPA sales.

In short, creditors are being told that a court might award them zero—nothing.

This is the first time that the FOMB or any official source has raised the possibility that the level of fiscal distress at PREPA means that the utility doesn’t have the money to pay its debts.

PREPA Bond Recovery Rate Proposals, 2016 to the present

Some creditors have argued that there is plenty of money available at PREPA to pay off the debt. But the FOMB filing with the bankruptcy court makes the implicit argument that it is in the best interest of the creditors to take the current bond deal. Rejecting it and relying on a potential court-imposed settlement under existing non-bankruptcy rules is likely to yield lower recovery rate than being offered in the current proposed deal and could result in zero.

Another set of voices that are not usually heard from in a bankruptcy proceeding are the customers and employees/retirees of the company involved. Recently, the court has received almost 800 motions from PREPA customers and retirees who are expressing concern about raising rates on the one hand and losing pension benefits on the other.

Adding to the list of individual customers with concerns are various business associations, including the Puerto Rico Manufacturer’s Association, United Retailers’ Association, Gasoline Retailers’ Association, Community Pharmacies Association, Builders Association, and League of Cooperatives. All see rate increases causing smaller profit margins and less likelihood that businesses can survive. To stakeholders who are bondholders, the issue is how the losses in Puerto Rico will affect their diverse portfolios. Stakeholders that are businesses on Puerto Rico are more likely to be concerned with whether monthly incomes can be stretched to meet rising prices.

IEEFA’s findings from its analyses over the course of seven years conclude that the revenue available for debt service should be zero.

The solution that IEEFA has proposed would not, however, result in zero recoveries for the bondholders and other claimants. It would require the underwriters, lawyers, accountants, engineers, and all other diligence providers to establish a pool of funds to settle the claims of the various creditors—bondholders, unsecured creditors and pensions included. As we have stated, the diligence providers collectively have at least $12 trillion in assets under management. Establishing a pool to satisfy claims can go a long way to settling PREPA’s debt situation and putting it on a path to fiscal solvency.

The negligence of the diligence providers leading up to the bankruptcy has been amply documented. The abusive pattern of setting consultant fees is a diligence question that extends beyond the bankruptcy declaration. This issue has been raised by both the utility regulator and the bankruptcy court’s fee examiner.

In Moody’s annual default study, which covers the years from 1970 to 2022, it notes that Detroit and Puerto Rico continued to add debt even as evidence of fiscal distress was mounting. The credit agency concludes: “Both Detroit and Puerto Rico issued additional debt while their distress was deepening. Had they not, and defaulted earlier, defaulted debt recoveries might have been better.”

Affordable electricity is a key goal for the economic growth of the commonwealth. So is reliable electricity. An unsustainable debt settlement that increases utility rates is counter to these goals.

We see the following steps needed:

- Establish a pool to be used to settle all claims.

- Require all insurers to cover their obligations.

- Pursue criminal prosecutions.

- Establish an independent private sector inspector general (IPSIG) to provide closer oversight of utility financial management.

- Provide resources to pay 100% of the lost value of on-island, small bondholders.

The FOMB submission to the bankruptcy court concluded that creditors may end up with zero from a court-ordered, non-bankruptcy settlement because they estimate that PREPA’s expenses exceed revenues.

This solution gives PREPA an opportunity to move forward with a balanced budget. If PREPA emerges from bankruptcy freed from legacy debt, their fiscal condition will remain stressed for a period of time. With proper deployment of federal resources, significant improvement in the grid should occur. An IPSIG should be able to help maintain budget discipline and root out operational bottlenecks.

To those who are concerned that a low or zero recovery rate will prevent PREPA from participation in the bond markets, the following should be considered. Any new debt issuance will be offered by a utility with a new grid, a balanced budget and zero debt obligations. Such a scenario should prompt investors to participate in a new issuance, even if the system lacks a history of solid operational performance and that history is marred by the taint of negligence. At this level, a fulsome commitment of all stakeholders working together and setting PREPA on a path to fiscal solvency while providing the commonwealth with a tool to grow its economy should help to allay market concerns.

There is a choice to be made here by the bondholders and underwriters: Work on a plan similar to that spelled out by IEEFA or face a possible future where judicial intervention leaves them with nothing.