U.S. tariff deal could undermine South Korea's climate goals

Key Findings

South Korea’s agreement to purchase USD100 billion worth of energy from the United States, including liquefied natural gas (LNG), could undermine its decarbonization plans.

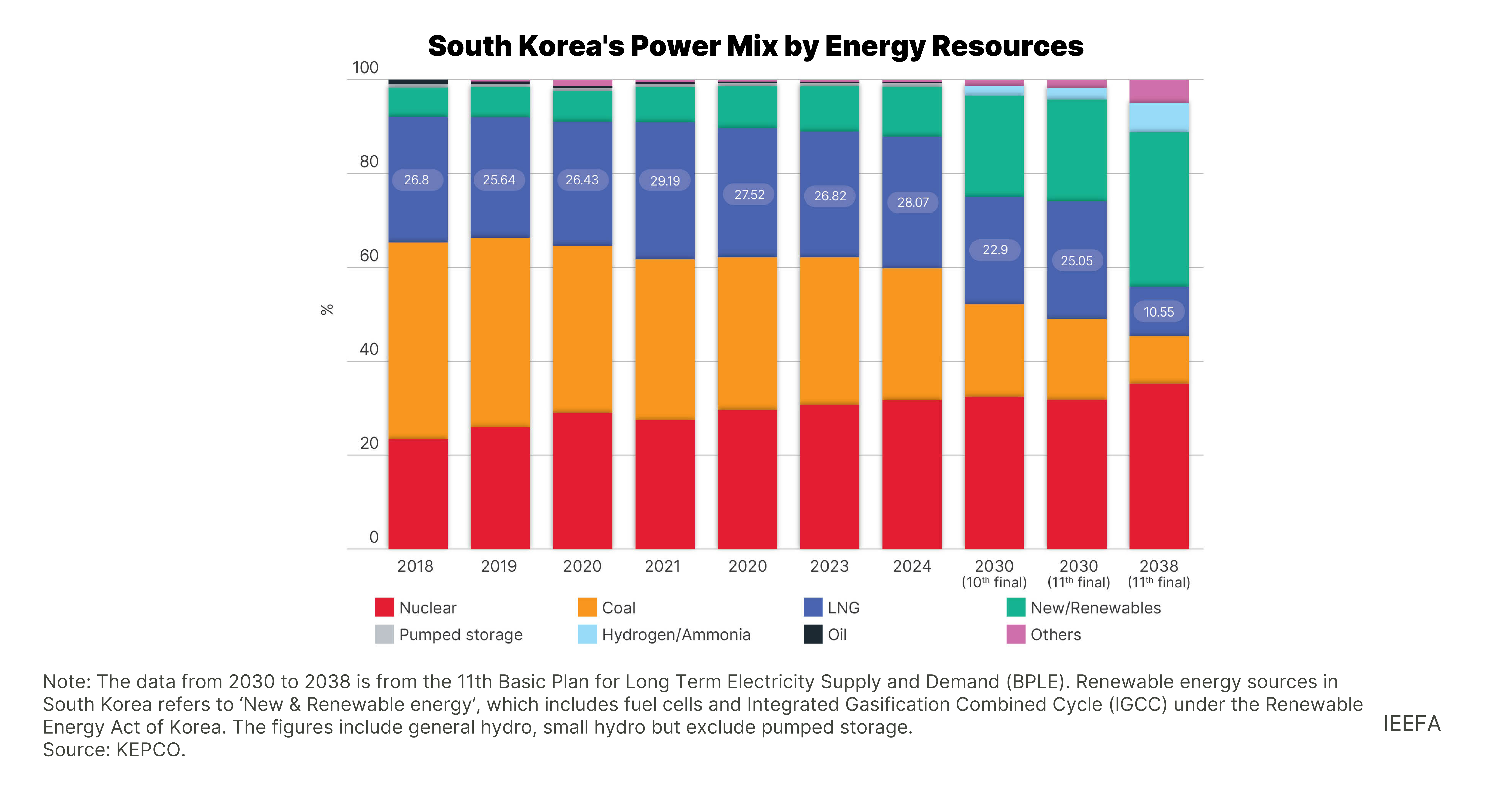

Significantly increasing LNG imports could lock South Korea into long-term fossil fuel dependence, jeopardizing its goal of cutting LNG’s share in the power mix to 10.6% by 2038.

Committing to additional LNG imports presents challenges for South Korea, amid an impending global supply glut and anticipated demand and price drops. Overreliance on LNG could exacerbate stranded asset risks as LNG demand declines and pressure for the energy transition grows.

On 31 July 2025, South Korea’s government agreed to buy USD100 billion worth of energy from the United States (U.S.) as part of the tariff negotiations between the two countries. Consequently, a 15% tariff will be levied on most South Korean exports to the U.S. While this agreement may have avoided higher tariffs, the fossil fuel purchase commitment could undermine South Korea’s decarbonization goals, increase energy costs, and exacerbate stranded asset risks amid weakening liquefied natural gas (LNG) demand.

U.S. energy import bill could increase significantly

The Institute for Energy Economics and Financial Analysis (IEEFA) estimates that if South Korea buys approximately USD25 billion to USD33 billion worth of U.S. energy for the next three to four years, its U.S. energy import bill could increase between 1.3 and 1.7 times its current level. As of 2024, South Korea imported around USD19 billion worth of U.S. energy products, including crude oil (USD14.25 billion) and natural gas (USD3.09 billion).

The sensitivity analysis below assumes a three-year timeframe as the base case, consistent with similar energy agreements with other countries. Scenarios for three-and-a-half-year and four-year durations are also included, as official bilateral announcements regarding the energy imports were still pending as of 7 August 2025.

According to IEEFA’s scenario analyses, to meet its commitment of procuring around USD25 billion to USD33 billion worth of U.S. energy annually, South Korea would need to increase the volume and value of its energy purchases by approximately 29% to 72%. Assuming the composition of energy products and 2024 prices remain unchanged, this would translate to an estimated increase in annual U.S. crude oil imports to around 30 million to 39 million tonnes and LNG imports to approximately 7 million to 10 million tonnes, depending on the period.

In 2024, South Korea imported around 5.6 million tonnes of LNG from the U.S., representing 12% of its total annual LNG imports of 46.33 million tonnes. Nearly 29 million tonnes, or 68%, was secured through long-term contracts.

Increasing LNG purchases is not feasible

According to data from energy service provider Bloomberg New Energy Finance (BNEF), South Korean buyers have already signed long-term contracts with various suppliers worldwide for nearly 36 million tonnes of LNG, including about 6.5 million tonnes from the U.S., set to ramp up between 2026 and 2028. Many of these deals have terms spanning 15 to 20 years.

These contracted volumes mark a significant increase in fixed-take commitments from South Korean buyers. They now account for nearly 72% of total projected national demand, exceeding the historic range of 65% to 68%. Spot purchases of LNG help balance supply with demand, which can fluctuate significantly across the year due to changes in weather or economic conditions. Given existing contractual commitments and the need to maintain flexibility for spot purchases to meet total demand, there is little room for additional long-term contracts under the U.S.-South Korea tariff deal.

The figure below shows historic LNG imports by supplying country, both long-term and spot (left), and contracted future long-term supplies through 2040 (right). As the projection indicates, room for additional LNG supplies will not materialize until 2029. Even then, buyers will need to consider future demand constraints, as government decarbonization targets under the 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE), adopted earlier in 2025, are set to reduce the LNG needs beginning in the 2030s.

If South Korea attempts to meet the USD33 billion per year purchase commitment, it will need to source its energy exclusively from the U.S. This would require breaking existing contracts and incurring significant penalties. Furthermore, concentrated sourcing is inadvisable; portfolio and supplier diversification are key for energy and economic security. Even under a U.S.-focused scenario, the projected decline in LNG demand and fluctuations in global oil and gas prices make it unlikely that the value of purchases would reach the agreed target.

Déjà vu of Free Trade Agreement (FTA) renegotiation in 2017

The new tariff deal and the potential increase in U.S. energy imports, especially LNG, resemble the 2017 renegotiations of the Korea-U.S. Free Trade Agreement (FTA), which prompted a substantial increase in U.S. LNG imports.

LNG imports from the U.S. spiked 70 times year-on-year after the first U.S. export project, Sabine Pass, began operating in 2016. One of the main reasons for South Korea’s LNG imports from the U.S. included efforts to address the trade deficit, which prompted renegotiations of the Korea-U.S. FTA. The media and parliament frequently mentioned LNG as a potential remedy to alleviate the trade disparity and FTA cancellation risks by the U.S.

At the G20 Summit in 2017, South Korea’s administration announced its 'Coal and Nuclear-free Economy' policy, counterintuitively recognizing LNG as a form of ‘green energy’, and making it a key component of the country’s energy transition strategy. In December that year, the Ministry of Trade, Industry, and Energy (MOTIE) increased the 2030 LNG share target in the power mix from 16.9% to 18.8% by 2030. By year’s end, South Korean imports of U.S. LNG had more than doubled year-on-year, coinciding with the start of the Korea-U.S. FTA renegotiation.

In December 2020, the targeted share of LNG in South Korea’s power mix increased to 23.3% by 2030, and U.S. LNG imports hit a historic high in 2021. Since then, the U.S. share of South Korea’s LNG imports has remained level, despite overall LNG demand stagnating and declining. In the first quarter of 2025, LNG demand was down 16% compared to the same quarter in the previous year.

Undermining decarbonization, increasing stranded asset risks

Significantly increasing LNG imports to satisfy the U.S. tariff deal would contradict the South Korean government’s ambitious decarbonization targets, including those under the BPLE, which aim to reduce fossil fuel dependence while increasing renewable energy.

Incentivizing LNG imports could lock in fossil fuel dependence, leading the country to miss its 2038 target of reducing the share of LNG in the power mix to 10.6% from 28% in 2024. This goal requires the current LNG-fired power generation to more than halve to 74.3 terawatt-hours (TWh) by 2038, which means substantially decreasing LNG imports. Consequently, signing new, long-term LNG supply commitments would be inopportune.

Given the imminent global LNG supply glut and the anticipated lower prices in the international market, it is risky to commit to additional long-term purchases of U.S. LNG amid the current energy landscape. Instead, a strategy that favors more flexible cargoes from physical spot markets offering potentially reduced prices would be advantageous.

There is a widening gap between LNG import infrastructure and demand in South Korea. A growing number of the country’s mega-scale LNG receiving terminal projects are underutilized, while proposed new projects have been scrapped.

South Korea’s commitment to achieving net-zero carbon emissions by 2050 necessitates recognizing that LNG is a fossil fuel and that its use should decline. Additional imports of U.S. LNG could add further stranded asset risks amid the country's declining demand and the fuel’s diminishing role in the energy transition.

Related IEEFA commentaries: