Bangladesh’s LNG dependence raises concerns about energy resilience

Key Findings

The LNG pathway, pursued as a fuel diversification strategy without enough investment in exploring domestic gas, has become an economic burden for Bangladesh.

On a ballpark estimate, industries, excluding the fertiliser sector, incurred additional costs of approximately Tk45.6 billion (USD0.37 billion) in FY2023-24 compared to FY2022-23 because of gas price hikes. Likewise, the government received additional payments of approximately Tk31.6 billion (USD0.26 billion) from gas-fired captive power generators during the same period.

In a less favourable scenario of limited gas discovery and high price volatility, to meet the current level of demand, Bangladesh could pay as much as USD8.5 billion in FY2029-30 on account of LNG imports.

Bangladesh must enhance its energy system resilience, expand renewable energy at a faster rate by strongly focusing on decentralised systems like rooftop solar, and simultaneously deploying sufficient budget to explore local gas and enhance efficiency.

The combination of soaring natural gas demand and plummeting domestic production has pushed the Bangladesh government to diversify its energy sources. In the past, various plans, including the Integrated Energy and Power Master Plan 2023, have attempted to address this concern, but they have driven a shift towards imported liquefied natural gas (LNG) instead. The LNG pathway, pursued as a fuel diversification strategy without enough investment in domestic gas exploration, has become an economic burden for the country.

With surging LNG imports, the government has increased gas tariffs drastically, making industrial production expensive. Yet, the government pays a hefty annual subsidy on account of LNG imports. Unless Bangladesh streamlines its energy pathway, the reliance on imported LNG may further expose the vulnerability of its energy system, leading to a recurring subsidy problem.

Rising LNG imports strain Bangladesh’s energy system

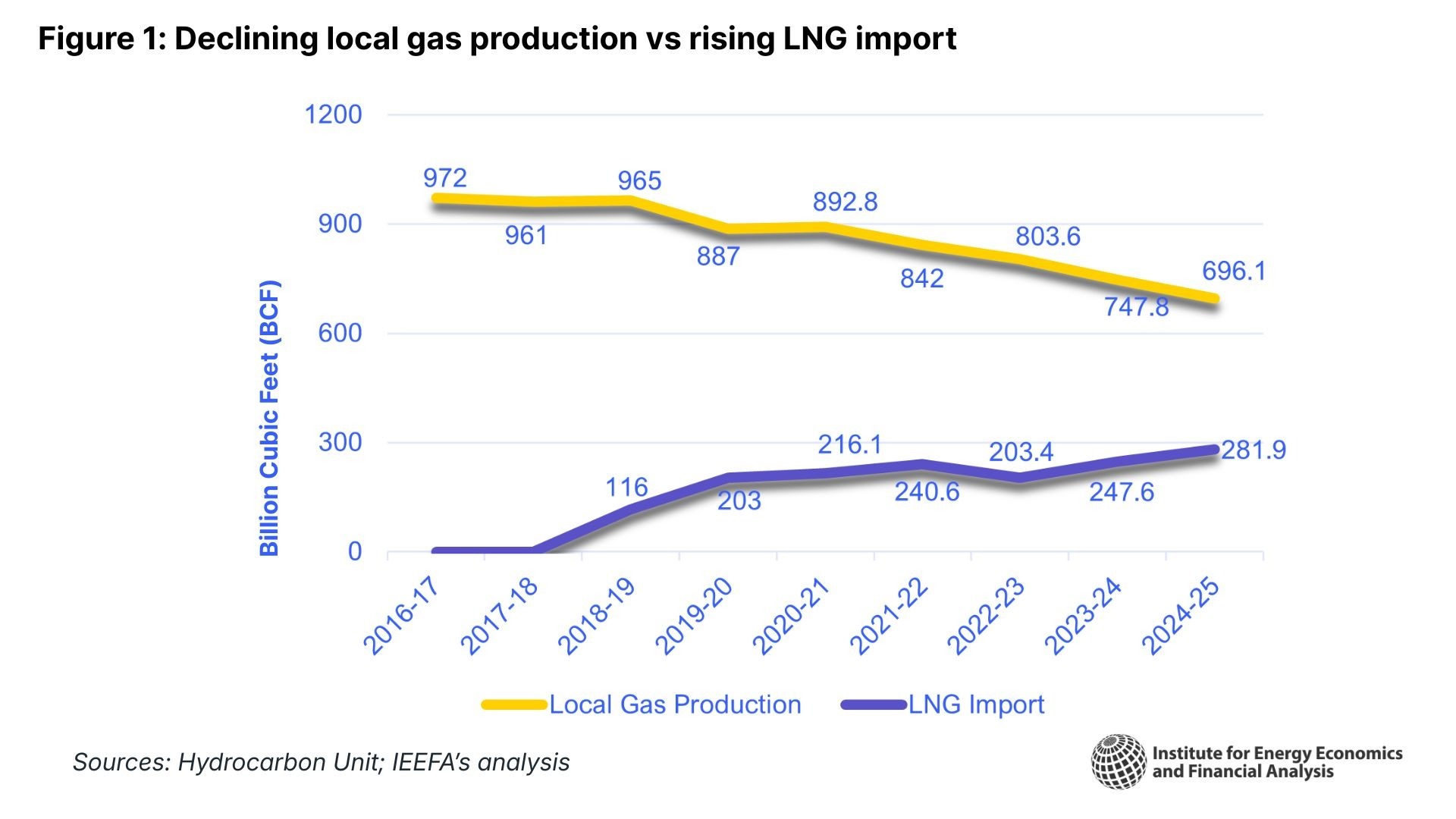

Bangladesh’s LNG imports surged by 21.7% and 13.86% in FY2023–24 and FY2024–25, respectively, following a 15.45% reduction in FY2022–23 (see Figure 1). The country’s LNG imports declined in FY2022–23 due to elevated spot market prices and tight fiscal conditions. Imports, however, rebounded in the subsequent years because of affordable LNG prices.

While the contribution of expensive LNG to total gas consumption stands at 28.8%, the government is gradually passing the additional costs on to different sectors, excluding power generation. Between February 2023 and April 2025, the government raised gas tariffs for industrial production twice and captive power generation thrice. The gas price for industrial production increased from Bangladeshi Taka (Tk) 16/ cubic metre (m3) (USD0.13/m3) to TK40/m3 (USD0.33/m3), while the gas price for captive power generation soared to Tk42/m3 (USD0.33/m3) from the same level (*conditions applicable for new and old industries and captive power plants).

On a ballpark estimate, industries, excluding the fertiliser sector, incurred additional costs of approximately Tk45.6 billion (USD0.37 billion) in FY2023–24 compared with FY2022–23 because of gas price hikes (calculated based on gas consumption and tariffs of the respective years). This occurred despite a 5.9% year-on-year decline in gas supply to the sector.

Likewise, the government received additional payments of approximately Tk31.6 billion (USD0.26 billion) from gas-fired captive power generators during the same period, driven by higher tariffs. Notably, gas supply to captive power generation declined by 6.5%.

LNG dependence may rise further

Bangladesh’s average gas supply in FY2024–25 was 2,679 million cubic feet per day (MMcfd) (derived from the annual consumption of 978 billion cubic feet (Bcf) (see Figure 1)) against a demand of around 4,000MMcfd. This implies a gas supply deficit of more than 1,300MMcfd. With domestic production declining at an average rate of 4.64% per annum since FY2018–19, this demand-supply gap may widen further, potentially prompting the government to enhance regasification capacity and increase LNG imports.

While the government has set a goal of adding local gas of 648MMcfd and 1,500MMcfd to the grid by 2025 and 2028, respectively, it should keep sufficient funds for exploration. The allocation to the energy sector as part of the annual development programme stands at a paltry Tk20.86 billion (USD0.17 billion), which is inadequate to achieve this year’s goal. Available reports suggest that the government’s initiatives may add only 143MMcfd of gas to the grid in 2026.

The government is also planning to float an international tender to explore onshore gas to ramp up local production. In the event of moderate success, if Bangladesh connects 1,000MMcfd of new gas, including the announced 143MMcfd, to the grid by FY2029–30, domestic gas production will reach 2,500MMcfd (assuming existing gas supply continues to decline at the current rate of 4.64% per annum). Therefore, even to meet the current demand of 4,000MMcfd in FY2029–30, the country will need to import 1,500MMcfd of LNG. The annual LNG import will then rise to 547Bcf, making an annual payment obligation of more than USD5 billion in FY2029–30 (taking USD10/MMBtu of LNG, based on Bangladesh’s long-term contracts and recent spot-market purchases).

In a less favourable scenario of limited local discovery and high price volatility, Bangladesh could pay as much as USD8.5 billion in FY2029–30 on account of LNG imports (assuming the government adds 500MMcfd of domestic gas to the grid, existing gas supply continues to fall at the current rate of 4.64% per annum, and the average LNG price reaches USD12/MMBtu). Alternatively, the unaffordability of LNG and fiscal constraints could worsen energy supply shortfall, thereby stifling economic activities.

The recurring subsidy burden

Despite massive gas price hikes in the last two-and-a-half years, the government allocated a subsidy of Tk90 billion (USD0.74 billion) for LNG imports in its FY2025–26 budget. Low gas tariff for grid-based power plants is one of the key reasons behind this hefty subsidy burden. For instance, the government charges power plants at Tk14.75/m3 (USD0.12/m3), which means it must provide a subsidy of around Tk29.85/m3 (USD0.24/m3) if the LNG price is USD10/MMBtu.

High LNG dependence in the near future may prompt the government to raise gas tariffs for grid-based power plants, affecting the Bangladesh Power Development Board (BPDB). With rising generation costs, BPDB’s revenue shortfall is likely to widen. The government might pivot to adjust power tariffs to provide BPDB some relief.

As Bangladesh is yet to lock in a very high LNG dependence, the best course of action for the country is to design an alternative energy pathway, focusing on utilising renewable energy and local gas. There are two concrete examples. In 2020, Vietnam installed more than 9 gigawatts (GW) of rooftop solar capacity, backed by a guaranteed feed-in-tariff. Pakistan imported solar panels and battery packs of 17GW and 1.25 gigawatt-hours (GWh) capacities in 2024, leading to a solar boom amid the country’s energy supply crunch and unaffordable power tariffs. This surge in solar power generation resulted in a subdued demand for LNG in Pakistan.

The key to Bangladesh’s success in enhancing energy system resilience is to expand renewable energy at a faster rate by focusing on decentralised systems like rooftop solar. Meanwhile, the government can allocate sufficient budgetary resources to explore local gas and strengthen energy efficiency to wean itself off its LNG reliance.

This article was first published in The Daily Star.