Navigating Bangladesh’s energy trilemma

Key Findings

Bangladesh’s efforts to enhance demand-side energy efficiency and minimise losses remain limited. Regulations and guidelines exist, but there’s a lack of enforcement.

The oil-fired peaking power plants cost Bangladesh over twice the average grid-based power, prompting the government to provide hefty subsidies each year. With its new Renewable Energy Policy targeting 20% renewables by 2030 and 30% by 2040, the country needs a roadmap to limit reliance on these plants.

Bangladesh spent a staggering US$17.6 billion between August 2018 and mid-July 2025 to import around 1,500 Bcf of LNG—just 1.5 times the country’s current annual gas output. At only a fraction of the import costs, it could explore enough local gas and lower its LNG imports.

In 2009, only 47% of Bangladesh’s population had access to electricity. Sixteen years on, the country has rapidly transformed its power sector and now has surplus generation capacity. On the primary energy front, it opted for expensive and volatile liquefied natural gas (LNG) to meet its insatiable appetite for gas.

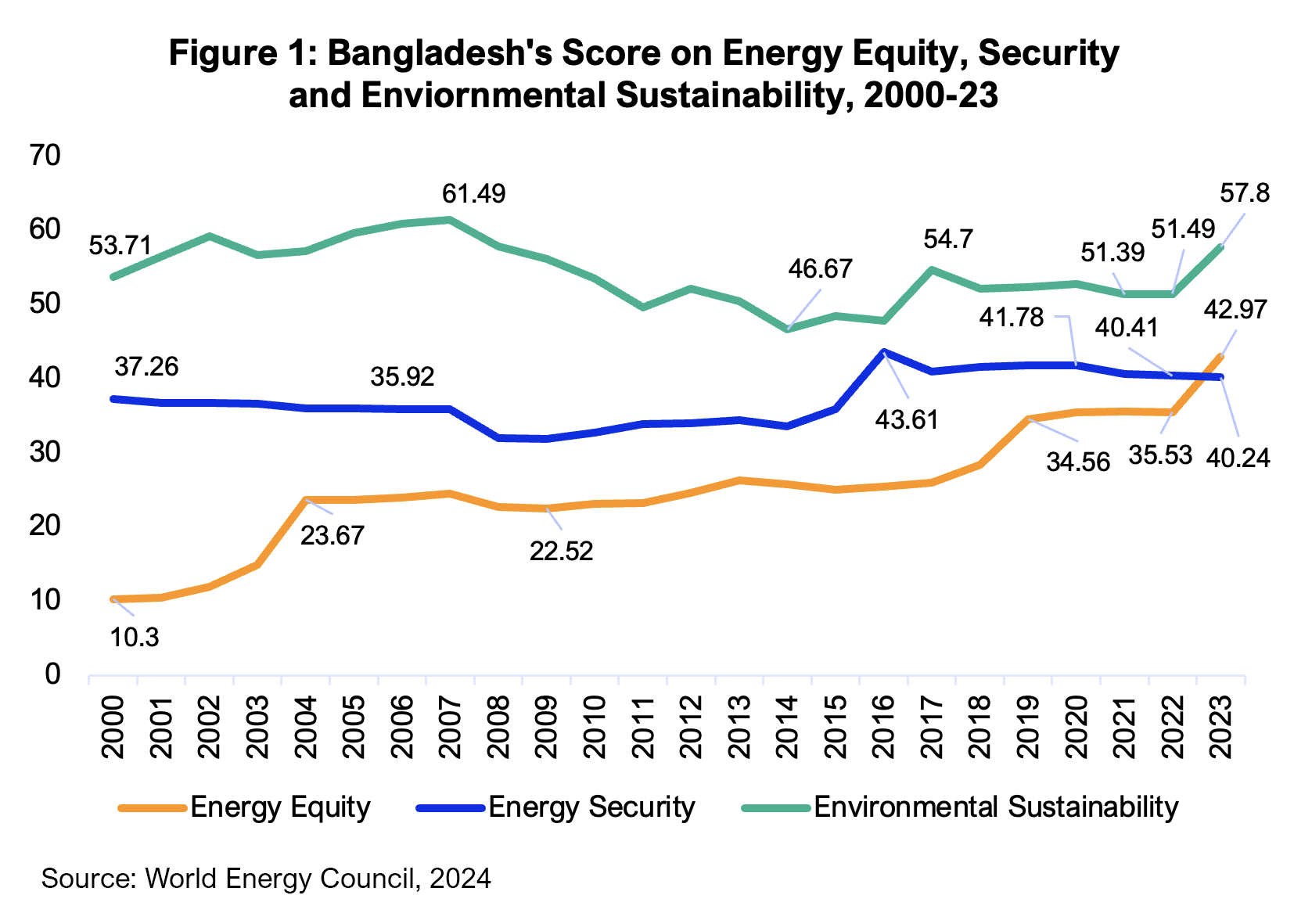

The World Energy Trilemma Index—an annual measurement of the national energy system performances of over 120 countries by the World Energy Council (WEC)—ranked Bangladesh 83rd among the top 99 countries in 2023, five spots lower than in 2022.

Bangladesh currently faces an energy trilemma. Despite the country’s rapid improvement in the ‘energy equity’ parameter—measured based on energy access and affordability—its weak performance in ‘energy security’ points to the high vulnerability of its energy system. The country has improved on environmental sustainability due to efficiency gains but remains dependent on fossil fuels.

Bangladesh can successfully navigate its energy trilemma by prioritising cheap energy sources over expensive imports, and by frontloading energy efficiency and conservation, which would limit its reliance on LNG.

Significant gains in energy equity, but challenges persist

The WEC recognised Bangladesh as one of the top-performing nations on energy equity as its score quadrupled between 2000 and 2023 (see Figure 1), as a result of increased power generation capacity. However, high generation costs prompted the Bangladesh government to increase power tariffs four times between January 2023 and March 2024. This made electricity over 20% more expensive at the retail level. The country also experienced load shedding on at least 23 days in 9 months of the fiscal year (FY) 2023-24.

Further, the gas supply shortfall of 1,000 million cubic feet per day (MMcfd), against a demand of 4,000 MMcfd, continues to force industries to curtail production.

Energy security is the country’s prime concern

Bangladesh’s energy security score peaked at 43.61 in 2016 and then fell to 40.24 in 2023 due to growing LNG and coal imports, which are also rapidly narrowing the country’s fiscal space.

For instance, the gap between the average grid power purchase and selling prices hovers around Bangladeshi Taka (Tk) 4.5 per kilowatt-hour (kWh) (US$0.037/kWh). Further, an LNG spot price of even US$11 per metric million British thermal units (MMBtu) means that the government incurs losses of around Tk32.7 per cubic meter (m3) (US$0.27/m3) and Tk17/m3 (US$0.14/m3) for regasified LNG supplied to the power and commercial sectors, respectively (excluding the shipping and regasification costs). As a result, the government has allocated Tk370 billion (US$ 3.03 billion) for power generation and Tk90 billion (US$ 0.74 billion) for LNG imports in FY2025-26.

IEEFA finds that a reliance of more than 60% on imports for power generation, and 44% for primary energy supply worsens the country’s fiscal position, which affects both energy security and equity.

This calls for scaling up energy efficiency and utilising local resources, including renewable energy.

The country registers the highest score on environmental sustainability

With a score of 57.8, Bangladesh’s environmental sustainability emerges strongest among the three parameters of the energy trilemma, supported by the fact that natural gas contributes a third of the country’s primary energy supply, and efficiency in power generation has increased. However, the country’s per capita carbon emissions are increasing, registering a 31.49% surge between 2012 and 2019. Further, the share of coal in power generation increased four-fold between June 2008 and June 2025, which may negatively impact the energy sector’s environmental competitiveness.

Charting a roadmap to tackle the energy trilemma

Bangladesh must strive to use energy more efficiently and explore cheaper sources to limit import dependence to transition to a secure, affordable, reliable and sustainable energy future.

Enhancing energy efficiency and reducing losses are key

Bangladesh’s efforts to enhance demand-side energy efficiency and minimise losses are few and far between despite the mounting pressure to improve energy security. The regulations and guidelines are in place, but a lack of enforcement and monitoring means energy consumers often carry on with business as usual.

The country could, for instance, reduce LNG imports worth 100 billion cubic feet (Bcf) per annum—representing 39% of the LNG imports in 2024—by enhancing energy efficiency in captive power generation and limiting system losses to 2% in the gas sector.

Similarly, a transition from gas to electric boilers and massive energy efficiency measures in homes and commercial sectors could limit Bangladesh’s dependence on imported fossil fuels and enhance its energy security.

Renewable energy could reduce costs

The oil-fired peaking power plants cost Bangladesh more than twice the average grid-based power, prompting the government to provide hefty subsidies each year. As the government approved the new Renewable Energy Policy on 16 June 2025, with the aim to harness 20% power from renewables by 2030 and 30% by 2040, it should design a roadmap to limit the use of expensive peaking plants.

With the apparel sector facing growing pressure from international buyers to reduce its carbon footprint, all factories should utilise their available space for rooftop solar. Additionally, industries should attempt to maximise the use of green energy, realising the potential of corporate power purchase agreements (CPPAs). This requires the government to finalise the CPPA guidelines to provide a boost to the sector with the aim of greening production processes to compete in the international market.

Utilising own gas to limit LNG imports and infrastructure expansion

Bangladesh entered the LNG market in August 2018 on the back of diminishing local gas supply resulting from a lack of investment in exploration. Fast forward to 2025, the country’s brief relationship with LNG has proven highly turbulent. Reliance on LNG for only around 25% of annual gas consumption led to price adjustments over the past 3 years. The government raised gas tariffs in different sectors, ranging from 14% to 179% in January 2023, followed by the increase in the power sector and captive plants by 2.5% and 5.36%, respectively, in February 2024. The government further raised gas tariffs for industries by up to 33% in April 2025.

The country spent a staggering US$17.6 billion between August 2018 and mid-July 2025 to import around 1,500 Bcf of LNG—just 1.5 times the country’s current domestic annual gas output. Utilising only a fraction of the LNG import costs, Bangladesh could explore enough local gas and thereby lower its LNG imports.

For instance, the Bangladesh Petroleum Exploration and Production Company (BAPEX) spent Tk1.9 billion (US$15.6 million) to discover gas worth Tk60 billion (US$492 million) in Bhola district. It also discovered gas worth Tk25 billion (US$205 million) in Zakiganj at a cost of Tk0.78 billion (US$6.4 million). However, limited budgetary allocation for exploration and insufficient capacity development constrained BAPEX’s efforts.

The Bangladesh government, therefore, should consider allocating sufficient funds to ensure local gas supply to limit highly volatile and expensive LNG imports and its infrastructure expansion.

The Energy Trilemma Index underscores the fragility of Bangladesh’s energy system while also highlighting areas to focus on. By harnessing energy efficiency and renewable energy and utilising local gas to limit LNG imports, the country could gradually transition to sustainable energy.

This article was first published in AmCham Journal.