Budgeting for Bangladesh’s energy transition

Key Findings

Bangladesh needs to gradually reduce oil-fired power generation to limit subsidies. To do this, the government should incentivise renewable energy expansion through budgetary support.

As Bangladesh’s variable renewable energy capacity is likely to surge in the next five years, the old electricity grid might experience stability issues. The new budget should allocate sufficient funds for grid modernisation and expansion.

Prudent budgetary allocation can help the country’s gas distribution companies invest in replacing old gas pipelines. The government should also deploy a team to monitor gas pilferage, which contributes to system loss.

Bangladesh’s interim government is preparing to unveil its first budget on 2 June 2025 amid high expectations of a balanced allocation of funds to streamline the country’s energy transition. A prudent budgetary assessment by the government is much needed given that the power sector’s subsidy burden is reportedly expected to soar by 55% year-on-year in the fiscal year (FY) 2024-25. This is despite the electricity price hike by more than 20% between January 2023 and February 2024.

Bangladesh should follow a merit order dispatch – using the lowest-cost power sources first and then moving to the more expensive ones if demand increases – to bring down its subsidy burden. This opens up opportunities for government intervention – supporting renewable energy capacity addition to ease the transition from oil-fired power and investing in grid modernisation.

Furthermore, the system loss in Bangladesh’s gas sector, which hovers around 7%, calls for budgetary support to revamp gas distribution networks.

While Bangladesh will need a long-term strategy to stave off its energy and power sector challenges, the next budget can lay the foundation for an orderly transition.

Reducing the Power Sector’s Subsidies

Bangladesh needs to gradually reduce oil-fired power generation to limit subsidies. To do this, the government should incentivise renewable energy expansion through budgetary support.

i. Limiting the share of oil-fired power in total generation

In FY2023-24, the cost of oil-fired power was more than two times compared to the average power generation cost. If purchases from oil-fired plants are excluded, the average generation cost comes down to Tk9.54/kWh (US$0.078/kWh). In turn, this can lower the sector’s subsidies.

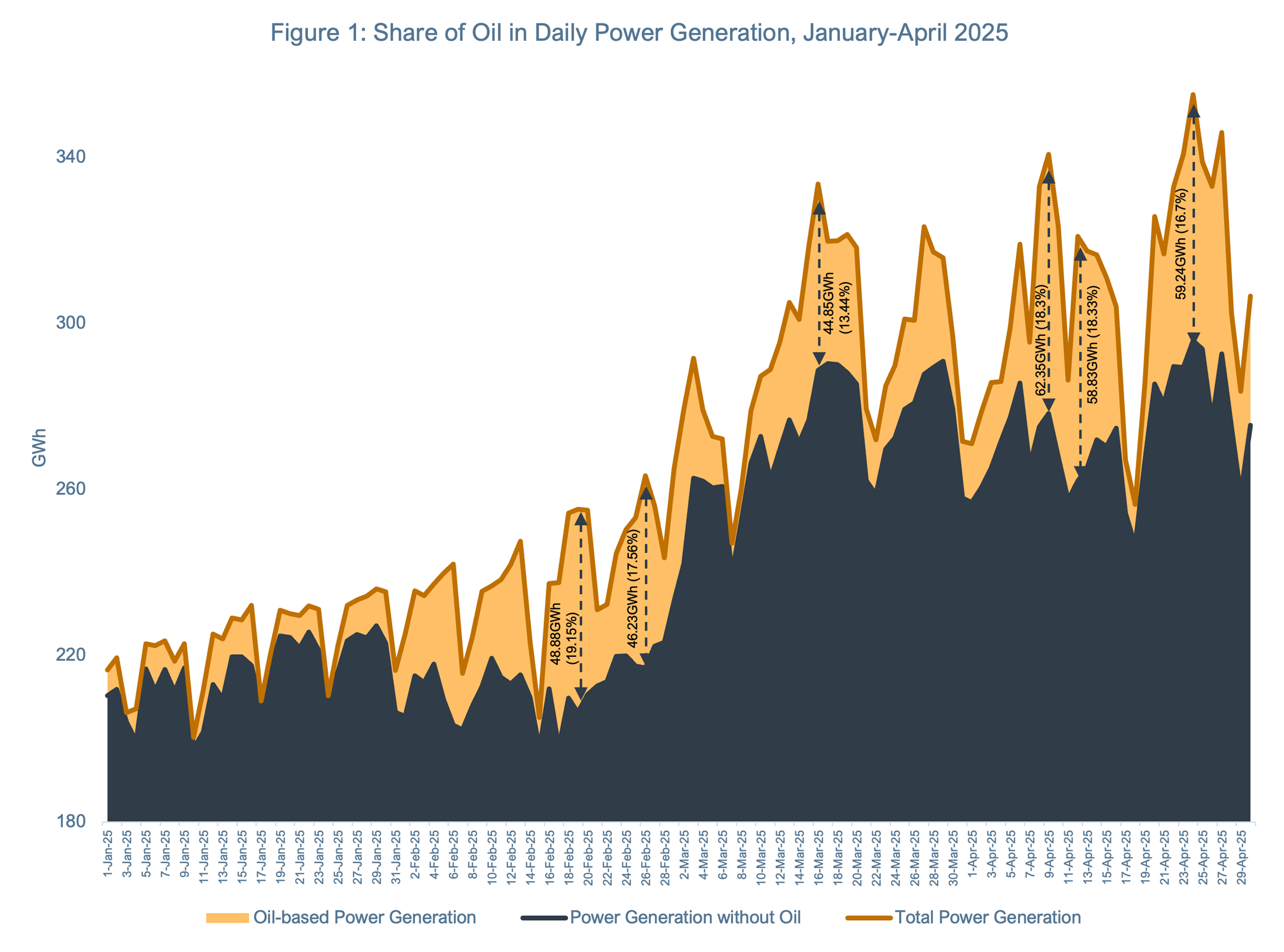

Earlier this year, the government initiated steps to reduce the share of oil-fired power in total power generation. After a temporary decline in January 2025, the share of oil-based power generation rebounded between February and April 2025, contributing to 10.27% of grid-based power and 29.27% of total fuel costs (Figure 1 highlights the days when the share of oil-fired power was considerably high). This pattern mirrors the trend seen in 2024.

The Ministry of Power, Energy and Mineral Resources (MPEMR) should strive to reduce oil-based power generation from FY2025-26, based on the estimates of the Bangladesh Power Development Board. As the Ministry of Finance allocates sectoral subsidies, this assessment will help the MPEMR and the Ministry of Finance to phase down power sector subsidies.

Sources: Power Grid Bangladesh PLC's Daily Operational Data; IEEFA's Analysis

ii. Incentivising renewable energy uptake

With declining costs and improving technologies, Bangladesh can lower its overall power purchase cost by deploying cheaper renewable energy. However, since the utility-scale projects’ pipeline is empty and land acquisition poses a challenge, the upcoming budget can allocate part of the Public-Private-Partnership fund to support land acquisition and attract private investment.

Further, the government can provide a duty waiver on imported accessories to incentivise rooftop solar and solar irrigation expansion as quickfire solutions.

As solar irrigation systems are not viable without a grant of around 50% of the capital cost, the government can enlarge the renewable energy funding base of Tk1 billion (US$8.2 million) established in last year’s budget, and allocate a part of it as viability gap funding for the accelerated implementation of solar irrigation projects. The government can let the Infrastructure Development Company Limited, which has significant experience in financing solar irrigation, utilise this subsidy. With this support, microfinance institutions working in rural areas can also scale up solar irrigation projects.

These steps will help the country achieve its goals of attaining 6,145 megawatts (MW) and 17,470MW of renewable energy by 2030 and 2041, respectively, as set out in the Renewable Energy Policy 2025.

Supporting Grid Modernisation

As Bangladesh’s variable renewable energy capacity is likely to surge in the next five years, the old electricity grid becomes a bottleneck. With a greater share of variable renewable energy, old grid may experience stability issues.

While the previous budget allocated Tk10,634 crore (US$0.87 billion) for grid expansion and modernisation, and the development of power evacuation systems, the new budget should continue to fund grid modernisation.

Bringing Down the Gas Sector’s System Loss

Bangladesh could not utilise 68.6 billion cubic feet (Bcf) of gas in 2024 due to a system loss of 7% (total consumption recorded in 2024 was 980Bcf) resulting from old pipelines in the gas distribution network and pilferage. By limiting the gas sector’s system loss to 2% from 7%, Bangladesh can save at least 49Bcf of gas per annum (5% of the 980Bcf consumed in 2024), reducing LNG imports worth US$497 million per annum (taking an LNG price of US$10.5/metric million British thermal units (MMBtu)). Prudent budgetary allocation can help the country’s gas distribution companies invest in replacing old gas pipelines. Besides, the country should deploy a team to monitor gas pilferage, which also contributes to system loss. As the country’s fossil fuel imports continue to swell, budgetary support to reduce this system loss is crucial.

The sustainability of Bangladesh’s energy and power sectors hinges on strategic budgetary allocation. With planned investments and timely implementation, the country can steer its power and energy sectors in the right direction and meet its renewable energy targets.

This article was first published in The Business Standard.