Prioritizing economic viability in South Korea’s U.S. LNG import strategy

Key Findings

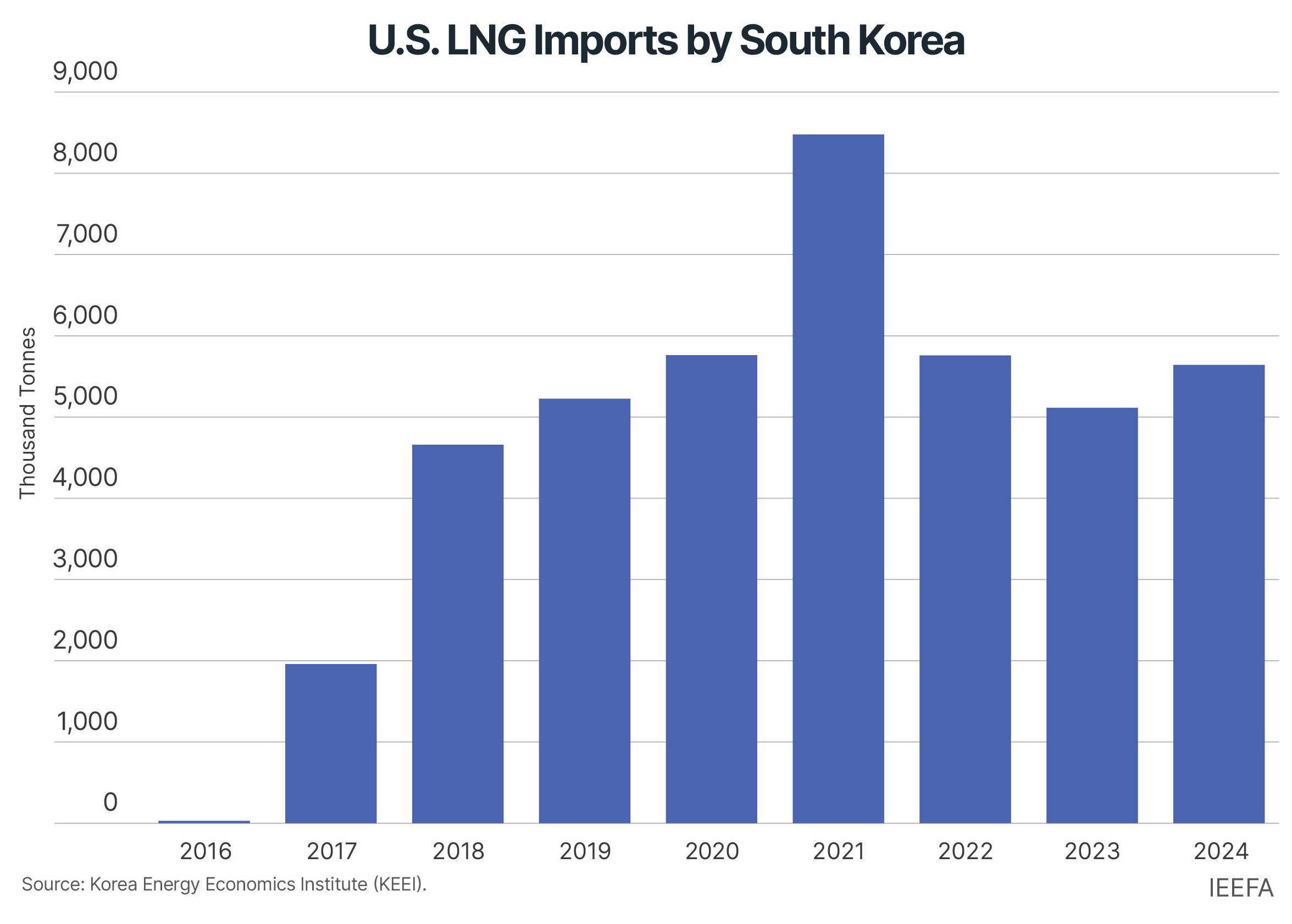

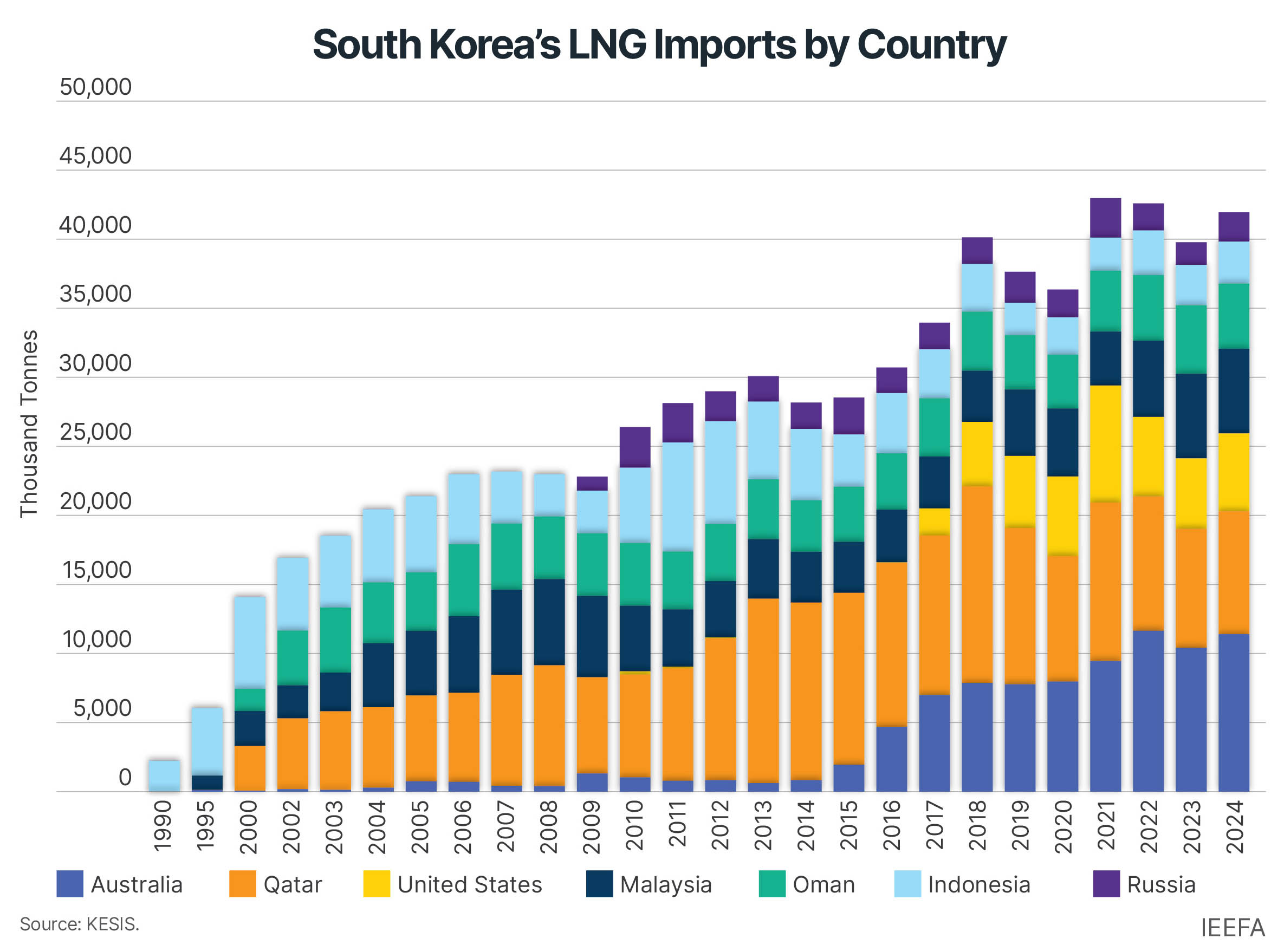

South Korea began importing liquefied natural gas (LNG) from the United States (U.S.) in 2017, driven by the U.S. shale gas boom, the Korea-U.S. Free Trade Agreement renegotiations, and domestic policies that promoted LNG as a form of ‘green energy’ in the national energy transition strategy.

U.S. LNG imports have recently resurfaced as an option to address the trade deficit between South Korea and the U.S. However, given declining domestic demand, high costs, and existing long-term contracts, relying on LNG is unlikely to be an economically feasible solution for South Korea.

Despite nearly two decades of development, the U.S. Alaska LNG project still lacks committed buyers, creating economic uncertainty. To secure financing, 80% of its output should be committed under long-term contracts.

Given South Korea’s net zero targets for 2050, declining LNG demand, reduced role in the energy transition, and the Alaska project’s early stage, increasing U.S. LNG imports warrants caution. Although LNG imports briefly rebounded in 2024, the downtrend will likely continue amid accelerating decarbonization efforts worldwide.

Since South Korea began tariff discussions in Washington in late April 2025, there has been growing speculation over whether the country will participate in the proposed United States (U.S.) Alaska liquefied natural gas (LNG) export development project. The USD44 billion undertaking aims to boost U.S. energy exports to key allies like South Korea and Japan.

In March 2025, U.S. President Trump mentioned cooperation between the U.S. and South Korea in the shipbuilding sector and the Alaska LNG project during a call with Acting President and Prime Minister Han Duck-Soo.

A delegation from South Korea's Ministry of Trade, Industry and Energy (MOTIE) and the state-run gas utility Korea Gas Corporation (KOGAS) visited Alaska in early June 2025 to gather information on the LNG project.

On 3 June 2025, Alaska LNG developer Glenfarne announced that 50 companies had expressed interest in purchasing gas from the project at an estimated total contract value of USD115 billion. Given South Korea’s commitment to achieving net zero emissions by 2050 and the early stage of the Alaska project’s development, questions arise about the suitability of the LNG project for the country.

U.S. LNG imports driven by geopolitical considerations

South Korea began importing LNG from the U.S. in 2017, primarily driven by the U.S. shale gas boom and geopolitical considerations. The country’s LNG imports from the U.S. spiked 70 times year-on-year after the first U.S. export project, Sabine Pass, began operating in 2016. KOGAS signed a long-term contract with Cheniere, the LNG project developer. The South Korean utility imports 3.5 million tonnes per annum (MTPA) of LNG from the project through a 20-year purchase agreement.

Additional reasons for South Korea’s LNG imports from the U.S. included efforts to address the trade deficit, which prompted renegotiations of the Korea-U.S. Free Trade Agreement (FTA). The media and parliament frequently mentioned LNG as a potential remedy to alleviate the trade disparity and FTA cancellation risks by the U.S.

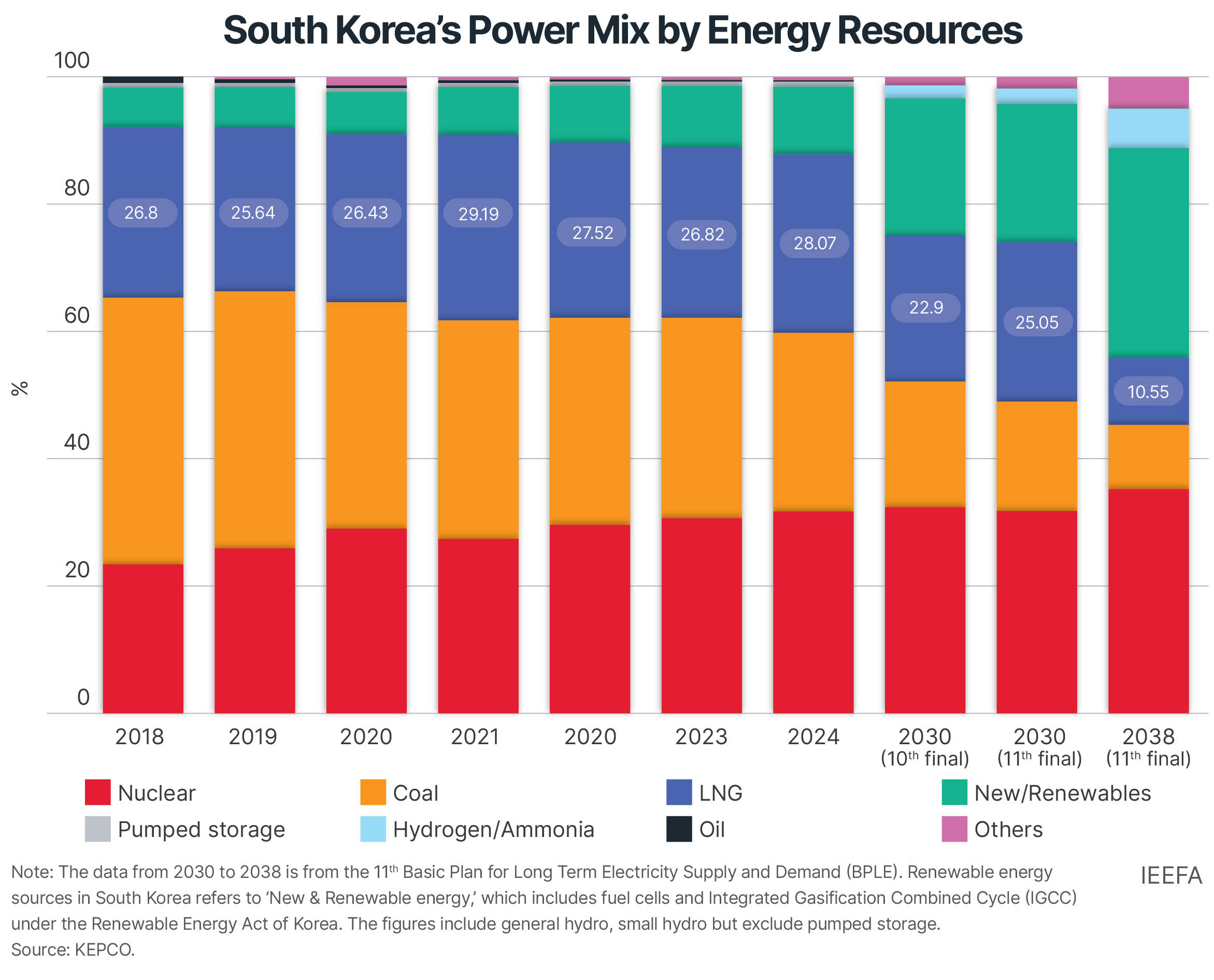

At the G20 Summit in 2017, South Korea’s administration announced its 'Coal and Nuclear-free Economy' policy, recognizing LNG as a form of ‘green energy’ and a key component of its energy transition strategy. In December of that year, MOTIE increased the targeted share of LNG in the power mix from 16.9% to 18.8% by 2030.

By the end of the year, South Korean imports of U.S. LNG more than doubled year-on-year, coinciding with the start of the Korea-U.S. FTA renegotiation.

In December 2020, the targeted share of LNG in the country’s power mix increased to 23.3% by 2030, and U.S. LNG imports hit a historic high in 2021.

Financial consequences of additional LNG imports

South Korea needs to carefully consider its energy sourcing strategy, given the potential impact LNG purchases could have on the economy. Currently, U.S. LNG purchases are being considered as an option for tariff negotiation to address the trade imbalance between South Korea and the U.S. In 2024, that deficit was USD66 billion.

As of 01 May 2025, the LNG spot market price was around USD10.50per million British thermal units (MMBtu). South Korea would need to purchase an estimated 121 million tonnes (Mt) of LNG annually to close the trade deficit. In 2024, the country imported46.3Mt of LNG, with only 5.6Mt coming from the U.S. The U.S. exported only 88Mt of LNG in 2024 to over a dozen countries. It does not produce enough LNG to close South Korea’s trade deficit or meet the requirements of multiple trading partners simultaneously.

Most South Korean LNG imports are secured through existing long-term contracts. In 2024, around 18% of the country’s imports came from the short-term or spot market, suggesting some potential for converting spot purchases into longer-term contracted purchases. This could allow for an additional small percentage of long-term imports from U.S. sellers.

However, South Korea should maintain flexibility in its purchasing portfolio to account for LNG consumption changes, as demand depends on economic fluctuations and weather patterns. The country’s demand for LNG is declining. It fell 5% in 2023 and is projected to decrease 20% through 2030. LNG is the most expensive imported fuel, as demonstrated during the Russia-Ukraine war, providing a natural price signal that has triggered reductions in demand. The South Korean economy and its electric power sector may struggle to bear the additional LNG costs.

Energy security affected by disrupted LNG supplies

South Korea’s U.S. LNG import has faced challenges. The U.S. Freeport export facility, one of South Korea’s primary suppliers, experienced frequent outages starting in 2022, lasting more than a year. This undermined energy security during the Russia-Ukraine war when stable LNG supplies were crucial amid global disruptions.

In 2022, South Korea's U.S. LNG imports plummeted by 31.84% year-on-year due to outages at the Freeport facility, which accounts for 17% of total U.S. LNG export capacity.

The disrupted U.S. supply reduced the power output from one of South Korea’s fleet of LNG-fired power plants. For example, SK E&S, an off-taker from the Freeport facility, lowered the operating rates of its LNG-fired power plants from 79% in 2021 to 71% in 2022 due to the supply shortage.

This prompted the company and KOGAS to purchase more expensive spot LNG to compensate for the losses. The U.S. LNG cargoes bought by South Korea were also costly, as prices were 16% higher than cargoes sold to Japan in 2022. These illustrate the potential risks of increasing LNG imports from the U.S.

Uncertain economics of the Alaska LNG project

The Alaska LNG project is one of several proposed export projects in the U.S. However, final investment decisions and commercial partnerships with buyers and financiers are still pending, and the project has experienced delays due to costs, market conditions, and geopolitical shifts.

Despite being proposed nearly two decades ago, the Alaska LNG project is still in its early stages of development. So far, no buyers have signed long-term purchase agreements. For LNG export projects to progress, at least 80% of output should be committed under such contracts to obtain financing.

In 2017, KOGAS signed a memorandum of understanding with the Alaska Gasline Development Corporation (AGDC) to develop the project. However, the state-run gas company stalled its rollout due to economic feasibility and strategic considerations.

LNG’s declining demand and limited role in the energy transition

South Korea’s declining LNG demand and the fuel’s diminishing role in the energy transition are key reasons why U.S. LNG imports should be approached cautiously. South Korea’s LNG imports have been on a downtrend since 2022, when they peaked at a historic high of 46.4MTPA. Despite imports rebounding in 2024 due to stronger industry demand amid lower prices, the downtrend will likely continue amid strengthening decarbonization efforts worldwide.

South Korea’s recently finalized 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) also aims to reduce the share of gas from 28% to 10.55% by 2038 to reach its decarbonization goals by reducing fossil fuel dependency and increasing renewable energy generation in its power mix.

The country’s commitment to achieving net zero carbon emissions by 2050 necessitates recognizing that LNG is a fossil fuel and that its use should decline. While U.S. LNG imports may appear to offer a solution to bridge the trade deficit, declining domestic LNG demand and reduced targets for gas generation in the power mix suggest that increasing LNG imports may not be economically or environmentally viable for South Korea. Any decision to import additional U.S. LNG should be carefully evaluated on longer-term economic considerations rather than trade and geopolitical factors.