Prices, not politics, will shape U.S. LNG flows to Japan going forward

Key Findings

U.S. claims that Japan will start importing U.S. liquefied natural gas (LNG) “immediately” and in “record numbers” mask essential realities. Private companies procure LNG, and political statements cannot change the economic feasibility of LNG flows without addressing underlying economic barriers.

Japan has not followed up on recent political announcements with tangible commercial agreements. Stakeholders continue to avoid investing in the Alaskan LNG project due to high costs, while the CP2 and Rio Grande LNG projects may not yield cargoes until 2028.

The Japanese government is instructing companies to procure LNG consistent with a higher demand scenario. The flexible nature of U.S. LNG contracts, without destination restrictions, may suit Japan’s strategy and allow the resale of surplus cargoes to other countries.

Long shipping distances make the landed cost of U.S. LNG relatively expensive compared to alternatives. Several new policies, including U.S. tariffs on Chinese and steel imports, and evolving market dynamics may exacerbate the U.S. LNG disadvantage, impeding a meaningful increase in LNG flows.

Following the first summit between Japanese Prime Minister Ishiba Shigeru and U.S. President Donald Trump in early February 2025, both leaders announced an intention to increase “exports of U.S. liquefied natural gas (LNG) to Japan in a mutually beneficial manner.” President Trump claimed that Japan would start importing U.S. LNG “immediately” and in “record numbers.”

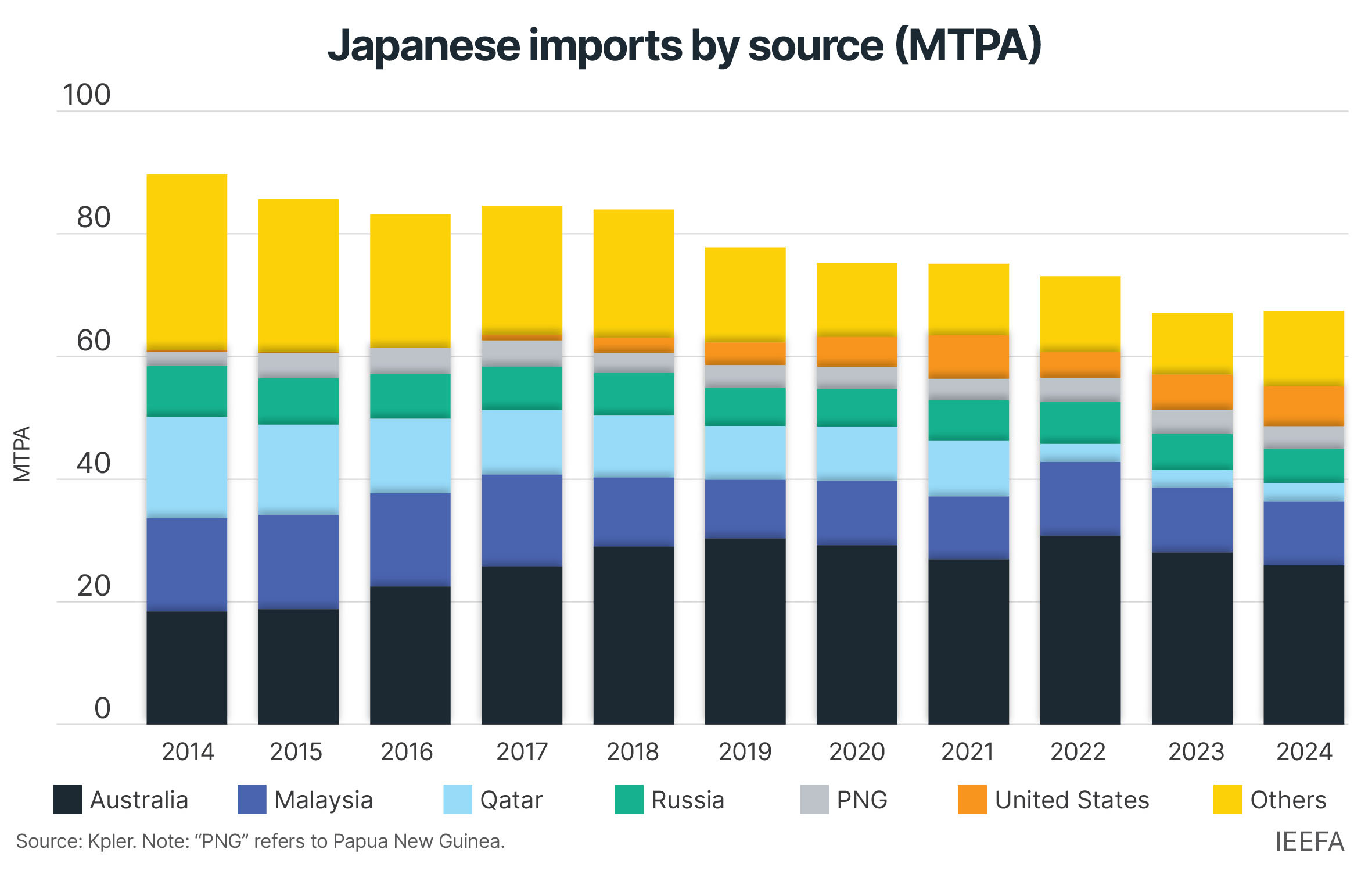

However, these announcements mask important realities about the U.S.-Japan LNG trading relationship that are cause for skepticism. First, recent political announcements have not been accompanied by commercial deals between private LNG buyers and sellers. Second, the economics of key U.S. projects like Alaska LNG remain questionable, and Asian buyers have resisted signing onto the project for years. Third, Japan’s LNG demand has fallen sharply over the past decade, and the country is now reselling more LNG overseas than ever before.

Political statements cannot change the economic feasibility of Alaska LNG

President Trump stated that Japan would form a “joint venture” with the U.S. to support the proposed Alaska LNG project near Anchorage — a US$44 billion facility that also involves the construction of an 800-mile pipeline from the North Slope. However, the Japan Gas Association notes that private companies, not political leaders, procure LNG. Japan’s investment in the project depends on whether private companies see a viable business case.

Yet, the Alaska LNG project has remained in the nascent stages of development for nearly two decades. To date, no buyers have finalized long-term purchase commitments from the facility. LNG export projects typically require 80% or more of their capacity to be covered by these contracts to secure financing.

Japan’s Mitsui Co. is reportedly evaluating the project due to its proximity to Asia but will only consider cost-competitive proposals. The project’s remote location and expensive construction costs for lengthy permafrost-resistant pipes make this unlikely, and potential buyers have expressed strong doubts about its economic feasibility.

When asked recently about the development, Mitsui’s Chief Financial Officer Tetsuya Shigeta replied, “We have nothing we can talk about now, including our policy.” Japan Petroleum Exploration (JAPEX) recently described Alaska LNG as an unrealistic investment proposition.

What about other U.S. LNG export projects?

Other U.S. projects could meet Japanese buyers’ feasibility criteria. However, Japan has not followed up on recent political announcements with tangible commercial agreements.

The most recent sales and purchase agreement between a Japanese and U.S. company was signed in April 2023, when JERA agreed to buy 1 million tonnes per annum (MTPA) from Venture Global’s CP2 project. Japanese companies Inpex and Itochu also signed deals with U.S. companies in late 2022/early 2023 to buy 1 MTPA each of LNG from the planned CP2 and Rio Grande LNG projects, respectively. All these deals are expected to begin in 2028, provided the projects are built according to schedule.

However, since building LNG export facilities takes roughly four years, neither may be completed during President Trump’s second term. Both the CP2 and Rio Grande LNG projects are facing legal delays. Furthermore, Venture Global is reportedly renegotiating its existing contracts with CP2 buyers, aiming to secure higher prices, which could further derail the project.

Why is Japan looking to buy more U.S. LNG?

Japan’s draft strategic energy plan envisions the role of thermal energy (coal, LNG, among others) falling steeply over the next two decades — from nearly 70% of the power mix to between 30-40% by 2040. LNG demand may continue to fall from its peak in 2014, in accordance with climate targets and a large renewables buildout scenario.

However, the government is instructing Japanese companies to procure LNG volumes consistent with a scenario in which climate targets are not achieved, renewables deploy slowly, and electricity demand rises due to end-use electrification and higher consumption from data centers.

Given this uncertainty, the flexible nature typical of U.S. LNG contracts may fit well with Japan’s strategy. Flexible contracts without destination restrictions allow cargo resales to other countries, which Japanese companies have become proficient in as the country’s LNG demand has fallen. In contrast, agreements with other countries like Qatar may come with destination restrictions that prevent resales.

Consequently, due to Japan’s falling LNG demand and need for flexible contracts, deals between Japanese and U.S. companies would not necessarily guarantee increased U.S. LNG inflows.

Will Japan replace its existing suppliers with U.S. LNG?

Some believe that the U.S. can double its exports to Japan and completely displace Russian imports. However, considerable uncertainties could challenge this.

Contracts with Russian suppliers are expiring, but U.S. LNG will have to contend with numerous competitors. This includes Russia, as buyers may re-sign with Sakhalin-2 due to its proximity to Japan. Negotiations are ongoing for more Qatari LNG, but that will depend on the flexibility offered. U.S. LNG only comprises 10% of current Japanese LNG imports because it is relatively expensive due mainly to longer shipping distances.

Several dynamics could exacerbate this disadvantage. Higher borrowing and input costs are increasing U.S. liquefaction fees, prompting suppliers to renegotiate existing contracts at higher rates. Tariffs on China and steel will raise the costs of producing natural gas and constructing liquefaction terminals. Growth in gas exports and domestic demand for powering data centers could increase Henry Hub prices.

While President Trump promotes unleashing American energy, economic trends suggest that certain U.S. projects may become less viable, potentially hindering a meaningful increase in LNG flows to Japan.