Japan’s LNG resales into overseas markets hit record high in FY2023 as domestic demand plummeted

Key Findings

Japanese companies resold a record volume of LNG to overseas markets in FY2023, as domestic demand fell 8% compared to FY2022.

Despite declining demand at home, government policies direct Japanese companies to continue transacting large volumes of LNG. As a result, Japan now resells more LNG abroad than it imports from each of its largest LNG trading partners.

Japanese policymakers often tout the need for more LNG to ensure the country’s own energy security. However, the high volume of LNG resales suggests that the government’s political and financial support for LNG is designed to solidify commercial opportunities and maintain long-term dominance in the fossil fuel trade.

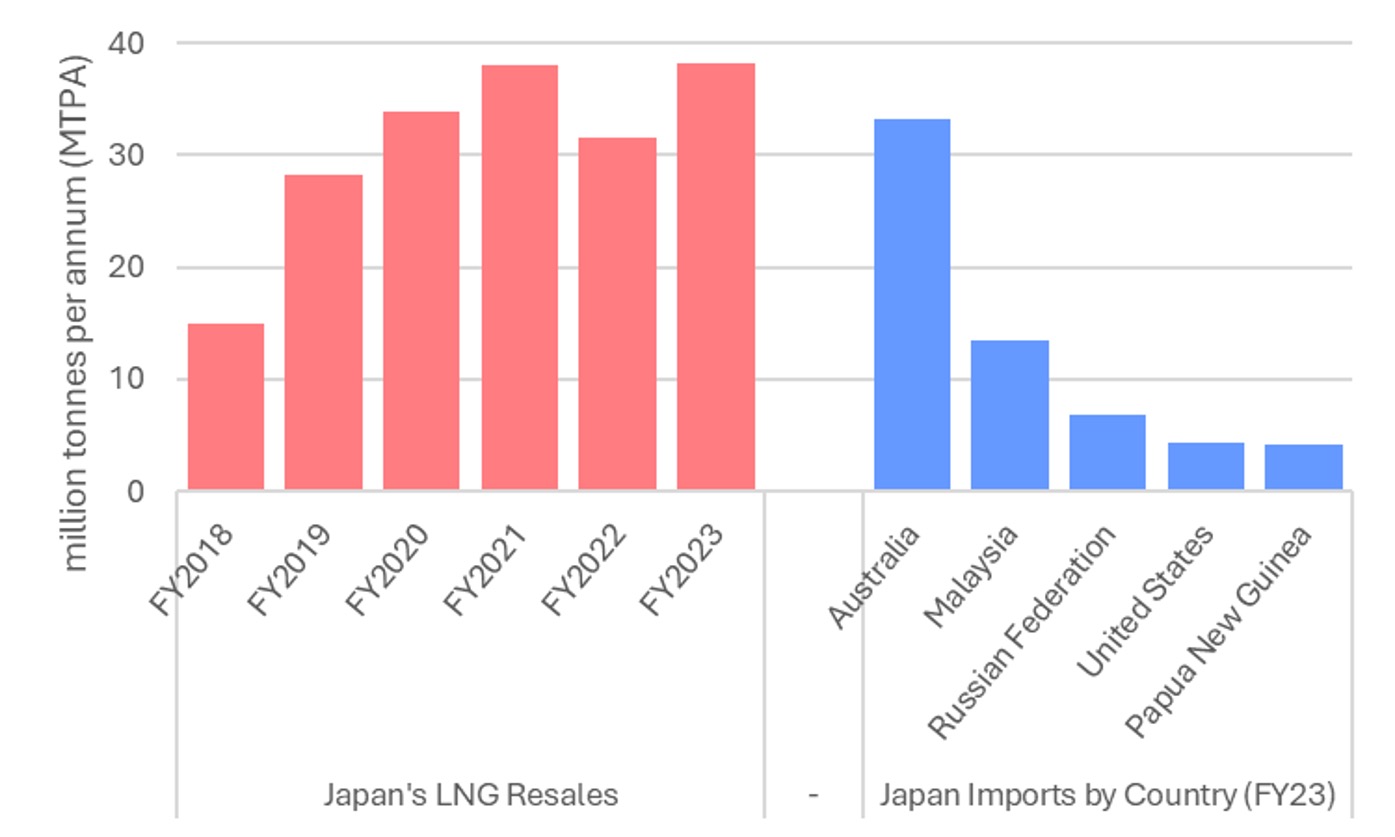

Japanese companies resold a record volume of liquefied natural gas (LNG) to overseas markets in fiscal year 2023, according to a recent survey of 30 companies conducted by the Japan Organization for Metals and Energy Security (JOGMEC). LNG resales reached 38.25 million tons (mt) in the fiscal year, which runs from April to March, surpassing a previous high of 38.11 mt in FY2021.

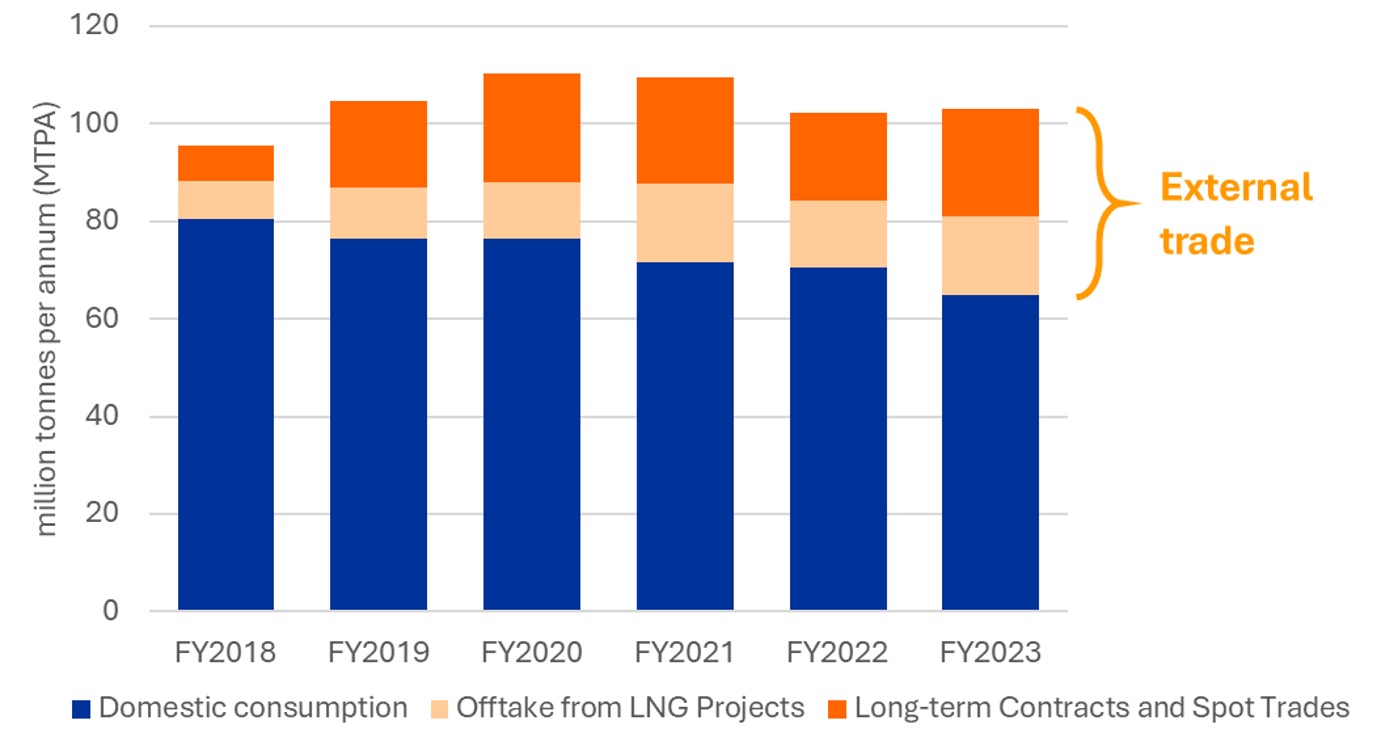

Meanwhile, Japan’s own demand for the fuel fell to 64.89 mt, down 8% from FY2022. The data shows that during FY2023, 37% of the total volumes handled by Japanese companies were resold abroad rather than consumed domestically, up from 16% five years ago.

Until recently, Japan was the world’s largest LNG importer, but declining demand due to nuclear restarts and the country’s planned renewables buildout have pushed the country’s largest LNG companies to resell greater volumes of the fuel overseas. The Institute for Energy Economics and Financial Analysis (IEEFA) published a report in March 2024 detailing these trends, which have significant implications for the global LNG industry.

Although Japan’s own demand is declining, government policies have directed companies to maintain their current level of total LNG transactions and preserve the country’s influence in global markets. The Ministry of Economy, Trade and Industry’s (METI) International Resource Strategy instructs companies to continue handling at least 100 million tonnes per annum (MTPA).

Figure 1: LNG-handling volumes by Japanese companies

Source: JOGMEC; IEEFA.

As a result, total LNG transactions remained relatively flat in FY2023 compared to the previous fiscal year, increasing by just 1%. However, domestic demand fell sharply over the period, so more volumes were resold abroad. Japan’s LNG imports peaked in 2014, and resales have increased 2.5 times since FY2018.

In FY2023, Japan resold more LNG overseas than it imported from each of its largest LNG trading partners, namely Australia, Malaysia, Russia, the United States, and Papua New Guinea. Japan’s resales surpassed the total volume of LNG produced annually in Russia, the world’s fourth-largest LNG exporter in 2023.

Figure 2: Japan’s LNG resales compared to imports from LNG trading partners

Source: JOGMEC; Kpler; IEEFA.

Japan is also the largest public financier of gas and LNG projects around the world, despite a G7 commitment to phase out financial support for overseas fossil fuel projects. Policymakers often claim that overseas investments in LNG infrastructure are needed to maintain the country’s own energy security and have lobbied against potential barriers to LNG in exporting markets.

However, the high volume of LNG resales amidst declining domestic demand suggest that LNG investments are instead designed to shore up commercial opportunities for major Japanese companies. Japan’s largest LNG buyers have repeatedly stated their corporate strategy to send more cargoes into key growth markets like South and Southeast Asia, due to declining demand at home.

In line with this strategy, Japanese companies are supporting LNG infrastructure development along the entire supply chain. Data from IEEFA and Reuters found that Japanese companies are involved in more than 30 different gas and LNG-related projects throughout South Asia, Southeast Asia, and Taiwan. These projects include LNG import terminals, power plants, gas distribution businesses and others.

Meanwhile, Japan’s own LNG demand is expected to continue falling through 2030 based on current energy plans. Although LNG imports to the country through October 2024 are up by 1%, demand fell 25% between 2014 and 2023. IEEFA estimates that imports could fall another 22% to 31% by 2030 under the Sixth Strategic Energy Plan.

That said, some analysts have suggested that the country may need more LNG to meet rising electricity consumption from data centers and electrification in other sectors. These trends may be reflected in the updated Seventh Strategic Energy Plan. A draft of the plan is set for release by the end of the year.

Due to the uncertainty of domestic LNG demand, Japanese buyers increasingly require destination flexibility in long-term LNG purchase contracts. Traditionally, LNG contracts included destination restrictions preventing LNG resales, but the share of Japan’s LNG contracts without these limitations is set to rise to 66% in FY2030, up from 25% in FY2016.

Japanese companies have lobbied the government to support the removal of destination restrictions in new contracts to further unlock LNG resale opportunities. In 2021, Japanese companies allowed 7 MTPA of LNG purchase contracts with Qatar to expire, due partly to strong destination restrictions in Qatari contracts.

JOGMEC’s official survey does not include data on the origin or destination of LNG resales. Ship tracking data, which may underestimate the volume of LNG transactions, indicates that a large share of LNG is being resold from the United States and Australia, likely due to destination-flexible contractual terms. Shipments have largely gone to major LNG importing nations in Asia, including South Korea, China, Taiwan, and India.

Japan’s resales and domestic consumption trends have important implications for global LNG markets, which are currently experiencing an unprecedented buildout of new LNG export capacity. The rapid growth of LNG supply, combined with falling demand in key markets like Japan and Europe, is likely to result in a global LNG glut later this decade.

Amidst this oversupply, Japanese companies reselling LNG are likely to find themselves increasingly in competition with other exporters, putting downward pressure on prices and exacerbating financial risks for LNG traders. In other words, Japan’s efforts to maintain long-term LNG dominance may not pay off.