Long-brewing cash crisis spells chance of rate increases for Puerto Rico ratepayers, while bondholders insist on full debt repayment

Key Findings

The Puerto Rico Energy Bureau opened an investigation into the liquidity crisis facing the electrical system with the possibility of imposing an energy rate increase.

PREPA remains in bankruptcy without enough cash resources.

PREPA’s executive director notified FOMB that PREPA would run out of money to pay retiree pensions in December unless an immediate source of funds could be found.

Puerto Rico’s bondholders are still arguing to the bankruptcy court that Puerto Rico can afford to pay in full the $8.5 billion that triggered the bankruptcy.

The question of increasing rates for Puerto Rico ratepayers is on the docket at the Puerto Rico Energy Bureau. This month the Bureau opened an investigation into the liquidity crisis facing Puerto Rico’s electrical system with the possibility of imposing an emergency rate increase—while PREPA remains in bankruptcy and without enough cash resources.

The investigation was triggered initially by private grid operator LUMA Energy stating in a filing with the Energy Bureau in October that the Puerto Rico Electric Power Authority (PREPA) had failed to fund certain operating accounts for LUMA at even two-thirds of their required amounts.

Failure to fund any of these accounts to at least two-thirds of the required funding level constitutes an event of default under LUMA’s contract and gives LUMA the right to terminate the contract—a right that LUMA has not yet exercised.

PREPA responded that there is little it can do, emphasizing that to straighten the issue out they need to collect more money and receive overdue payments from the U.S. Federal Emergency Management Agency (FEMA). Since LUMA is responsible for these revenue collections, PREPA can do little. The majority of the system is now in private hands.

Also this month, the executive director of PREPA notified Puerto Rico’s Financial Oversight and Management Board (FOMB) that PREPA would run out of money to pay retiree pensions in December unless an immediate source of funds could be found.

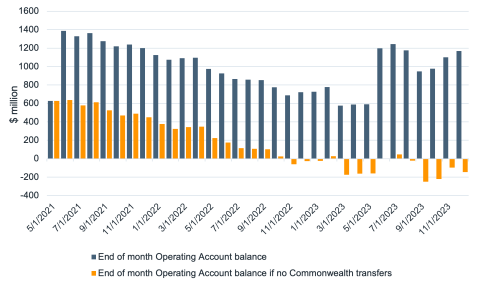

The electrical system’s cash crisis should not come as a surprise. IEEFA has tracked the monthly bank account balances published by the Puerto Rico Fiscal Agency and Financial Advisory Authority (AAFAF), which have consistently shown predominantly negative cash flows for the electrical systems for years.

IEEFA pointed out PREPA’s declining cash flow position in testimony to the bankruptcy court in February and noted that, had it not been for injections of cash from the Commonwealth government in June 2021, June 2023 and December 2023, PREPA would have already run out of cash. Since submitting that testimony, the electrical system has not experienced a single month of positive cash flow during 2024.

Amidst all the issues that demonstrate PREPA’s lack of cash, Puerto Rico’s bondholders are still arguing to the bankruptcy court that Puerto Rico can afford to pay in full the $8.5 billion that triggered the bankruptcy. Judge Swain’s statement in July that the bondholders are “likely delusional” seems all the more pertinent.