Frustration mounts over Puerto Rico bondholder insistence on full repayment of legacy debt

Key Findings

A group of PREPA bondholders are litigating to receive billions of dollars for the full face value of their legacy bond debt.

A federal judge has signaled frustration with the bondholders’ litigation, which could cost Puerto Rico’s electrical system more than it can afford to pay.

Given the dire state of the electrical system and the level of poverty in Puerto Rico, any additional funds raised must prioritize the reconstruction of the electrical system.

An electrical system that is given the time and resources needed to recover and become a going concern could support the island’s economic growth.

A federal judge recently signaled her frustration with a group of Puerto Rico Electric Power Authority (PREPA) bondholders led by GoldenTree who have indicated they’ll continue to litigate to suck far more money from Puerto Rico’s electrical utility than it can afford to pay.

A current debt restructuring plan being considered would pay $2.5 billion of roughly $10 billion owed to creditors. IEEFA submitted testimony criticizing this plan for not adequately taking into consideration the physical condition of the electrical system and the urgent need for billions of dollars of capital investment (not covered by federal funds) and maintenance that would be crowded out by diverting billions of dollars to pay bondholders. IEEFA has also highlighted that after seven years, the utility still has not achieved a balanced budget.

Yet from the other side, a group of PREPA bondholders are insisting on recovering the full face value of the legacy bond debt. They are also asserting an administrative claim of more than $3 billion, which they argued is revenue that PREPA should have set aside for debt service since the bankruptcy case began in 2017. If upheld by the courts, the claim would have to be paid in cash.

Judge Laura Taylor Swain described the creditors—led by New York-based GoldenTree Asset Management and the Bermuda-headquartered Assured Guarantee Corporation—as “expansively aggressive in their attack” and “likely delusional.”

The judge has stated that years of further litigation would represent a failure to show “decency and compassion for the plight of over 3 million people, who are living in often unbearable heat, paying high bills for electrical service that is unacceptably unreliable.”

The judge’s words reflect the unfortunate reality of Puerto Rico’s electrical system, which is in even worse physical condition now—in terms of basic reliability—than it was before Hurricane Maria devastated the grid in 2017. Given this situation, another major hurricane would have similarly deadly consequences for the island.

And things continue to move largely in the wrong direction. Transmission and distribution system reliability metrics are worse today than they were a year ago, according to private grid operator LUMA. The Financial Oversight and Management Board (FOMB) noted last month that there is no capital plan for the electrical system or transparency for the use of federal funds to rebuild the grid. These flaws represent a stunning failure after the board’s own heavy-handed interventions in the electrical system over the last seven years.

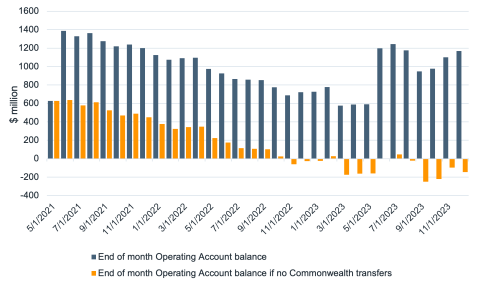

Financially, the system continues to burn through cash. The electrical system was cash flow-negative for 10 of the last 12 months and would have suffered a loss of $750 million over the last year if not for one-time transfers from the commonwealth budget.

Not only does the electrical system not have the money on hand to pay the upfront cash the bondholders are demanding, but it also can’t raise rates to divert billions of additional dollars to bondholders. Given the dire state of the electrical system and the level of poverty in Puerto Rico, additional funds raised must prioritize the reconstruction of the electrical system.

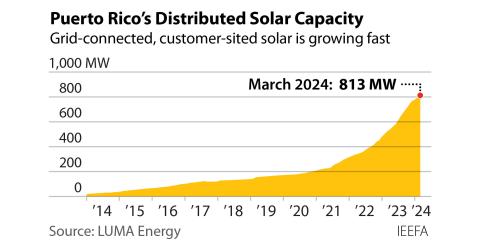

Even if the bondholders win in court, that doesn’t mean they will actually get the money. Raising rates to pay bondholders will result in more pressure to starve the system of funds for necessary maintenance and will drive PREPA’s customer base towards going out of business, going solar, or leaving Puerto Rico. More debt, rapidly declining sales and higher rates for worse service are conditions that will place PREPA at high risk of a second bankruptcy.

On the other hand, an electrical system that is given the time and resources needed to recover and become a going concern could support the island’s economic growth and take on new debt in the future. Swain’s words indicate that she is far more cognizant of what is at stake in this case than the objecting bondholders. The bondholders are pursuing a strategy that could preclude Puerto Rico’s ability to rebuild its electrical system, crippling the island’s economic prospects and resulting in another humanitarian disaster in the next hurricane.