Puerto Rico utility’s annual budget deficits persist after six years of federal oversight

Key Findings

A federal judge is deciding if Puerto Rico will be forced to borrow more than $2.5 billion to cover legacy debt owed by its bankrupt utility.

The debt restructuring proposal being considered is an improvement over previous versions but still would harm island residents.

Even with a reduced amount, the utility isn’t bringing in enough money to pay the debt.

A federal judge is deciding if Puerto Rico will be forced to issue more than $2.5 billion in new bonds to cover legacy debt, hundreds of millions of dollars in fees and possible contingency payments to restructure more than $9 billion in debt owed by the Puerto Rico Electric Power Authority (PREPA). The decision is critically important because of the size of the bonds involved and its potential impact on the pocketbooks of Puerto Ricans. Puerto Rico’s median income is half that of Mississippi which is the poorest state in the United States.

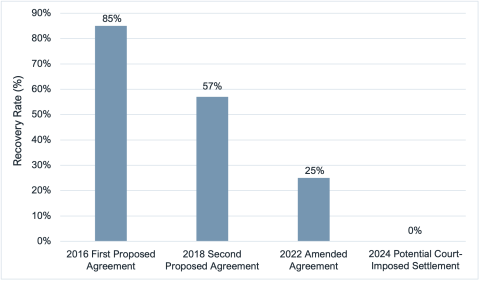

As IEEFA has previously testified to the court, the debt restructuring proposal being considered by U.S. District Court Judge Laura Taylor Swain represents an improvement over previous proposals but is still not aligned with the financial realities of Puerto Rico’s electrical system. In 2016, the bond proposal called for an 85% recovery rate for bondholders. Today, the proposed recovery rate hovers around 25%.

The 25% recovery rate is progress, but only when compared to other proposals. Debt transactions must also demonstrate that bonds can be repaid. Major indicators tell us there is not enough money to pay even this reduced debt level.

Even without any payments on the legacy debt, Puerto Rico’s electrical system currently is not bringing in sufficient revenues to cover expenses, according to a review of monthly operating cash flow statements published by the Puerto Rico Finance Agency and Financial Advisory Authority.

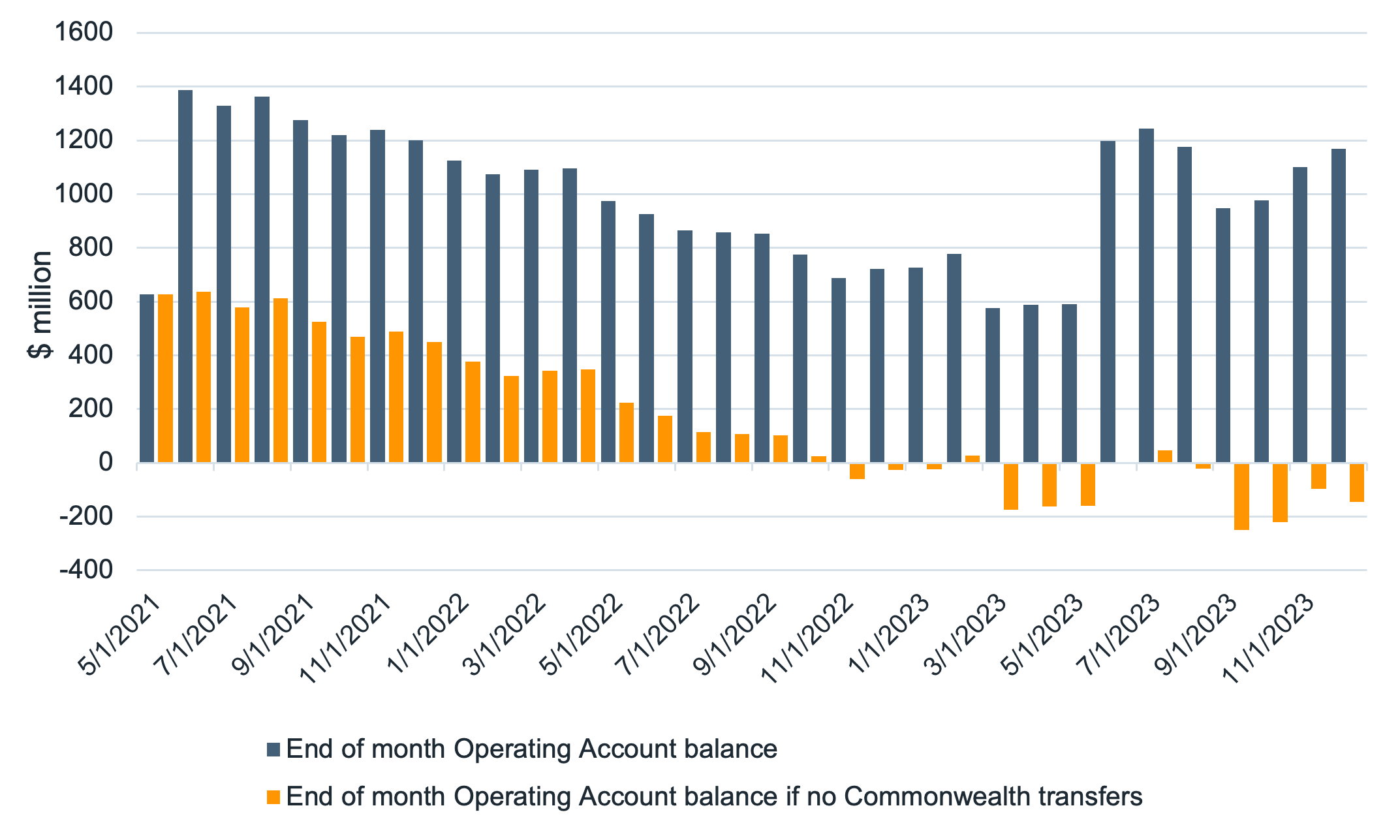

At the end of May 2021, PREPA had $627 million in its operating account. Since then, the commonwealth’s government has made more than $1.3 billion in a series of one-time contributions to PREPA (June 2021, June 2023 and December 2023). Each time the commonwealth cash payments were made, the end of month balance increased before rapidly declining in the following months due to monthly cash shortfalls. As of December 2023, PREPA had almost $1.2 billion in its operating account—less than the total amount contributed by the commonwealth. Without the transfers, PREPA would have suffered a cash loss of $771 million. In other words, it would have run out of cash, as shown by the following graph.

Figure 1: PREPA Operating Account Balance With and Without Commonwealth Transfers

Source: Puerto Rico Finance Agency and Financial Advisory Authority; chart by IEEFA.

The debt restructuring plan plainly states that “PREPA’s fiscal year 2024 budget includes an operating deficit of $130 million that must be funded through its cash.”

The Puerto Rico electrical system’s inability to balance its budget after the 2016 congressional legislation known as PROMESA imposed the Financial Oversight and Management Board (FOMB) should be a major red flag when analyzing financial projections that underlie the 35-year bond deal. Given FOMB’s track record—including the fact that no utility-scale renewable energy has been built since then despite many promises of a rapid transition to renewable energy—the board’s assertions that PREPA will be able to balance its budgets, restore the grid to basic reliability standards and transition to renewable energy with enough revenue left over to repay legacy creditors, strain credulity.

PREPA today is a utility that is unable to provide the basics without debt service. Now is not the time for this kind of bond deal.