EU combined gas and LNG imports fall due to reduced demand

Key Takeaways:

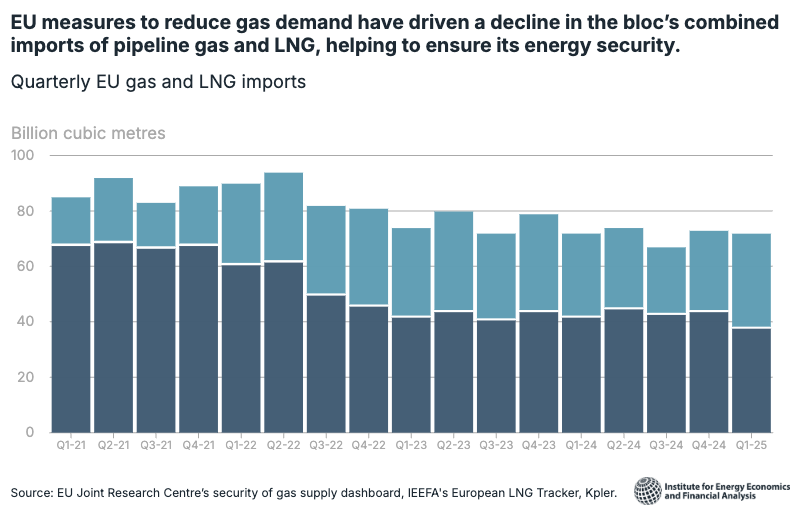

EU efforts to curb gas demand have driven a decline in the bloc’s combined imports of pipeline gas and LNG in recent years.

The EU’s combined gas and LNG imports in the first quarter of 2025 were flat year on year, even though the end of Russian gas transit via Ukraine in January led to increased LNG shipments.

If the EU continues with policies to reduce gas consumption, it could satisfy demand without additional gas infrastructure.

EU imports of Russian pipeline gas via Türkiye grew by 16% year on year in the first quarter of 2025.

30 April 2025 (IEEFA) | EU measures to reduce gas demand have driven a decline in the bloc’s combined imports of pipeline gas and LNG, helping to ensure its energy security, according to a new data tracking tool published today by the Institute for Energy Economics and Financial Analysis (IEEFA).

The EU Gas Flows Tracker shows that between 2021 and 2024, EU countries reduced their combined imports of gas and LNG by 18% thanks to a 20% decrease in gas consumption.

The end of Russian gas transit via Ukraine on 1 January 2025 led to a year-on-year increase in EU LNG imports in the first quarter (Q1) of 2025. However, the bloc’s combined gas and LNG imports were flat year on year in that quarter and 1% less than in the same period of 2023.

“EU countries’ reliance on gas pipeline imports and LNG shipments means they are exposed to geopolitical issues and supply disruptions. However, they have mitigated this dependence by curbing gas consumption, diversifying import sources, shifting gas flows and installing more renewables,” said Ana Maria Jaller-Makarewicz, lead energy analyst, Europe, at IEEFA.

“If the EU continues with policies to cut gas consumption, the bloc could satisfy demand without additional gas infrastructure or increased imports. Investing to accelerate renewable energy and heat pump installations will further boost the EU’s energy security and reduce the impact of volatile gas prices on businesses and households.”

The tracker complements IEEFA’s European LNG Tracker by showing how EU countries’ pipeline gas imports have changed since 2021 and how this has impacted the direction of cross-border gas flows. The page will be updated regularly as new data becomes available.

With the EU due to publish a roadmap on 6 May detailing its strategy to phase out Russian energy by 2027, the tracker highlights the EU’s ongoing reliance on Russian gas.

In 2024, the bloc’s combined imports of Russian gas and LNG grew by 19.5%. And while transit via Ukraine ended in January, EU imports of Russian pipeline gas via Türkiye increased by 16% year on year in Q1 2025.

Nonetheless, the data shows how the EU has gradually progressed in reducing its dependence on Russian imports as the gas and LNG supply landscape has shifted.

In Q1 2025, Norway supplied 30% of the EU’s gas and LNG, followed by the US (25%), Russia (14%) and Algeria (13%).

Press contact

Jules Scully | [email protected] | +447594 920255