European LNG Tracker

Last updated: October 2025

About

IEEFA’s European LNG Tracker is an interactive dataset that visualises Europe’s* LNG infrastructure, capacity, demand and import flows. It is built by compiling data from a range of sources, including Kpler, Gas Infrastructure Europe, Aggregated LNG Storage Inventory, Eurostat, the Digest of UK Energy Statistics and IEEFA analysis.

Note: Using an updated internet browser will help to ensure all graphics on this page display correctly. For any issues, contact us.

Subscribe to receive all the latest updates

To view pipeline gas data, access the EU Gas Flows Tracker.

* For this project, "Europe" refers to the 27 Member States of the EU (EU27), the UK, Norway and Türkiye.

Key Findings

Europe’s slowing LNG buildout reflects demand uncertainty

Europe’s gas consumption has increased this year because of cold weather and low renewable power generation. However, IEEFA forecasts that Europe’s gas consumption will continue declining from next year and fall by 15% between 2025 and 2030.

The uncertainty over Europe’s future gas demand may be reflected in the slowdown in the continent’s LNG terminal buildout.

Europe’s regasification capacity increased by 21.5 billion cubic metres (bcm) in 2022 and a record 35.2bcm in 2023. In 2024, the expansion in capacity fell to 24.1bcm.

So far this year, Europe has commissioned two LNG terminals and expanded two. One terminal ended operations and another was transferred from Germany to Jordan due to commissioning delays. In October, a court in France ordered that a floating storage and regasification unit (FSRU) in the country be closed as it had not been receiving deliveries. One more terminal is expected to be expanded by the end of the year. This means Europe’s LNG regasification capacity will increase by 5.7bcm in 2025, less than a quarter of the growth recorded in 2024.

EU policies help deliver energy security

The EU launched its REPowerEU proposal in May 2022 to end its dependency on Russian fossil fuels by 2027. The plan aims to help the EU save energy, diversify energy supplies and accelerate the rollout of renewables. The EU expressed these commitments again in a roadmap published in May 2025. In June 2025, the EU Commission proposed a plan to gradually and effectively stop the import of Russian gas and oil into the EU by the end of 2027.

In October 2025, the EU adopted sanctions against Russia that include a ban on imports of Russian LNG from 1 January 2027 for long-term contracts and within six months as of the entry into force of the sanctions for short-term contracts.

In the first half (H1) of 2025, Russia supplied 16% of the EU’s LNG imports and 13% of its total gas imports (combining both LNG and pipeline flows).

In the three years since the REPowerEU proposal, the EU has installed 10 floating storage and regasification units (FSRUs) and has expanded seven LNG terminals.

Parallel to this, EU Member States agreed to European Commission proposals to voluntarily reduce gas use. This led the bloc to decrease its gas consumption by 20% between 2021 and 2023. EU gas consumption increased by 4% year on year in H1 2025.

Between 2021 and 2023, the UK and Türkiye’s gas consumption fell by 18% and 16%, respectively.

Britain’s gas demand this winter will be 3% lower than last winter, mainly due to reduced power sector demand, according to gas transmission system owner National Gas. It expects that Britain’s gas demand for power will fall by 18% this winter as renewable energy output increases.

.

Existing and planned LNG infrastructure

Since the beginning of 2022, Europe’s LNG regasification capacity has increased by 32% to 338.9bcm. The installation of 11 FRSUs (10 of them in the EU) accounts for 62.3bcm of new capacity, while the expansion of existing terminals accounts for 20.7bcm.

Between January and October 2025, Europe increased its LNG regasification capacity by 5.4bcm. The 1.9bcm Excelerate Excelsior FSRU at Germany’s Wilhelmshaven 2 terminal and the 5bcm FSRU BW Singapore at Ravenna in Italy both started operating. Terminal expansions took place at Belgium’s Zeebrugge (adding 1.8bcm) and the LNG Croatia FSRU at Krk in Croatia (adding 3.2bcm). The 6.5bcm Energos Power FSRU ended operations at Germany’s Mukran port and was sent to Egypt.

By the end of 2025, Europe’s regasification capacity is expected to increase by a further 0.3bcm as an expansion of the UK’s Isle of Grain terminal is partly offset by the planned closure of the FSRU at France’s Le Havre port.

Albania

The Vlora LNG terminal is stalled. There have been no recent announcements about the project.

Croatia

The capacity of the FSRU at the Krk terminal in Croatia increased from 2.9bcm to 6.1bcm this year. The vessel operator said it completed the expansion in October.

Cyprus

The 2.4bcm Vasiliko terminal is still stalled.

Estonia

Gas Infrastructure Europe said the Paldiski terminal in Estonia will start operations in 2025. But there have been no recent updates about the project.

France

In France, an FSRU in the port of Le Havre is idle because of high operational costs. The unit was commissioned in 2023 and received its last cargo in June 2024. In October, a court in France ordered TotalEnergies to decommission the FSRU.

Germany

Energos Power FSRU started operating at Germany’s Mukran port in 2024. But in February 2025, terminal operator Deutsche ReGas announced that it had ended a contract with Germany’s government for the vessel. Deutsche ReGas said one of the reasons it terminated the contract was because state-owned Deutsche Energy Terminal marketed its capacities for regulated LNG terminals at prices significantly below the cost-covering fees approved by Germany’s energy regulator. Energos Power FSRU has since moved to Egypt.

Deutsche Energy Terminal expected the Energos Force FSRU to start operations in 2024 at the Stade terminal. However, following delays to the facility’s commissioning, the FSRU was sublet to Jordan earlier this year.

Deutsche Energy Terminal said in December 2024 that the Wilhelmshaven 1 FSRU would stop operations for several months at the beginning of 2025 because capacities had not been marketed.

Nonetheless, Deutsche Energy Terminal’s second terminal in Wilhelmshaven started operations in August 2025. Using the Excelerate Excelsior FSRU, the terminal can feed up to 1.9bcm of gas into the German grid in 2025. Its capacity is expected to rise to 4.6bcm in 2026 and 2027.

Greece

In Greece, the Alexandroupolis FSRU terminal started operations in the fourth quarter of 2024. Operations were suspended in January 2025 because of a technical issue. This meant the terminal had a utilisation rate of 2% in H1 2025. Terminal operator Gastrade said regasification services resumed in August 2025 but at a reduced capacity.

In January 2025, Dioriga Gas FSRU in Corinth received approval to begin operations in 2026.

In May 2025, Mediterranean Gas reportedly announced that its 5.2bcm Argo FSRU project in Volos is scheduled to commence operations in July 2027. It will deliver gas to Greece and neighbouring countries.

Greek company Elpedison is progressing with plans to install an FSRU in the port of Thessaloniki by 2029.

If all proposed projects go ahead, Greece’s LNG regasification capacity will increase from 12.5bcm in 2025 to 27.5bcm in 2030.

Ireland

Authorities will not decide on the planning application for Shannon LNG, a proposed terminal in Ireland, until 2026.

The Mag Mel FSRU is stalled.

Italy

In Italy, the Ravenna terminal began operations in the second quarter of 2025. Using the FSRU BW Singapore, the terminal received its first commercial cargo on 11 June 2025.

The proposed Porto Empedocle LNG terminal in Sicily has not been confirmed.

Latvia

In 2023, Latvia’s Skulte terminal lost support from the country’s government because it deemed it no longer necessary.

Lithuania

It is unclear whether a planned expansion of the Klaipėda (Independence FSRU) terminal will go ahead.

Poland

In Poland, construction started earlier this year on the Gdańsk terminal. It will feature an FSRU and is scheduled for commissioning in early 2028.

In 2023, terminal operator Gaz-System shelved plans for a second FSRU at Gdańsk due to a lack of interest. Gaz-System announced plans to revive the project in September 2025.

The Netherlands

The companies behind Zeeland Energy Terminal, a proposed LNG terminal in the Netherlands that will feature an FSRU, said they expect it to start operations in 2028 or 2029.

UK

In August 2025, British Gas owner Centrica and US-based investor Energy Capital Partners announced the acquisition of the UK’s Isle of Grain LNG terminal for an enterprise value of £1.5 billion. Grain is Europe’s largest LNG terminal. Centrica said Grain is currently undergoing an expansion that will increase its regasification capacity from 21.7bcm to 27bcm and its storage capacity by 20% to 1.2 million cubic metres.

Teesside Gasport terminal was decommissioned in 2015.

.

.

.

Gas consumption and LNG outlook

The EU’s adoption of the REPowerEU plan to reduce its dependency on Russian gas imports has accelerated the rollout of renewables, saved energy and boosted energy efficiency. The EU enhanced its energy security by reducing gas demand by more than 20% between 2021 and 2024.

Europe’s gas consumption increased by 6% year on year in H1 2025, while the EU’s grew by 4%.

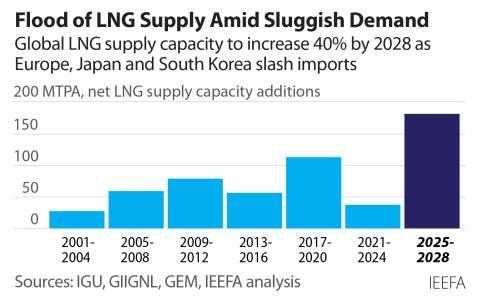

Following a rise in LNG imports in 2025, IEEFA expects Europe’s demand for the fuel to continue declining in the coming years as gas consumption falls. Between 2025 and 2030, IEEFA expects Europe’s LNG imports to drop by 20% to 134bcm and the EU’s LNG imports to drop by 19% to 110bcm.

As new LNG import projects come online and gas consumption continues falling, IEEFA forecasts that Europe’s 2030 regasification capacity will be more than three times its 2030 LNG demand.

The average utilisation rate of the EU’s LNG import terminals in H1 2025 was 52%. Six terminals had utilisation rates below 20%.

The EU countries with the lowest LNG terminal utilisation rates in H1 2025 were Finland (17%), Greece (19%), Spain (29%) and Germany (32%). Finland, Greece and Germany have all installed new terminals since the beginning of 2022.

Five of Spain’s seven LNG terminals had utilisation rates below 35% in H1 2025.

France’s Le Havre FRSU was idle in H1 2025. Greece’s Alexandroupolis FSRU had a very low utilisation rate of 2%.

.

.

LNG import volumes

Europe has increased its reliance on LNG imports this year after Russian gas pipeline flows via Ukraine ended on 1 January.

While Europe’s LNG imports rose by 24% year on year in H1 2025, they were at a similar level in H1 2023. EU LNG imports increased by 21% year on year in H1 2025.

Europe’s largest LNG importers are France, Spain, the Netherlands, Italy, Türkiye, the UK and Belgium.

In H1 2025, Europe’s LNG imports from the US, Russia, Nigeria and Angola increased year on year. Conversely, imports from Qatar, Algeria, Trinidad and Tobago, Norway and Peru fell.

In terms of combined pipeline gas and LNG imports in H1 2025, EU countries sourced 29% from Norway, 27% from the US, 13% from Russia and 12% from Algeria.

European LNG re-exports to other European countries decreased by 50% year on year in H1 2025. Half of the re-exports were from Spain. The rest were from Belgium, the Netherlands and Greece.

.

.

.

.

.

US dominates supply

The US has reinforced its position as Europe’s main supplier of LNG. European imports of US LNG rose by 46% year on year in H1 2025, as they reached a record high for any-half year period. This meant the country accounted for 57% of the continent’s LNG imports.

Fourteen European countries imported US LNG in 2025. France, the Netherlands, the UK, Spain and Türkiye were the largest European importers of US LNG in that period.

Eleven European countries sourced more than 50% of their LNG imports from the US in H1 2025. Three countries sourced more than 80% of their LNG imports from the country: Germany (94%), Greece (84%) and Finland (81%).

More than a quarter (27%) of Europe’s imports of US LNG in H1 2025 were from the Sabine Pass liquefaction plant in Louisiana.

.

.

Europe's reliance on Russian LNG

Russia is Europe’s second-largest LNG supplier, accounting for around 13% of the continent’s imports of the fuel in H1 2025.

Europe’s imports of Russian LNG increased by 2% year on year in H1 2025, meaning they reached a record high for any half-year period.

While the EU plans to end imports of Russian fossil fuels by the end of 2027, the bloc’s imports of Russian LNG rose by 7% year on year in H1 2025.

France accounted for 41% of Europe’s imports of Russian LNG in H1 2025, followed by Belgium (28%), Spain (20%), the Netherlands (9%) and Portugal (2%).

Belgium’s Zeebrugge imported more Russian LNG than any other European terminal in H1 2025, followed by Dunkerque and Montoir-de-Bretagne in France.

The EU, UK and US have implemented numerous sanctions targeting Russia’s LNG sector, including export terminals and tankers.

The EU’s ban on reloading services of Russian LNG in EU territory for the purpose of transshipment operations to third countries took effect in March 2025.

Contracts

Yamal LNG

Novatek

Novatek is Russia's largest independent gas producer. The company owns a majority stake in major Russian LNG projects like Arctic LNG 2 (60% ownership) and Yamal LNG (50.1% ownership). It also owns its own gas fields, such as Yurkharovskoye, and holds licenses for fields in the Yamal Peninsula.

.

.

.

.

EU27 spending on LNG

EU countries spent about €258 billion on LNG imports from the beginning of 2022 to June 2025. Of this, €117.4 billion came from the US, €37.5 billion from Russia and €34.4 billion from Qatar.

From the beginning of 2022 to June 2025, EU countries spent about €120 billion on pipeline gas and LNG imports from Russia.

Average price of LNG paid by EU Member States

The average prices EU Member States paid for LNG in H1 2025 were similar to those in 2021.

.

.