Strains in Australian met coal supply heighten energy security risks for India, which depends on imports for 90% of its needs

India, the world’s key market for steel demand growth, is expanding steelmaking capacity primarily through blast furnace-basic oxygen furnace (BF-BOF) technology, which relies on met coal

Key Takeaways:

India has taken steps to strengthen its energy security, but more action is needed to avoid the risks clouding its fast-expanding steel sector. The country still relies on imports, primarily from Australia, for about 90% of its metallurgical (met) coal needs.

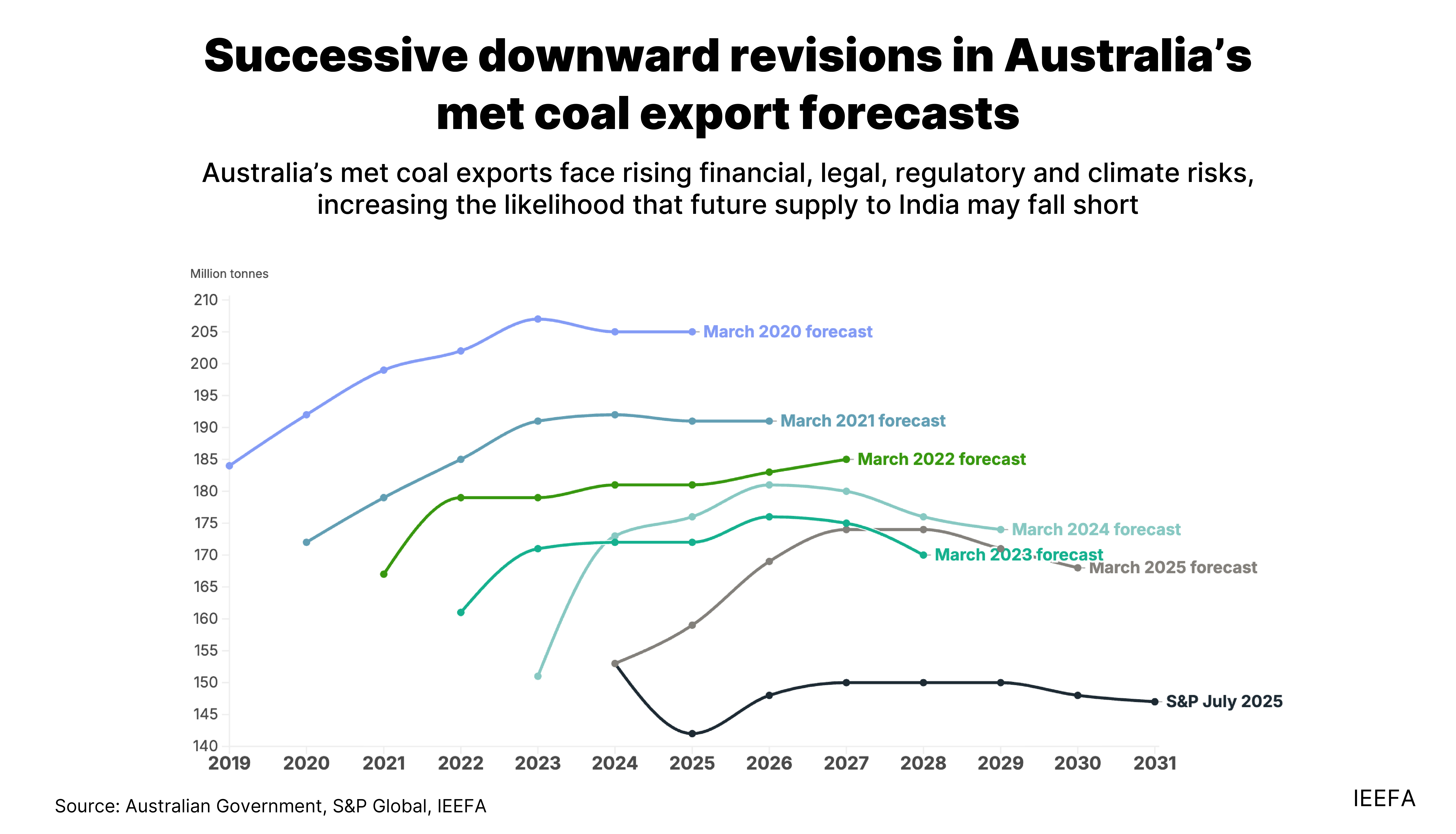

Australia is by far the largest met coal exporter globally. However, its long-term production is increasingly at risk from financial, legal, regulatory and climate risks, increasing the likelihood that future met coal supply from the country may fall short for India.

If India’s continued blast furnace capacity expansion keeps met coal demand high, a global shortfall could drive significant and structural price increases given the risks associated with developing new supply.

Green hydrogen and scrap steel will become strategic, domestic resources that can reduce energy and materials security risk in India’s steel sector. Actions to further accelerate their long-term availability should begin now.

4 December 2025 (IEEFA): The Indian government and steelmakers have begun reducing reliance on Australian metallurgical (met) coal, but India needs to go further to prevent India’s steel sector from being weighed down by long-term energy security challenges, states a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

India aims to reach a crude steel production capacity of 300 million tonnes per annum (mtpa) by 2030. Much of this growth is driven by the blast furnace (BF) technology that uses met coal. As a result, the Indian steel sector depends heavily on imported met coal since domestic met coal does not meet quality requirements due to its high ash and sulphur content. India currently imports around 90% of its met coal, primarily from Australia.

However, concerns are mounting over the reliability of the future supply from Australia, the world’s largest exporter of met coal. The sector faces a series of risks that could leave Indian steelmakers exposed to supply shortfalls. These include over-optimistic met coal export forecasts by the Australian government; slowing mine development; rising financial, legal and regulatory constraints; escalating mining costs; and price volatility driven by climate impacts.

If India continues to develop blast furnaces requiring much more met coal, a supply shortfall could drive significant and structural price increases given the risks associated with developing new supply. The country now faces the urgent need to accelerate the move to alternative steelmaking technologies.

“Key risks include growing concern about the methane emissions associated with Australian met coal mining and legal challenges. Coal mine capacity expansions are now being successfully challenged in Australian courts on climate and emissions grounds,” says Simon Nicholas, Lead Analyst, Global Steel at IEEFA and co-author of the report.

“India has a 2070 net-zero emissions target, but is reliant on met coal imports from a country that has a 2050 target and will need to take emissions reduction actions sooner. During COP30 in November 2025, Australia was among the dozens of countries that signed the Belém Declaration which calls for a quick and just transition away from oil, gas and coal,” adds Nicholas.

The report examines long-standing concerns over future coking coal supply, including rising mining costs, companies opting to acquire existing operations rather than opening new mines, the growing challenge of methane emissions, and the withdrawal of finance for greenfield met coal projects by Australian banks. It then recommends ways in which India can accelerate its shift towards steelmaking technologies that do not rely on met coal.

“The combination of scrap-based electric arc furnaces (EAF) expansion, green hydrogen-based steelmaking, and policy incentives for low-carbon technologies could gradually reduce India’s reliance on imported met coal. In doing so, India would not only enhance its energy security but also strengthen its competitiveness in global low-carbon steel markets,” says Saumya Nautiyal, Energy Finance Analyst, Steel at IEEFA and the co-author of the report.

India looks like it can become one of the most cost-competitive producers of green hydrogen. But the focus should be on domestic use of green hydrogen in key industries like steelmaking, rather than export.

These shifts represent the next stage of India’s energy and industrial transition.

Read the briefing note: India’s steel sector confronts growing coal risks

Media Contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Simon Nicholas ([email protected]), Saumya Nautiyal ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)