Only 2.8% of target capacity delivered yet under India’s battery manufacturing incentive scheme

The Advanced Chemistry Cell Production Linked Incentive scheme is yet to unlock the country's battery manufacturing potential.

Key Takeaways:

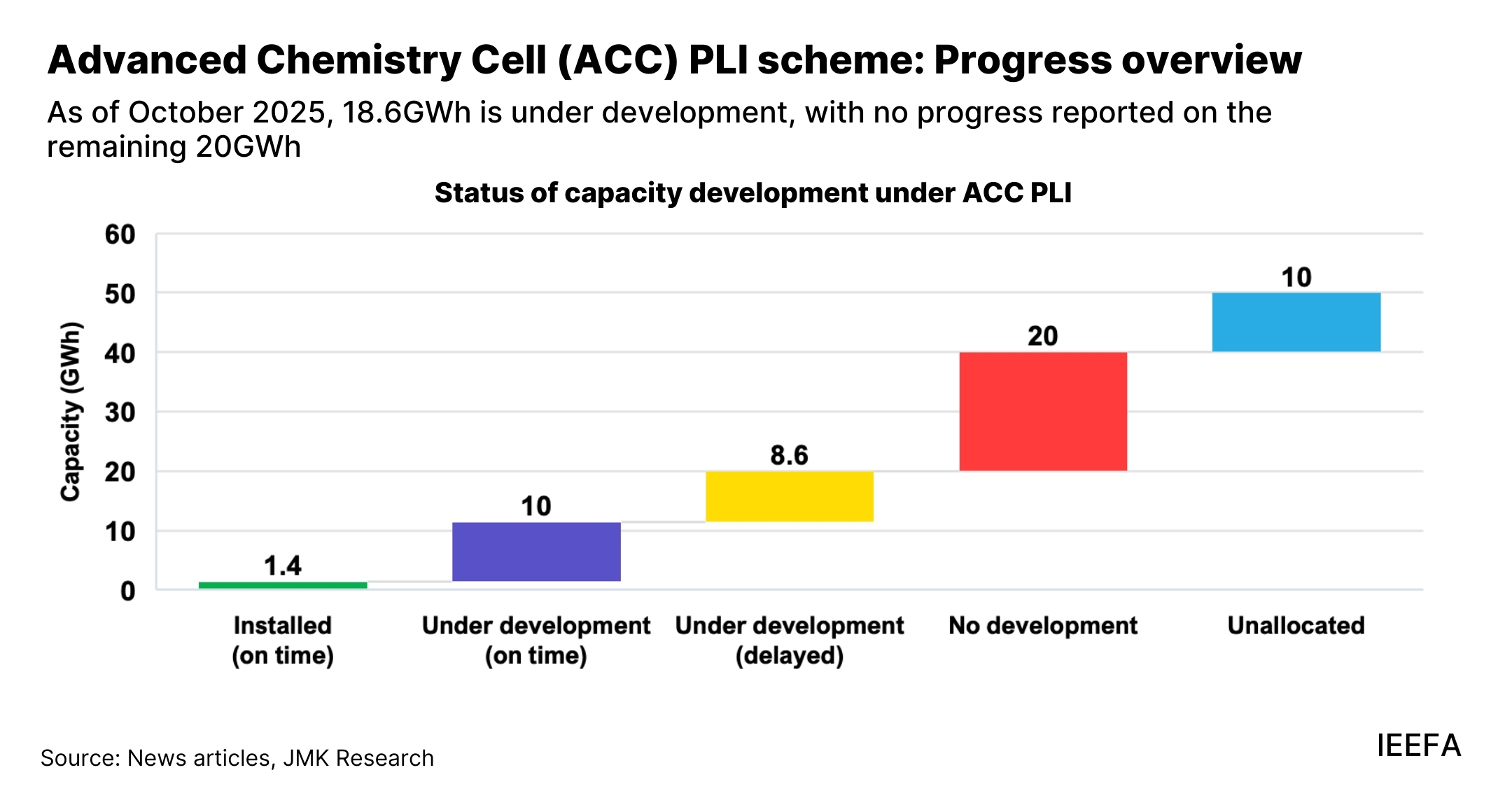

Despite strong industry interest, India’s Advanced Chemistry Cell Production Linked Incentive (ACC PLI) scheme, launched in October 2021, is yet to translate policy ambition into realised capacity. As of October 2025, only 2.8% (1.4GWh) of the targeted 50GWh capacity has been commissioned within the stipulated timeline, entirely by Ola Electric.

Of the 40GWh allocated so far under ACC PLI, Reliance New Energy is the only beneficiary that has indicated commissioning its second-round award capacity (10GWh) on time. Ola Electric plans to commission 5GWh of its 20GWh by March 2026. However, Ola’s decision to limit its capacity to 5GWh until FY2029 dilutes the commitments the scheme envisions.

Beneficiaries have faced significant supply chain and implementation bottlenecks, such as the stringent domestic value addition (DVA) requirements, an aggressive two-year installation timeline, and visa approval delays for Chinese technical specialists needed for equipment installation, leading to delays in commissioning capacity.

India needs a dedicated scheme for critical minerals, covering both sourcing and refining, alongside one for cell components. In addition, tariff measures such as basic customs duty (BCD) and anti-dumping duties will be essential for the cell manufacturing industry to achieve the intended outcomes of ACC PLI.

22 January 2026 (IEEFA South Asia and JMK Research): India launched the Advanced Chemistry Cell Production Linked Incentive (ACC PLI) scheme in October 2021 to build domestic battery manufacturing capacity and reduce India’s reliance on imported lithium-ion cells, primarily from China. With an outlay of INR181 billion (USD2.08 billion), the scheme aimed to establish 50 gigawatt hours (GWh) of advanced battery cell manufacturing capacity in India by 2025. However, as of October 2025, only 2.8% (1.4GWh) of the targeted capacity has been commissioned within the stipulated timeline—all by Ola Electric—shows a new report by JMK Research, and the Institute for Energy Economics and Financial Analysis (IEEFA).

The report, ‘Assessing India’s incentive scheme to enhance the battery manufacturing ecosystem’, provides in-depth analysis of the scheme, its beneficiaries, and progress to date. It identifies key bottlenecks and suggests measures to improve the scheme’s effectiveness.

There is a substantial gap between the intended and actual outcomes of the ACC PLI scheme. Against an estimated 1.03 million jobs, it has generated only 1,118 jobs (0.12% of the target). Investment levels have also lagged, with around INR28.7 billion (USD330 million) committed so far, accounting for 25.58% of the targeted INR112.5 billion (USD1.29 billion).

“Although strong policy support led to substantial investment announcements and capacity plans outside the ACC PLI scheme, on-ground progress remained sluggish. For beneficiaries, the Centre has imposed a penalty of 0.1% of the performance security for each day of delay in commissioning. Moreover, with India’s dependence on imported battery cells still close to 100%, the scheme’s original objectives remain largely unfulfilled,” says Prabhakar Sharma, senior consultant, JMK Research, and a co-author of the report.

While the ACC PLI tenders attracted overwhelming interest, capacity allocation remains incomplete. The MHI initially allocated the full 50GWh in the first auction held in March 2022, but Hyundai Global Motors’ withdrawal from its 20GWh allocation prompted a second auction. In the September 2024 round, bidders secured only 10GWh. The government plans to tender the remaining 10GWh at a later stage.

As of October 2025, no incentives have been disbursed against the targeted INR29 billion (USD332 million). Reliance New Energy has indicated on-time commissioning of the capacity awarded under the second auction round (10GWh), while capacity allocated in the first auction round (5GWh) remains delayed. Ola Electric has scaled back its expansion plans and now aims to install only 5GWh of its 20GWh capacity by FY2029.

The report also highlights gaps in the scheme’s evaluation framework. Among all bidders across both auction rounds, only Exide Industries and Amara Raja had prior experience in battery manufacturing, yet neither qualified. The evaluation criteria placed greater emphasis on domestic value addition (DVA), proposed capacity, and subsidy benchmarks, where new entrants scored higher, resulting in the selection of firms without prior expertise.

“Going forward, improving the effectiveness of ACC PLI will require a holistic, multi-pronged strategy. This would include introducing robust cell testing and certification infrastructure; scaling up equipment manufacturing, and recycling; and developing skilled domestic talent, among other things,” says the report’s co-author Saif Jahangir, consultant, JMK Research and Analytics.

Moreover, a dedicated policy for critical minerals, covering both sourcing and refining,will be crucial.

“It is equally important to assess how India can attract global battery players to establish manufacturing facilities in the country. The government designed the scheme to encourage both domestic and international participation and bringing established global players into the ecosystem would strengthen capabilities, accelerate technology transfer, and help steer the industry in the right direction,” says Vibhuti Garg, Director – South Asia, IEEFA.

Read the report: Assessing India’s incentive scheme to enhance the battery manufacturing ecosystem

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contact: Prabhakar Sharma ([email protected]); Saif Jahangir ([email protected]), Vibhuti Garg ([email protected]); Jyoti Gulia ([email protected]), Charith Konda ([email protected]); Dhruv Garg ([email protected]).

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. (www.jmkresearch.com)