Production Linked Incentive scheme drives robust growth in India’s solar manufacturing sector

However, much of the progress will depend on sustained policy coherence, capital mobilisation and upstream integration

Key Takeaways:

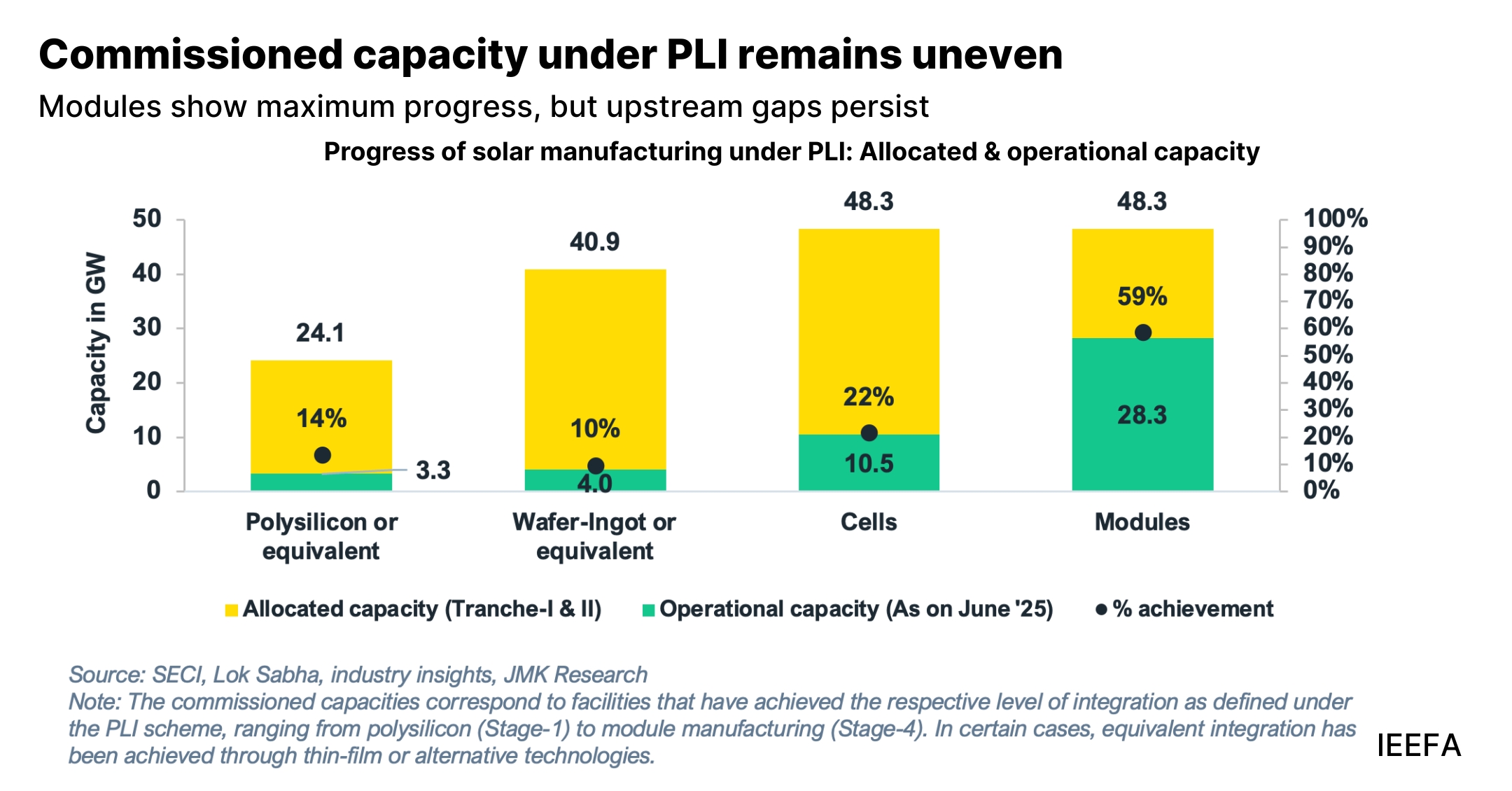

Launched in 2021, the Production Linked Incentive (PLI) scheme for high-efficiency solar modules has attracted strong industry interest and revived investor confidence in domestic solar manufacturing. However, capacity additions remain below targets, with only 56% of module and 14% of polysilicon capacity achieved as of June 2025.

In June 2025, India’s PV capacity reached 3.3 gigawatts (GW) polysilicon, 5.3GW wafer, 29GW cell, and 120GW module, with the PLI scheme driving all upstream capacity.

Future iterations of PLI must adopt a comprehensive manufacturing-linked framework that integrates fiscal support, upfront capital subsidies, ancillary development and longer policy tenures.

The PLI scheme has reinforced the government’s push for self-sufficiency, spurring an upsurge in domestic module capacity and investment inflow into the sector. At the same time, its full potential is yet to be realised due to delays in upstream integration, policy uncertainties, technical constraints, and volatility in global raw material prices.

9 December 2025 (JMK Research and IEEFA South Asia): A new report from JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA) notes that while the solar PLI scheme has helped lay the groundwork for domestic PV manufacturing, it continues to face significant operational and policy challenges.

“The scheme channels government support towards measurable industrial output, helping build durable, long-term manufacturing capacity,” says Vibhuti Garg, Director, IEEFA South Asia, and a contributing author of the report.

According to the report, India’s solar manufacturing capacity has expanded significantly since 2022, with current operational capacity reaching 120GW for modules and 29.3GW for cells (as of June 2025). Post-2022 capacity additions totalled 82GW in modules and 22.7GW in cells, representing a 216% and 344% increase, respectively, from 2022 levels.

Whatever limited polysilicon and wafer capacities exist in India have come solely through the PLI scheme — underscoring India’s continued upstream dependence on imports — while about 36% of total cell and 24% of module capacity originate from PLI allocations.

“However, the PLI scheme for solar PV manufacturing faces implementation challenges like high capital intensity of upstream integration, inadequate incentives, inconsistencies in trade policy, import dependency, and global raw material price volatility,” says Prabhakar Sharma, senior consultant, JMK Research, and one of the report’s authors.

Policy asymmetries — such as unrestricted imports for polysilicon and wafers alongside module restrictions under the Approved List of Models and Manufacturers (ALMM) — and frequent ALMM revisions have created uncertainty for domestic manufacturers. Besides, the scheme’s emphasis on fully integrated wafer-to-module facilities requires steep upfront investments, while incentives cover only a small fraction of production costs.

“India’s reliance on imported machinery, components, and Chinese technical expertise has further slowed capacity ramp-up, a situation worsened by visa restrictions and limited equipment availability,” says Chirag H Tewani, senior research associate at JMK Research, and a co-author of the report.

Meanwhile, global price volatility — especially in polysilicon and wafers — and China’s dominance in upstream production expose Indian manufacturers to cost spikes and supply disruptions. Limited scale in domestic polysilicon production also undermines cost competitiveness, highlighting the structural challenges in achieving a self-reliant and globally competitive solar manufacturing ecosystem.

“Delays in implementing PLI solar PV facilities have also limited the scheme’s economic impact,” says Sharma. As of June 2025, only 31GW of the targeted 65GW module capacity was commissioned, attracting roughly Rs48,120 crore (~US$5.5 billion) in investments and creating 38,500 direct jobs — far below the targets of Rs94,000 crore (US$10.45 billion) and 1.95 lakh direct jobs, the report states.

The report underscores that PLI non-compliance can lead to substantial financial losses for solar PLI awardees. According to JMK Research, across both tranches, solar PLI awardees can incur a monetary risk of up to Rs41,834 crore (~US$4.80 billion) cumulatively, combining direct penalties (bank guarantees encashment), lost incentives, and unrealised revenue from sales.

The scheme’s trajectory hinges on comprehensive recalibration rather than timeline extensions alone. “Future PLI iterations should focus on improving cost competitiveness, upstream integration and market resilience,” says Aman Gupta, research associate, JMK Research, and an author of the report. Key measures include tax credits, low-cost financing, and risk buffers against global price volatility; layered incentives and longer policy horizons to encourage full value-chain participation; and support for critical components to foster an integrated domestic supply chain.

With the emerging 50% US tariff on Indian solar exports adding pressure, the policy environment is becoming increasingly complex and will require strategic adaptation. The report emphasises that India must develop institutional mechanisms for coordinated policy implementation, and better align incentives with manufacturing timelines and market protection measures, while providing long-term policy certainty.

Read the report: Assessing the effectiveness of India’s solar Production Linked Incentive scheme

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Vibhuti Garg ([email protected]), Prabhakar Sharma ([email protected]), Chirag H Tewani ([email protected]), Aman Gupta ([email protected]), Soni Tiwari ([email protected])

About JMK Research & Analytics: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewable energy, electric mobility and the battery storage market. (www.jmkresearch.com)

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)