South Korea needs to address supply chain carbon risks by accelerating renewables deployment

Expanding global carbon regulations and Carbon Border Adjustment Mechanism (CBAM) exposure could increase costs and vulnerabilities for the semiconductor and Artificial Intelligence (AI) sectors

December 1, 2025 (IEEFA Asia): Expanding global carbon regulations and stricter reporting requirements that include indirect greenhouse gas (GHG) emissions, such as Scope 2 and 3, could substantially increase supply chain carbon risks for South Korean companies, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Scope 1 emissions are associated with direct inputs to a production process and are under the control of a manufacturing company. Scope 2 emissions arise indirectly from purchased energy and inputs needed to produce a product, and Scope 3 emissions represent the embedded carbon from Scope 1 and 2 activities that were required to manufacture finished goods.

“The inclusion of indirect GHG emissions, such as Scope 2 and 3, could substantially increase supply chain carbon risks, including investment aversion, higher carbon cost exposure, and counterparty and reputational risks,” says report author Michelle (Chaewon) Kim, IEEFA’s Energy Finance Specialist, South Korea.

High emissions in the South Korean tech industry compared to global companies

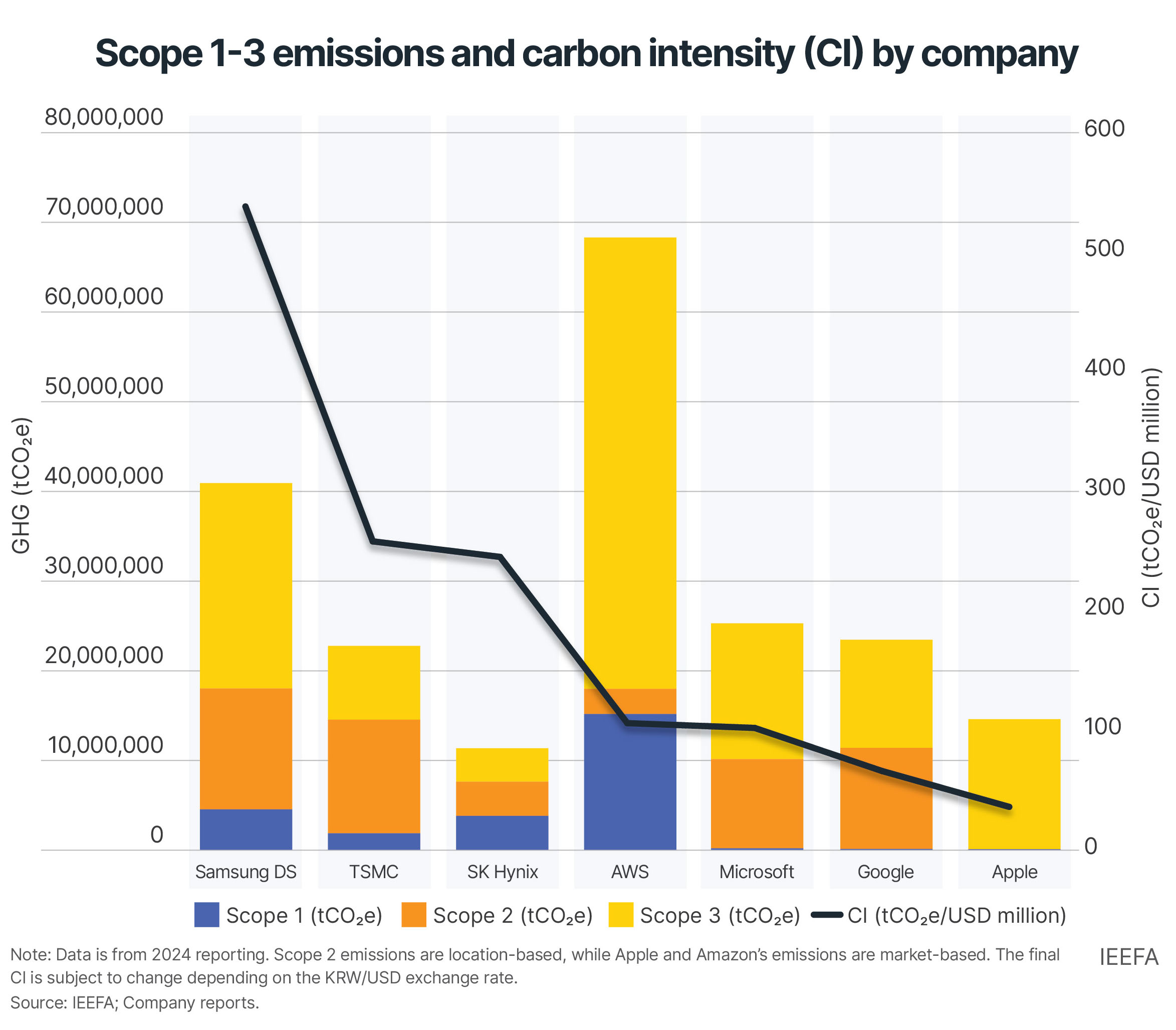

IEEFA’s analysis shows that South Korea’s leading chip maker, Samsung Device Solutions (DS), recorded Scope 1–3 emissions of approximately 41 million metric tonnes of carbon dioxide equivalent (MtCO2e) in 2024 — the highest among seven major global tech companies — with a carbon intensity of 539 tCO2e per USD million of revenue.

Another South Korean chip manufacturer, SK Hynix, recorded a carbon intensity of around 246 tCO2e/USD million.

These emission levels compare unfavorably with those of the global Big Tech companies purchasing these chips. For example, Apple has a carbon intensity of around 37 tCO2e/USD million, while Google and Amazon Web Services (AWS) have carbon intensities of 67 tCO2e/USD million and 107 tCO2e/USD million, respectively.

These reflect their global strategies to maximize clean energy use and minimize GHG intensity across complete supply chains.

Carbon Border Adjustment Mechanism (CBAM) adds to supply chain carbon risks

South Korea’s economy is highly dependent on international trade, which accounts for approximately 70% of its Gross Domestic Product (GDP). Intensifying supply chain carbon risks could significantly impact national economic viability.

The report examines how carbon regulations, including carbon taxes, emissions trading systems (ETSs), the European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM), and voluntary carbon management initiatives, could undermine South Korea’s export competitiveness by increasing domestic carbon costs.

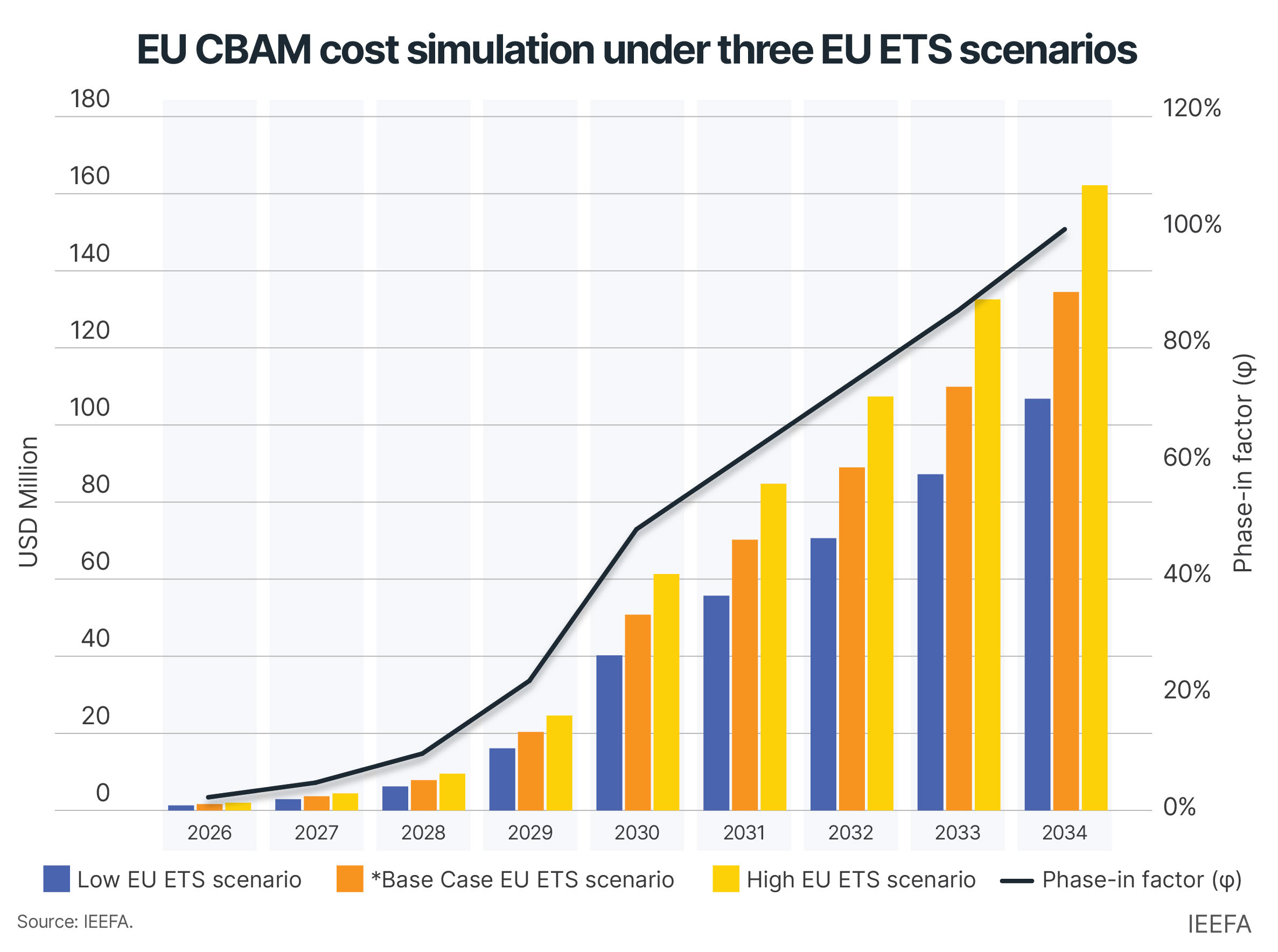

Although semiconductors are currently exempt from the EU CBAM, and Scope 2 and 3 are omitted, their inclusion in the future could impose significant expense.

IEEFA estimates that South Korean chip importers could face approximately USD588 million (KRW847 billion) in CBAM certificate expenses between 2026 and 2034.

“The sharp increase in CBAM costs may prompt European importers to switch their chip suppliers from high-emission South Korean producers to low-carbon suppliers,” says Kim.

CBAM carbon cost exposure scenarios for South Korean LNG-powered semiconductors

IEEFA conducted a scenario-based case study, assuming the inclusion of semiconductors in the EU CBAM’s scope.

The analysis estimates the CBAM certificate costs using an Embedded Emission Factor (EEF) that covers the entire supply chain (Scope 1–3). It applies an embedded carbon intensity based on value rather than mass, using annual GHG emissions and revenues to determine the value-based EEF, reflecting the lightweight and high-value characteristics of semiconductors.

“An estimated USD162 million (KRW233 billion) of CBAM certificate expenses could be incurred in 2034 under the high EU ETS scenario,” notes Kim. This equates to 9.9% of the total chip exports to the EU.

Increasing carbon costs and counterparty risks

Investors are increasingly excluding carbon-intensive companies from their portfolios, which could limit access to financing for high-carbon emitters, raising the cost of capital and reducing corporate valuations.

According to IEEFA’s analysis, if Scope 2 and 3 emissions were included in the South Korean ETS, Samsung DS’s carbon costs under the current 10% paid allocation system would be USD26 million.

If free allowances are removed and companies pay 100% of their allocation in the future, the ETS expenditure could increase tenfold to USD264 million.

Rising carbon costs in liquefied natural gas (LNG) powered semiconductor clusters and fossil fuel-based Artificial Intelligence (AI) data centers could further increase counterparty risks and production expenses, particularly if LNG is later included in the CBAM scope.

“Downstream customers and upstream suppliers may hesitate to work with high-carbon companies as it would impact their supply chain carbon accounting,” explains Kim.

Recommendations to avoid exclusion from global supply chains

High-emission companies risk exclusion from global supply chains. Countries heavily reliant on fossil fuels may also face the ‘exodus risk’ of companies relocating to more low-carbon-friendly nations.

Leading global tech companies are adopting low-carbon supply chain strategies to reduce indirect Scope 3 emissions, such as Apple’s Supplier Clean Energy Programme and Taiwan Semiconductor Manufacturing Company’s (TSMC) Collective Procurement Programme.

The report provides recommendations for South Korea to mitigate supply chain carbon risks and strengthen the competitiveness of its tech industry.

Key measures include establishing a public-private supply chain carbon risk management system, improving access to renewable energy, and removing bottlenecks in Power Purchase Agreements (PPAs) and the Renewable Portfolio Standard (RPS).

Additional recommendations call for devising financial support through government-backed funds, tax rebates, and low-interest loans to address supply chain carbon risks, as well as developing a domestic ETS market and strengthening international decarbonization initiatives.

Read the report: Navigating supply chain carbon risks in South Korea

Read this press release in Korean

Author contact: Michelle (Chaewon) Kim ([email protected])

Media contact: Josielyn Manuel ([email protected])