Key Findings

Expanding global carbon regulations and stricter reporting requirements for indirect greenhouse gas (GHG) emissions (Scope 2 and 3) could significantly increase supply chain carbon risks for South Korean companies, including investment aversion, higher carbon cost exposure, and counterparty and reputational risks.

Samsung Device Solutions emitted approximately 41 million tonnes of carbon dioxide equivalent (MtCO2e) in 2024, with a carbon intensity of 539 tCO2e/USD million — far higher than Apple (37 tCO2e/USD million) and Amazon Web Services (107 tCO2e/USD million), reflecting inadequate clean energy use and upstream supply chain GHG management.

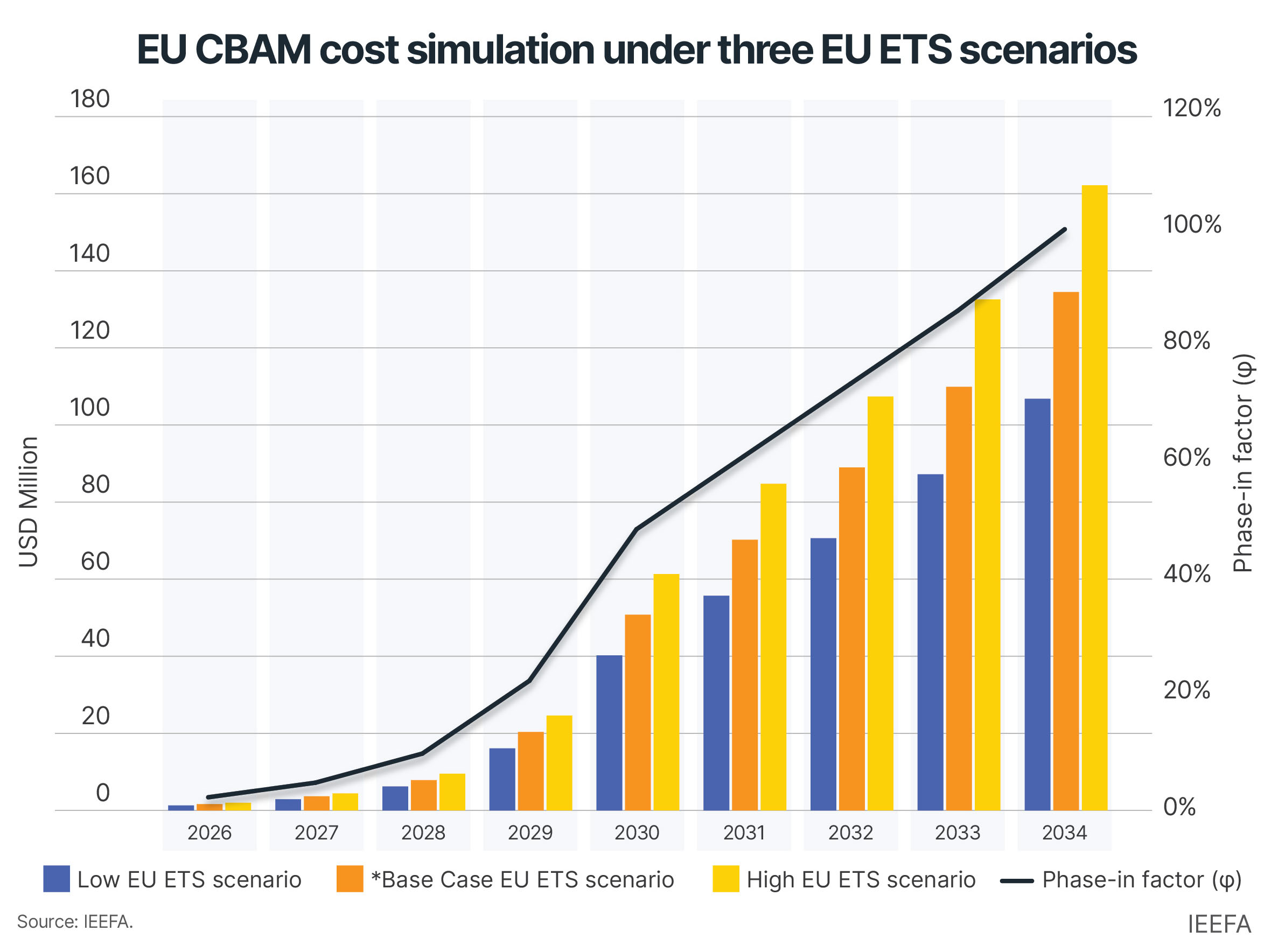

If the European Union’s Carbon Border Adjustment Mechanism (CBAM) expands to include semiconductors and full supply chain emissions, South Korean chip exporters could face USD588 million in CBAM certificate costs between 2026 and 2034, potentially prompting importers to switch from high-emission producers to low-carbon suppliers.

Rising supply chain carbon costs in liquefied natural gas (LNG)-powered semiconductor clusters and Artificial Intelligence (AI) data centers could increase counterparty risks and production expenses, as South Korea's renewable energy shortage limits global data center investment and heightens carbon cost exposure.

Executive Summary

South Korean companies are facing increasing carbon risks along their supply chains as global carbon regulations continue to strengthen. These directives include the International Financial Reporting Standards Sustainability Standards (IFRS S2), the European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM), as well as voluntary carbon management initiatives across the global tech industry.

A growing number of Asian markets, such as Singapore and Hong Kong, have mandated IFRS S2, requiring companies to disclose climate-related risks and opportunities, including Scope 1 and 2 greenhouse gas (GHG) emissions from the 2024–2025 reporting cycle, and are in the process of adding Scope 3 from 2026.

Scope 1 emissions are associated with direct inputs to a production process and are under the control of a manufacturing company. Scope 2 emissions arise indirectly from purchased energy and inputs needed to produce a product, and Scope 3 emissions represent the embedded carbon from Scope 1 and 2 activities that were required to manufacture finished goods. The inclusion of indirect GHG emissions, such as Scope 2 and 3, could substantially increase supply chain carbon risks, including:

(1) Investment aversion

(2) Higher carbon cost exposure

(3) Counterparty and reputational risks

According to analysis by the Institute for Energy Economics and Financial Analysis (IEEFA), South Korea’s leading chip maker, Samsung Device Solutions, recorded Scope 1–3 emissions of approximately 41 million metric tonnes[1] of carbon dioxide equivalent (MtCO2e) in 2024 — the highest among seven major global tech companies — resulting in a carbon intensity of around 539 tCO2e per USD million of revenue. Another South Korean chip manufacturer, SK Hynix, had a carbon intensity of around 246 tCO2e/USD million.

These emission levels compare unfavorably to those of the global Big Tech companies purchasing these chips. For example, Apple has a carbon intensity of 37 tCO2e/USD million of revenue, while Amazon Web Services (AWS) has an intensity of 107 tCO2e/USD million.[2] These lower emissions reflect their global strategies of maximizing clean energy sales and minimizing GHG intensity, particularly in upstream supply chain purchases.

Financial investors are increasingly excluding carbon-intensive companies from their portfolios, which could limit access to financing for high-carbon emitters, raising the cost of capital and reducing corporate valuations as forms of carbon penalties.

The inclusion of indirect emissions in financial reporting could increase companies’ carbon costs through various regulations, including carbon taxes, emissions trading system (ETS) compliance, and CBAM directives. Assuming Scope 2 and 3 are included in the South Korean ETS, Samsung Device Solutions (DS) would face carbon costs of around USD26 million under the current 10% paid allocation system, according to IEEFA’s analysis. If the free ETS allowance is abolished and companies are required to pay 100% of their credit allocation in the future, the ETS costs based on the entire Scope 1–3 emissions would increase tenfold to USD264 million.

Expanding carbon emission disclosures could also increase counterparty and reputational risks. Both downstream customers and upstream suppliers may hesitate to conduct business with companies that report high GHG emissions due to stricter Scope 1–3 reporting requirements, which would impact their carbon accounting for entire supply chains. Companies with high emissions are at risk of being excluded from global supply chains, as several large, multinational tech companies, such as Apple and Taiwan Semiconductor Manufacturing Company (TSMC), have endorsed initiatives to reduce carbon emissions in their supply chains.

The CBAM increases carbon risks along the supply chain since there is (1) a significant difference between the EU ETS and South Korea’s ETS, (2) more countries could potentially adopt the CBAM, and (3) the system could be expanded to cover more goods. Any of these factors could undermine South Korea’s export competitiveness by raising CBAM financial exposure and potentially lead to supplier substitutions.

Although currently exempt, if the EU CBAM scope expands to cover the semiconductor sector and indirect emissions, such as Scope 2 and 3, South Korean chip exporters could face substantial disadvantages in global trade. If semiconductors are included in the EU CBAM scope and the embedded emission factor (EEF) used for the CBAM certificates encompasses the entire supply chain (Scope 1–3), IEEFA estimates that South Korean chip importers in the EU could face approximately USD588 million (KRW847 billion) in CBAM certificate expenses between 2026 and 2034. The sharp increase in CBAM costs may prompt European importers to switch their chip suppliers from high-emission-intensive producers to low-carbon providers to limit financial exposure.

Given that South Korea’s economy is highly dependent on international trade, which accounts for approximately 70% of its Gross Domestic Product (GDP), intensifying supply chain carbon risks will significantly impact national economic viability. Rising supply chain carbon costs in liquefied natural gas (LNG)-powered semiconductor clusters and fossil fuel-based Artificial Intelligence (AI) data centers could increase counterparty risks and raise production expenses.

Against this backdrop, the South Korean government is promoting RE100 industrial complexes (industrial parks that run on 100% renewable energy) and developing an ‘Energy Highway’ to expand renewable energy use across industries and streamline grid integration. The ‘Special Act on the Creation and Support of RE100 Industrial Complexes and Energy New Cities’ is expected to be enacted in 2025. The Energy Highway plan includes constructing a high-voltage direct current (HVDC) transmission infrastructure to connect areas with high renewable energy to consumers.

The tightening of global carbon regulations from 2026 in an increasingly uncertain economic landscape exacerbates carbon risks in South Korea’s supply chains. Higher tariffs imposed by the United States (US) following tariff negotiations, as well as the failure to attract global data centers amid a chronic shortage of renewable energy compared with peers, continue to hinder South Korea’s industrial competitiveness. Data center investments are concentrated in countries that can offer abundant, low-cost renewable energy. South Korea risks missing out on attracting such investments due to the lack of cheap, readily available clean energy.

IEEFA recommends the following measures for South Korea to address supply chain carbon risks and strengthen the competitiveness of its tech industry, including the semiconductor sector and AI data centers:

[1] Scope 2 GHG emissions were location-based. Samsung. 2025 Sustainability Report. 27 June 2025. Page 77 and 79.

[2] AWS. 2024 Amazon Sustainability Report. July 2025. Carbon intensity was calculated based on Scope 1–3 GHG emissions and revenues.