IEEFA’s new Data Dive reveals the drivers, barriers, and costs of Asia’s gas and LNG demand

Interactive tool analyzes Asia’s complex gas and LNG landscape and highlights how sectoral demand and market dynamics are shaping Asia’s gas future

December 10, 2025 (IEEFA Asia): The Institute for Energy Economics and Financial Analysis (IEEFA) launched its latest Data Dive report, an interactive data tool that provides detailed insights into the demand for natural gas and liquefied natural gas (LNG) in 14 Asian economies.

The report analyzes trends in sectoral gas consumption and natural gas production, LNG imports, annual LNG spending, and average import prices in Asia using official government sources, converted to equivalent units and standardized categorizations.

“Natural gas is used as a fuel or a feedstock in many applications throughout Asia, making it challenging to understand the key sectoral drivers of demand,” says co-author Sam Reynolds, IEEFA’s LNG/Gas Research Lead, Asia. “This free tool organizes government data from around the region, allowing users to understand specifically where Asia’s gas demand has grown in the past, and where it might grow in the future.”

“Economics are a core driver of Asia’s energy transition, particularly for emerging markets,” adds co-author Christopher Doleman, IEEFA’s LNG/Gas Specialist, Asia. “Understanding the end uses of gas and LNG is critical to analyzing various economic drivers and barriers to demand growth in each market.”

Natural gas demand and supply in Asia

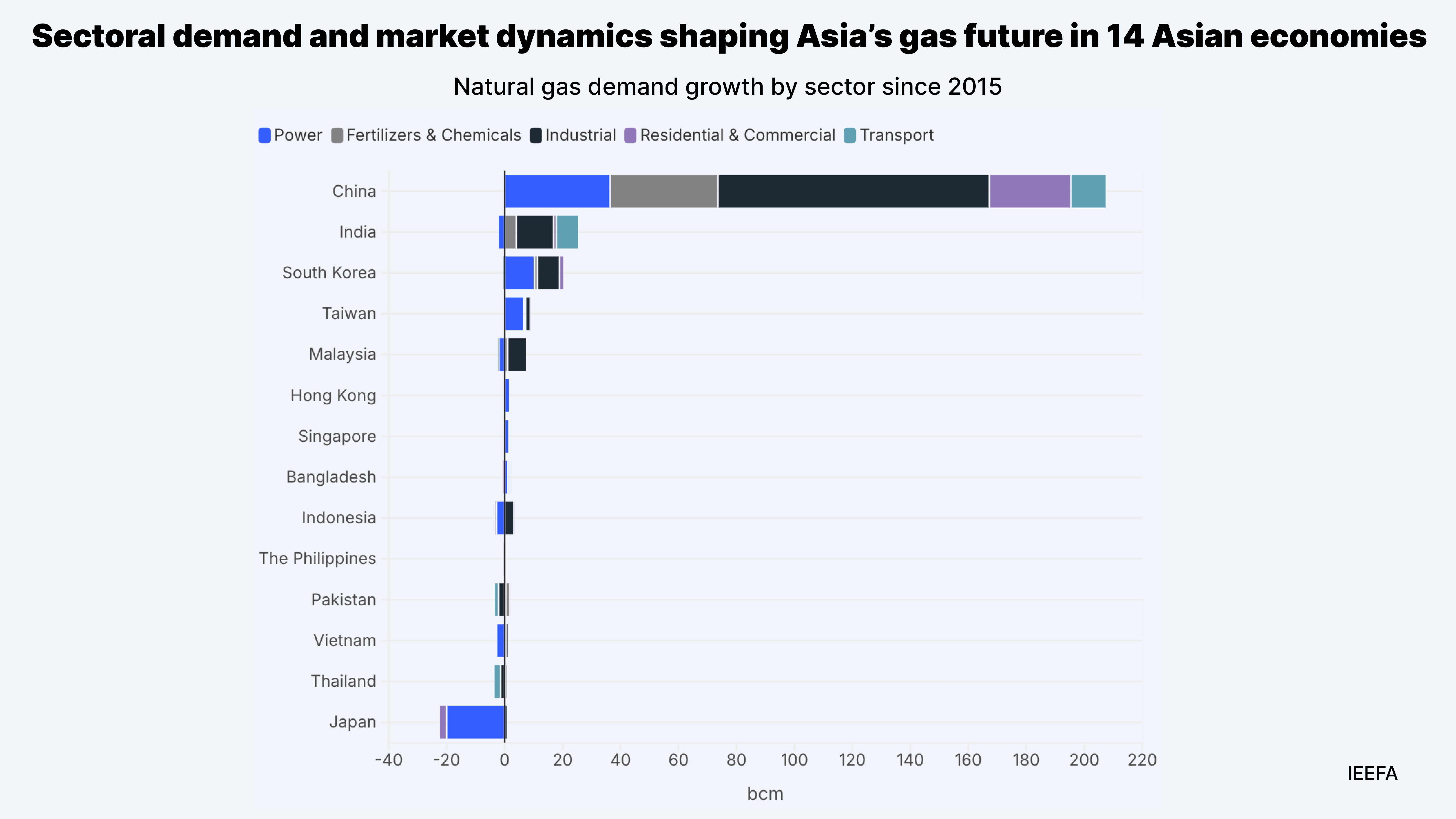

The report finds that Asia’s natural gas consumption increased 35% between 2015 and 2023, with China accounting for over 90% of the growth. Meanwhile, falling gas demand in the Philippines, Vietnam, Thailand, Malaysia, and Japan was enough to offset growth elsewhere in the region, excluding China and India.

Although the power sector currently consumes the most natural gas in Asia, the industrial sector has accounted for the largest volume of growth since 2015, followed by the chemical and fertilizer sectors. The report provides data on specific subsectors driving consumption in each country on a comparable, energy equivalent basis.

For example, nearly all gas demand growth in residential and commercial buildings has occurred in China. India aims to expand residential connections but remains behind target, while gas is only expected to play a marginal role in buildings across Southeast Asia.

Similarly, gas demand from transportation has fallen in Japan, Thailand, Pakistan, South Korea, and Malaysia, with growth limited to China and India.

In the power sector, falling gas demand in Japan, India, Indonesia, Malaysia, Vietnam, and the Philippines since 2015 was enough to offset growth in all other countries, excluding China.

At the same time, domestic gas production is declining throughout Asia, with the notable exceptions of China and Malaysia. Total depletion of natural gas reserves is imminent in the Philippines, Thailand, and Bangladesh. On the other hand, China has already surpassed its 2030 targets for domestic gas production.

Uncharted territory: The shift to imported LNG

Domestic gas production declines are driving a shift to imported LNG. Customs data indicates that the 14 markets surveyed — excluding Hong Kong, Indonesia, and Vietnam — spent USD177.6 billion on LNG imports in 2023, nearly double the amount paid in 2015.

Between 2015 and 2024, Australia supplied the largest volume of LNG to Asia, followed by Qatar, Malaysia, the United States (US), and Russia. Over the period, the share of Australian and US LNG in Asia has increased, while the share of Qatari LNG has fallen.

However, Asia’s LNG imports are down 5% through August 2025. In particular, imports from the US have fallen in China, Japan, South Korea, Taiwan, and Thailand, despite political pressure to buy US LNG.

“While LNG prices are currently around USD12 per million British thermal units (MMBtu), many parts of Asia produce gas at a cost below USD5/MMBtu,” says Doleman. “In certain cases, subsidized industries like the fertilizer sector in Pakistan have relied on gas input costs below USD2/MMBtu. Integrating pricier LNG into industrial processes has and will prove difficult for less wealthy importing markets.”

Risks to Asia’s gas and LNG demand growth

While not intended to provide a detailed demand outlook, this report also highlights barriers to demand growth in the power, industrial, chemical, fertilizer, buildings, and marine and road transportation sectors. It also considers possible outcomes if LNG markets tilt into oversupply, causing prices to fall.

“Often, energy demand forecasts simply assume that imported LNG can replace domestic natural gas production,” says Reynolds. “But the shift to LNG presents very different investment risks for new gas-based infrastructure, including higher fuel input costs, energy supply vulnerabilities, and exposure to volatile commodity markets.”

“Falling prices are likely to boost short-term LNG demand in Asia, particularly among price-sensitive end-users in emerging markets,” says Doleman. “That said, prices are still likely to remain higher than legacy domestic gas costs. For many sectors in the region, the shift to LNG may continue to undermine regional competitiveness compared to markets with lower-cost, localized energy inputs, even in a low LNG price environment.”

Read the interactive report: Data Dive: The drivers, barriers, and costs of Asia’s gas and LNG demand