China’s LNG trucking boom unlikely to pull LNG cargoes off the global market

Most Asian countries lack the infrastructure, manufacturing capability, and lower-cost feedstocks to emulate China’s LNG trucking surge

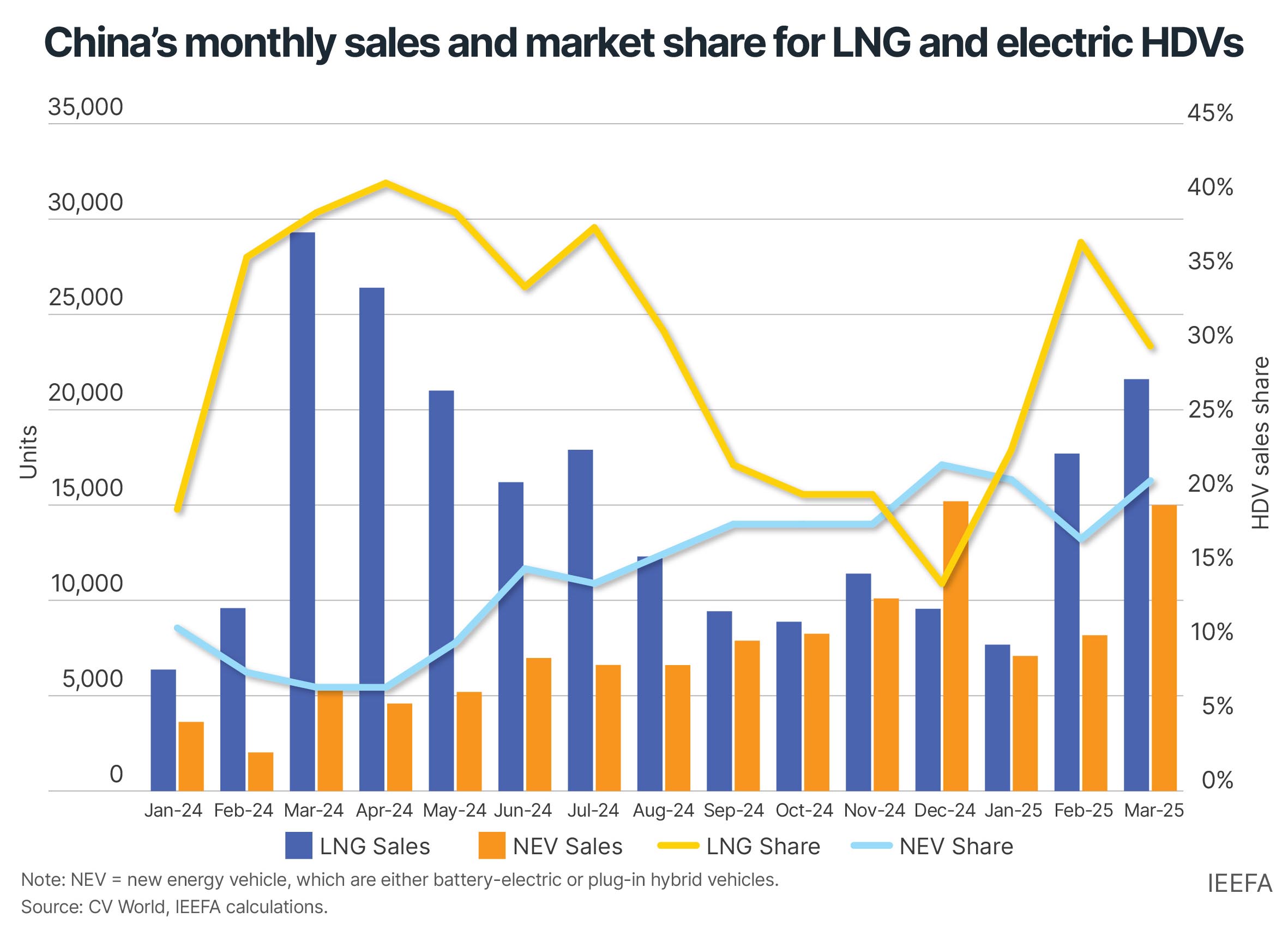

China is experiencing a boom in liquefied natural gas (LNG)-fueled heavy-duty vehicles (HDVs) driven by its expansive gas infrastructure, increasing lower-cost gas supplies, and coordinated policy incentives. Unit sales of the LNG segment grew 17% to an all-time high in 2024, capturing almost 30% of the heavy-duty market.

While proponents interpret this as a strong signal for LNG demand growth, a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) finds that the trucking boom is unlikely to materially affect global LNG trade. The report concludes that China’s growing fleet of domestic liquefaction plants produces sufficient LNG to meet road transport demand, and electric alternatives are becoming viable options for heavy-duty vehicles.

Surge in LNG trucking in China due to domestic advantages

China’s extensive pipeline network, which provides lower-cost gas supplies from domestic production and imports throughout the country, is integral to the recent success of LNG trucking. The availability of such cheap gas feedstocks has spurred the growth of liquefaction plants and the LNG refueling network necessary to catalyze sales.

LNG proponents banking on China’s trucking trend to rekindle confidence in global LNG demand should recognize that the country may be self-sufficient in LNG output to cover the fuel requirements for its road transport.

“China produces enough LNG from its domestic liquefaction plants to meet current trucking needs. LNG production has doubled over the last five years to nearly 25 million tonnes (Mt), outstripping the 22Mt required for road transport in 2024,” says report author Christopher Doleman, IEEFA’s LNG/Gas Specialist, Asia.

Plant additions increased China’s domestic liquefaction capacity by 41% in 2024, and this production capability continues to grow.

“Rising gas supply from domestic production and pipeline imports, combined with valorizing byproduct coke oven gas at stand-alone coking facilities, will provide ample low-cost feedstock to increase domestic LNG production,” adds Doleman.

The government has also promoted LNG refueling stations to displace oil and included transport as a priority sector for gas utilization. Stricter vehicle emission standards, increased HDV manufacturing capacity, and subsidies for replacing aging, higher-emitting diesel models with LNG alternatives accelerated the shift.

Headwinds facing the LNG trucking segment in China

With sales highly responsive to the LNG-diesel price ratio, LNG’s inherent volatility and diesel’s relative stability in China could dampen sales during tight supply periods. Fleet operators typically require the LNG-diesel price ratio to fall under 80% to compensate for the higher capital costs of LNG vehicles. Sales decline when the ratio rises above that level.

Meanwhile, electric alternatives are also gaining momentum. Electric or new-energy vehicles (NEVs) sales increased 140% in 2024, with market share rising from 5.6% in 2023 to 13.6%, and surpassed LNG-fueled vehicles in December 2024. Preferential subsidies are available for electric models to accelerate the replacement of older diesel HDVs.

In the first quarter of 2025, the electric segment captured almost 20% of HDV sales, up from 8.1% a year ago. LNG sales constituted 31% of the market, down from over 33% in 2024.

“Declining battery costs and support for the development of battery-swappable vehicles will further improve the cost competitiveness of electric alternatives in heavy-duty applications,” notes Doleman, “LNG may only play the role of a transitional fuel for China’s heavy-duty trucking segment.”

Asia may struggle to replicate China’s unique qualities

Governments and proponents that view China as a blueprint for LNG-fueled HDV adoption should acknowledge the difficulty in replicating China’s unique, enabling environment across Asia.

Most Asian countries lack access to lower-cost gas sources and the expansive infrastructure to establish a liquefaction network. Such supplies are rising in China but falling in South and Southeast Asia, where almost all significant gas producers are in a state of structural decline due to resource maturity. Pipeline trade is scarce, and the transformation of coke oven gas, a cheap LNG feedstock in China, has limited potential in other countries.

Without these innate characteristics, the proliferation of refueling infrastructure necessary to catalyze LNG sales will be difficult to establish across Asia.

“Countries aiming to replicate China’s diesel displacement should recognize the difficulty of recreating the enabling environment present there. They may be better served directing funds towards electrification rather than investing in an LNG-fueled HDV supply chain that could become stranded,” says Doleman.

While lower prices from an emerging LNG glut could spur adoption, cost parity from electric alternatives may begin to stall LNG truck sales and emerge as Asia’s main displacer of diesel in road transport.

Read the report: Heavy trucking unlikely to materially increase China’s LNG imports

Read the fact sheet: Insights from China's current LNG trucking boom

Author contact: Christopher Doleman ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. (www.ieefa.org)