Key Findings

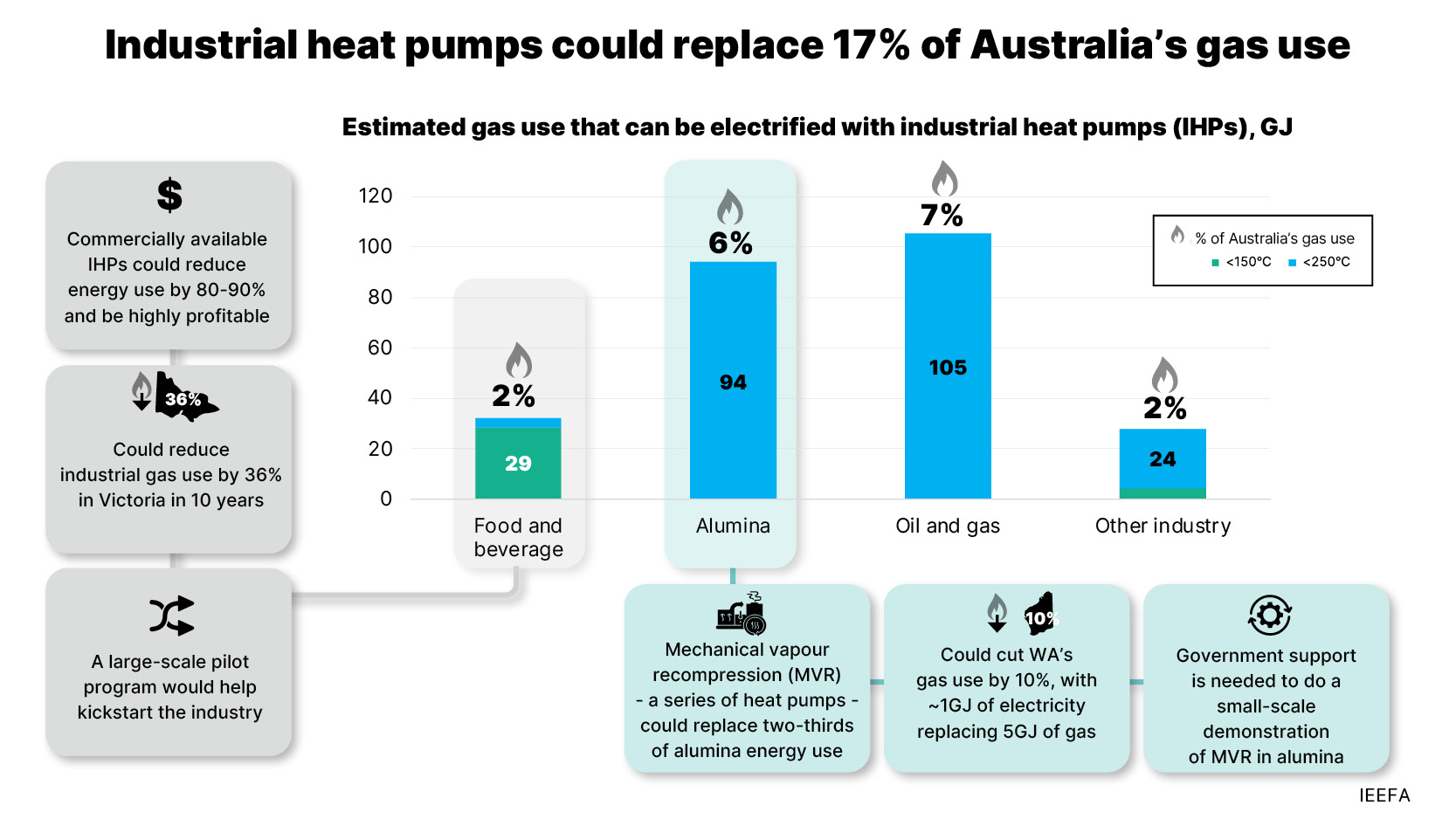

Heat pumps could electrify industrial processes below 250°C and replace up to 17% of Australia’s gas use.

Applying commercially available heat pumps in the food and beverage sector could replace 29PJ of gas and reduce Victoria’s industrial gas use by 36% in 10 years.

Shifting from gas to heat pumps in alumina refining could reduce WA’s gas use by 10% and help alleviate upcoming excess gas demand, but it needs pilot trial support.

In the food and beverage and alumina sectors, heat pumps could cut energy use by more than 80% and eliminate emissions if powered with renewables.

Executive Summary

The technology landscape of industrial heat pumps (IHPs) is developing rapidly. Models capable of providing process heat up to 150°C have already been implemented in multiple commercial settings. New solutions, involving either emerging technologies or “cascaded” systems, can reach 280°C.

In total, IHPs could replace more than half of gas used for Australia’s industrial process heat, or about 17% of domestic gas use. The two most prospective applications are in the food and beverage (F&B) sector and alumina refining. Commercially available IHPs could replace 29 petajoules (PJ) of gas use in F&B. The application of mechanical vapour recompression (MVR), which works as a series of open-cycle heat pumps, in alumina could cut gas use by 94PJ but needs demonstration.

The opportunities are concentrated in Victoria and Western Australia (WA) respectively, two states facing large excess gas demand in the coming decade. IEEFA calculates that commercially available IHPs in the F&B sector could reduce gas demand by about 14PJ in the next 10 years in Victoria, cutting the state’s industrial gas use by 36%. In WA, MVR could deliver gas demand reductions in the next decade equivalent to 10% of the state’s total gas consumption today.

Figure 1: The potential of IHPs to reduce Australia’s gas use

Source: IEEFA

Despite this, IHPs seem absent from government plans, and the Australian market lags its global peers. IEEFA recommends the government support a large-scale pilot program focused on implementing heat pumps in the F&B sector. Such a program could help build better data, expertise and supply chains for IHPs in Australia. In parallel, government should also support the small-scale demonstration of MVR in the alumina sector. Although an MVR pilot project at Alcoa’s Wagerup facility in WA was recently closed due to higher than expected costs, the company believes there is still a potential role for MVR in decarbonising the alumina industry, and emphasised the need for successful small-scale demonstration of MVR to derisk investment for larger-scale deployment.

Heat pumps are increasingly recognised as a critical technology to support electrification, with mature applications in buildings and emerging applications for industry. One of the main benefits of IHPs is their high efficiency – they can typically provide heat with an efficiency of 250-400%, and even above 500% for lower temperatures. This means that for every unit of electricity consumed, an IHP can produce 2.5-5 units of heat. In contrast, fossil-fuel-based thermal systems typically have efficiencies of 50-80%, and as low as 30% in some cases. This means IHPs can likely deliver energy savings of at least 68-90% compared with traditional thermal systems. IHPs are most compelling when they can replace an inefficient centralised thermal system (e.g. with high distribution losses and oversized to cater for the highest heat requirements) with a highly efficient distributed system (e.g. point-of-use heat pumps tailored to varying temperature requirements), when they provide both cooling and heating and when they can reuse waste heat.

One of the challenges in assessing IHP potential in Australia is the lack of detailed information on heat requirements or waste heat availability. The only data on process heat in Australian industry includes assumptions that likely underplay the potential for substitution with IHPs, particularly in the F&B sector. Using results from detailed global studies, IEEFA found that the likely high energy losses in existing systems would mean IHPs could deliver energy savings of 80-90%, and therefore be highly financially attractive in the F&B sector. In the alumina sector, the use of waste heat means MVR could cut energy use by about 87%, only needing about 1GJ of electricity to replace each

8GJ of gas.

A key challenge for IHP deployment is their significantly higher upfront costs compared with conventional technologies. The global IHP market is expected to grow from US$2 billion in 2023 to US$11-$21billion by 2030, bringing cost reductions. IHPs can deliver large operational cost savings through reduced energy use. Focusing on gas-based systems, and using relative wholesale spot prices as a proxy in the absence of actual energy cost data, we found that the electricity-to-gas price ratio has steadily decreased from 2015 to 2024, reaching about 2:1 in recent times. With such a ratio, IHPs could likely deliver energy cost savings of 36-75% compared with a traditional thermal system.

The infancy of the Australian market means there are few on-the-ground examples and very little public information on operational and financial performance of IHPs. A small number of government-supported feasibility studies and a real-life case study have found material energy and cost reductions in the F&B sector, with a range of productivity benefits, such as reduced maintenance costs and equipment downtime, as well as improved working conditions.