Harnessing industrial heat could cut gas use by 17%

Australia missing out on key opportunity to tackle excess gas demand

Key Takeaways:

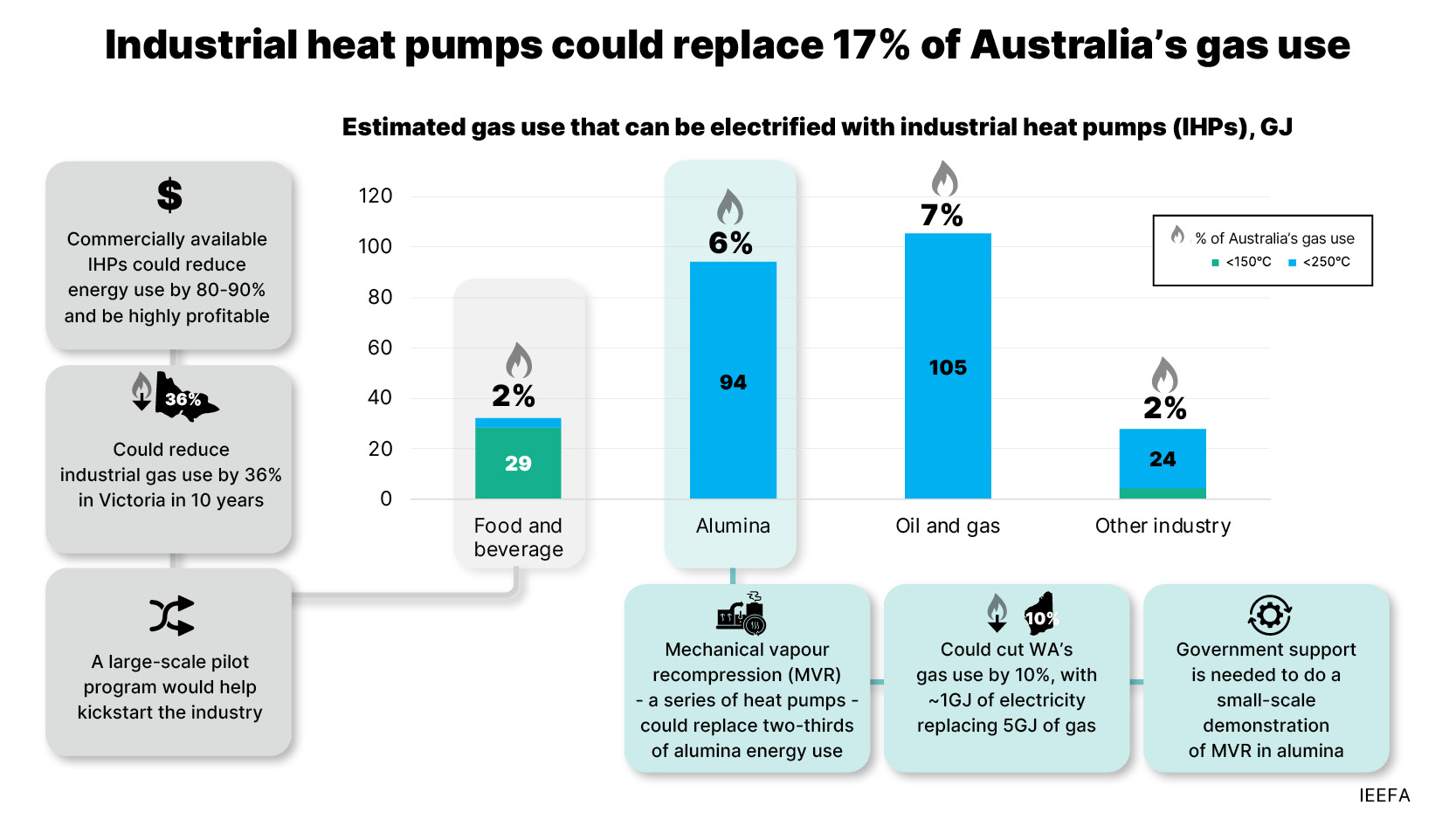

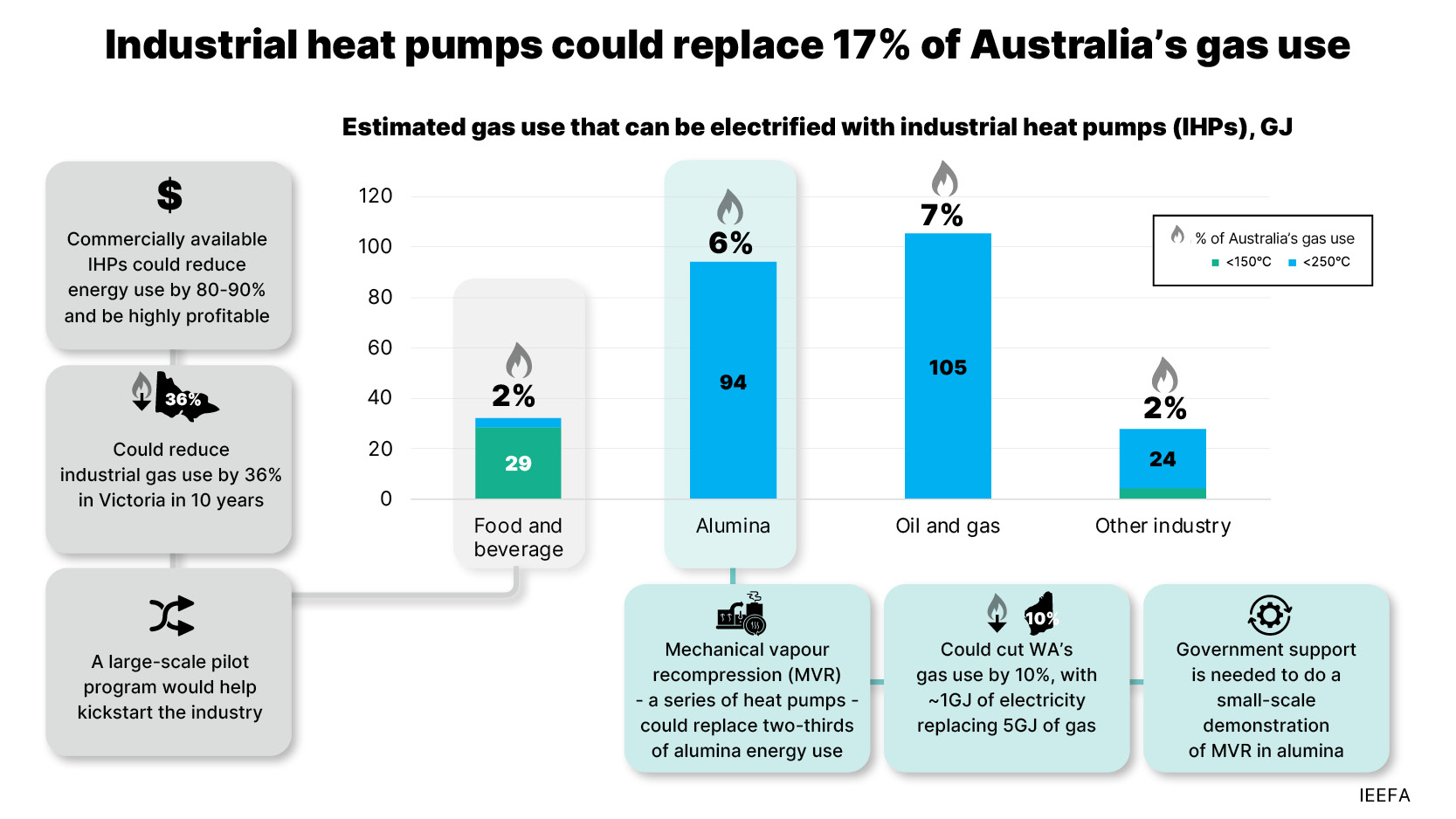

Heat pumps could electrify industrial processes below 250°C, and replace up to 17% of Australia’s gas use.

Applying heat pumps in the food and beverage sector could replace 29PJ of gas and reduce Victoria’s industrial gas use by 36% in 10 years.

Shifting from gas to heat pumps in alumina refining could reduce WA’s gas use by 10%, and help alleviate upcoming excess gas demand, but it needs pilot trial support.

In the food and beverage and alumina sectors, heat pumps could cut energy use by 80% or more, and eliminate emissions if powered with renewables.

31 October 2024 (IEEFA Australia): Heat pumps are widely recognised as critical to the electrification and decarbonisation of global energy use, yet their potential impact in industrial settings is being largely overlooked in Australia, according to new research from an independent think tank.

In its latest report ‘Industrial heat pumps key to addressing excess gas demand’, the Institute for Energy Economics and Financial Analysis (IEEFA) shows that industrial heat pumps (IHPs) could replace about 17% of Australia’s total gas use, particularly in states facing excess gas demand in coming years. Key near-term opportunities to reduce gas demand include an estimated 94 petajoules (PJ) in alumina refining and 29PJ in the food and beverage sector – respectively 6% and 2% of Australia’s annual gas use.

“The food and beverage sector presents the most readily deployable opportunity as commercially available IHP models can meet the temperatures needed in the sector,” says Cameron Butler, IEEFA guest contributor and the report’s co-author.

“Given the high energy losses typically experienced in the food and beverage sector, IHPs could deliver energy savings of 80-90%, and therefore be highly financially attractive.”

The opportunity, while less mature, is even more significant in the alumina sector. Mechanical vapour recompression (MVR), which works as a series of open-cycle heat pumps, could replace about two-thirds of the energy used in alumina refining.

“MVRs could slash energy use in alumina by recovering and reusing heat from the process, potentially requiring just 1GJ of electricity to replace about 5GJ of gas,” Mr Butler says.

However, the technology has yet to be demonstrated in the sector. An MVR pilot in alumina refining was started in 2021, but it closed late last year due to cost overruns.

“The industry still believes the technology could play an important role in the sector, but has stressed the need for further government support to demonstrate the technology and derisk future investments,” Mr Butler says.

The potential gas demand reductions delivered by IHPs could play a big role in alleviating an impending tightening of gas markets expected in both the east and west coasts of Australia.

“The majority of the opportunity lies in Victoria and Western Australia, which are both facing material excess gas demand in the coming years,” says Amandine Denis-Ryan, CEO of IEEFA Australia’s CEO and co-author of the report.

“Implementing commercially available IHPs in the Victorian food and beverage sector could save 14PJ of gas in the next 10 years, and reduce the state’s industrial gas use by 36%.

“In Western Australia, shifting from gas to IHPs in alumina refining could save over 74PJ of gas, equivalent to 10% of the state’s total gas use today, going a long way to avoiding excess gas demand in the early 2030s.”

Upfront costs for IHPs are typically three to four times higher than new gas or electric boilers. However, the technology is developing rapidly, with the global market expected to grow from US$2 billion in 2023 to US$11-US$21 billion by 2030, driving down costs. Nonetheless, IEEFA found some commercially available IHPs could show a return on investment within just two years.

“A small number of government-supported feasibility studies and a real-life case study have found material energy and cost reductions in the food and beverage sector, with a range of productivity benefits, such as reduced maintenance costs and equipment downtime, as well as improved working conditions,” Mr Butler says.

IEEFA recommends the government support a large-scale IHP pilot program in the food and beverage sector, along with a smaller-scale program in the alumina sector, to build better data, expertise and supply chains for IHPs in Australia.

“Despite their large potential, IHPs seem absent from government plans, and the Australian market lags its global peers. It is time the Australian government steps up,” Ms Denis-Ryan says.

Read the report: Industrial heat pumps key to addressing excess gas demand

Media contact: Amy Leiper [email protected] +61 (0) 414 643 046

Author contact: Amandine Denis-Ryan, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)