Key Findings

A major blue hydrogen project under development is a lose-lose proposition that would cost billions of dollars in subsidies for essentially zero environmental benefit.

An IEEFA analysis finds that the Louisiana Clean Energy Complex, is a potential money-making bonanza for Air Products but will have little if any environmental benefit, while costing taxpayers billions.

Air Products can benefit from generous federal tax credits under 45Q regardless of the project’s net emissions impact.

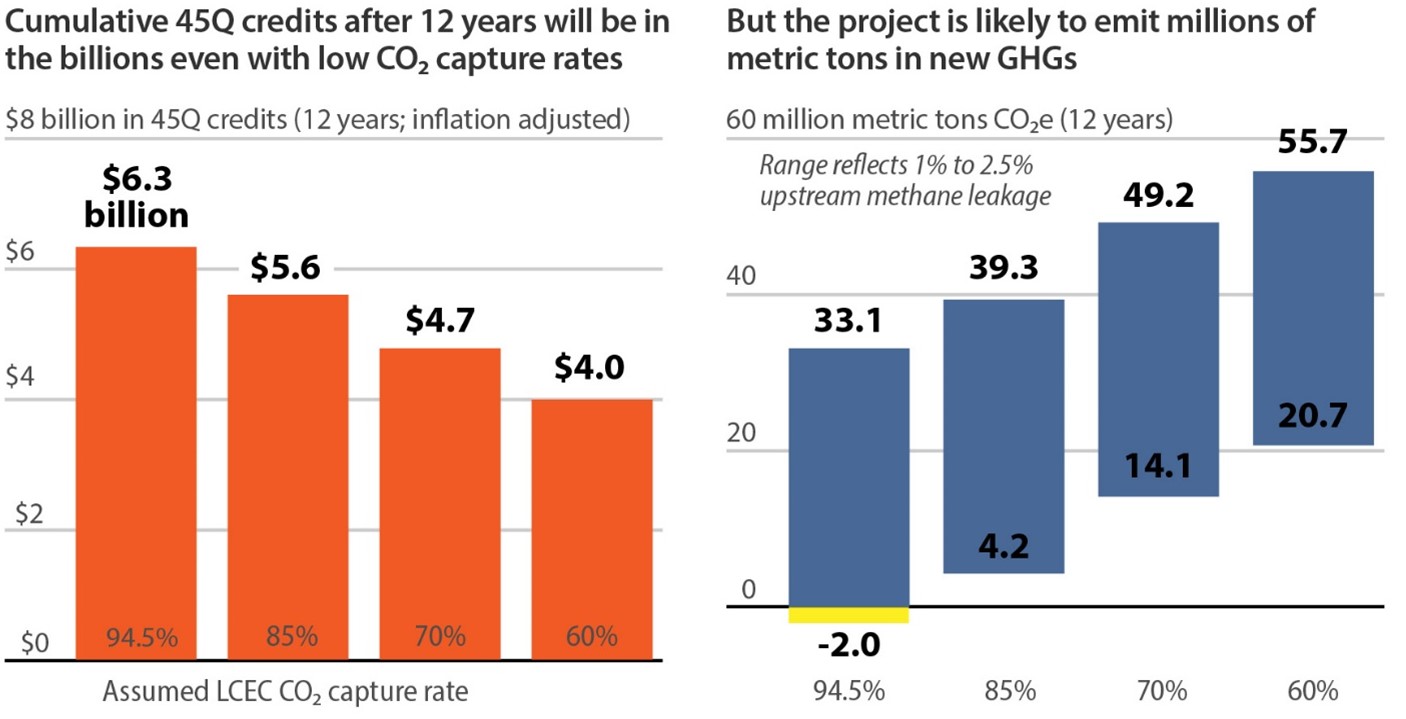

The project will likely result in substantial new CO2 emissions at enormous cost to taxpayers; Air Products could claim up to $440 million per year and $6.3 billion over a 12-year period.

Legislators looking for a bipartisan issue should focus on blue hydrogen. IEEFA’s latest analysis shows that the process, which uses methane gas with carbon capture to produce a supposedly cleaner fuel, is a lose-lose proposition that would cost billions of dollars in subsidies for essentially zero environmental benefit. It is an issue that both fiscal conservatives and environmental advocates should agree needs changing.

The focus of our analysis is Air Products’ planned Louisiana Clean Energy Complex (LCEC), one of the largest blue hydrogen projects in development in the U.S. The company says the facility, estimated to cost $7 billion, will begin commercial operation in 2028 and produce almost 600,000 metric tons of hydrogen per year from methane gas. Air Products also says the facility will capture and store 5 million metric tons of carbon dioxide (CO2) annually, which would qualify for generous federal tax credits under the existing 45Q program.

Our analysis shows that the project, while a potential money-making bonanza for Air Products, will have little if any environmental benefit, while costing taxpayers billions of dollars. Under optimal operating assumptions, particularly assuming very high carbon capture rates, the facility could produce a minimal reduction in net emissions. But if more realistic assumptions are used, reflecting real-world data and current scientific research, our evidence-based estimates find that this project will likely result in substantial new CO2 emissions at enormous cost to taxpayers. Specifically, Air Products could claim up to $440 million per year and $6.3 billion over the 12 years of eligibility for the 45Q credit for the capture and storage of 5 million metric tons of CO2, even if the project achieves no net reduction in greenhouse gas emissions.

The emissions profile of the project, analyzed on a life-cycle basis using realistic assumptions, shows that it will likely result in a net increase in emissions. Despite the company’s promises, the hydrogen produced at the LCEC will be neither clean nor low carbon.

The IEEFA analysis found:

- The LCEC project would likely capture between 33% and 52% of carbon (well-to-gate), depending on the level of upstream methane emissions. This is based on the project sponsor’s assumption of a 95% CO2 capture rate at the facility.

- Under a realistic scenario, which entails using lower carbon capture rates and higher projected emissions from upstream methane leakage, the project would result in a net increase of 7.5 million metric tons of carbon dioxide equivalent (CO2e) per year. Even under a best-case scenario with very high carbon capture rates and minimal emissions from all other sources, the LCEC project would result in a net reduction of just 200,000 metric tons of CO2e per year—roughly equivalent to just 5% of a typical coal plant’s emissions per year.

- Air Products can benefit from generous federal tax credits under 45Q regardless of the project’s net emissions impact. The 45Q tax credits are based solely on the number of tons of CO2 stored per year. For 45Q tax credit purposes, it does not matter if the project generates more CO2e emissions than it captures. No demonstration of net emissions reduction is required to access the credit.

- For the single scenario in our analysis that results in a net emissions reduction, we calculate an astronomical cost of $2,600 per metric ton of avoided CO2 under the current 45Q credit value of $85 per metric ton CO2 stored. If the 45Q credit amount is increased to $100 per metric ton, the cost rises to $3,100.

Figure ES 1: Cumulative 45Q Credits vs. GHG Emissions After 12 Years

Source: IEEFA analysis