Oregon marks climate risk milestone

Key Findings

As the financial risks of climate change become clearer by the day, investors like the state of Oregon are stepping up their ambition.

The state has enacted a law mandating new reporting and climate-safe investing practices in the state pension’s decarbonization progress.

The passage of the law builds on other important steps to date, such as the pension’s net-zero plan and the legislature’s coal divestment directive.

As the pension itself recognizes, there is more work to do. But this latest bill helps lay a strong foundation for prudent, forward-looking risk management.

As some financial institutions cave to political pressure and walk back decarbonization commitments, others are raising the bar. Oregon recently enacted a law to help its investment council integrate climate risk management into its activities. It is a prudent and pragmatic step that will help protect beneficiary interests in the decades to come.

The bill, HB 2081A, did not seek to enumerate new powers so much as to clarify what’s already been true: that climate change poses material risks to long-term investors. Recognizing that “urgency justifies taking every possible action in the fund portfolio to reduce investment risks associated with a rapidly changing climate,” it instructs the state treasury department’s investment staff to continue incorporating climate-related financial impacts into their analysis; to pursue reductions in the carbon footprint of the investment portfolio; and to report regularly to the legislature on these efforts. It also calls on the pension fund to participate in the energy transition, including by exploring investment opportunities in low-carbon technologies and companies.

The law is just the latest example of foresight and pragmatism from the state. In 2022, the Treasury commissioned a set of important reports laying out the risks of business-as-usual to the fund’s bottom line. In 2024, the legislature directed the pension fund to exit its coal holdings because of the sector’s unappealing performance and outlook. That same year, the Treasury released its net-zero plan, recognizing that “climate change will have an economic impact on the fund” and that doing nothing would leave it “overexposed to investment risks from climate change.” Promoted by State Treasurer Elizabeth Steiner and backed by a broad coalition of organized labor, environmental advocates, and others, the law builds on this important momentum.

Advocates such as the Divest Oregon coalition deserve immense credit for keeping fossil-fueled climate risk on the public policy agenda, and the fund should be commended for taking the issue seriously. This latest step speaks to a continued fiduciary appetite for climate action, and to a continued seriousness about serving beneficiaries’ long-term interests.

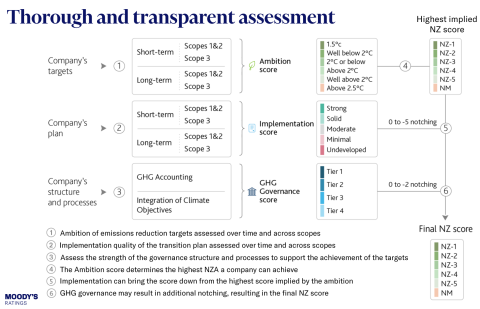

With political consensus and legislative backing now firmly behind the Oregon Investment Council and Treasury’s vision for decarbonization, the ball is in the fund’s court to achieve meaningful implementation. There is more work to do. While the law focuses most explicitly on public equities, climate risk also threatens fixed income, real assets and other private market holdings. And while the reporting mandates apply to Scope 1 and 2 emissions, Scope 3 data is important to grasping the full picture of how greenhouse gas emissions degrade the wealth held by institutional investors. Fulfilling the spirit of Oregon’s law will require robust evaluation of a broader scope of emissions, across more parts of the portfolio; it will require building on the strong foundation laid so far.

The true test of Oregon’s seriousness will come in how monitoring, reporting, and goal-setting translate into concrete stewardship and portfolio allocation decisions. The fund will need to build out its frameworks for identifying low-carbon opportunities that meet investment standards. It will need to pursue focused and forceful engagement in contexts where such strategies can reduce asset- and system-level misalignment with the energy transition. And it will need to build out plans for dealing with those companies that refuse to heed investor concerns, where off-ramps and exit strategies need to be on the table.

This pragmatism will be especially needed in a moment when fossil fuel majors are rolling back decarbonization commitments and struggling to articulate a credible long-term value thesis. Inaction, after all, has costs of its own: As the Treasury noted, “investment losses from fossil fuel investments could lead to worsening unfunded liabilities for PERS [Public Employees Retirement System] over time, which would cut into budgets that fund the services and programs state and local agencies, school districts, and other public entities provide.” The fund's net-zero plan is an important first step, laying out a process to identify the most relevant candidates for engagement, escalation, and exit. To maintain its momentum, Oregon will need to demonstrate further ambition and sustained attention to this matter.

As Oregon continues along its path, this bill will be an important milestone for the years to come. It is a valuable recognition on the part of the fund and state legislature of the energy transition’s enduring market power. It is an important case study in what it means to think about the climate crisis as a fiduciary. And it is a crucial example of leadership in a moment when markets are looking for direction. The financial impacts of climate change and the energy transition are already beginning to reshape the investment landscape. Oregon is paying attention—and other states should take note.