New York State Common Retirement Fund takes action to protect New Yorkers from further losses from oil and gas company investments

Key Findings

Under the leadership of New York State Comptroller Tom DiNapoli, the New York State Common Retirement Fund has announced some very big steps toward holding fossil fuel companies accountable on climate change.

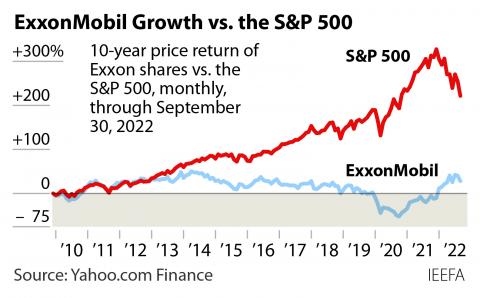

The Fund is divesting from ExxonMobil because the company's energy transition plan failed to meet the Fund's standards.

The Fund has also announced it is doubling its sustainable investment portfolio from $20 billion to $40 billion, reflecting the growth of these investments in the market generally.

The divestment steps protect the Fund from further fossil fuel investment losses and increases investments in lower-carbon indexes that are growing.

Under the leadership of New York State Comptroller Tom DiNapoli, the New York State Common Retirement Fund (“Fund”), the third largest pension fund in the U.S., has announced some very big steps toward holding fossil fuel companies accountable on climate change.

The Fund embarked on an unprecedented industry-wide review of the coal, oil and gas industry starting in December 2020, after more than a decade of frustrating discussions with fossil fuel companies. The review questioned if the companies have plans to address the energy transition. If a company failed the test, the Fund would step up its responses. The potential responses included divestment.

The Fund’s deep dive into the oil and gas industry has produced important new information. The action steps are heavily nuanced and weighty. The big picture: The new information is being used to defend the Fund against future losses from fossil fuels and to position the Fund to generate solid returns by investing in the energy transition.

The Fund reviewed the sustainability plans of all the oil and gas majors. ExxonMobil’s plan failed to meet the standards established by the Fund, so it is divesting its actively managed holdings from ExxonMobil.

The Fund has taken another important step—moving $10 billion out of passive indexes and into sustainably mandated funds. The Fund currently has approximately $108 billion in stocks. The largest component is in passively managed indexes. This action begins a process of moving core assets into new, low-carbon indexes. Typically, these new low-carbon indexes do not hold fossil fuel companies.

IEEFA’s recent research has provided 33 examples of sustainably mandated funds offered by the largest names on Wall Street—MSCI, Standard & Poor’s and Russell.

The Fund’s action in this direction acknowledges the deterioration of the fossil fuel sector’s position in a modern portfolio. In the 1980s, fossil fuels held almost 30% of the market. Today, they hold less than 4% and the outlook is increasingly negative.

The deep dive has also resulted in another major policy statement by the Fund. It will no longer allow investments from its private equity portfolio to be invested in fossil fuels. This step is consistent with market trends. Fossil fuel private equity funds once were the leading force in this high-risk, high-yield sector. But McKinsey's tracking system is now showing that investment dollars and deals are gravitating away from traditional energy investments and toward renewables.

This is a big deal.

Money invested in private equity is meant to generate higher returns than standard market investments. The New York State Common Retirement Fund invests $37 billion of its $248 billion portfolio in private equity. This asset class is expected to produce 7.5% returns, the highest of any asset class in the Fund. McKinsey’s disclosure indicates the private equity market has already walked away from fossil fuels. The Fund’s action is another powerful indicator of the declining relevance of fossil fuels to investors.

The Fund’s overall decision leaves it holding some $500 million in carbon-exposed companies. Divestment from the active portfolio has a relatively small dollar impact of $27 million. The effort to move indexes has a far greater dollar value, and as a policy, it is the most far-reaching. Roughly speaking, every $10 billion moved into low-carbon indexes decreases the Fund’s investments in fossil fuel companies by at least $50 million.

For all of the positive aspects of this plan, the scope of the divestment is too small and the pace of change does not adequately address the continued loss of value, weak responses from the companies or the urgency of the climate problem. There is a real risk in continuing to do too little. The market signals are telling the Fund to move faster. The fossil fuel sector has lost its financial rationale. It has become a small holding with a negative outlook. The existence of large-scale, low-carbon indexes shows that the means to achieve a retreat from fossil fuels are available. The transition plan developed by the leading company in the sector, ExxonMobil, failed the Fund’s test. A careful retreat from fossil fuels is clearly justified by the Fund’s extensive diligence. Its leadership position, which it has earned, requires it.

One area where the Fund might improve is to explain its rationale for maintaining investments in most of the large oil majors like Shell, BP and Chevron.

The Fund has also announced it is doubling its sustainable investment portfolio from $20 billion to $40 billion. The Fund’s investment of $20 billion in sustainably mandated assets reflects the growth of these investments in the market generally. Doubling the amount targeted for this purpose also reflects market confidence in the general direction of the economy.

The Fund’s actions are critically important for the retirees, state and local governments served by the fund, as well as for taxpayers. DiNapoli, the sole Fund trustee, is aligning this large asset with the direction of the economy. The divestment steps protect it from further fossil fuel investment losses. The forward-looking investments in lower-carbon passive indexes—and more directly, in the Fund’s sustainability portfolio—seek to reap the benefits from a new growth area in the economy.

The Fund’s program to hold fossil fuel companies accountable now moves to utilities. From a market perspective, this targets a major consumer of fossil fuels—not a major producer, as earlier reviews have targeted. The program will continue to annually review the fossil fuel companies still in the portfolio. This program to keep reviewing all companies with fossil fuel exposure is vitally important. There is more to be done. We will be hearing more from DiNapoli on climate change. That is a good thing for the fund, and the continued public debate is important to finding climate solutions.